Ecoinometrics - Bitcoin as a hedge against debasement

The importance of understanding what you are hedging against.

If you look back only three years ago the only people really worried about inflation were gold bugs and Bitcoiners. First they were ridiculed: inflation was only a transitory phenomenon. Then it turns out they were right…

But does Bitcoiners being worried about inflation make Bitcoin a good hedge against it?

With two years of above target inflation we have enough data to answer that question.

Without data you are just another investor with an opinion.

The Ecoinometrics newsletter gives you insights from crypto and macro data to help you make better investment decisions.

Each issue of the newsletter tells you what you need to know in 5 minutes or less, direct to the point, with lots of charts to allow you to quickly visualize what’s important.

Join more than 20,000 investors here:

Done? Thanks! That’s great! Now let’s dive in.

P.S. Checkout our latest tracker of MicroStrategy Bitcoin holdings at https://www.ecoinometrics.com/microstrategy-bitcoin-holdings-with-charts/.

Bitcoin as a hedge against debasement

The takeaway

Bitcoin doesn’t work as a hedge against inflation. The data from this post-COVID period is clear on that.

Looking to hedge against a short term spike in energy prices driven by an imbalance between demand and supply? Bitcoin is not going to help.

Looking to hedge against price increases due to a disrupted global supply chain after China shutdown? Bitcoin is not going to help about that either.

Looking to hedge against a debasement of your currency? That’s where Bitcoin really shines.

Investors who understood this trade back in 2020 have navigated this period pretty well:

Adjusted for inflation, investors who bought Bitcoin during the unprecedented period of M2 expansion in 2020, are up more than 20%.

Meanwhile investors who waited for inflation to start buying BTC are now down more than 20%.

As long as you understand what you are buying there is no surprise. So let’s break this down.

Inflation on the decline

The headline inflation rate is down to 3.1% year-on-year in the US.

Even if a large part of this drop is due to the base effect (energy and food prices surged last year at the same period leading to a large decline one year later) it is undeniable that we have a downtrend.

Whatever the Fed is doing, this seem to be working. The jury is still out on whether or not this tightening cycle will throw the US economy into a recession. We’ll only know for sure over the next 6~12 months.

So now isn’t a bad time to look back at the post-COVID inflation spike to see whether or not Bitcoin works as an inflation hedge.

To really understand what is going on I’ve prepared a chart that breaks down the timeline in three key moments:

The COVID crash which started it all in February 2020.

The top of the Federal Reserve response in February 2021.

The complete reversal of the monetary response at the end of 2022.

In green you can see the year-on-year change in the M2 money supply. In red you can read the headline inflation rate. Those two metrics are normalized meaning that they are scaled to take values between 0 (lowest point over the period) and 1 (highest point over the period).

Check it out.

The sequence should be pretty clear from the picture:

First there is the monetary response.

A year later as inflation enters its “transitory TM” phase the Federal Reserve slows down the money printing press.

After it becomes clear that transitory can still be pretty long the Fed slows down the monetary expansion to the point reversal at the end of 2022.

And now we are in a contraction phase which is pretty rare historically.

So despite the fact that inflation had several causes, like supply chain issues and lockdown-reopening dynamics, it is clear that monetary expansion was part of what triggered the first wave. And that’s something crucial when you want to discuss the role of Bitcoin as a hedge.

Bad inflation hedge

Because as the critics have observed over the last couple of years, Bitcoin is not a hedge against inflation in the traditional sense of what commentators mean by “inflation hedge”.

The first thing most people think about when they hear inflation hedge is:

Inflation goes up, Bitcoin should go up at least as much to compensate.

Inflation comes down, Bitcoin should go down at least as much to compensate.

And then you’ll hear commentators say thing like “inflation in the US just printed a new high this month but Bitcoin was down on the day”… which is totally irrelevant if your objective for buying Bitcoin is to preserve your money over the long run…

But ok, by that definition which isn’t very relevant, Bitcoin isn’t a good direct hedge against inflation. Just check the chart below. You can see two scatter plots:

On the left you have the month-on-month change in Bitcoin vs inflation.

On the right you have the year-on-year change in Bitcoin vs inflation.

Check it out.

Those two show no relationship between Bitcoin and inflation. Bitcoin rise when inflation is low. Bitcoin falls when inflation is high. And many other combinations. Basically if you define as a Bitcoin being an edge against inflation the fact that they rise and fall at the same time when considering the same period then no Bitcoin is not a good hedge against inflation.

However that’s probably not the correct way of measuring whether or not Bitcoin is a good hedge against inflation.

Good debasement hedge

The issue being that in 2020 Bitcoiners have started to warn people to buy Bitcoin way before inflation already hit. Actually they started warning people when the monetary expansion of M2 started.

So a better way of measuring whether or not Bitcoin is a good hedge against inflation is to see whether or not the people who listened to the warnings that started with the M2 monetary expansion did beat inflation or not.

Here are three scenarios:

You bought Bitcoin as soon as the COVID crash happened and QE started.

You waited until after M2 had greatly expanded in May 2020 to buy BTC.

You waited until February 2021 when the growth of M2 started to decelerate and inflation was ramping up to buy BTC.

How would those positions have performed against inflation up to now? Here is the answer with one chart.

Out of those three scenario only those who waited for inflation to actually rise ended up in trouble. Those who took actions early are way ahead of inflation on their BTC positions.

And this is not me cherry picking a few dates to make a point. This is a pattern that works over the whole period.

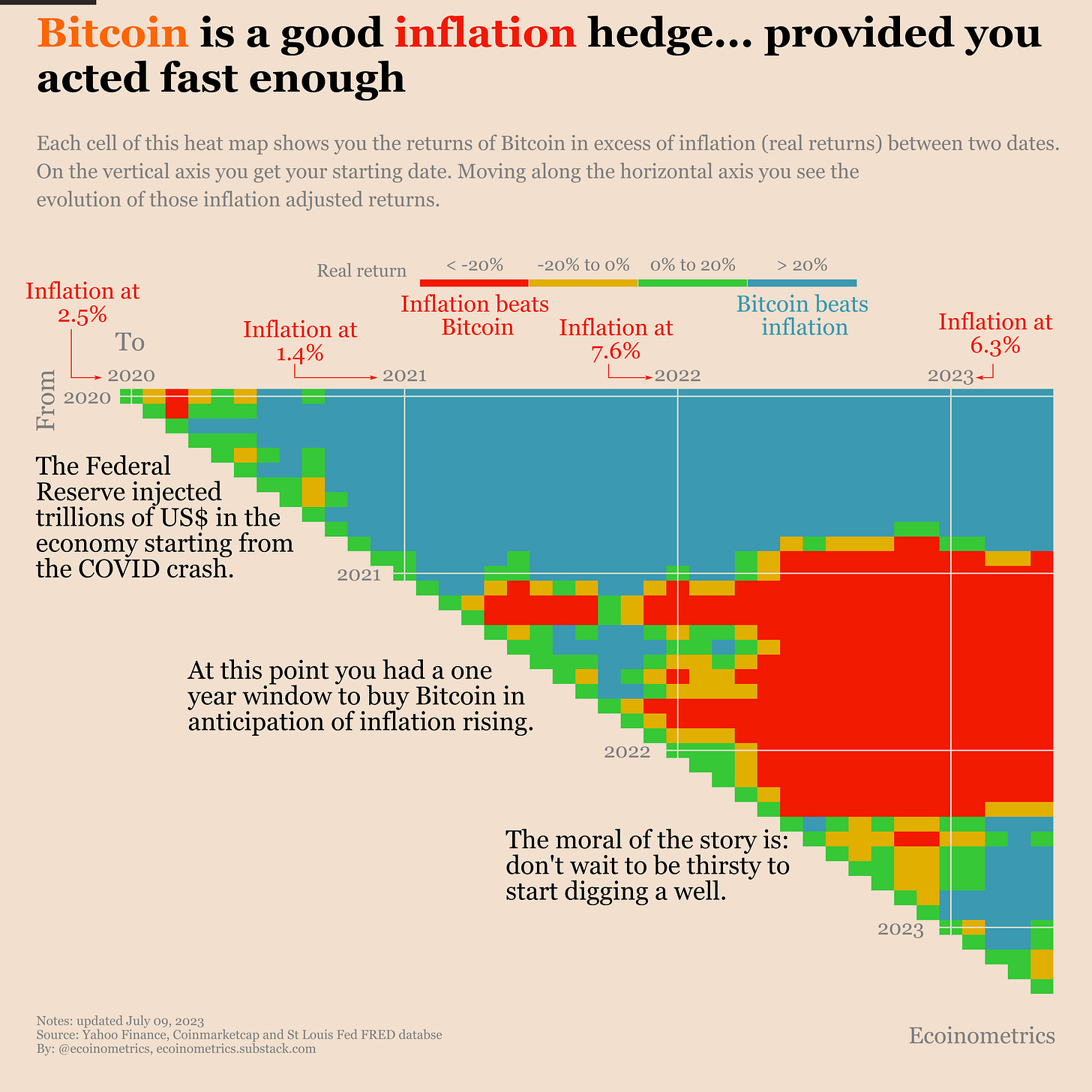

To see that I’ve made a heat map of Bitcoin’s total returns adjusted for inflation as a function of the date at which you bought BTC. Read this heat map as follows:

Pick a row, the start of the row is the month on which you opened your BTC position.

From left to right, each cell on this row represents the total return of this BTC position adjusted for inflation.

The colour of each cell tells you if at this point in time BTC is beating inflation or the opposite.

Take a moment to read the chart.

There are three periods:

If you bought Bitcoin anytime between the moment the Fed started QE, all the way to peak M2 expansion and inflation starting to ramp up then your Bitcoin position preserved your wealth against inflation up to now.

If you bought Bitcoin during the inflation spike then you have been in the red most of the time and you are still in the red now.

If you bought Bitcoin past the peak of inflation the results are so so in the short term.

The lesson here is that Bitcoin is not an inflation hedge. Bitcoin is a debasement hedge.

Investors that bet on Bitcoin often do so specifically for its attributes as a store of value. Those investors aren’t waiting for inflation to show up to pour money into BTC. They will act at the first sight of outrageous monetary debasement.

And as we have seen in 2020 this can lead inflation by a full year. Waiting for inflation to show up is a guarantee to be late to the party.

Moral of the story: don’t wait to be thirsty to start digging a well.

Things you might have missed

Here is a round up of a few articles you might have missed recently:

What the Federal Reserve is planning until the end of the year.

Why it is a good time to consider buying Bitcoin miners stocks.

That’s it for today. If you have any question don’t hesitate to reply to this email and I’ll get back to you.

If you have learned something please like and share to help the newsletter grow. Using the referral button you get rewarded for bringing in new subscribers:

Don’t forget to checkout other resources on the Ecoinometrics website such as:

A dollar cost averaging performance calculator for the stock market.

Which assets really hold up against inflation over the long run.

If you are already a free subscriber please consider upgrading to a paid tier to get the full access including:

All the issues of the newsletter (2 every week) including all the reports (Bitcoin miners, Bitcoin on-chain accumulation, Bitcoin correlations, macro liquidity, …)

A fast track to get your questions answer. Shoot me an email, if I don’t have an answer I’ll do the research and publish the result in an issue of the newsletter.

Cheers,

Nick

P.S. For hot takes and daily charts follow Ecoinometrics on Twitter, Instagram and on Threads @ecoinometrics.