Did the Bitcoin ETFs change the correlation patterns?

Bitcoin correlations report, February 2024

One reason to look at Bitcoin's correlation to other assets is to get a feel for what is driving the plot.

Sometimes it is the macro environment. Sometimes it is portfolio rotations. And sometimes it is a structural shift in the market.

With the introduction of the ETFs you might have expected the latter. But has anything changed really?

The Ecoinometrics newsletter gives you insights from crypto and macro data to help you make better investment decisions.

We spend hours every day gathering data, creating metrics and bringing them to life with data visualizations that allow you to quickly get to the heart of things.

We then distill all that knowledge in each issue of the newsletter with less words and more charts so that you get insights, direct to the point, in five minutes or less.

Join more than 21,000 investors here:

Done? Thanks! That’s great! Now let’s dive in.

P.S. we have just released a new dashboard on the Bitcoin miners. The purpose of this dashboard is to track if the Bitcoin miners stocks are over priced or under priced relative to Bitcoin. Paid subscribers can check it out here.

Did the Bitcoin ETFs change the correlation patterns?

The takeaway

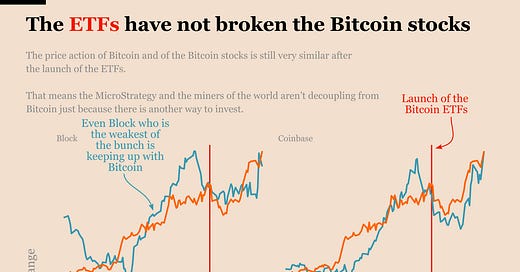

The Bitcoin ETFs could have messed up a lot of the long established correlation patterns.

But they didn't.

The Bitcoin stocks are as correlated to Bitcoin as they have ever been. And Ethereum only went from being insanely correlated to being highly correlated.

That's a sign the ETFs are mostly bringing in new participants to the market with new money. And that’s a net positive for Bitcoin and the ecosystem.

Ethereum is the only new correlation trend

Keep reading with a 7-day free trial

Subscribe to Ecoinometrics to keep reading this post and get 7 days of free access to the full post archives.