Coinbase’s fate is tied to Bitcoin

Also deficit is destiny and is it three or six rate cuts in 2024?

Welcome to the Friday edition of the Ecoinometrics newsletter.

Every week we bring you the three most important charts on the topics of macroeconomics, Bitcoin and digital assets.

Today we'll cover:

Coinbase’s fate will be decided by Bitcoin.

Deficit is destiny.

The Fed sees three rate cuts, Wall Street is betting on six.

Each topic comes with a small explanation and one big chart. So let’s dive in.

In case you missed it, here are the other topics we covered this week:

If you aren’t subscribed yet, hit the subscribe button, to receive this email every week directly in your inbox:

Coinbase’s fate will be decided by Bitcoin

For better, for worse, for richer, for poorer, in sickness and in health, to love and to cherish, till death do us part... if you are married you know what I'm talking about... but that's also the story of Coinbase and Bitcoin.

Now the marriage didn't start well for sure. It all starts with the date of the direct listing for Coinbase: April 14, 2021. In hindsight it was hard to pick a worse date than that.

Coinbase was listed basically at the same time as Bitcoin was reaching $60k. And we all know where the story goes after that. Yes there was a retest of the all-time high later that year. But you can argue that the top of the bull market was already in.

Since the listing, Coinbase's stock is following Bitcoin's price action pretty closely. Big correction in 2022, bottomed at -90%. Big recovery in 2023, up +393%.

If Bitcoin realizes its full halving+ETF potential in 2024 that will be big for Coinbase as well.

Same as betting on the miners, betting on Coinbase is a leverage play on Bitcoin's performance. So that's something worse considering (although I would caution against expecting the ETFs to provide a miraculous boost to Coinbase).

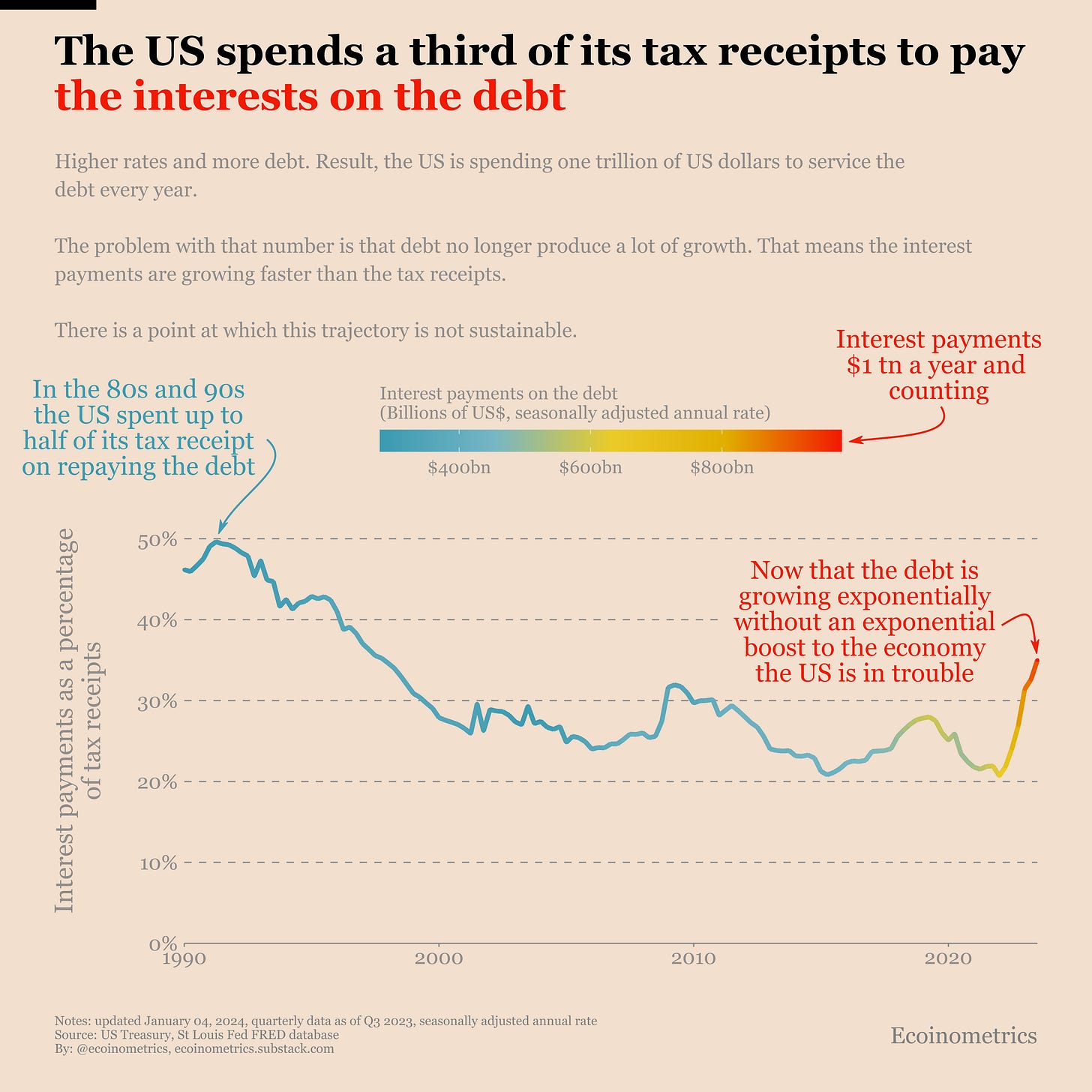

Deficit is destiny

What is going to influence the most the monetary policy of the US over the next decade?

If I had to bet I'd say the US deficit. We have reached the point where debt has diminishing returns. For decades it was a tool to boost growth. But now the same amount of extra debt produces less growth on average.

Which means to keep up the US has to borrow in always larger quantity. It is a bit like chasing losses. You wouldn't recommend that to a gambler or an investor. But that's exactly what the federal government is doing.

The problem is that at some point more debt for less growth implies that you won't be able to pay the interest on the debt by raising taxes on the economic activity.

In that situation monetary debasement (a.k.a. the monetization of the debt by the Federal Reserve) is the only way forward to avoid a default.

We aren't there yet but it is unavoidable. Deficit is destiny.

The Fed sees three rate cuts, Wall Street is betting on six

At the last FOMC meeting, the dot plot signalled good chances of three rate cuts this year. Of course, the situation could change.

Inflation could spike, which would mean no rate cuts. Alternatively, a recession could hit the US economy, leading to a return to a zero interest rate environment.

FOMC members express their opinions based on the information available at a given point in time, but economists are not particularly good at making predictions, especially concerning the future.

However, based on the current information we have, it does feel like Wall Street got carried away. What are they pricing for 2024? No less than six rate cuts. Seems legit…

That’s it for today. I hope you enjoyed this. We’ll be back next week with more charts.

Cheers,

Nick

P.S. We spend the entire week, countless hours really, doing research, exploring data, surveying emerging trends, looking at charts and making infographics.

Our objective? Deliver to you the most important insights in macroeconomics, Bitcoin and digital assets.

Armed with those insights you can make better investment decisions.

Are you a serious investor? Do you want to get the big picture to get on the big trades? Then click on the button below.