Bitcoin Miners And MicroStrategy Playbook

Also Bitcoin’s Volatility Vs. Mega-Cap Tech Stocks & Inflation Is Re-Accelerating

Welcome to the Friday edition of the Ecoinometrics newsletter.

Every week we bring you the three most important charts on the topics of macroeconomics, Bitcoin and digital assets.

Today we'll cover:

Bitcoin Miners And MicroStrategy Playbook

Bitcoin’s Volatility Vs. Mega-Cap Tech Stocks

Inflation Is Re-Accelerating

Each topic comes with a small explanation and one big chart. So let’s dive in.

In case you missed it, here are the other topics we covered this week:

Checkout the Bitcoin Market Monitor to understand what’s driving the market in just five charts:

Read the Bitcoin Market Forecast for the probabilities of key scenarios and the essential risk metrics to manage your portfolio:

If you aren’t subscribed yet, hit the subscribe button, to receive this email every week directly in your inbox:

Bitcoin Miners And MicroStrategy Playbook

MicroStrategy's playbook is simple: build a Bitcoin treasury so large that it overshadows your core business and you become a pseudo Bitcoin ETF. To achieve this, you use every available tool: issuing more shares, borrowing, and any other viable strategy.

The more conservative version of this playbook follows Michael Saylor's original 2020 thesis. It states that cash and bonds are poor reserve assets because they face debasement. So don’t build your reserves on that. Convert your cash to Bitcoin for long-term wealth preservation.

So far no one has followed MicroStrategy's approach at scale. But one industry is embracing the concept: Bitcoin mining.

This makes perfect sense. Who better to use Bitcoin as a treasury asset than those who mine it?

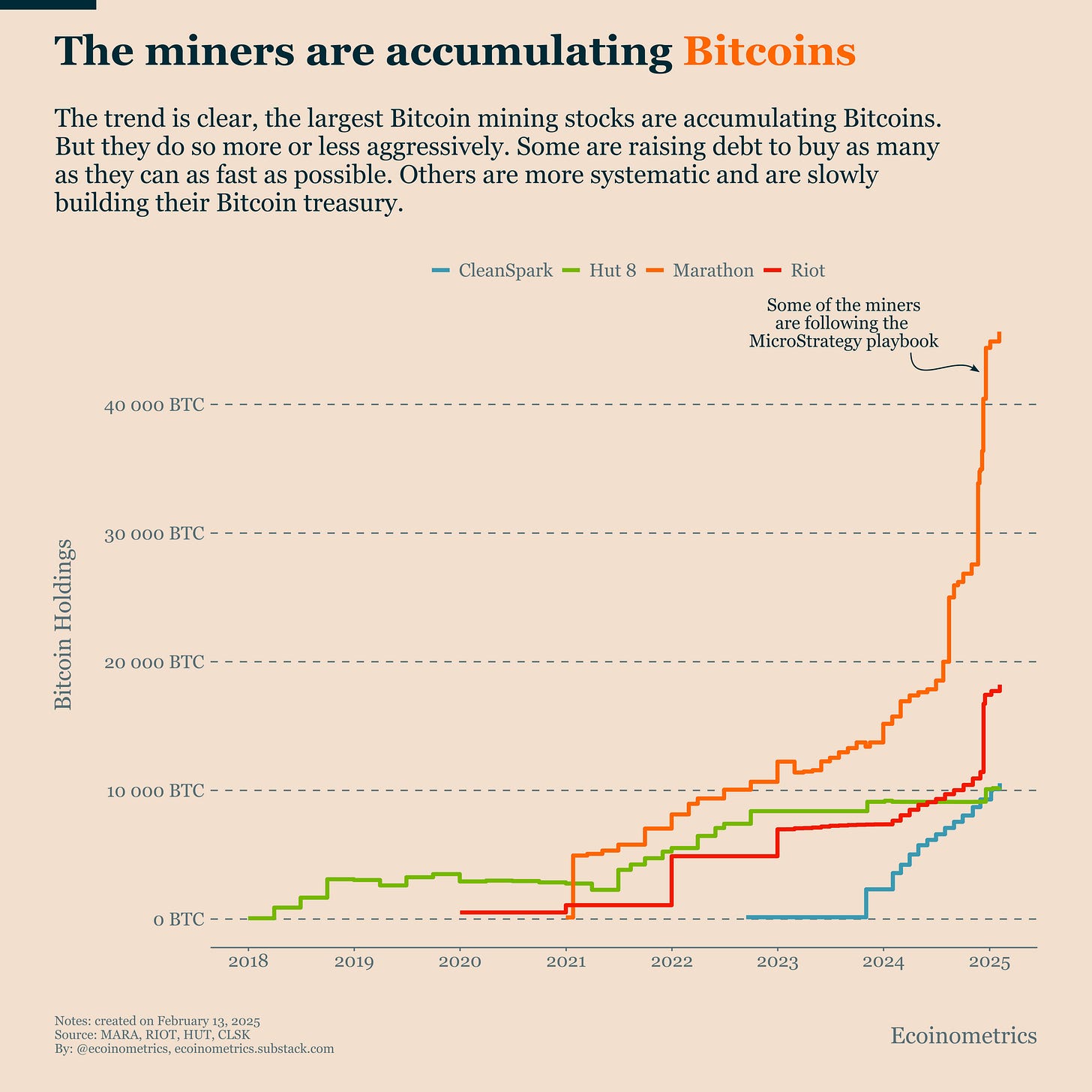

With the miners we are seeing the whole range of different approaches. Large operators like Marathon and Riot are accumulating coins aggressively. Others, like CleanSpark and Hut 8, prefer a slower, steadier strategy.

Marathon, in particular, stands out on the chart with its dramatic accumulation curve. They appear to be following the full MicroStrategy playbook most closely, making them the best example to watch to judge if this strategy works.

What's notable is that since mid-2024, miners have become a significant source of demand for Bitcoin as a reserve asset.

This trend will likely play a crucial role in how mining stocks are valued going forward.

While it's uncertain if other industries will adopt this strategy, the miners' embrace of it is already positive for Bitcoin.

Bitcoin's Volatility Vs. Mega-Cap Tech Stocks

People still argue that Bitcoin is too volatile, has no value, and could crash any minute.

Having invested in Bitcoin for almost 10 years, I've noticed some arguments never change.

When someone claims Bitcoin is too volatile, you could point out that volatility itself isn't bad. What matters is risk-adjusted returns. In that regard Bitcoin's upside volatility has helped it generate outstanding returns.

But these days, you can make an even simpler point: compared to other mainstream assets, Bitcoin isn't exceptionally volatile anymore.

The chart shows the monthly volatility distribution of Bitcoin versus other assets over recent years. The clear clustering of volatility patterns shows that Bitcoin has matured into the same risk category as major tech stocks, a significant shift from its early "wild west" reputation.

Surprisingly, Bitcoin isn't even the most volatile asset. Both Nvidia and Tesla have shown higher volatility over this period. All these assets have similar market caps, making it a fair comparison.

While Bitcoin isn't as stable as gold, it no longer deserves to be singled out as extremely volatile.

Inflation Is Re-Accelerating

This is a big deal.

Core inflation in the US remains stuck because the labor market is too tight. We have been saying that’s a big problem for ages.

Now headline CPI inflation is also clearly trending up. That's four straight months of accelerating year-on-year inflation.

Looking at the last six months of inflation and projecting it forward gives us a 3.6% annual rate. Both 3-month and 6-month annualized rates are now significantly above the Fed's 2% target, suggesting this isn't just a temporary blip.

With core inflation high and headline inflation gaining momentum, the Federal Reserve is unlikely to stay quiet.

Expect them to increase their hawkish tone rather than announce rate cuts.

We flagged this issue earlier and discussed it in detail in Monday's newsletter.

This matters a lot because monetary policy and financial conditions drive Bitcoin trends more than anything else.

If inflation climbs and the Fed hints at possible rate hikes, Bitcoin could face serious headwinds.

This needs close attention.

That’s it for today. I hope you enjoyed this. We’ll be back next week with more charts.

Cheers,

Nick

P.S. We spend the entire week, countless hours really, doing research, exploring data, surveying emerging trends, looking at charts and making infographics.

Our objective? Deliver to you the most important insights in macroeconomics, Bitcoin and digital assets.

Armed with those insights you can make better investment decisions.

Are you a serious investor? Do you want to get the big picture to get on the big trades? Then click on the button below.