Bitcoin Rallies on ETF Demand Spike

Also Bitcoin Rallies Against NASDAQ Headwinds & Gold Isn’t Backing Down This Time

Welcome to Ecoinometrics' Friday edition.

Each week, we analyze the three most critical market signals impacting Bitcoin and macro assets, delivering institutional-grade insights through data-driven charts and analysis.

Today we'll cover:

Bitcoin Rallies on ETF Demand Spike

Bitcoin Rallies Against NASDAQ Headwinds

Gold Isn’t Backing Down This Time

Today we’re looking at three key signals shaping Bitcoin’s trajectory.

Strong inflows into the ETFs triggered a sharp price rally this week but macro headwinds haven’t gone away. The NASDAQ is still trending lower, and that’s usually a red flag for Bitcoin’s upside potential. Meanwhile, gold continues to assert its role as the dominant safe haven in this cycle, rising alongside Bitcoin rather than trailing it.

Let’s dig in.

In case you missed it, here are the other topics we covered this week:

Essential Decision-Making Tools

Bitcoin Market Monitor - Key Drivers in Five Charts:

Bitcoin Market Forecast - Probability Scenarios & Risk Metrics:

Get these professional-grade insights delivered to your inbox:

Bitcoin Rallies on ETF Demand Spike

Bitcoin surged 10% in just a couple of days this week. That move coincided with three strong days of inflows into Bitcoin ETFs, some of the largest since January, and even ranking among the top 15 inflow days ever.

It’s a mirror image of what happened in late February. Back then, three days of heavy outflows triggered a 10% drop in Bitcoin’s price.

These kinds of sharp moves are dramatic, but they fall into a familiar category: outliers driven by external catalysts. This week, two such catalysts appeared. First, the Trump administration softened its stance on tariffs, relieving some macro pressure. Second, the confirmation of a new SEC chairman with a pro-crypto background gave markets a small sentiment boost.

The real question now is whether this rally is just a knee-jerk reaction or if we’ve turned the corner on the fear and uncertainty that had been weighing on Bitcoin over the past few weeks.

If this marks a shift in sentiment, we should see ETF inflows stay positive. That would set the stage for a sustained recovery. If not, Bitcoin could quickly slide back toward $80k on the next bout of bad news.

We don’t know yet. But three consecutive days of moderate-to-strong inflows is a promising sign. We’ll continue tracking this closely in the Bitcoin Market Monitor.

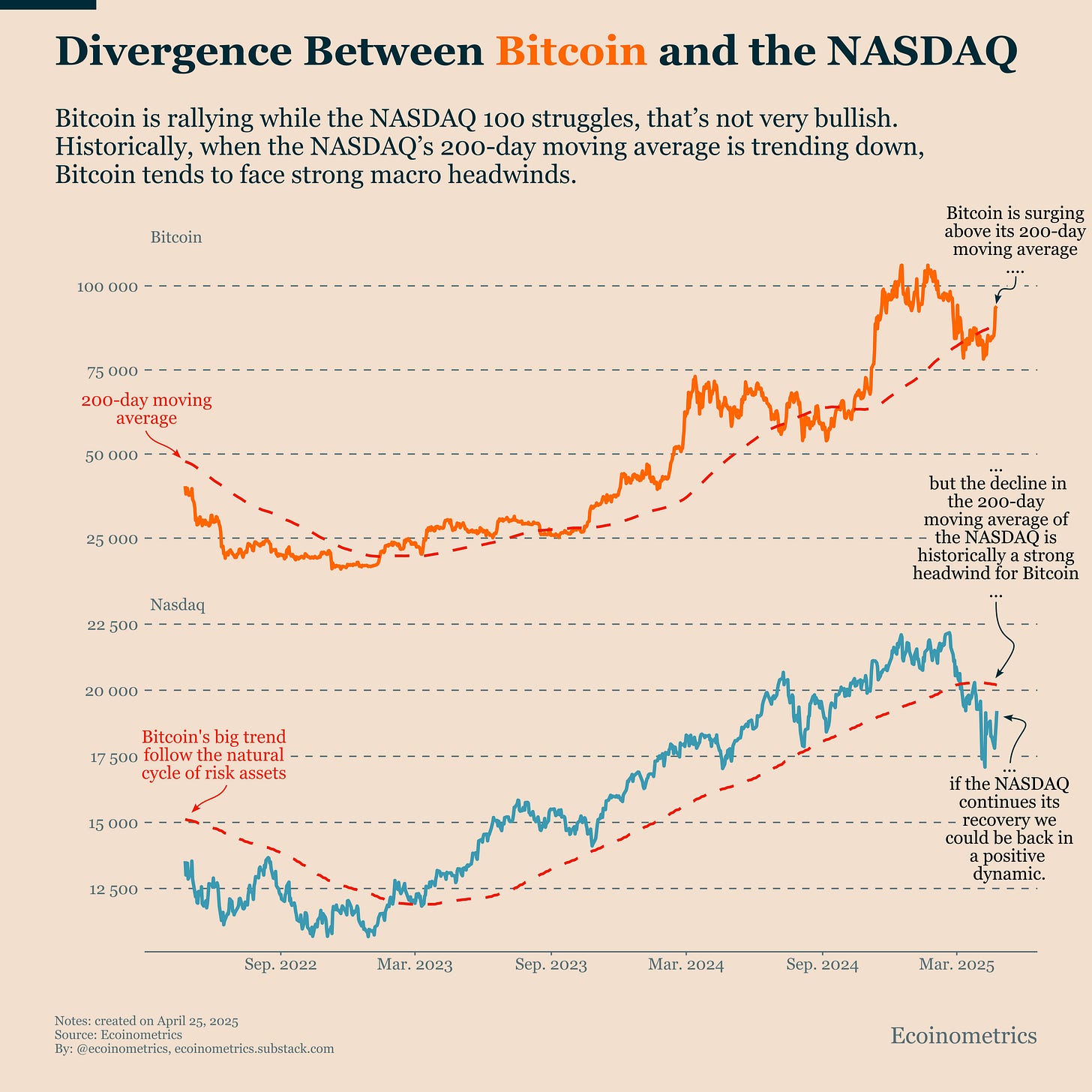

Bitcoin Rallies Against NASDAQ Headwinds

To reinforce what we discussed in the previous section: macro conditions are still not favourable to Bitcoin.

One way to see that is by looking at the divergence between Bitcoin and the NASDAQ 100.

Historically, when the NASDAQ’s 200-day moving average is rising, Bitcoin has a better chance to rally. But when the NASDAQ is trending down, it usually signals tightening liquidity. And under those conditions, Bitcoin often underperforms or even corrects sharply.

A couple of weeks ago, the 200-DMA of the NASDAQ turned down. So while Bitcoin broke above its own 200-DMA this week, boosted by strong ETF inflows, the broader macro picture is still a headwind.

For Bitcoin to exit this soft patch and confirm a more durable uptrend, two things need to happen:

ETF inflows must persist

The equity market (especially the NASDAQ) needs to show a clearer recovery

The good news? This week’s softening in trade war rhetoric is also lifting tech stocks. The NASDAQ remains below its 200-DMA, but if the narrative shift holds and no new negative catalysts appear, we could see a quick reversal. For now, we stay cautiously optimistic.

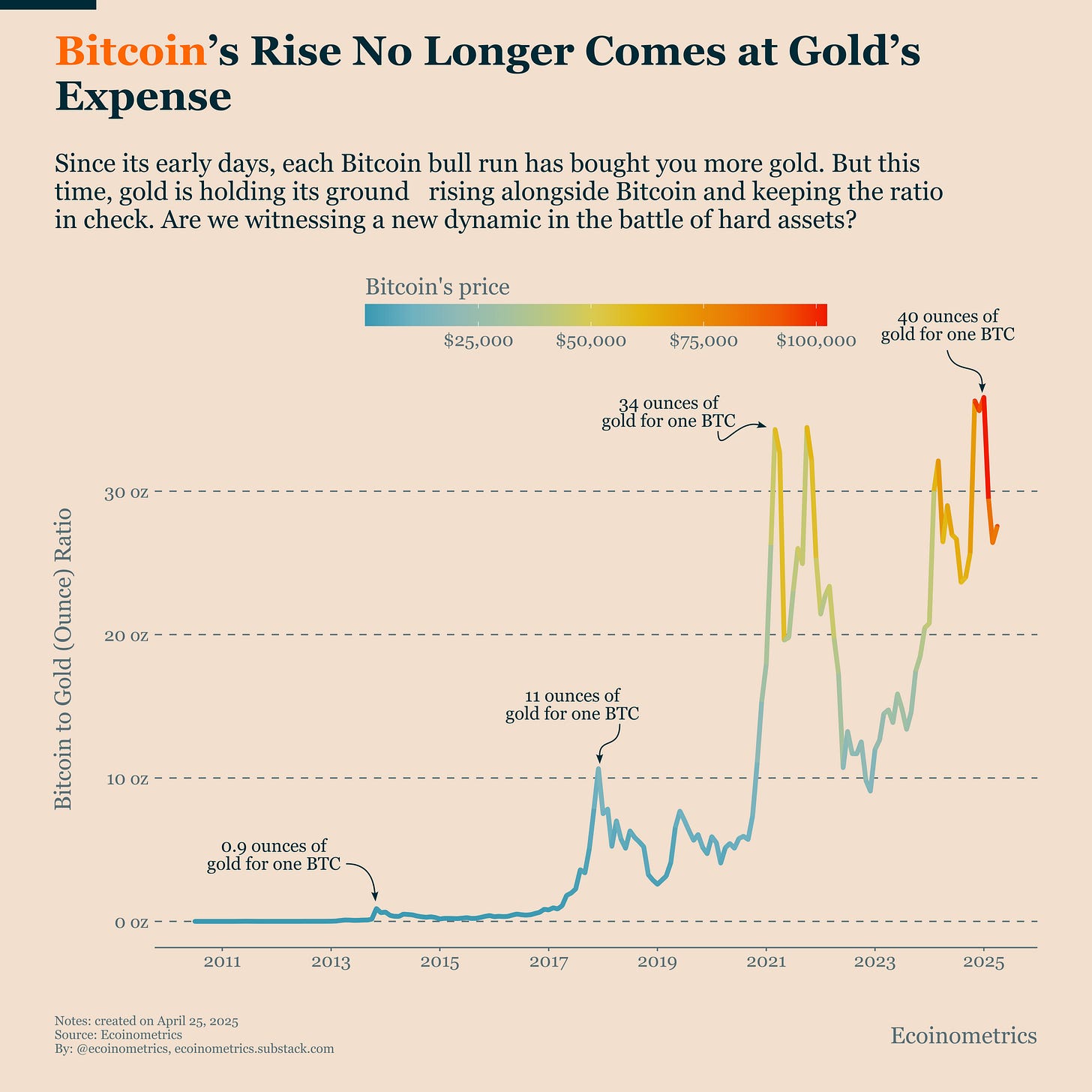

Gold Isn’t Backing Down This Time

Bitcoin has been gaining steadily against gold over the past decade. In every bull cycle, one Bitcoin has been able to buy significantly more gold than in the previous one.

Except this time.

Back in 2021, one BTC could buy 34 ounces of gold. At the peak of the current cycle, that number only climbed to 40 ounces. That’s a smaller relative gain than what we’ve seen before, definitely not another 3-10x leap.

But this isn’t because Bitcoin has stalled. It’s because gold has been on a strong, consistent uptrend of its own, posting new all-time highs repeatedly.

Gold’s strength over the past two years is largely driven by persistent geopolitical risk, rising debt levels, and central bank buying especially from emerging markets looking to de-dollarize.

What’s clear is that Bitcoin and gold are now moving on different tracks, reflecting their diverging roles in the current macro environment.

Since Trump re-entered the spotlight, markets have rediscovered a need for traditional safe havens. That’s been a major tailwind for gold. You can see it in how gold is trading relative to the dollar and to Bitcoin.

Bitcoin, by contrast, still has one foot in the risk asset camp. It’s seen both as a long-term hedge against monetary debasement and as a high-beta growth asset which means it’s still exposed to macro headwinds.

Bitcoin continues to face pressure from restrictive monetary policy, tightening liquidity, and regulatory uncertainty. Until those fade or reverse, Bitcoin’s risk-on profile will keep it from behaving like a classic safe haven.

That's it for today. Thanks for reading.

Cheers,

Nick

P.S. Every week, our team conducts extensive research analyzing market data, tracking emerging trends, and creating professional-grade charts and analysis.

Our mission: Deliver actionable macro and Bitcoin insights that help institutional investors and financial advisors make better-informed decisions.

Ready for institutional-grade research that puts you ahead of the market? Click below to access our premium insights.

Fascinating read! I’m Harrison, an ex fine dining industry line cook. My stack "The Secret Ingredient" adapts hit restaurant recipes (mostly NYC and L.A.) for easy home cooking.

check us out:

https://thesecretingredient.substack.com