Bitcoin ETF Flows Point to Latent Strength Beneath the Surface

Also Ethereum Trades at a Deep Discount to Bitcoin & Fed Sentiment Hovering Just Above Neutral Territory

Welcome to Ecoinometrics’ Friday edition.

Each week, we analyze the three most critical market signals impacting Bitcoin and macro assets, delivering institutional-grade insights through data-driven charts and analysis.

Today we’ll cover:

Bitcoin ETF Flows Point to Latent Strength Beneath the Surface

Ethereum Trades at a Deep Discount to Bitcoin

Fed Sentiment Hovering Just Above Neutral Territory

Together, these three signals tell a consistent story. Bitcoin’s fundamentals remain solid beneath the surface, Ethereum’s relative weakness hints at untapped potential, and the Fed’s gradual shift toward a dovish stance keeps liquidity supportive. In short, the macro backdrop still favours risk assets, even if sentiment hasn’t caught up yet.

In case you missed it, here are the other topics we covered this week:

Bitcoin Market Monitor - Key Drivers in Ten Charts:

Get these professional-grade insights delivered to your inbox:

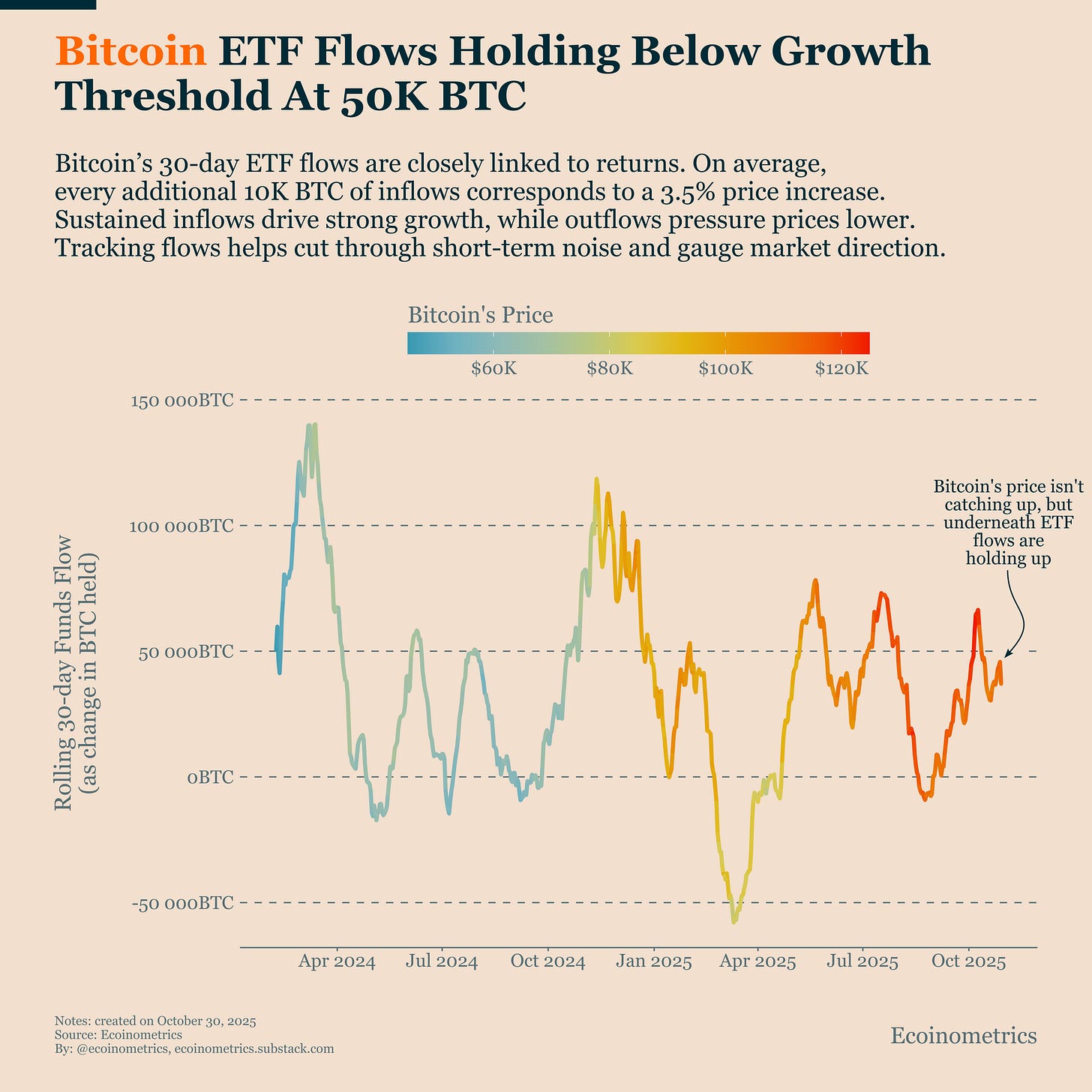

Bitcoin ETF Flows Point to Latent Strength Beneath the Surface

The Nasdaq 100 has already recovered, made new highs, and pulled back slightly. Bitcoin, by contrast, still hasn’t managed a meaningful rebound since its dip on October 10 following tariff worries.

That might look worrying at first glance. But under the surface, there’s no evidence of a slow bleed in positions. On a 30-day rolling basis, Bitcoin ETF flows are holding steady just below 50 K BTC per month, which is historically a strong level.

It’s simply missing a few days of solid inflows to return to the trend seen in early October. Investors remain cautious, capital allocation has slowed down, but there is no downside pressure from flows.

We can’t know exactly when sentiment will flip, but given this level of demand, there’s no reason to be pessimistic. The market isn’t showing structural weakness, it’s showing hesitation.

Historically, when ETF flows hover near 50 K BTC and then turn upward, Bitcoin’s price tends to catch up within weeks. If that pattern repeats, this could be the setup for a sharp rebound once sentiment normalizes.

Now to be fair, you’d expect that turn to have started already, given gold’s stagnation, new highs in U.S. equities, and a friendlier macro backdrop.

After all, trade tensions between the U.S. and China are easing, and the Federal Reserve has just cut rates and is on track to eventually inject more liquidity in the market (we’ll come back to that later in this issue).

But something is still holding investors back.

Regardless, the data suggests this isn’t the start of a bear market, it’s a pause before the next leg higher. So what makes sense is to stay positioned for Bitcoin to breakout to the upside at some point.

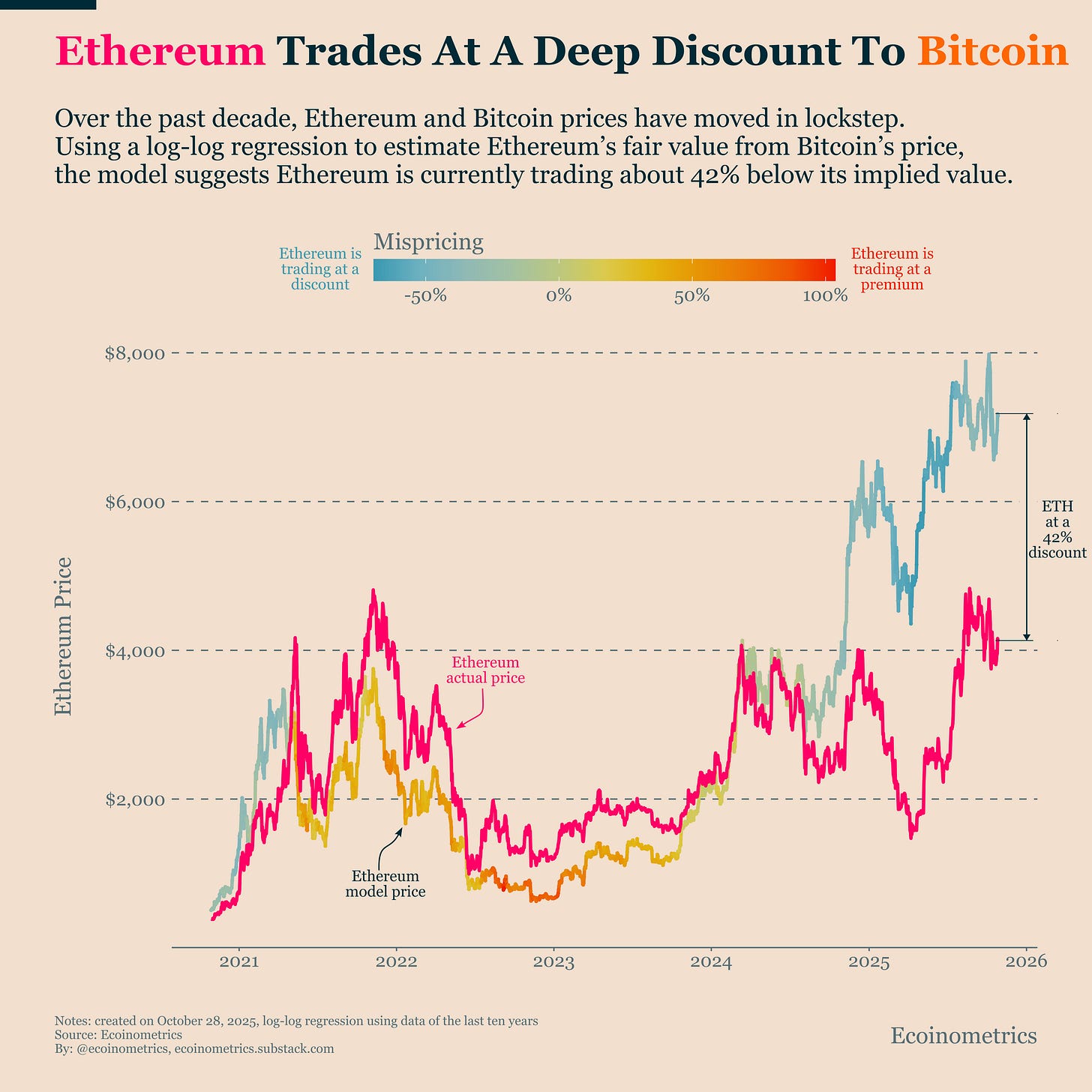

Ethereum Trades at a Deep Discount to Bitcoin

Ethereum ETFs have attracted far more inflows this year than last, a clear sign of progress. But that hasn’t been enough to close the performance gap with Bitcoin.

Right now, Ethereum trades about 42% below its fair value implied by its long-term relationship with Bitcoin. That’s a sizeable discount, reflecting the fact that this bull market hasn’t yet seen a proper altcoin season.

The missing piece is narrative. There isn’t a strong new theme pulling capital toward Ethereum today. The only one with potential is real-world asset (RWA) tokenization.

That’s the idea of bringing traditional financial assets such as bonds, equities, or real estate on-chain to trade and settle on blockchain networks. Much like NFTs and Web3 five years ago, a credible RWA wave could drive significant inflows and lift Ethereum’s valuation if it gains momentum.

Ethereum has the right foundations for it: a long-standing developer ecosystem, mature Layer 2 chains, and an active DeFi base. If one base layer is positioned to capture that trend, it’s Ethereum. Still, it remains an early and speculative bet.

In the meantime, the large valuation gap with Bitcoin looks attractive from a relative-value perspective. Markets often revert toward historical relationships, and a trade betting on mean reversion could turn into a self-fulfilling move as capital rotates between Bitcoin and Ethereum in anticipation.

So while Bitcoin offers the cleaner risk-reward setup, Ethereum presents an interesting asymmetry. Short term, mean reversion could boost its price. Long term, success in tokenizing real-world assets could add a new structural tailwind.

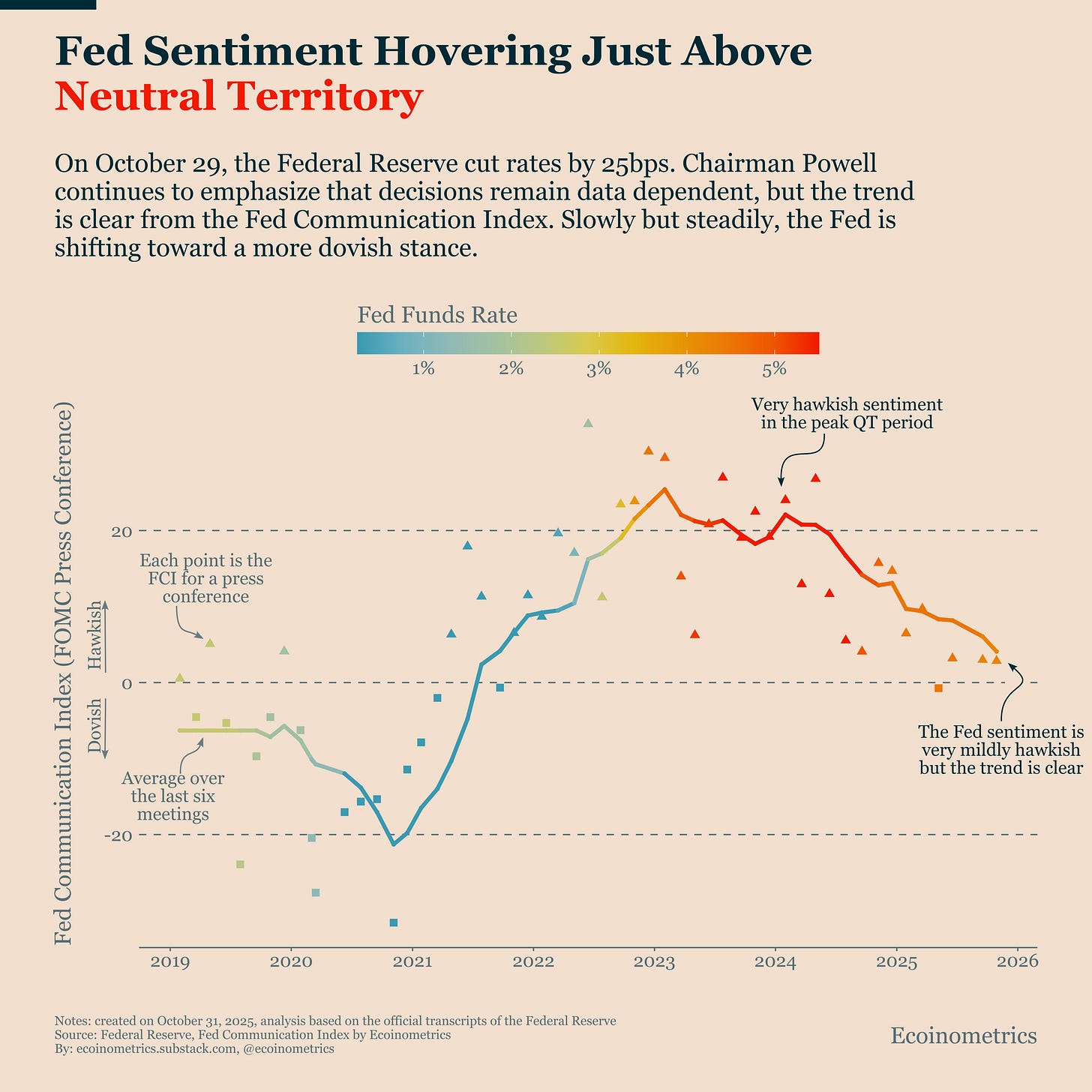

Fed Sentiment Hovering Just Above Neutral Territory

The Federal Reserve delivered another small 25bps cut this week. That’s exactly as the market expected and in line with prior guidance.

During the post-FOMC meeting press conference, Chairman Powell repeated that policy decisions remain “data dependent.” But reading between the lines, the tone is clearly softening.

Our Fed Communication Index, which quantifies sentiment from each press conference, shows another mildly hawkish reading, but just barely. The broader trend over recent meetings is a steady drift toward neutral and, eventually, dovish territory.

Add to that the signals more rate cuts ahead, growing concern about employment, and an end to the Fed’s balance-sheet reduction program by year-end. Then taken together, the picture points to a central bank that’s shifting from restraint to accommodation.

That means liquidity conditions are unlikely to tighten again anytime soon.

For Bitcoin, which thrives on abundant liquidity and easing financial conditions, this is another tailwind and a strong argument against the idea that we’re at the start of a bearish phase.

That’s it for today. Thanks for reading.

Cheers,

Nick

P.S. Every week, our team conducts extensive research analyzing market data, tracking emerging trends, and creating professional-grade charts and analysis.

Our mission: Deliver actionable macro and Bitcoin insights that help institutional investors and financial advisors make better-informed decisions.

Ready for institutional-grade research that puts you ahead of the market? Click below to access our premium insights.