There's a popular notion that Fed rate cuts will weaken the US Dollar, creating a tailwind for Bitcoin. Often, this idea is oversimplified to “weak US Dollar means strong Bitcoin”. But this relationship is too vague to be confirmed or refuted easily.

So today let’s try to be a bit more specific by focusing on where this is not true.

The Ecoinometrics newsletter gives you insights from crypto and macro data to help you make better investment decisions.

We spend hours every day gathering data, creating metrics and bringing them to life with data visualizations that allow you to quickly get to the heart of things.

We then distill all that knowledge in each issue of the newsletter with less words and more charts so that you get insights, direct to the point, in five minutes or less.

Join more than 24,000 investors here:

Done? Thanks! That’s great! Now let’s dive in.

Bitcoin vs US Dollar Strength: Not So Straightforward

The Takeaway

The link between Bitcoin and US Dollar strength is more complex than often portrayed. While there's a correlation, it's not causal.

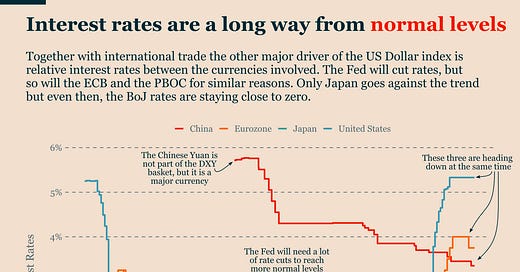

As we approach Fed rate cuts, don't expect a dramatic dollar weakening or Bitcoin surge. Other central banks are also adjusting policies, moderating potential impacts.

The real catalyst for significant Bitcoin movement would be a return to quantitative easing, which seems unlikely at the moment. It is still time for caution.

Bitcoin and US Dollar Strength: Correlation, not Causation

Keep reading with a 7-day free trial

Subscribe to Ecoinometrics to keep reading this post and get 7 days of free access to the full post archives.