Bitcoin’s extraordinary risk-adjusted returns

Also an average year for BTC and finally rate cuts

Welcome to the Friday edition of the Ecoinometrics newsletter.

Every week we bring you the three most important charts on the topics of macroeconomics, Bitcoin and digital assets.

Today we'll cover:

Bitcoin’s extraordinary risk adjusted returns.

An average year for Bitcoin.

Finally, rate cuts.

Each topic comes with a small explanation and one big chart. So let’s dive in.

In case you missed it, here are the other topics we covered this week:

If you aren’t subscribed yet, hit the subscribe button, to receive this email every week directly in your inbox:

Bitcoin’s extraordinary risk-adjusted returns

It hasn’t be very exciting to invest in Bitcoin in recent months. No volatility. Returns are pretty much flat. Even the halving hasn’t been a catalyst for changes.

Yet if you compare Bitcoin’s performance to other assets of similar size, Bitcoin is still an outlier.

Over the last 12 months it has easily the highest returns of all the major assets, except for Nvidia. And over the same period it also gives you the best risk adjusted returns by a large margin, except for Nvidia.

What pointing out is that the only thing that has managed to outperform Bitcoin is Nvidia. But where Nvidia has benefitting from the AI boom over the past 18 months, BTC has just been having an average time.

That tells you how much potential there still is for Bitcoin.

An average year for Bitcoin

To reinforce the point I was making in the previous chart, here I have plotted the year-to-date returns of Bitcoin. You can see this year vs the five previous years.

At the end of July BTC is up 53%.

Where does that place it? Basically in the middle of the average growth trajectory of Bitcoin in any given year.

So there is no reason to be worried about the lack of action since March. Bitcoin is doing what it always does. What it needs to see the next leg upward is a macro catalyst.

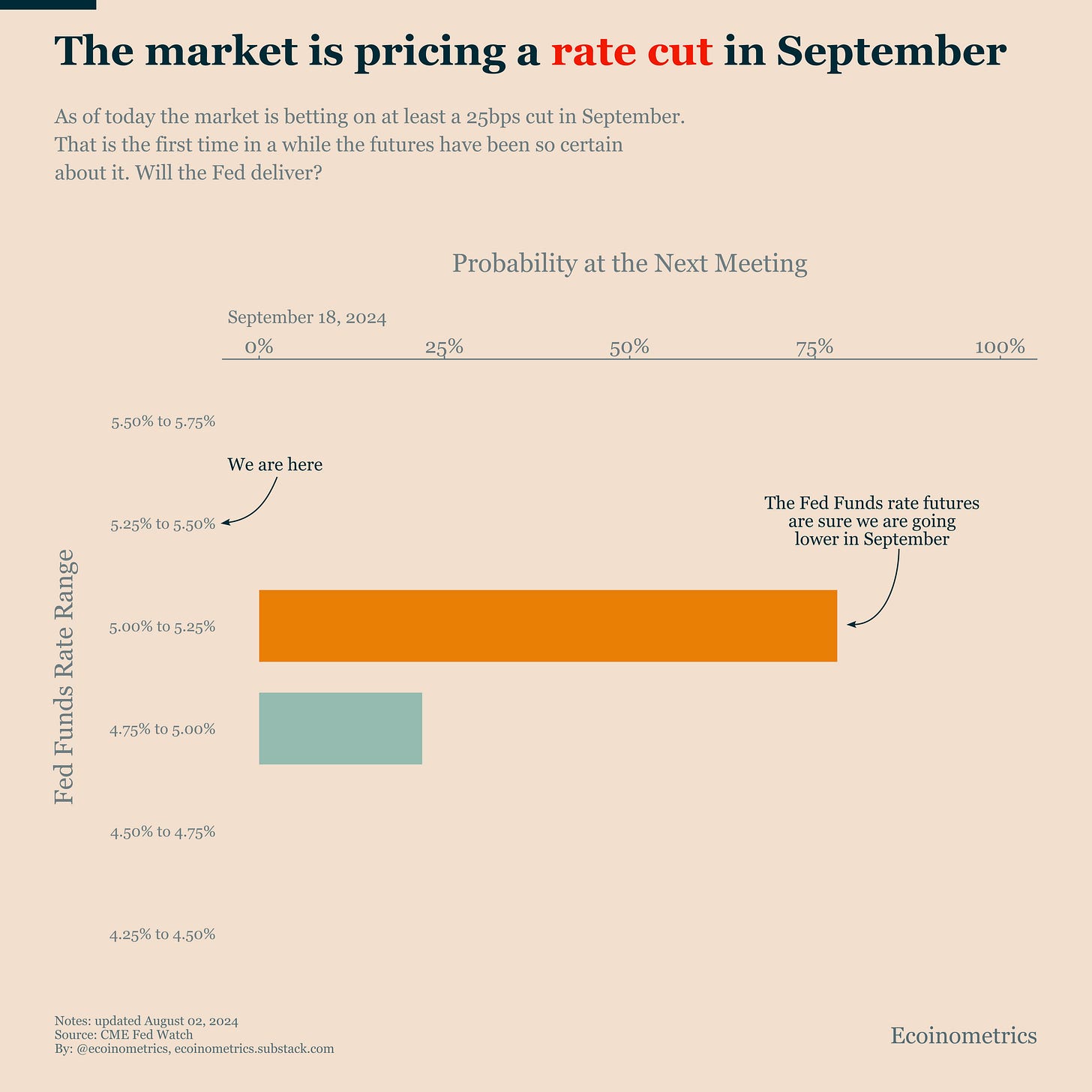

Finally rate cuts

And talking about macro catalysts, we just had a meeting of the Federal Reserve this week. Fed Chairman Jerome Powell announced that they are keeping rate unchaged for now.

But everything is hinting at rate cuts in the fall.

Actually the Fed Funds Rate futures are now pricing in at least a 25bps rate cut this September. As you can see on the chart below, the market is certain about it. And they even put substantial odds for a larger cut.

If there is no surprise in the economic data chances are the FOMC will deliver. But we’ll discuss that in more detail inside the upcoming Monday issue of the newsletter.

That’s it for today. I hope you enjoyed this. We’ll be back next week with more charts.

Cheers,

Nick

P.S. We spend the entire week, countless hours really, doing research, exploring data, surveying emerging trends, looking at charts and making infographics.

Our objective? Deliver to you the most important insights in macroeconomics, Bitcoin and digital assets.

Armed with those insights you can make better investment decisions.

Are you a serious investor? Do you want to get the big picture to get on the big trades? Then click on the button below.