Bitcoin is catching up to gold: becoming the new store of value

Also the least negative year for BTC and the endless tightening of the oil supply.

Welcome to the Friday edition of the Ecoinometrics newsletter.

Every week we bring you the three most important charts on the topics of macroeconomics, Bitcoin and digital assets.

Today we'll cover:

Bitcoin’s rise as a store of value.

2023 hasn’t been that bad for Bitcoin.

The endless tightening of the crude oil supply.

Each topic comes with a small explanation and one big chart. So let’s dive in.

In case you missed it, here are the other topics we covered this week:

If you aren’t subscribed yet, hit the subscribe button, to receive this email every week directly in your inbox:

Bitcoin’s rise as a store of value

Bitcoin’s strongest narrative is that of digital gold. There is no doubt about that. Investors can get behind the idea that BTC is by design the ideal store of value for the digital age.

Scarcity. Check. Durability. Check. Divisibility. Check. Portability. Check. Decentralized nature. Check. Fungibility. Check…

Gold and Bitcoin have a lot in common. The main difference being that Bitcoin is a digitally native asset and its properties are enforced by code. Also the fact that Bitcoin is like 14 years old compared to gold which has been used the same way for millenia.

But the point is that as the global economy becomes more and more digital, there is less and less practical use for a physical store of value like gold.

So one could reason that as time goes (and younger generations start inheriting more wealth) we should see a gradual replacement of gold by Bitcoin.

Now we are still far away from that. Physical gold is a $13 trillion market compared to $500 billion for Bitcoin. But Bitcoin is growing relatively fast while gold itself has barely moved over the same time period.

In the past 10 years Bitcoin is up 16x again gold. For Bitcoin to dethrone gold, one BTC would need to be worth almost $700k. We’ll see how fast we can get there.

The least negative year

Let’s be honest, 2023 has been an uneventful year for Bitcoin. People who expected very strong bull catalysts such as the approval of a spot BTC ETF by SEC are disappointed. People who expected a spectacular crash and maybe the occasion to scoop up very cheap sats have just been sitting on the sideline the whole time.

So we need to find some ways in which 2023 has been an interesting year for Bitcoin.

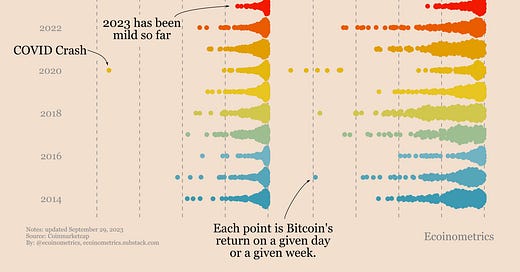

Well here is my contribution. Yes Bitcoin has been awfully quiet in 2023 but this has led to the least negative year over the past 10 years.

What do I mean by that?

Take all the negative return days in each year and compare those distributions to each other. What you’ll see is that negative days in 2023 haven’t been very negative and they haven’t been as numerous as in the previous years.

The exact same thing applies to the negative weekly returns. No crazy negative week. Just your quiet bear rally instead.

So you can complain that there isn’t enough volatility. But at least we are not getting massive dips in the price either.

The endless tightening of the crude oil supply

We’ve been following the tightening of the crude oil supply for years now. And it hasn’t been getting better.

There is currently a deficit of 200 million barrels of crude oil and refined products compared to the average level of inventories over the past 5 years.

And we got there with a single steep post-COVID decline of inventories. That’s actually the steepest decline recorded in the past 25 years.

This situation can only mean one of two things:

There is a real deficit in crude oil inventories and that will eventually send WTI soaring past $110, $120+ per barrel.

The deficit in inventories only exist because crude oil producers anticipate a fall in the demand for their product. That’s likely to result in a price decline.

Right now we are in the in-between situation where we don’t know which scenario it is.

If the demand is real then crude oil is bound to be a constant pressure on the upside for inflation. If we are entering a global recession (or even just in the US) then all the speculators that are long WTI will certainly unwind their positions and crude oil should take a dip.

Moral of the story: macro is very important for crude oil prices and crude oil prices are very important for macro.

That’s it for today. I hope you enjoyed this. We’ll be back next week with more charts.

Cheers,

Nick

P.S. We spend the entire week, countless hours really, doing research, exploring data, surveying emerging trends, looking at charts and making infographics.

Our objective? Deliver to you the most important insights in macroeconomics, Bitcoin and digital assets.

So if you liked this, please refer Ecoinometrics to your friends to help us grow.

Bonus: referrals give you access to the premium content of the newsletter normally only accessible to paid subscribers.

3 referrals give you one month access for free

10 referrals give you 3 months access for free

25 referrals give you 6 months access for free

YTD Bitcoin is up over 50%. What's not to like about that?

"Least negative year"?????