Bitcoin’s Two-Year Streak at the Top

Also Bitcoin Enters a New, Low-Volatility Regime & Cooling Job Openings Ease Pressure on Inflation

Welcome to Ecoinometrics' Friday edition.

Each week, we analyze the three most critical market signals impacting Bitcoin and macro assets, delivering institutional-grade insights through data-driven charts and analysis.

Today we'll cover:

Bitcoin’s Two-Year Streak at the Top

Bitcoin Enters a New, Low-Volatility Regime

Cooling Job Openings Ease Pressure on Inflation

Together, these charts tell a clear story: Bitcoin continues to lead performance across major assets, but it’s doing so with unusually low volatility, a shift that changes how investors can think about risk.

Meanwhile, macro conditions are evolving in a way that could support this trend, with labor market pressures easing and inflation risks becoming more balanced. It’s a moment that invites strategic positioning, not reactive trades.

In case you missed it, here are the other topics we covered this week:

Essential Decision-Making Tools

Bitcoin Market Monitor - Key Drivers in Five Charts:

Bitcoin Market Forecast - Probability Scenarios & Risk Metrics:

Get these professional-grade insights delivered to your inbox:

Bitcoin’s Two-Year Streak at the Top

Month-to-month, leadership among major assets can shift quickly. In April, Bitcoin lagged behind most other assets. In May, it climbed back toward the top, though Ethereum outpaced it over that single month.

Short-term fluctuations matter if you’re making tactical calls. But when you zoom out to a 12-month view, the pattern looks very different and, frankly, more stable.

What stands out is the consistency of the top three performers: Bitcoin, gold, and the NASDAQ 100. Over the past two years, this trio has appeared near the top of the leaderboard in most rolling 12-month periods.

True, the order shifts depending on market conditions. Sometimes gold leads, sometimes it’s Bitcoin or tech stocks. But the trio itself rarely changes.

That kind of consistency matters. In a world where macro narratives and political headlines constantly shift market sentiment, having a core allocation to assets that persistently deliver is a useful anchor.

One interesting aspect here is that these three assets represent very different narratives: digital scarcity, hard money, and growth. That diversification of drivers may be part of why the trio has held up so well.

If you’re trying to outperform by timing every rotation, it’s easy to get whipsawed. But sticking with high-conviction trends that endure through different cycles can deliver strong performance without having to predict each twist in the road.

As the U.S. political environment becomes another source of volatility, it’s a good time to remember which assets have shown staying power.

Bitcoin Enters a New, Low-Volatility Regime

Long-term returns matter most, but over shorter horizons, volatility still shapes how investors allocate capital.

And right now, Bitcoin’s volatility is doing something unusual.

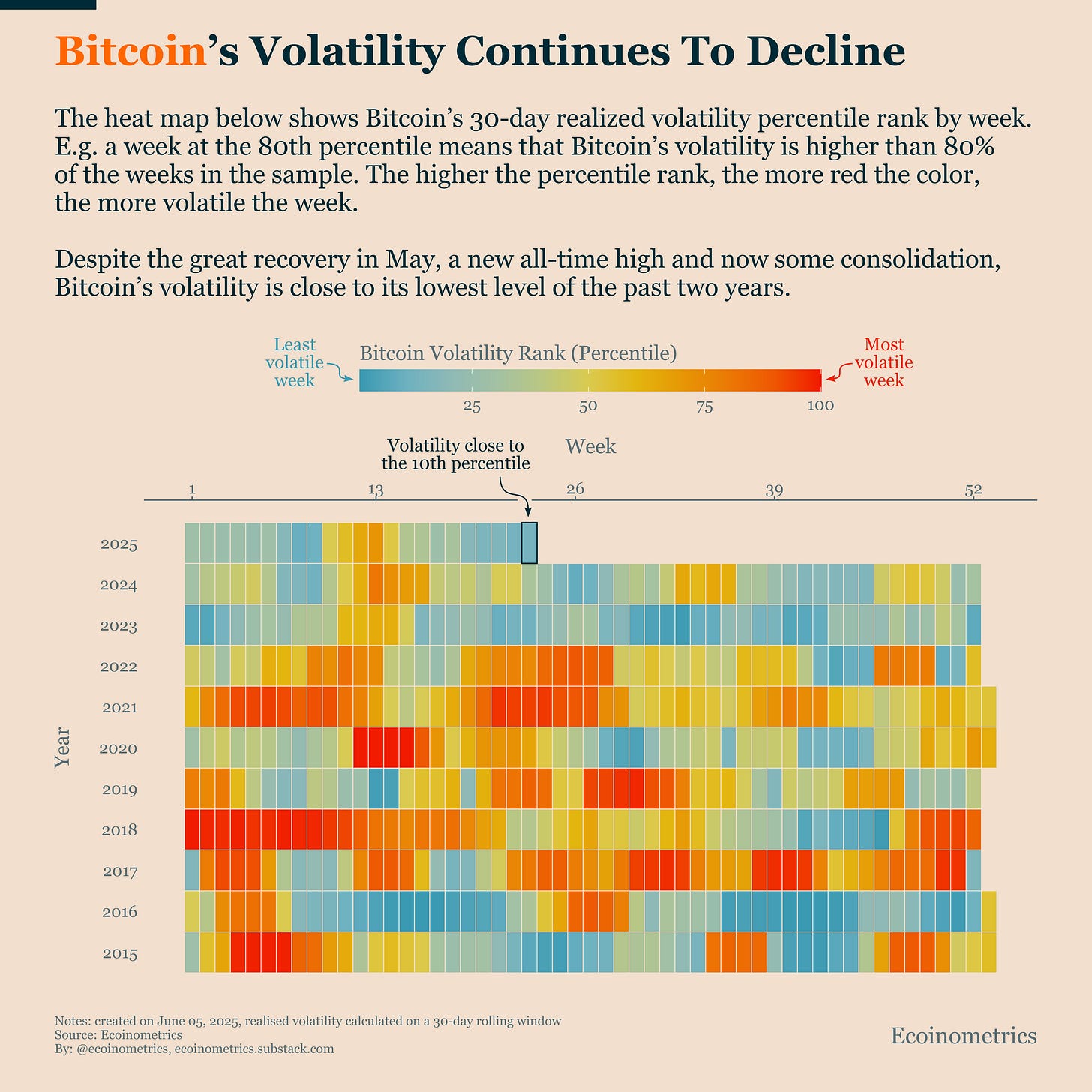

The heat map below shows Bitcoin’s 30-day realized volatility, ranked by week across the past decade. A darker blue means lower volatility for that week relative to history.

As of last week, Bitcoin’s volatility is near the 10th percentile, meaning it’s been less volatile than 90% of the time over the last 10 years.

That’s remarkable given that Bitcoin just hit a new all-time high last month. Even with that strong price action, volatility has stayed low.

But actually this isn’t a one-off. For most of the past two years, Bitcoin has rarely spiked into the high-volatility ranks, even as it delivered solid returns.

That’s in sharp contrast with prior cycles, where big returns were almost always paired with violent swings. The last two years have shown that Bitcoin can trend upward without triggering whiplash.

The implication is clear: Bitcoin may have entered a new phase in its evolution, one marked by more stable price action and fewer explosive moves.

It’s still more volatile than gold, but it no longer stands out as a major outlier. With each passing low-volatility week, that perception shifts further.

That opens the door for more professional allocators to revisit their assumptions. As volatility normalizes, Bitcoin becomes easier to fit into portfolios, without blowing up risk models or breaching volatility budgets.

Cooling Job Openings Ease Pressure on Inflation

Earlier this week, we got the latest data on U.S. job openings and it’s not bad news for the Federal Reserve.

Openings have now stabilized in the 7 to 8 million range, effectively returning to pre-COVID norms. That marks the end of a three-year stretch of labor market excess driven by:

A massive fiscal stimulus,

A post-lockdown demand surge, and

Labor shortages that constrained supply.

That combination caused job openings to spike to record highs. And with it came rising wage pressure, as companies competed more aggressively for workers. Those higher wages fed into core inflation, especially in service sectors where labor costs are sticky.

Wage inflation tends to be persistent. When job openings are high, firms raise pay to attract and retain workers. Those costs get passed on to consumers, fueling core inflation.

Now that the labor market is less overheated, those inflationary pressures should ease. It doesn’t mean inflation will fall back to 2% overnight but it does remove one of the more structural upward forces.

And that’s timely, because the Fed is still clearly concerned about inflation. We saw that in last month’s FOMC minutes, and it’s reflected in our Fed Communication Index, which remained firmly hawkish.

At the same time, there’s a new wildcard: U.S. tariff policy. The Fed can’t control that, but new tariffs could easily offset progress made on the labor front by pushing up goods prices and re-accelerating inflation.

So the tug-of-war is this: a softening labor market helps dis-inflate, while trade policy could reflate. The balance of those forces will shape macro conditions for the rest of the year.

For Bitcoin investors, this matters.

If disinflation resumes and the Fed regains confidence, that creates room for rate cuts or a more dovish tone, both of which tend to support risk assets and Bitcoin. The opposite is true if tariffs spark a new wave of inflation.

That's it for today. Thanks for reading.

Cheers,

Nick

P.S. Every week, our team conducts extensive research analyzing market data, tracking emerging trends, and creating professional-grade charts and analysis.

Our mission: Deliver actionable macro and Bitcoin insights that help institutional investors and financial advisors make better-informed decisions.

Ready for institutional-grade research that puts you ahead of the market? Click below to access our premium insights.

I totally agree with you, the most important thing about this Bitcoin cycle has to do with its low volatility. Many of us have been in the cryptocurrency world for several years and have witnessed this evolution closely. In my case, I thought we would see a spike in high volatility after the introduction of bitcoin ETFs, but it has been developing differently than I imagined it would.

The good thing is, as you rightly explain, this is great for fund managers, especially given the multiple ETFs as vehicles to invest in bitcoin.

No doubt, the future of bitcoin is promising.