Ecoinometrics - August 03, 2020

An asymmetric bet...

Most people are missing vital information about Bitcoin. That’s good, it means right now is a great time to invest. I’m going to repeat something a lot today: buying Bitcoin is making an asymmetric bet.

Asymmetric bet. Asymmetric bet. Asymmetric bet....

The Ecoinometrics newsletter decrypts Bitcoin’s place in the global financial system. If you want to get an edge in understanding the future of finance you only have to do two things:

Click on the subscribe button right below.

Follow Ecoinometrics on Twitter at https://twitter.com/ecoinometrics.

Done? That’s great! Thank you and enjoy.

People are worried about correlations

But they don’t need to be.

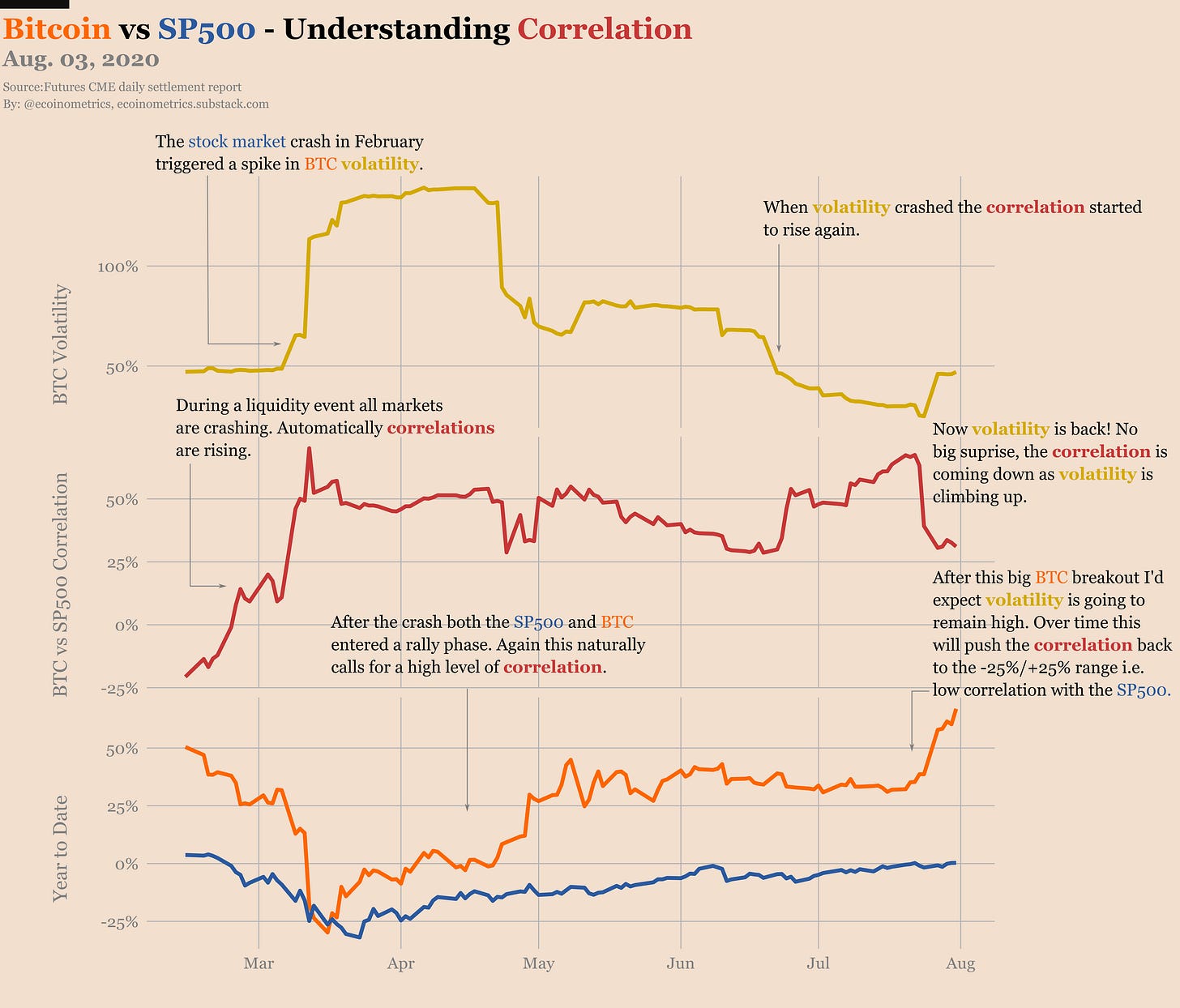

I’ve talked about it in a previous issue of the Ecoinometrics newsletter. Since the crash of March the correlation between Bitcoin and the SP500 has been high. Much higher than usual. And especially for the last month the correlation score was consistently above 0.5.

If you want to use Bitcoin as a hedge having it highly correlated to the stock market is obviously not ideal.

But back then my view was that this is a temporary state of the market. All of it can be explained by the sequence of events starting with the broad market crash:

The stock market is crashing. Margin calls happen. Investors sell their hard assets, including Bitcoin, to raise cash. High correlation.

The broad market enters a recovery phase. The stock market goes up. So does Bitcoin. High correlation.

Then Bitcoin gets trapped in a low volatility environment. Tight trading range. Short term trades. High correlation.

And now things play out pretty much as we expected. Bitcoin had a big breakout above $10,000. Volatility is back. And naturally the correlation between Bitcoin and the SP500 is decreasing.

Give it some more time and Bitcoin will regain its status as an uncorrelated asset. At least to the SP500.

When it comes to gold things might play out a bit differently. There is a common reason for gold and Bitcoin to rise in parallel.

Investors are bidding hard assets. They want to get a hedge against the actions of central banks. There aren’t that many hard assets you can buy to protect yourself against the debasement of fiat currencies.

Gold makes sense since it has been around for so long.

Bitcoin is the future. The BTC market cap is 40 times smaller than gold. I take it as a great opportunity to generate outsized returns.

Compared to gold, investing now in Bitcoin is making an asymmetric bet. The upside you can expect with Bitcoin is much larger than the downside risk. That’s still true with BTC at $11,000.

If you get in now you are still early and you are still getting the benefits of an asymmetric bet.

Your call.

Fidelity is bullish on Bitcoin

In case you aren’t aware, Fidelity Investments is a massive financial services company that’s managing something like US$2.5 trillion worth of assets.

But until recently they haven’t touched crypto. The reason of course is compliance. In order to be able to deal with digital assets they had to spin another business called Fidelity Digital Assets.

And now they are starting to put out some research. Pretty good timing I guess.

So here is the Fidelity Digital Assets investment thesis for Bitcoin. Honestly I think this report is making a bunch of good points.

I think this summary of the investment thesis is great: Bitcoin is an aspirational store of value.

Aspirational is the key word here. Believe it or not but that’s what makes the Bitcoin investment thesis especially attractive.

Aspirational means that if you invest now you are early. It means that your investment is actually an asymmetric bet. Your potential rewards for investing in Bitcoin before it goes from aspirational to actual store of value is much greater than the potential risk.

What are you waiting for?

What are the odds?

It’s interesting to see how people who are not invested in Bitcoin think about it. Here is an example.

What I get from this article is that Jack Hough is not going to take a BTC position. Why? Well someone who doesn’t do the math might think this way:

Bitcoin is this new magic internet money. It hasn’t been around very long. But yea I get it, it is supposed to be a “store of value”.

At the same time if I want a store of value I can just buy gold. It has been around for a long time so why would I buy this Bitcoin instead.

So I’m just going to play it safe and buy gold.

What is missing from this reasoning?

The odds.

We are always back to the same story. From a technological point of view Bitcoin is a superior store of value compared to gold. So technically Bitcoin is already a store of value.

However most of the world isn’t paying attention to it. What that means is that there is a massive untapped potential for growth.

That’s not the case for gold.

Just to catch up with gold, Bitcoin will need to multiply its market cap by 40. You are not going to get 40x growth by investing in gold.

With gold you are storing value. With Bitcoin you are storing value and you are making an asymmetric bet.

Building on Bitcoin

Should every decentralized project be built on top of Bitcoin? That’s a good question.

Back in 2017 we had the Ethereum and ICO boom when everybody and their mom was building their own Dapp.

I also played with smart contracts on Ethereum and looked at fun stuff like smart contract security. It was fun to tinker with but obviously the flaws were many. That’s not surprising when a new space grows very fast. Eventually most projects died when the price went south.

Until today.

Today the trending topic is DeFi. And most of the DeFi projects are based on Ethereum. The question is, why not build on Bitcoin for DeFi projects instead?

Sure Bitcoin is in many ways more rigid than Ethereum. But when it comes to security that’s a big advantage.

If you want to build something secure and reliable you don’t want to have too many bells and whistles. You want something boring and predictable.

So what if Bitcoin is all we need for the future of DeFi?

The Ecoinometrics newsletter decrypts Bitcoin’s place in the global financial system. If you want to get an edge in understanding the future of finance you only have to do two things:

Click on the subscribe button right below.

Follow Ecoinometrics on Twitter at https://twitter.com/ecoinometrics.

Done? That’s great! Thank you and enjoy.