Bitcoin cannot grow without the ETFs

Also Bitcoin is the only hedge you need and the long trend towards no growth

Welcome to the Friday edition of the Ecoinometrics newsletter.

Every week we bring you the three most important charts on the topics of macroeconomics, Bitcoin and digital assets.

Today we'll cover:

Bitcoin cannot grow without the ETFs.

Bitcoin is only hedge you need against debasement.

The long trend towards zero growth in the US.

Each topic comes with a small explanation and one big chart. So let’s dive in.

In case you missed it, here are the other topics we covered this week:

If you aren’t subscribed yet, hit the subscribe button, to receive this email every week directly in your inbox:

Bitcoin cannot grow without the ETFs

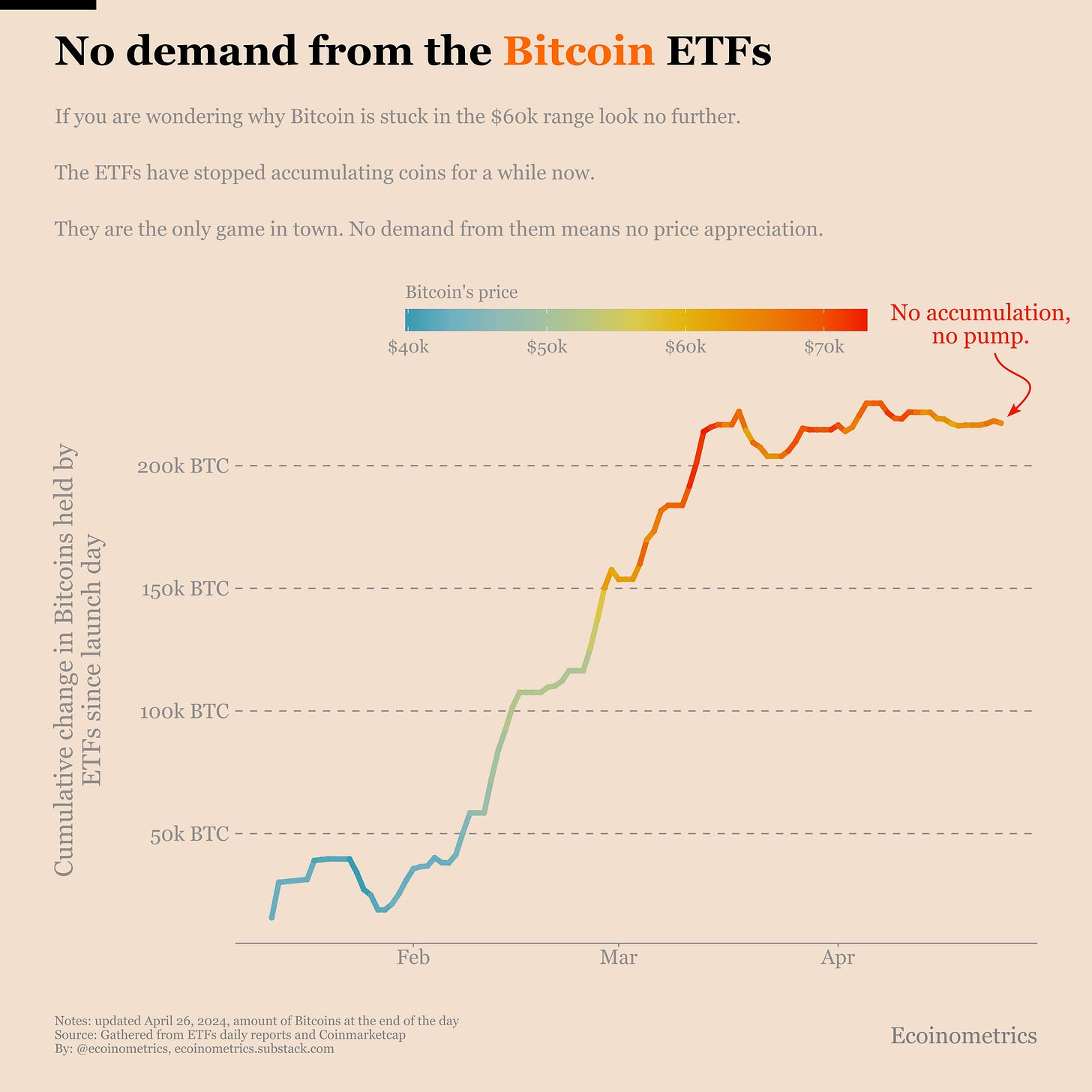

Just in case you are wondering why Bitcoin is in the $60k range since mid-March, take a look at the demand coming from the ETFs.

The Bitcoin ETFs have stopped accumulating coins (in aggregate) for more than a month. In total from the launch in January to the middle of March the ETFs managed to capture 200k. And that despite the huge outflows from Grayscale.

As a result BTC moved from $40k to $75k.

Then it all stopped. The inflow for the ETFs stopped. The price action stalled.

If you still needed to be convinced that the demand coming from the ETFs is the only game in town for Bitcoin in this bull market then that should seal it.

Now the real question is why are we seeing a slowdown in the ETFs inflow? My take is that this is related to uncertainties at the macro level. We cover a little bit of that in the correlations report. But we’ll dig into that again on Monday.

Bitcoin is the only hedge you need against debasement

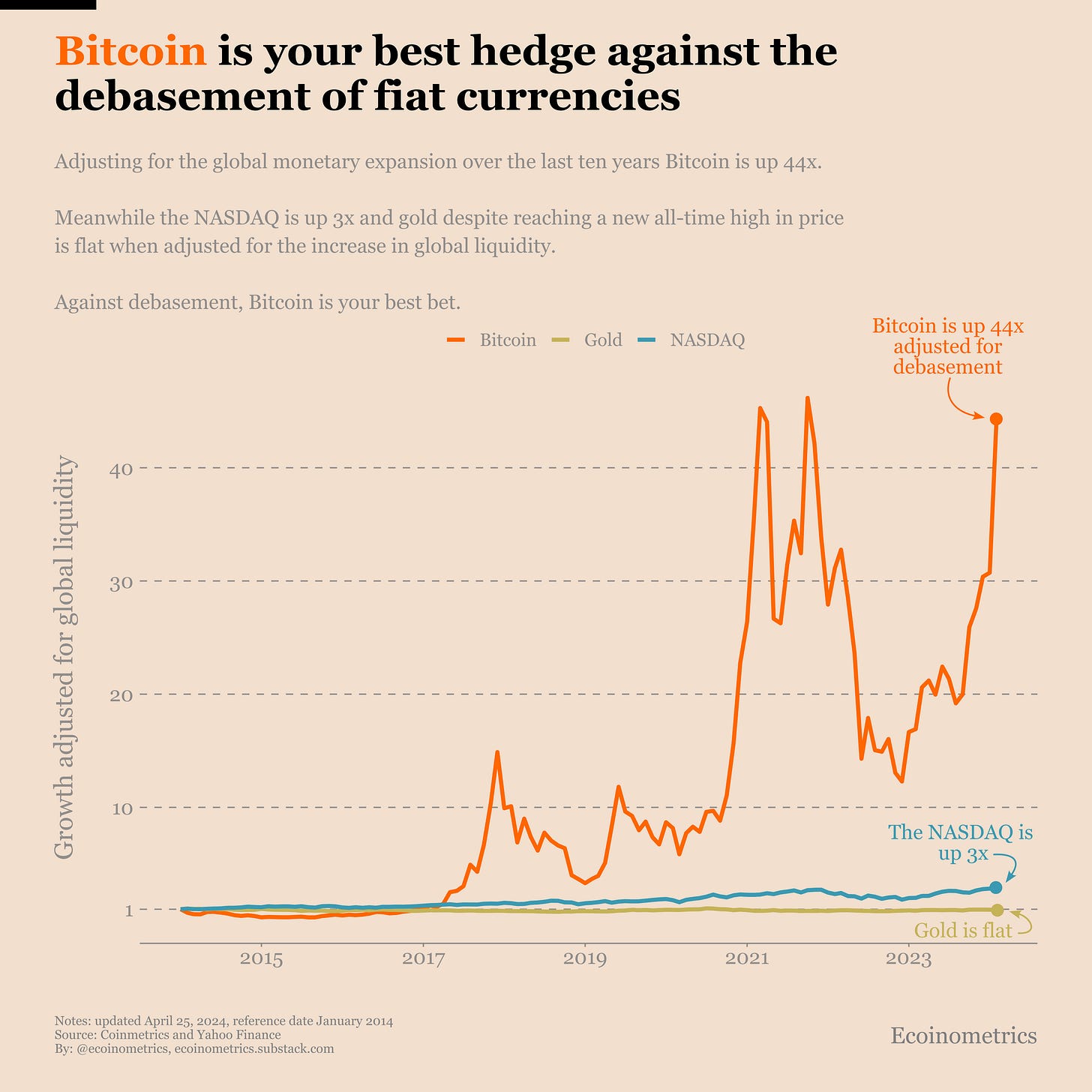

The lack of action in the past thirty days shouldn’t make you lose sight of the big picture though.

The big picture is that you are investing in Bitcoin as a hedge against the debasement of fiat currencies. Actually it isn’t a simple hedge. It is the best hedge available to you right now.

To give you some perspective, take the performance of Bitcoin, gold and the NASDAQ over the last ten years and adjust that for the growth of the global monetary base. What you find is that:

Gold is flat. Yes, despite being at a new all-time high gold is in fact just keeping up with global liquidity. That’s the level zero of hedging for debasement.

The NASDAQ is up 3x. That’s pretty good.

Bitcoin is up 44x…

No comment.

The long trend towards zero growth in the US

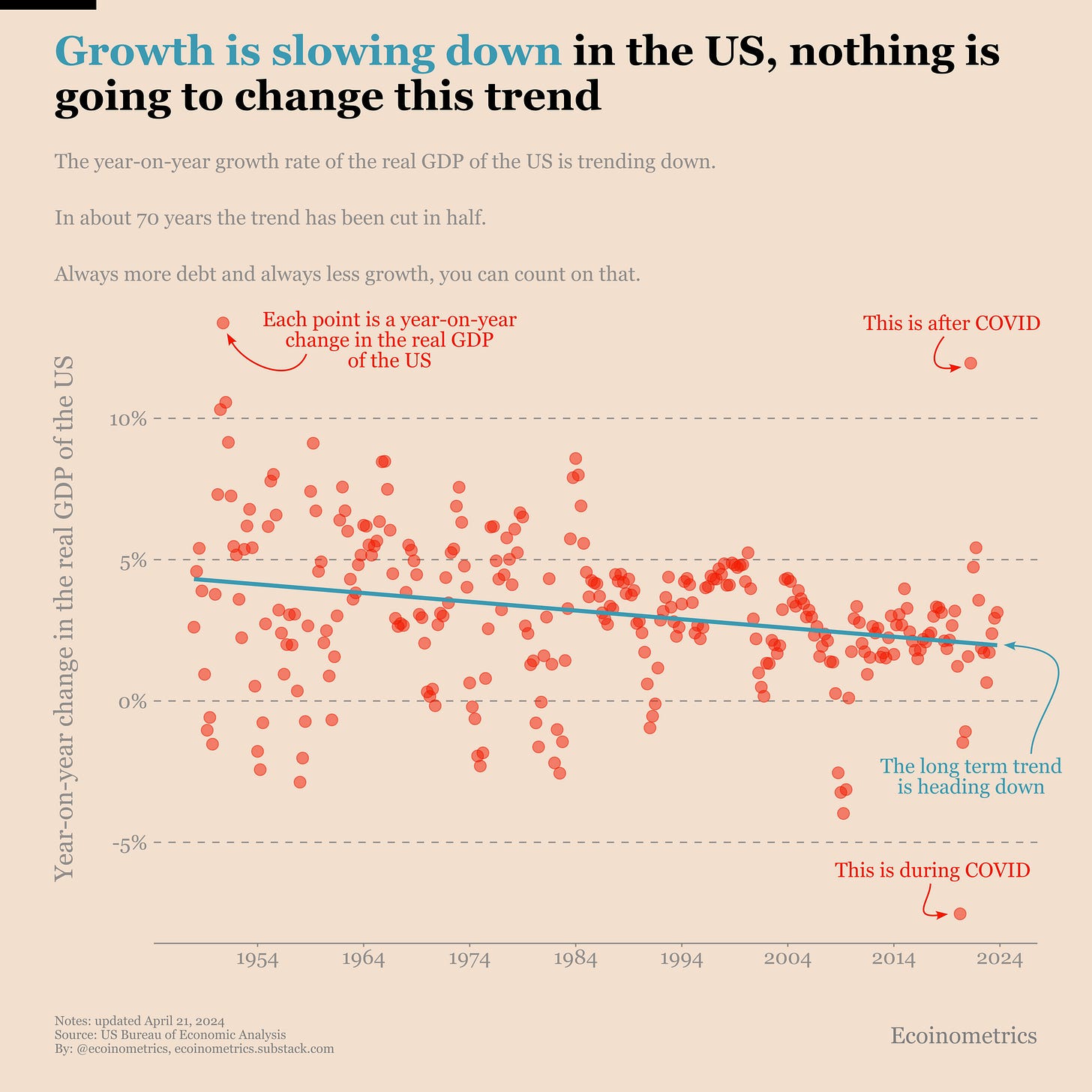

The real GDP of the US for Q1 2024 is up 0.39%. That’s kind of weak. But when you zoom out that’s not unexpected.

Go back 70 years a plot the trend in the year-on-year change of the real GDP for the US. It is distinctly going down. The average year-on-year growth has been halved over that period.

So we are getting always more debt for always less growth. That in turns deepens the deficit. Which requires more debt. Debt that is more expensive… you see where this is going right.

In the long run the US economy isn’t on a sustainable trajectory. The fact that it is doing better than most other countries doesn’t change that.

That’s it for today. I hope you enjoyed this. We’ll be back next week with more charts.

Cheers,

Nick

P.S. We spend the entire week, countless hours really, doing research, exploring data, surveying emerging trends, looking at charts and making infographics.

Our objective? Deliver to you the most important insights in macroeconomics, Bitcoin and digital assets.

Armed with those insights you can make better investment decisions.

Are you a serious investor? Do you want to get the big picture to get on the big trades? Then click on the button below.

Nasdaq is 'artificially' propped up. The 3 x you talk about is because of artificial interest rates and pumping of base money into the economy by the cantilionaires. ✌🏻 & ❤️

I disagree about the ETFs. While they're large players, they aren't the only buyers.