Time for some quarterly reports! Once more Coinbase didn’t disappoint. Let’s dig into those financials…

The Ecoinometrics newsletter decrypts the place of Bitcoin and digital assets in the global financial system. If you want to get an edge in understanding the future of finance you only have to do one thing, click on the subscribe button right below:

Done? Thanks! That’s great! Now let’s dive in.

Coinbase Q3

Coinbase just published their quarterly report for Q3 2021. You could say that they did pretty well:

Revenue $1.235 billion.

Profit $406 million.

That’s like a 32% profit margin. Nice business that you have here Brian Armstrong.

Now as you can see on the chart, this quarter wasn’t as good as Q1 and Q2. Why is that?

Well you have to remember what’s the business model they run. At a high level it is pretty simple. Coinbase is (mostly) an exchange. Money flows through it and they take a cut. That’s the business model.

Now Q3 feels like it was relatively quiet when it comes to the price action of crypto assets. But what does the data say?

The monthly transacting users (basically the users active on Coinbase) remained high during Q3. Lower than Q2 for sure, but still higher than Q1.

And while the volatility of Bitcoin was relatively low during this last quarter, Coinbase still managed to pull about as much traded volume in Q3 as it did in Q1. Hmmm...

So actually it seems that Coinbase is extracting less and less revenue from the volume traded on their platform as time goes:

0.40% of traded volume as revenue in Q3 2021.

0.48% of traded volume as revenue in Q2 2021.

0.54% of traded volume as revenue in Q1 2021.

0.66% of traded volume as revenue in Q4 2020.

0.70% of traded volume as revenue in Q3 2020.

From digging deeper in the data it doesn’t look like this decreasing take rate can be explained by a change in the mix between retail and institutional customers either.

My guess is that this is more of a function of the pressure Coinbase faces from the competition. With more trading venues competing for customers Coinbase needs to lower its gross take rate or risk losing market shares. So seeing this decline isn’t really worrying.

Considering that they still managed to pull out $400 million in profit they can definitely afford being less greedy.

Actually since the market for digital assets is a growing one, their focus should remain on acquiring as big of a market share as they can. That will allow them to extract more value down the line when crypto adoption has run its course.

The fact that they manage to do that while remaining profitable is very bullish in my opinion.

Now, how did the stock react to this good financial report? Well it didn’t… really? Yes.

The thing is that people don’t seem to care much about the financials when it comes to Coinbase. The stock price is basically just following whatever Bitcoin is doing.

See for yourself.

And since Bitcoin finally managed to climb out of its drawdown, Coinbase also finally managed to turn positive when compared to its direct listing price.

But compared to other “Bitcoin” stocks over the same period, Coinbase is lagging.

So what should you do with that? Well my opinion is that Coinbase is a buy for the long run:

They have solid financials.

They have a huge market share.

They are well positioned to expand from a regulatory perspective.

They are capitalizing on their large user base to launch new products (see their upcoming NFT platform as an example) which should increase the lifetime value of their customers.

The main risk of course is what will happen in case of a severe bear market for crypto assets. The most likely scenario is that the stock will tank following Bitcoin. But that’s true for any crypto related stock.

So at the end of the day just keep in mind that everything in the space is correlated to BTC and adjust your risk accordingly.

Market conditions

Alright, so Bitcoin is still stuck right above $60k. The problem is that there is way too much blue on this chart. Check it out.

Blue means those buckets of Bitcoin addresses aren’t accumulating coins over the past 30 days. In other words the buying pressure coming from the people who stack sats on-chain isn’t there at the moment.

Obviously that’s not ideal to support the next leg up.

That being said, coins are still flowing out of exchanges at a pretty fast rate. Last month alone 100,000 BTC moved from known exchange addresses to hodlers addresses.

So there is no need to panic. The supply shock isn’t cancelled.

And actually this slowdown in the accumulation trend isn’t necessarily bearish. Just look at what happened at the end of last year. The first red zone of the participation score brought BTC up to $20k. But the rest of the move up to $60k worked out fine without a massive amount of accumulation.

You have to remember how things work. Bitcoin’s price is a consensus built on the exchanges. It is a function of the demand for coins and how many of them are readily available on exchange addresses to be traded.

Simple supply and demand.

So as long as there are some people buying and the supply on the exchanges is dwindling we are still set up for a rise in Bitcoin’s value.

Here is how you should read the metrics:

When the net flow from exchange addresses is negative, the supply is getting reduced.

When the participation score is high, a lot of people are in the process of stacking sats at the same time i.e. the demand is strong.

Which means the only times you should be worried is when:

You see an inflow of BTC toward exchanges (orange/red exchange flow).

You see that no one is stacking sats (blue accumulation trend).

Those two things are captured in the aggregate risk score and right now we are all good.

What are we waiting for then? Probably a restart of the accumulation trend.

With Bitcoin is sitting above $60k we have seen the small fish being around their highest hodling level since the start of the bull market. However the whales have been playing a game of accumulation and distribution since July.

Let’s just see what’s their next move.

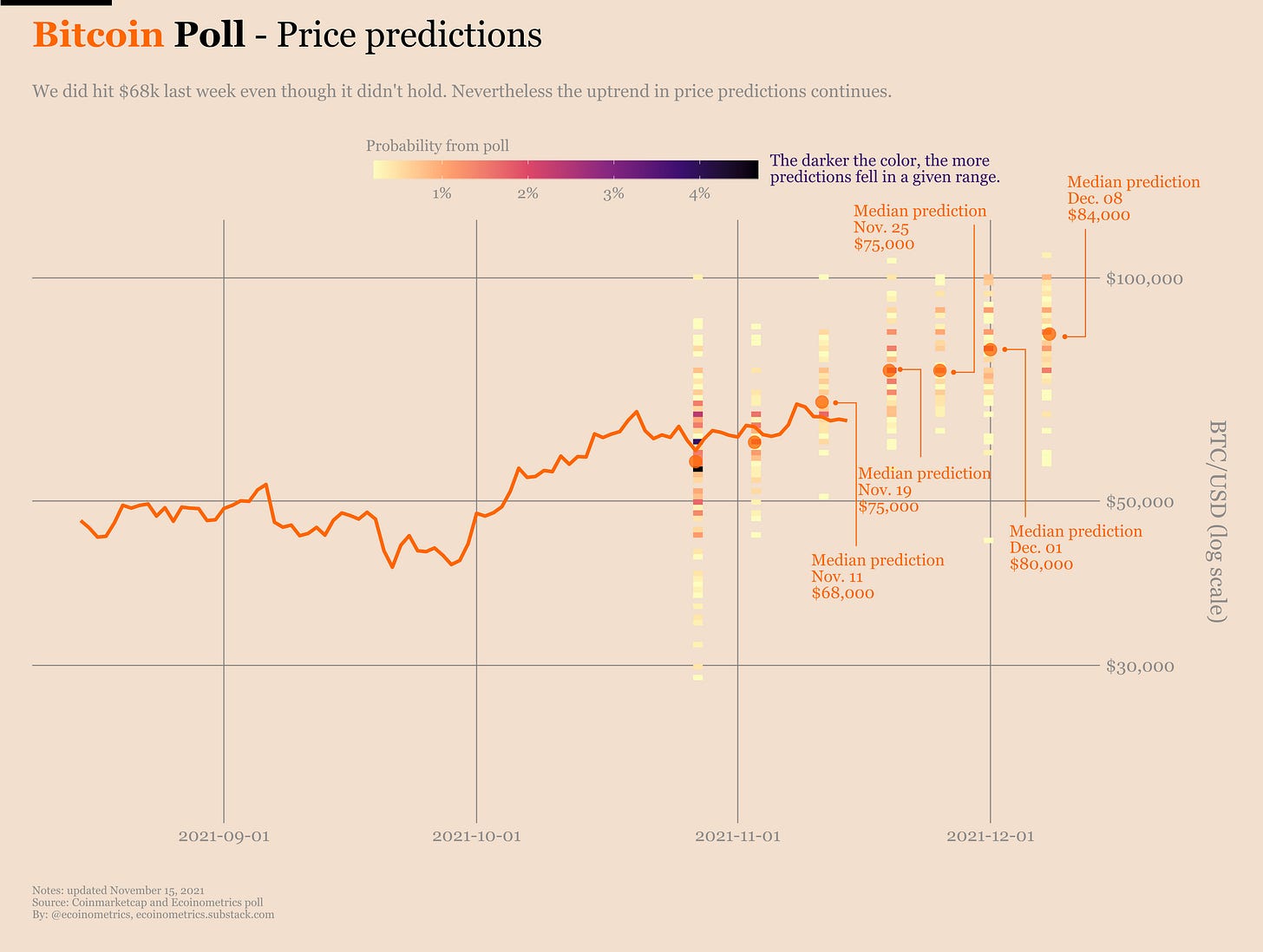

Among all that, the sentiment in the market is bullish. Since the start of our weekly price prediction poll we have had a steady rise of median price predictions at one month. This week doesn’t disappoint:

The median Bitcoin price target for December 08 is $84k.

The median Ethereum price target for December 08 is $6k.

So far those predictions have been relatively accurate. Let’s keep up the good work with some predictions for December 15 in the link below:

https://forms.gle/WmGv11aLj3Xmpb4k9

That’s it for today. If you have learned something please subscribe and share to help the newsletter grow.

Cheers,

Nick

Thanks, good write up. I don’t hold COIN but have a lot of MSTR. Although Microstrategy are now mainly defacto BTC fund, they should at least be slightly less risky in a crypto specific bear than an all crypto stock, as they can at least continue their steady profit generation and buy the dip. But I see all the stocks as being long term plays.