Ecoinometrics - August 05, 2020

Notice that it's raining today...

Here is a quote I love:

“Fundamentals are not about forecasting the weather for tomorrow, but rather noticing that it is raining today.

The great trades don’t require predictions.”

Colm O’Shea, interviewed by Jack Schwager in Hedge Fund Market Wizards.

So open the window and look at the weather outside. What do you see?

The Ecoinometrics newsletter decrypts Bitcoin’s place in the global financial system. If you want to get an edge in understanding the future of finance you only have to do two things:

Click on the subscribe button right below.

Follow Ecoinometrics on Twitter at https://twitter.com/ecoinometrics.

Done? That’s great! Thank you and enjoy.

I’ll tell you what I see:

Central banks around the world are printing record amounts of money.

Governments are running always larger deficits.

The stock market is completely disconnected from the real economy.

Asset prices inflation has been there for a long time.

Modern Monetary Theory policies are gaining in popularity.

Tl;dr this is not business as usual.

Meanwhile investors are bidding up hard assets. Gold is up more than 30% this year and is pushing above $2,000 per ounce. Bitcoin is up +67% this year and is on a trajectory to retake the all time high of 2017.

Something else that has already happened earlier this year is the third Bitcoin halving.

There has been much debate on whether or not the halving was priced in. But you just have to look in the past to convince yourself that it’s a good time to buy Bitcoin.

After the past two halvings, within two years the price had increased 10x to 100x. If we apply the previous growth trajectories to the third halving here is what we get. Check it out.

If the growth trajectory for the third halving is the average of the previous two we’ll have something like:

By the end of 2020, BTC is at $41,000.

By mid April 2021, BTC is at $100,000.

One year after the third halving, BTC is at $387,000.

Even if you take the low range of growth Bitcoin can reach $100,000 a year from now.

What’s my point?

Combine those things:

All over the world fiat currencies debasement is accelerating.

For this reason and the uncertainties on the state of the global economy investors are buying are assets.

Bitcoin is in its post halving phase where it has historically experienced most of its growth.

What you get is a great trade: buy Bitcoin.

If you don’t have any, start buying now. If you already have some you probably don’t have enough. If you are an institutional investor you need to get long exposure.

This is financial advice.

Moving on.

Let’s take a look at the CME Bitcoin derivatives. BTC remains volatile which should be good for trading activity. But right now it looks like we are getting a consolidation phase above the breakout level.

That’s a good thing too. Old resistance levels are going to become new support levels. If you are thinking long term, this is what we need. A good solid level on which to launch towards $20,000. Then let FOMO take over for a while.

As many of you have noticed the time spreads exploded just when it was time to roll the July contracts to August. As a result, compared to the usual expiry, three times as many contracts didn’t get rolled.

But hey, when you grow your open interests by 20% in only a few days who cares right?

After the excitement of the breakout, the daily traded volume is coming down significantly.

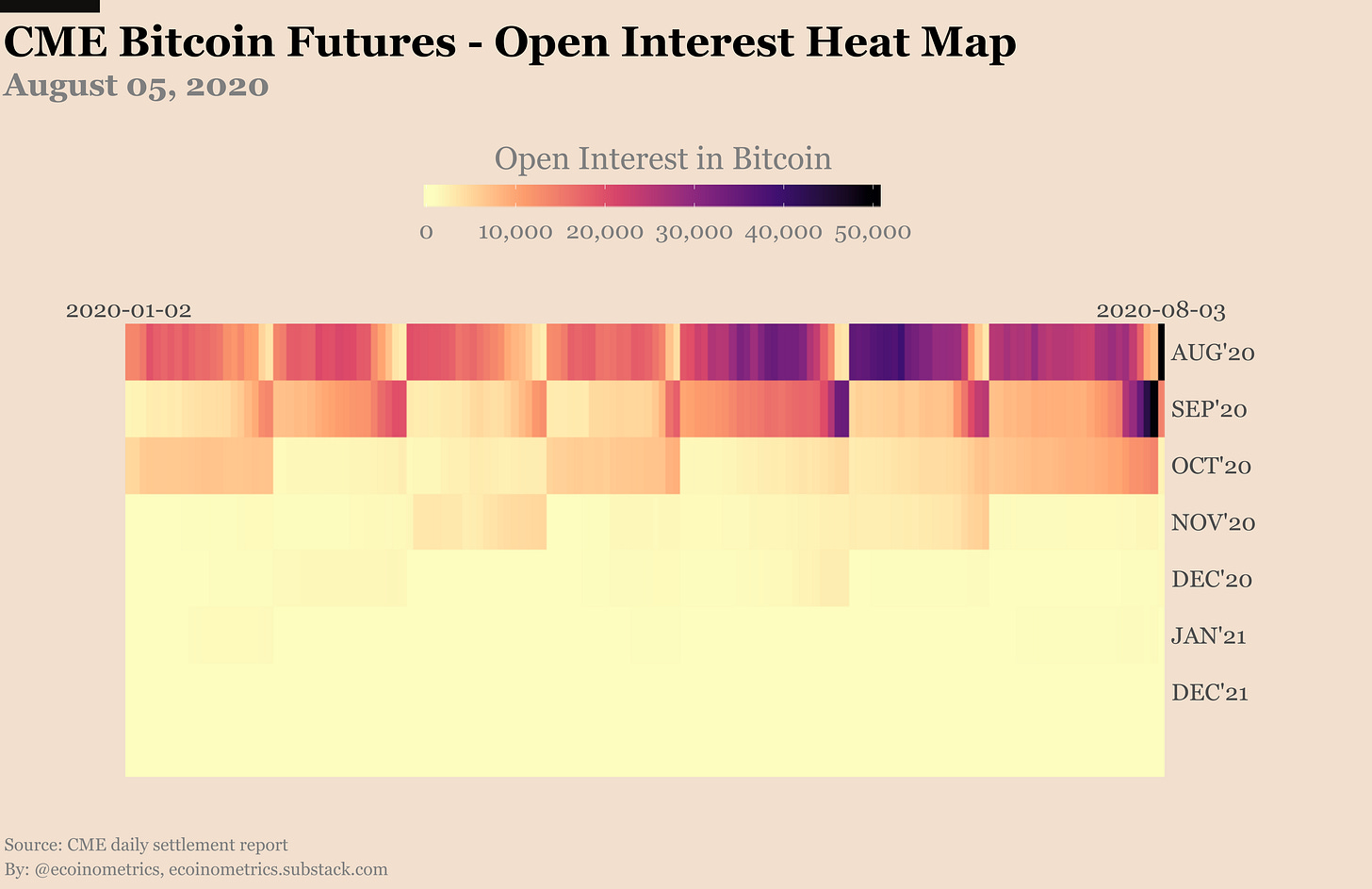

On the heat map the month of August is hot hot hot! There is 50,000 BTC worth of open contracts on Aug’20. This is an absolute record by a good margin.

But who is leading the charge? Retail traders of course! After the breakout retail investors added more than 1,000 contracts of net long positions.

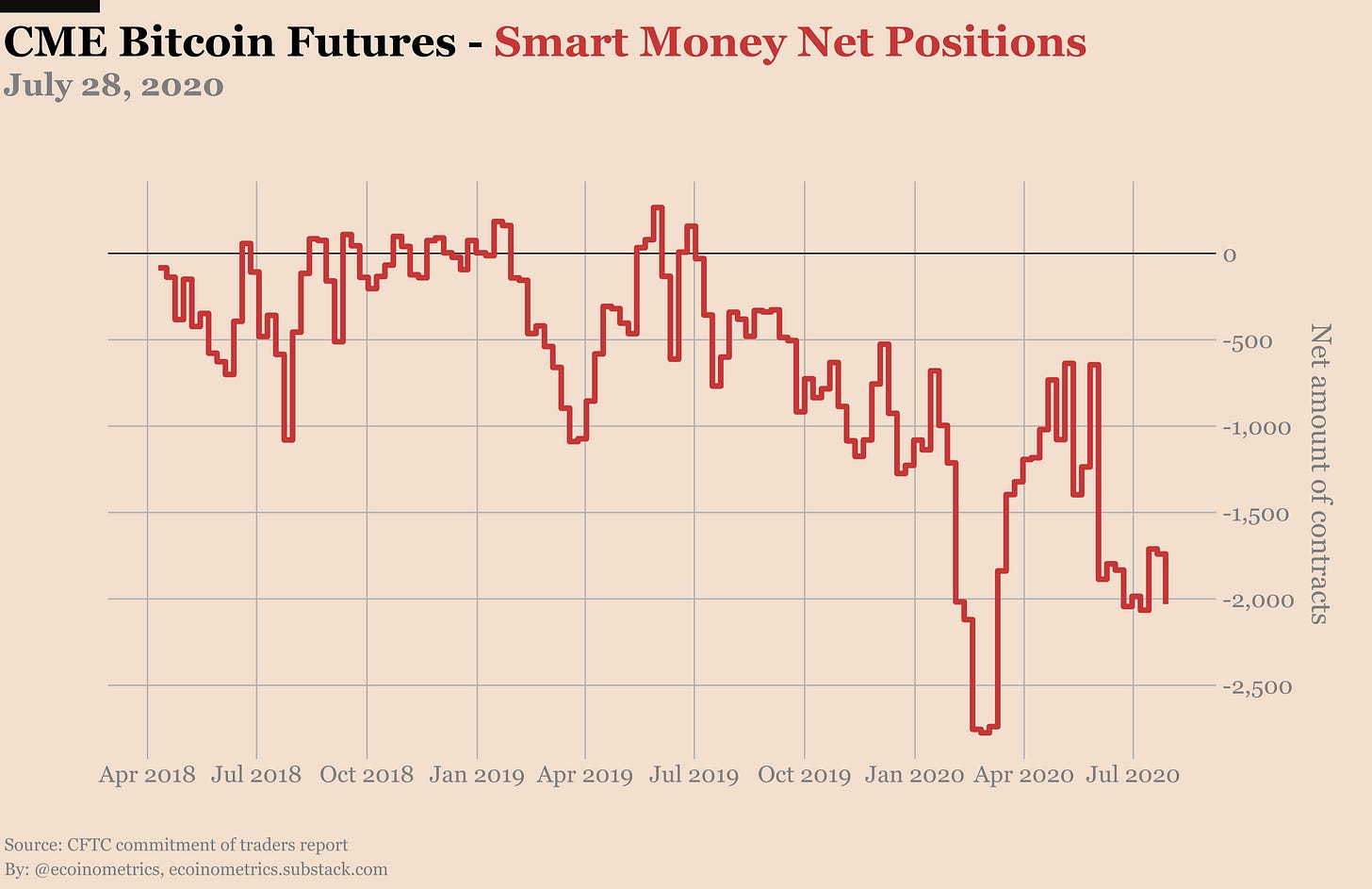

This is similar to what the smart money added in terms of long positions.

Here I’m saying long positions. Not net long positions. Because when it comes to net positions the smart money continues to be short around the same levels.

Last week I said that if the smart money remained so much net short after the breakout then I would need to rename them dumb money. Obviously that was a little hyperbolic.

Different players in the smart money group are applying different strategies. It isn’t always easy to distinguish what’s going on exactly and in what proportions with the aggregate data.

But we can give it a try.

You have the macro trend players. These are trend following or macro events investors. This group is long the CME Bitcoin futures. Their thesis is basically the Paul Tudor Jones strategy. Bet on Bitcoin as the fastest horse.

If you look at the evolution of the long positions you can see the general uptrend that started in January of last year. This trend is accelerating. That means more and more traders fall into this group that is getting long exposure to Bitcoin as a macro play.

Then you have the hedge funds that are running arbitrage strategies. They are likely to be the source of this net short positioning on the Bitcoin futures. Their strategy is most likely a variant of cash and carry. They somehow get an exposure to physical BTC and at the same time sell the futures to harvest the premium.

I haven’t done any analysis of how big a premium you can harvest this way. However it is likely that the return of the trade for each contract isn’t massive. That means they need to leverage the trade to get good returns. Hence the relatively large net short position.

Finally you have the rest of it: trading spreads, hedging other bets, more passive pension funds type of trades.

That’s more or less the landscape on the CME as far as I can see. The cash and carry trade is a staple so I’ll try to get some good data to evaluate what the returns of this strategy looks like.

That’s for another day though.

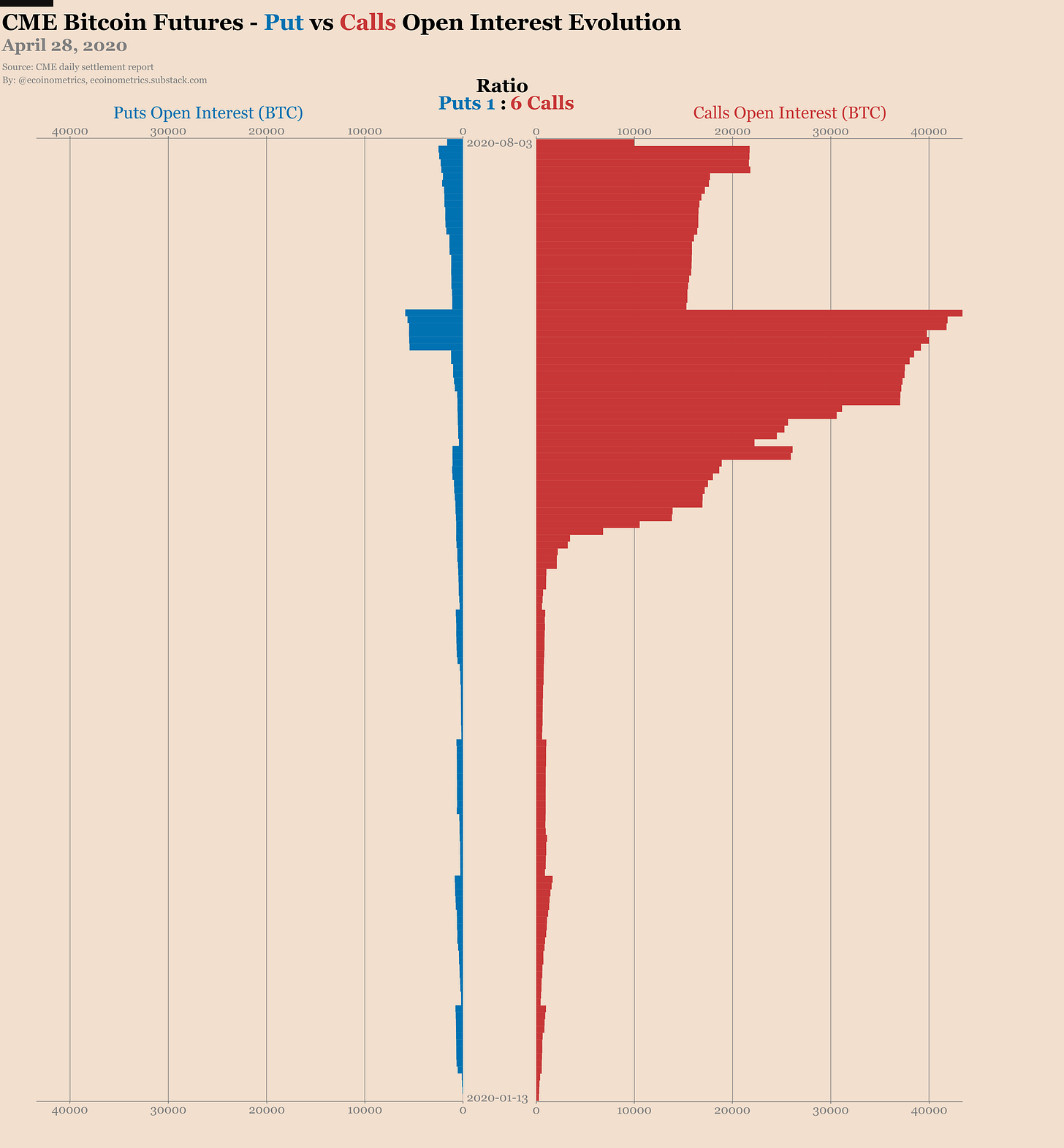

Not much is going on in the CME Bitcoin options market. After the expiration of the July contract we are down to 6 calls for every put. There is some trading activity but nothing particularly exciting.

A large portion of the calls are already in the money. The next target for the remaining bull call spreads is $12,500. That looks very much doable this month. Those bets are finally starting to pay off.

Let’s see how things play out.

The Ecoinometrics newsletter decrypts Bitcoin’s place in the global financial system. If you want to get an edge in understanding the future of finance you only have to do two things:

Click on the subscribe button right below.

Follow Ecoinometrics on Twitter at https://twitter.com/ecoinometrics.

Done? That’s great! Thank you and enjoy.