Bitcoin’s Third Move

Also Three ETFs in the Top 10 & Bitcoin Took the Lion’s Share of Crypto’s Market Expansion

Welcome to Ecoinometrics' Friday edition.

Each week, we analyze the three most critical market signals impacting Bitcoin and macro assets, delivering institutional-grade insights through data-driven charts and analysis.

Today we'll cover:

Bitcoin’s Third Move

Three ETFs in the Top 100

Bitcoin Took the Lion’s Share of Crypto’s Market Expansion

This week’s signals all point in the same direction: Bitcoin is not just performing well, it’s consolidating its role as the anchor of the crypto asset class. From repeated ETF-driven price surges to climbing the ranks among the largest ETFs by AUM, and now capturing the bulk of crypto market growth, the trend is clear. Institutional demand is reshaping the structure of this market and Bitcoin is at the centre of it.

In case you missed it, here are the other topics we covered this week:

Essential Decision-Making Tools

Bitcoin Market Monitor - Key Drivers in Five Charts:

Bitcoin Market Forecast - Probability Scenarios & Risk Metrics:

Get these professional-grade insights delivered to your inbox:

Bitcoin’s Third Move

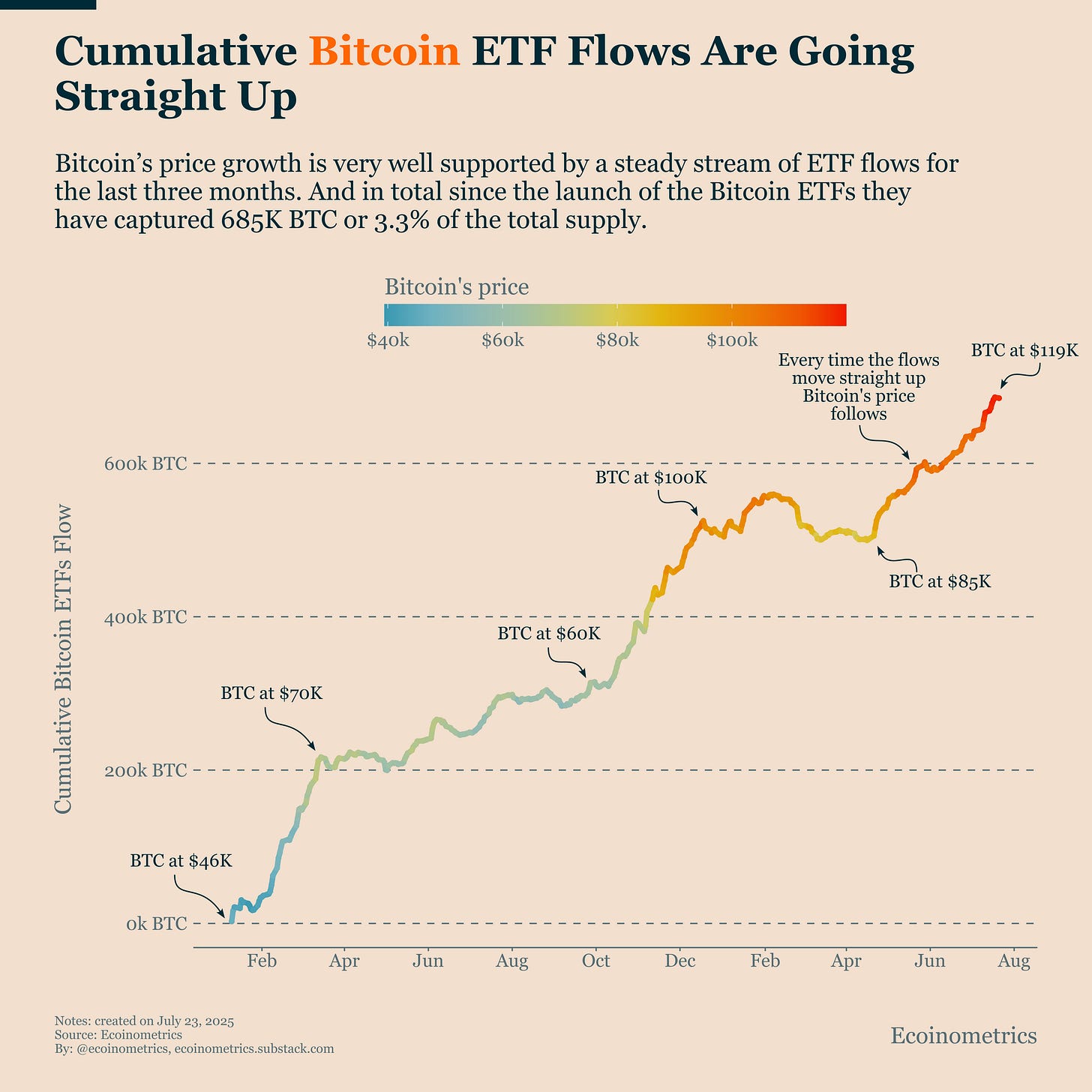

Since the launch of the spot Bitcoin ETFs 18 months ago, we’ve seen a clear and repeated pattern emerge.

It goes like this:

ETF flows ramp up, and Bitcoin’s price moves sharply higher.

Then flows stall, and Bitcoin consolidates.

That cycle has played out three times already:

Launch to March 2024: pent-up demand drove big inflows. Bitcoin jumped from $46K to $70K.

Fall 2024 to year-end: inflows picked up again after the U.S. elections. BTC rallied from $60K to $100K.

May 2025 to now: we’re in the middle of another sharp move up in ETF flows. Bitcoin has climbed from $85K to $119K.

In between those moves? Mostly sideways price action.

This isn’t just correlation. There’s a causal mechanism: when money flows into the ETFs, those funds need to buy more Bitcoins putting steady upward pressure on the price.

This also suggests that ETF-driven demand is becoming the dominant driver of Bitcoin’s cyclical behaviour, replacing narratives and retail speculation with institutional flows.

That’s why it makes sense to watch the slope of cumulative ETF flows. It gives you a real-time read on the market regime.

And right now, the slope is steep again. We’re in another expansion phase.

Three ETFs in the Top 100

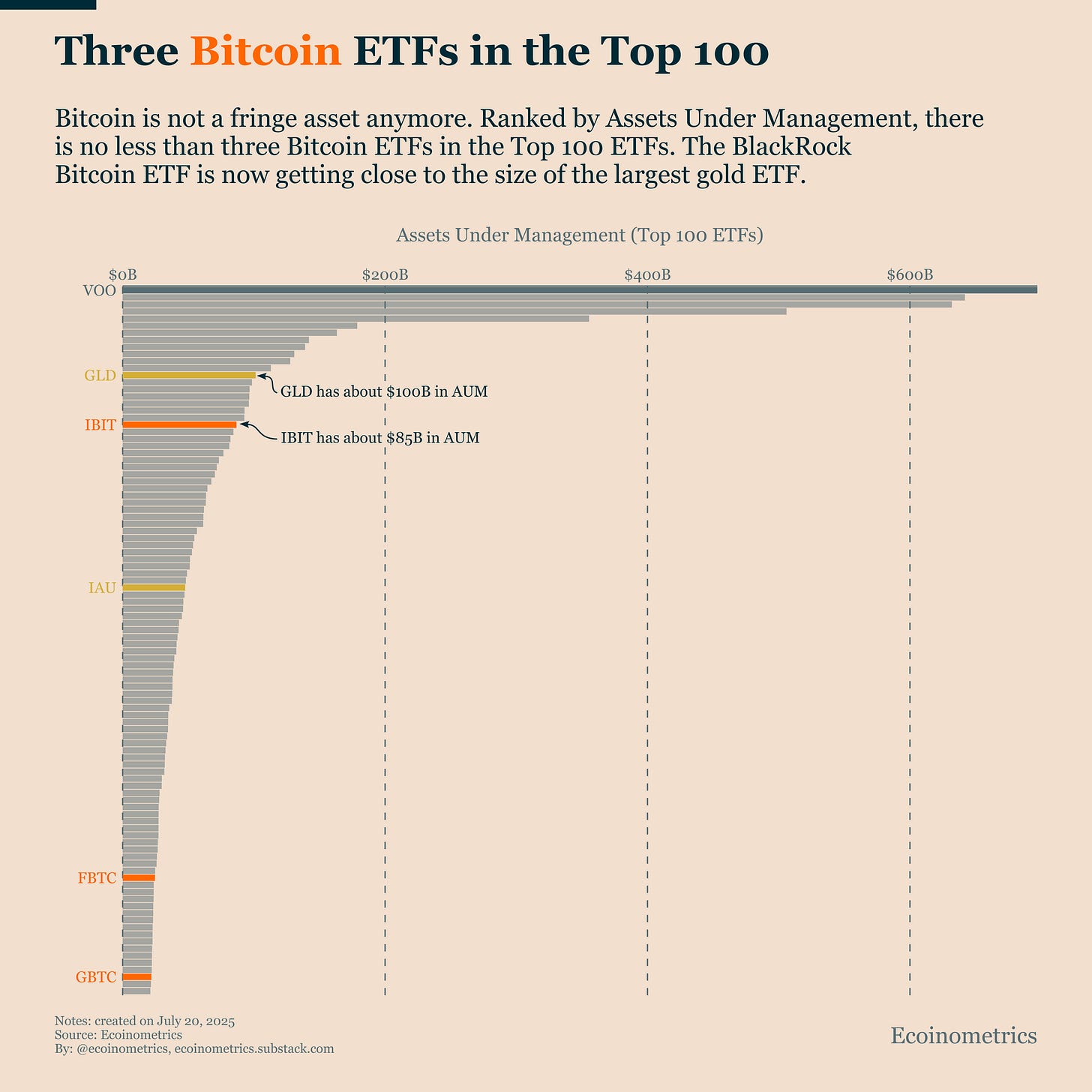

With nearly 700K BTC added to ETF holdings over the last 18 months, it’s no surprise that some of these funds are starting to get large.

How large?

As of now, three spot Bitcoin ETFs rank in the top 100 U.S.-listed ETFs by assets under management. The biggest, BlackRock’s IBIT, isn’t far behind GLD, which is the largest gold ETF.

And when you add them up, the combined AUM of these Bitcoin ETFs is about the same as the total AUM of the two gold ETFs that appear in the top 100.

So we’re no longer talking about a niche or exotic asset. Bitcoin is playing in the same league as gold.

Of course, it’s still far from challenging the massive equity ETFs, which dominate the list thanks to broad diversification and large retail inflows.

But the fact that Bitcoin ETFs are already competitive with gold tells you everything you need to know about their legitimacy.

You still hear people question whether Bitcoin is a “real” investment. But the financial adoption metrics speak for themselves: Bitcoin is now embedded in the structure of U.S. capital markets and it’s here to stay.

Bitcoin Took the Lion’s Share of Crypto’s Market Expansion

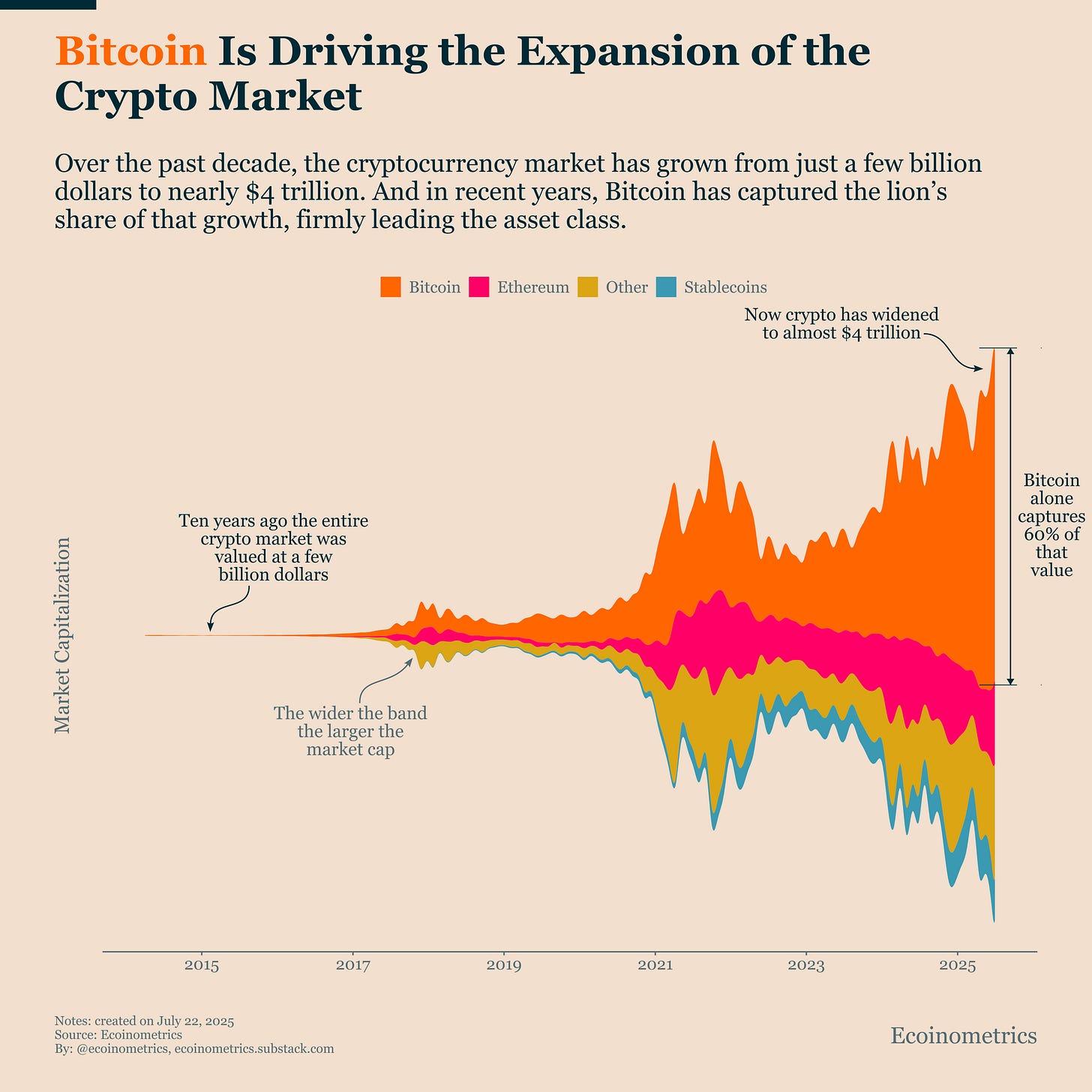

Looking back over the past decade, it’s remarkable how far crypto has come, expanding from just a few billion dollars in market value to nearly $4 trillion today.

But zoom in on the last three years, and it becomes clear: Bitcoin has driven most of that expansion.

In the first part of the cycle, this was typical of a bear market recovery. Bitcoin tends to outperform during that phase, with its dominance rising as capital flows back into crypto.

Then came the second leg (starting 18 months ago) driven by the launch of spot Bitcoin ETFs. That influx of capital flowed entirely into Bitcoin, supercharging its market cap relative to the rest of the crypto space.

Of course, it now looks like Bitcoin dominance may have peaked. If we’re entering the later stages of this bull cycle, growth is likely to be more evenly distributed across altcoins and Ethereum.

Still, it’s worth remembering that Bitcoin plays a privileged role in crypto’s market structure. It often leads the cycle. That’s why understanding Bitcoin’s market regime helps you make better decisions, even when your bet is further out on the crypto risk curve.

That's it for today. Thanks for reading.

Cheers,

Nick

P.S. Every week, our team conducts extensive research analyzing market data, tracking emerging trends, and creating professional-grade charts and analysis.

Our mission: Deliver actionable macro and Bitcoin insights that help institutional investors and financial advisors make better-informed decisions.

Ready for institutional-grade research that puts you ahead of the market? Click below to access our premium insights.

Was always going to.