Earlier this year the US Federal Reserve lowered the Federal Funds Rate to essentially zero. Unless they go negative there isn’t much more they can do on that side.

Negative rates are a possibility, after all that wouldn’t be the strangest thing we see in 2020, but in the short term that’s unlikely to happen.

So yield curve control is probably the next big thing for the Fed. But how is that going to impact Bitcoin?

The Ecoinometrics newsletter decrypts Bitcoin’s place in the global financial system. If you want to get an edge in understanding the future of finance you only have to do two things:

Click on the subscribe button right below.

Follow Ecoinometrics on Twitter at https://twitter.com/ecoinometrics.

Done? That’s great! Thank you and enjoy.

Yield curve control

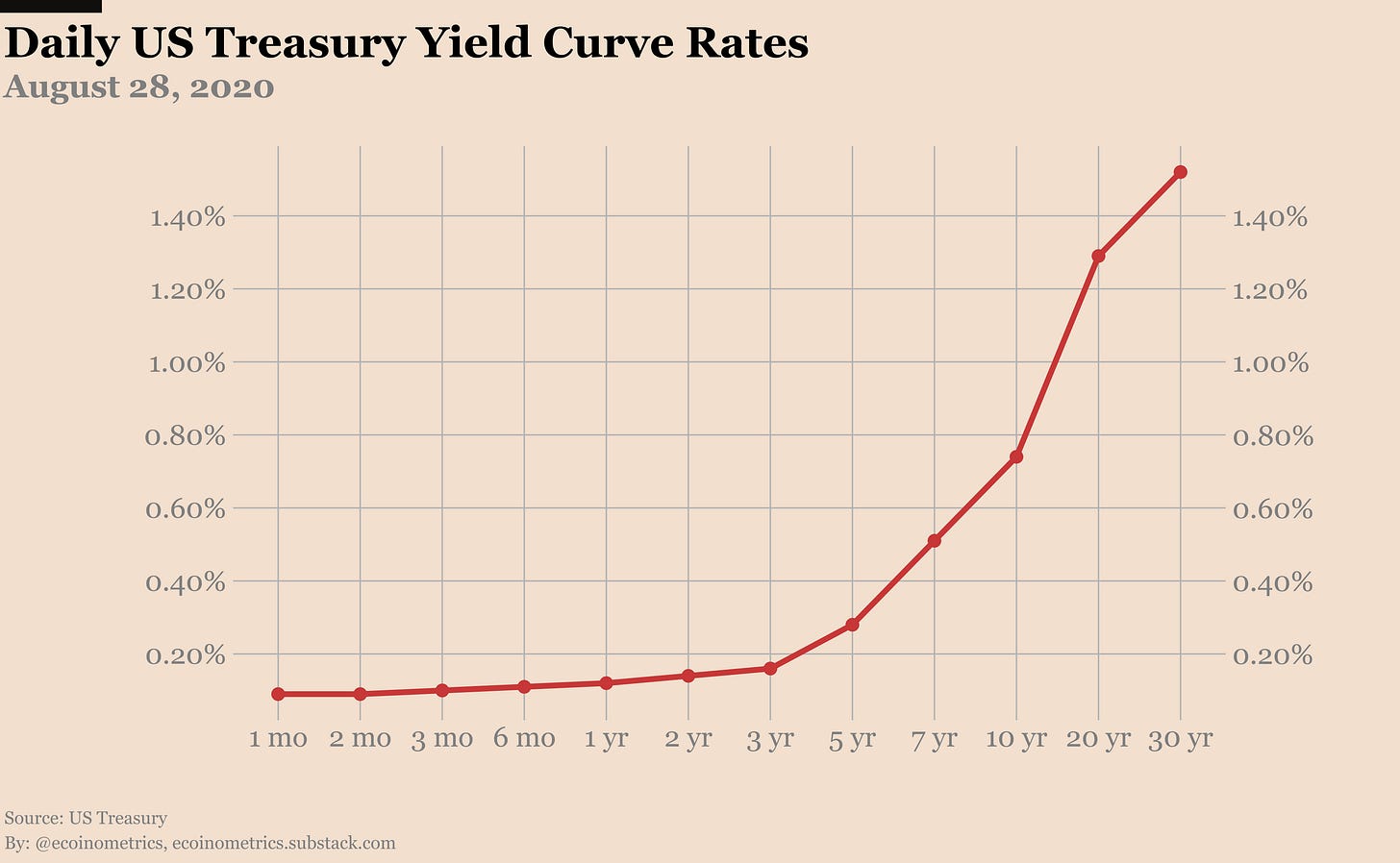

If you are not familiar with it, the yield curve refers to the curve formed by the rates of the US Treasury bonds at different maturity on any given day.

Right now the US Treasury is offering bonds with maturities ranging from 1 month to 30 years. And you have to go to maturities above 20 years to find anything yielding more than 1%...

Check it out.

In normal conditions, the Fed Funds Rate is influencing the front end of the curve. And with the Fed Funds Rate essentially zero the front end of the curve is really really flat right now.

Without a long term view you might just think that the coronavirus pandemic is to blame for that. The narrative is something like:

This coronavirus pandemic could not have been predicted.

The federal government had to shut down the economy.

The Fed had to step in and take drastic measures to save the economy.

Of course this is driving the yield curve down.

That’s cute.

Except that if you look at the past 30 years of 10 Year Treasury bonds yield you might be able to see that there is a long term trend playing out here.

Actually this trend of decreasing Treasury yield goes back to the 80s but my data set only starts in 1990.

The trend is pretty clear isn’t it?

So you can blame the coronavirus all you want but it is pretty much irrelevant for what’s been happening for a very long time.

Looking at the evolution of the yield curve since 1990 is even more telling. Here it is represented as a heat map:

The x axis is every trading day from 1990 to 2020.

The y axis is each US Treasury bond maturity (not all maturities are available at all time).

The lighter the colour, the lower the yield.

Now take a look at it.

After each financial crisis, yield is getting harder and harder to find. But for the Fed that’s not enough.

As we are closing in on zero they might start to consider yield curve control.

The goal of yield curve control is to cap the interest rates all along the yield curve, from the short maturities to the long ones. The idea of course is that if you can’t find yield anywhere then the economy will be stimulated whether it wants it or not…

So how do you achieve yield curve control? Easy, the Fed will buy whatever amount of Treasury bonds is necessary to keep the rates capped!

The key point here is: whatever amount.

How is that different from the usual QE? Well for

Quantitative Easing: the Fed is committing to a fixed amount of buying in US$ to inject liquidity in the market.

Yield Curve Control: the Fed is targeting a rate and will print an unlimited amount of US$ to buy Treasury bonds and keep the rates below the target.

That means the Treasury can create a lot more debt that is going to be monetized by the Fed creating a lot more money.

When the money printer goes Brrrr I don’t need to explain to you why this is good for Bitcoin but likely to be very bad for inflation in the long run.

The Fed Chairman speaks

Here is the latest speech of Fed Chairman Jay Powell: New Economic Challenges and the Fed’s Monetary Policy Review.

I don’t know about you, but when I read that my feeling is that the Federal Reserve is making things sound very complicated and theoretical to hide simple truths:

The Fed theoretical model of what is driving the CPI is not working.

Their solution to that is to just throw a lot more money printing at the problem expecting that this time it will be different.

The Fed doesn’t seem to see how it is causing asset price inflation by distorting the market.

The Fed doesn’t recognize that the problems they are having now are the result of decades of failed Fed policies.

The more you look at how monetary policies are made the more you understand why the global financial system is fragile.

If you want something antifragile build on Bitcoin.

Bitcoin mining

Something I encourage everyone to do is dig into the old discussions about the Bitcoin network from back when it all started.

What you will quickly realize is that Bitcoin is not some half-assed magic internet money. Most of the objections, potential problems, mechanics have already been examined in the past.

And most people don’t realize how well thought out the game theoretic aspect of Bitcoin is. Things run deeper than “just” solving the Byzantine Generals Problem. The game theory of Bitcoin also covers mining, adoption and long term resilience.

You can get some of Hal Finney’s insights on mining in this article. I highly recommend you have a look at it.

If you have learned something today don’t forget to subscribe to the newsletter to get my insights directly in your inbox.

Cheers,

Nick

The Ecoinometrics newsletter decrypts Bitcoin’s place in the global financial system. If you want to get an edge in understanding the future of finance you only have to do two things:

Click on the subscribe button right below.

Follow Ecoinometrics on Twitter at https://twitter.com/ecoinometrics.

Done? That’s great! Thank you and enjoy.