Ecoinometrics - Corporate isn’t stacking sats

We thought Bitcoin treasuries would soak up a lot of liquidity, turns out they aren’t.

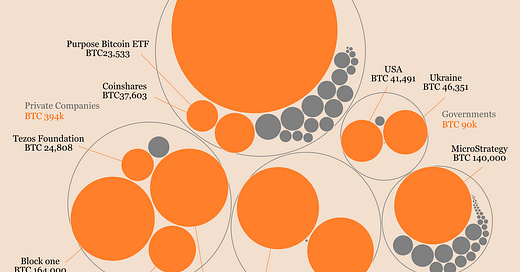

Public and private companies putting Bitcoin on their balance sheet predates Michael Saylor’s efforts to evangelize the idea.

But despite this strategy of corporate Bitcoin accumulation having worked pretty well for MicroStrategy, very few have followed the example.

Last time we looked at the state of the Bitcoin treasuries holdings was about six months ago. Back then BTC was still very deep in the bear market. Has anything changed now that Bitcoin is in a bear market recovery phase?

Without data you are just another investor with an opinion.

The Ecoinometrics newsletter gives you insights from crypto and macro data to help you make better investment decisions.

Each issue of the newsletter tells you what you need to know in 5 minutes or less, direct to the point, with lots of charts to allow you to quickly visualize what’s important.

Join more than 20,000 subscribers here:

Done? Thanks! That’s great! Now let’s dive in.

P.S. Checkout our latest tracker of MicroStrategy Bitcoin holdings at https://www.ecoinometrics.com/microstrategy-bitcoin-holdings-with-charts/.

Corporate isn’t stacking sats

The takeaway

If you don’t have time to read the whole thing here is what you need to know:

Bitcoin treasuries are stuck on a plateau. There is no real Bitcoin buying dynamic coming from those institutional entities.

In particular the narrative that public companies need to convert some of their cash to Bitcoins in order to keep up with inflation isn’t finding buyers.

But given that BTC isn’t exactly performing as a short term inflation hedge that’s not very surprising.

Keep reading with a 7-day free trial

Subscribe to Ecoinometrics to keep reading this post and get 7 days of free access to the full post archives.