It is this time of the year again. Bitcoin is having another significant correction and the traditional finance commentators are coming out of the wood to call the beginning of the end.

But drawdowns are part of every bull market and they have always been a good time to buy...

The Ecoinometrics newsletter decrypts Bitcoin’s place in the global financial system. If you want to get an edge in understanding the future of finance you only have to do two things:

Click on the subscribe button right below.

Done? That’s great! Now let’s dive in.

Tracking the dip

Obviously when it comes to money people tend to have emotional reactions during price swings. That’s natural.

During downturns you might think things like:

“Am I going to lose my money?”

“Should I sell now?”

“Is the bull market over?”

“Did I make a wrong decision when I just bought last week?”

...

These are fine questions to ask yourself but there is no reason to panic. Instead just put things in perspective.

Here is one way to think about it:

Is the current correction the result of some event that is invalidating your investment thesis?

Is the current correction looking different than anything else we have seen in the past?

Why those questions?

Well, if your investment thesis was wrong then there is no point staying in your position. Sell and move on.

If the market correction is completely unheard of then you need to dig deeper on the first question to see if you haven’t missed anything.

But if you answered no to these two questions then you are better served by doing nothing or buy the dip.

So which is it?

Different people will have different investment thesis for Bitcoin so obviously I can’t cover every case.

But I can tell you what I think.

Bitcoin is an adoption play. Price can fluctuate widely in the short term but as Bitcoin transitions to a fully fledged store of value more money is bound to flow into it.

That does not give us any specific price targets in the short term but I do think there are some milestones to watch out for:

$110k per BTC is where Bitcoin becomes larger than any stock (by market cap).

$135k per BTC is where Bitcoin becomes larger than the value of gold captured in financial instruments.

$500k per BTC is where Bitcoin becomes larger than the entire size of the physical gold market.

My guess is that we’ll overtake (1) and (2) in this cycle.

So does this price correction have anything to do with adoption?

Well the chain of events that triggered the correction is unclear. There is a bit of over leverage, a bit of sell the news after the direct listing of Coinbase and a bit of rumour for a purported 80% crypto gain tax in the US. Shake all that, add a drop of fear, a pinch of doubt and you get a selloff.

Over leverage and sell the news actions have no bearing on adoption which is a long term play.

An 80% crypto gain tax in the US would certainly be bad. But:

It is nothing but a rumour that sounds very unlikely.

These kind of tax laws invariably contain loopholes that can be exploited by institutional investors. So that might be bad for the small fish but end up being no big deal for the smart money.

The US is not the world so while bad it isn’t the end of crypto.

So should we be worried about our investment thesis? No.

What about the technicals of the dip? How does this one looks when compared to the past?

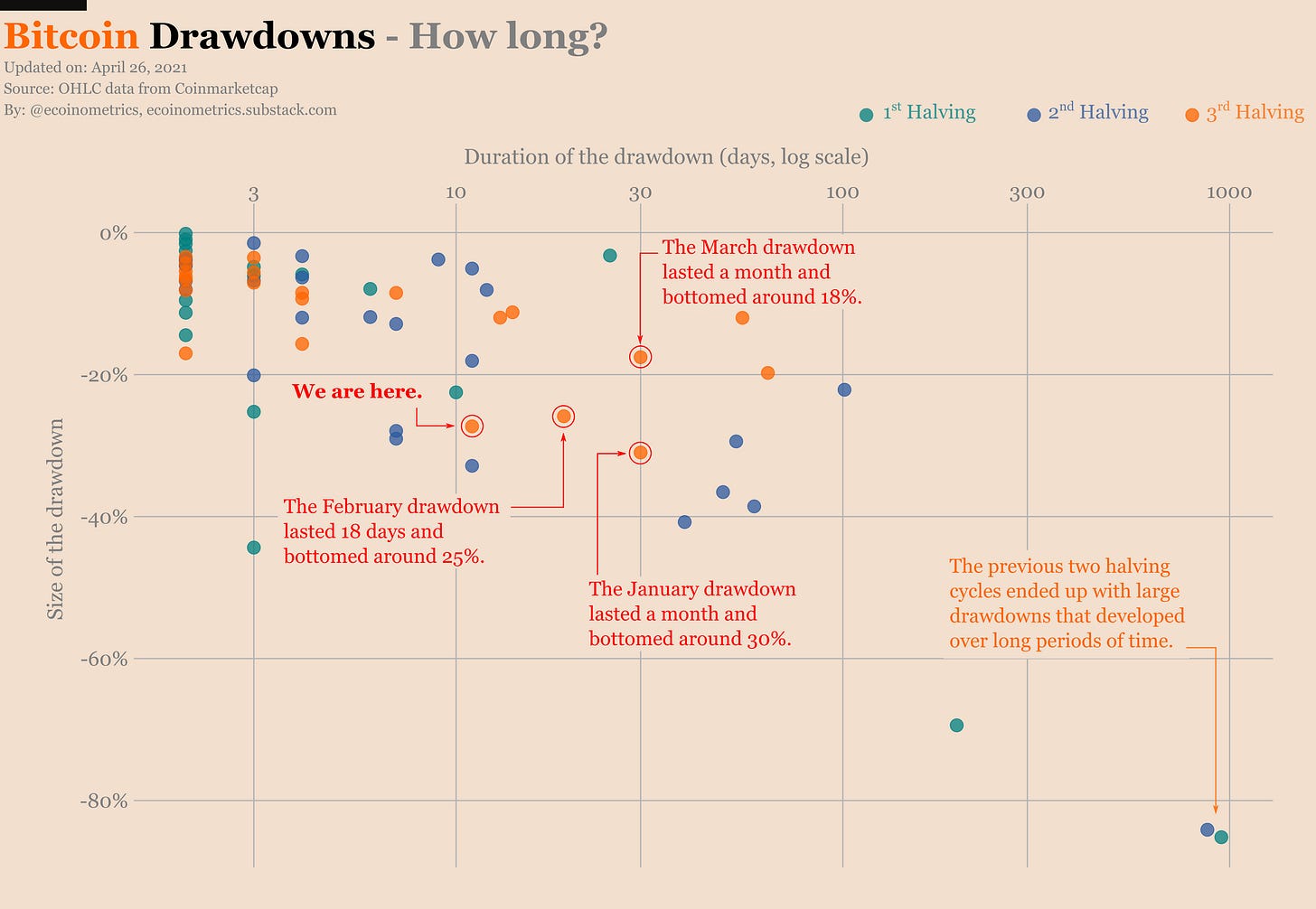

One way of looking at a correction is to measure how big it is and how long it has been going on.

This is exactly what the chart below tells you.

Each point is a drawdown. The colour encodes which halving cycle it belongs to. The lower the point on the vertical axis, the bigger the correction (measured from last all time high to lowest point). The further the point is to the right, the longer it took for the price to recover and make a new all time high.

If you count only the corrections that are larger than 10% and exclude the 80%+ corrections that have happened at the end of the previous two cycles you get:

7 significant drawdowns after the 1st halving.

13 significant drawdowns after the 2nd halving.

13 significant drawdowns after the 3rd halving.

As I’m writing those lines the bottom for this dip is standing at -27%. That makes it the second largest of the cycle but when compared to what happened in 2017 it looks pretty standard.

We can dig a little bit deeper by looking at the trajectory of these significant drawdowns.

Each of the corrections starts from an all time high on day 1 with a 0% drawdown. Then the price dips lower and for each day we record the lowest point as a percentage drop from the all time high. After a certain number of days the price recovers to at least the previous all time high and we are back at a 0% drawdown.

This is what the next chart shows.

Each blue curve is the price trajectory of a correction starting at the fall from an all time high and lasting until the price recovers.

On the vertical axis is the size of the drawdown (percentage fall from the all time high), on the horizontal axis is the number of days since the last all time high.

The curves are split in panels based on the halving cycles.

The current drawdown is added in orange for comparison.

Check it out.

The first observation is that for each cycle the largest corrections are getting smaller. This is compatible with the idea that as adoption grows volatility is decreasing.

The second observation is that among the spaghetti of price corrections seen on the graph the current one does not stand out.

Conclusion, this dip does not look any different than what we have seen in the past.

Which means it is a good time buy. Based on the historical distribution of the dips there is less than 1 chance in 5 that you’ll be able to buy the dip lower than where the price bottomed at yesterday.

So there is no reason to wait.

Tl;dr there is nothing indicating that this time is different. So stack sats and move on.

That’s it for today. If you have learned something please subscribe and share to help the newsletter grow.

Cheers,

Nick

The Ecoinometrics newsletter decrypts Bitcoin’s place in the global financial system. If you want to get an edge in understanding the future of finance you only have to do two things:

Click on the subscribe button right below.

Done? That’s great!