Welcome to the Friday edition of the Ecoinometrics newsletter.

Every week we bring you the three most important charts on the topics of macroeconomics, Bitcoin and digital assets.

Today we'll cover:

The bond market still expects a recession.

Technical recessions aren’t what they used to be.

Bitcoin is ahead of the previous bear markets.

Each topic comes with a small explanation and one big chart. So let’s dive in.

In case you missed it, here are the other topics we covered this week:

Also for paid subscribers we have a new dashboard looking at the Bitcoin miners. It is focused on evaluating whether a given Bitcoin miner stock is over priced or under priced relative to Bitcoin.

For the original idea behind this dashboard, go check out this issue of the newsletter.

If you aren’t subscribed yet, hit the subscribe button, to receive this email every week directly in your inbox:

A year later, the bond market still expects a recession

In normal conditions interest rates are higher on long duration bonds than short duration bonds. The idea is that the longer the time horizon, the more uncertainty there is and thus the higher the rates need to be to compensate for it.

The table below shows the current spreads between the yield on US Treasury bonds of different durations. As you can see most of those spreads are negative. Meaning, short-term rates are higher than long-term rates. Meaning, the bond market anticipates at least a slowdown (maybe a recession) that will force short-term rates lower.

The problem is that the bond market has been expecting that for over a year… But, the most recent data still isn't putting the US into a clear recession.

So is the bond market getting it wrong this time? Is this time going to be different? We'll find out this year.

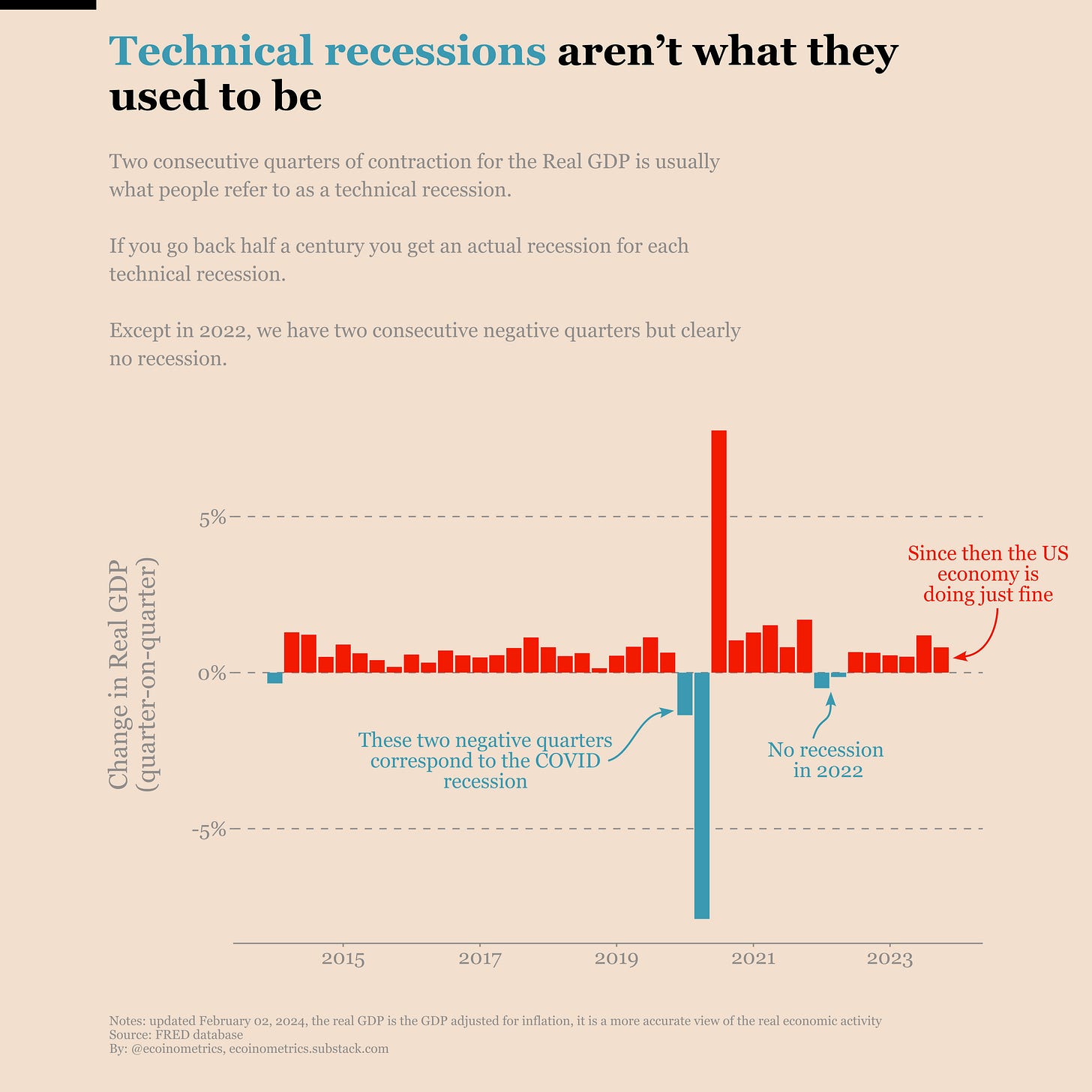

Technical recessions aren’t what they used to be

You probably have heard about the idea of a technical recession. This is what people call two consecutive quarters of negative Real GDP growth.

Now that's not really a recession because recessions are only periods of time declared as such by the economists at the National Bureau of Economic Research. And their decision making takes into account more than just the Real GDP.

The "guidelines" for a recession are:

A major decline of the economic activity in the US.

This decline must affect a wide range of sectors in the economy.

This decline must last at least a quarter.

This decline must be clearly visible in the Real GDP, the Real Income, the employment level, the industrial production and retail sales.

Back in 2022 we had a technical recession that did not lead to a recession. So we are still waiting.

As you have seen in the previous chart, the yield curve is still inverted. And it has been inverted for a while. Which historically means a recession could start anytime.

But the most recent Real GDP data isn't going at all in this direction.

That being said, history also shows that the Real GDP can be growing very well the previous quarter and completely crash the next. So while we can say with confidence that we are not in a recession just yet, that’s telling us nothing about what will happen in the coming months.

Bitcoin is ahead of the previous bear markets

Without a recession to slow things down, the stock market is already out of the drawdown that started in 2021.

Bitcoin not quite yet. But its recovery is more advanced than the previous two bear markets at the same time.

The bottom was reached:

365 days in the current drawdown sequence.

364 days in the last drawdown sequence.

411 days in the previous drawdown sequence.

So comparable timings. But fast forward to now, Bitcoin is significantly higher than where it was at the same time during the bear market of the 1st and 2nd halving cycles:

Down 40% in the current sequence.

Down 80% in the bear market of the 2nd halving cycle.

Down 65% in the bear market of the 1st halving cycle.

If the optimists are right and there is no recession on the horizon, then we could be out of this drawdown much faster than expected.

That’s it for today. I hope you enjoyed this. We’ll be back next week with more charts.

Cheers,

Nick

P.S. We spend the entire week, countless hours really, doing research, exploring data, surveying emerging trends, looking at charts and making infographics.

Our objective? Deliver to you the most important insights in macroeconomics, Bitcoin and digital assets.

Armed with those insights you can make better investment decisions.

Are you a serious investor? Do you want to get the big picture to get on the big trades? Then click on the button below.

In addition to growth, labor market is also an important part of a recession assessment.

For anyone interested, here is my labor market analysis based on the newest jobs numbers:

https://open.substack.com/pub/arkominaresearch/p/is-labor-market-really-that-strong?r=1r1n6n&utm_campaign=post&utm_medium=web