Bitcoin's Activity Reset: Early Signs of a Market Top?

Bitcoin On-Chain Activity Report, March 2025

The information you get from Bitcoin's on-chain metrics doesn't directly drive the price action.

You can see whales moving coins around and other similar behaviours. But interpreting what this means for price action is often tricky.

What on-chain metrics have been good at, though, is figuring out what market regime Bitcoin is in. That's especially true of the on-chain activity.

And right now it is showing signs of weakness.

Let's talk about it.

Ecoinometrics delivers professional-grade crypto and macro analysis to help institutional investors and serious traders make data-driven decisions.

Our team conducts rigorous quantitative research, developing proprietary metrics and institutional-quality visualizations that cut through the noise to reveal key market dynamics.

Each newsletter provides clear, actionable insights backed by data, delivered in a concise format that respects your time - five minutes to absorb, but deep enough to inform your investment strategy.

Join over 30,000 professional investors and fund managers:

Ready? Let's dig into the data.

Bitcoin's Activity Reset: Early Signs of a Market Top?

The Takeaway

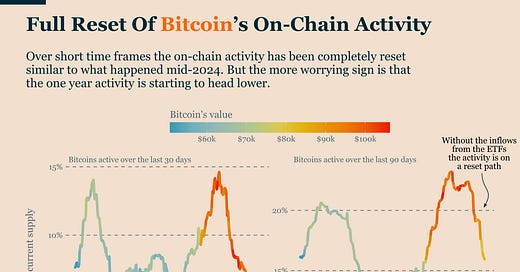

Bitcoin's on-chain metrics are showing concerning signals as long-term activity begins to decline.

This pattern has historically marked the end of bull markets, and it's now coinciding with ETF outflows and Bitcoin trading below its 200-day moving average.

The data suggests we're entering a consolidation phase with elevated downside risk, warranting a defensive position until market conditions improve.

Has The On-Chain Activity Topped?

Keep reading with a 7-day free trial

Subscribe to Ecoinometrics to keep reading this post and get 7 days of free access to the full post archives.