Ecoinometrics - Correlations, three years later

What's the state of Bitcoin's correlations 3 years after the COVID crisis?

There was a time when Bitcoin was uncorrelated to most financial assets and delivered extreme growths over short periods. Then the COVID crash happened and everything was different after that.

So what's the state of Bitcoin's correlations to other markets, has it changed since March 2020 and where is it likely to go given the macro outlook over the next 12 months?

The Ecoinometrics newsletter helps you navigate the landscape of digital assets and macroeconomics with investment strategies backed by data. Subscribe now to get the latest research directly in your inbox.

Done? Thanks! That’s great! Now let’s dive in.

Correlations, three years later

Let's start with a quick technical preliminary for what we are doing here. When we talk about the correlation between two assets we are calculating a score that tells us what is the typical relationship between the daily returns of those two assets over a given period of time.

The result is a number between -1 and 1 where:

The closer this number gets to 1 the more the assets are correlated i.e. tend to move in the same direction on a daily basis.

The closer this number gets to -1 the more the assets are anti correlated i.e. tend to move in opposite directions on a daily basis.

The closer this number gets to 0 the more the assets are uncorrelated i.e. tend to move independently of each other on a daily basis.

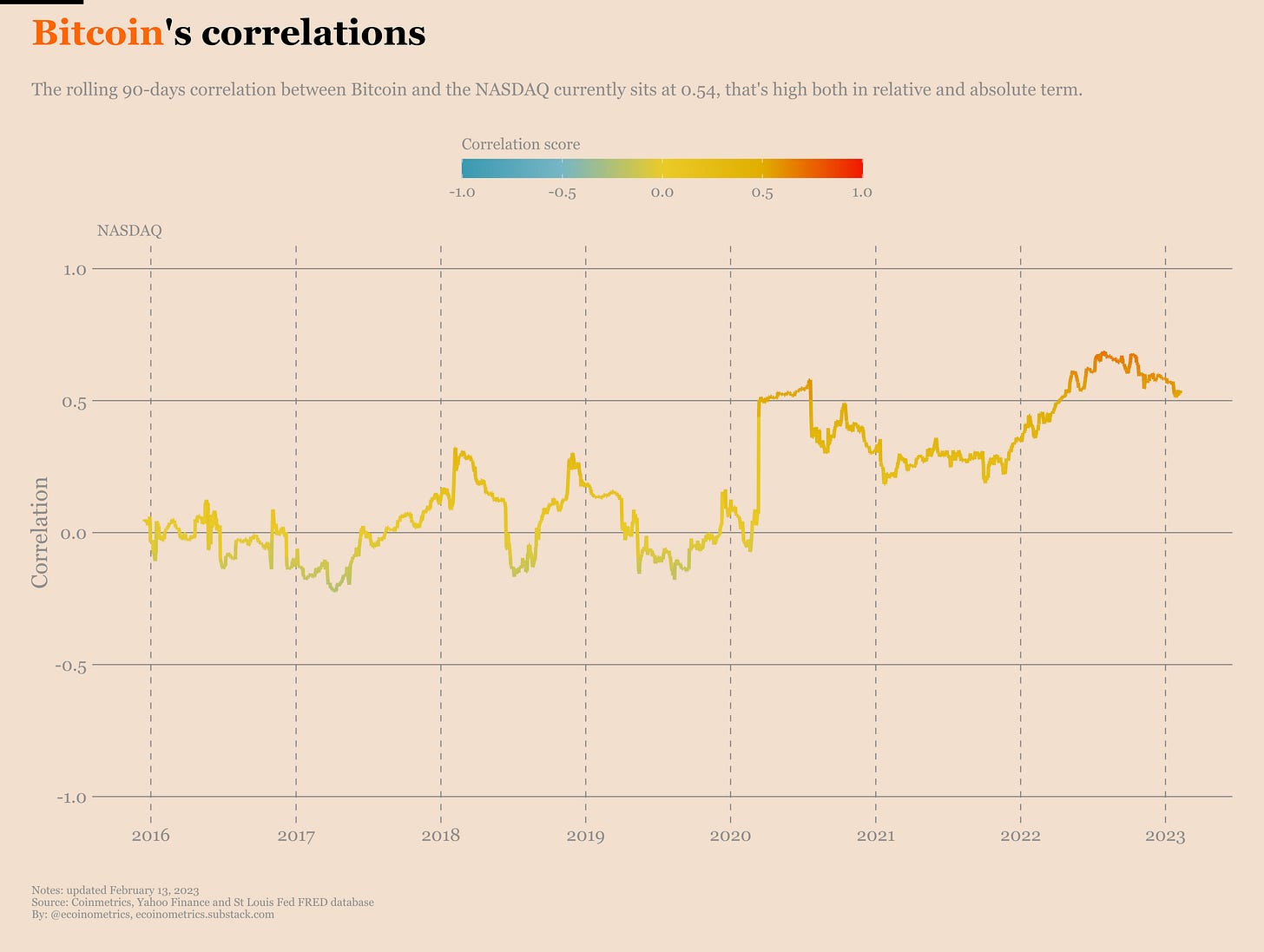

As an example we can calculate the correlation score between Bitcoin and the NASDAQ over the past 90 trading days. Right now this number comes out as 0.54. That's far enough on the positive side to qualify as a strong correlation. That's especially true when compared to the historical range.

So what this is telling us is that on a daily basis those two tend to behave the same way. Stocks go up, Bitcoin goes up on that days. Stocks go down, Bitcoin goes down on that day. You get the idea.

The important thing to remember is that in this particular formulation the correlation score gives us information about the relative behaviour of those assets on a day by day basis. Specifically it doesn't tell us anything about the bigger trend. You can imagine two assets not being particularly correlated on a day by day basis but still both of them going up over a long period of time. That's important to remember in order to not over interpret what this correlation score tells us.

When we look at several of these rolling correlations side by side the previous chart can become hard to read. So what we'll do in the rest of this post is encode the correlation score solely based on the colour scale.

That means the chart above collapses to the following:

Red means correlated.

Blue means anti correlated.

Yellow means uncorrelated.

What the correlation score tells you

Based on this technical description it should be clear that the main information this type of correlation score (there are many others) conveys is how two assets typically behave relative to each other over the course of a trading day.

If we want to get an idea about how the bigger movements correlate to each others between different asset we will need to calculate the correlation of returns over longer periods. Or use other methods. But we'll do that another day.

Today we focus on the correlation score calculated as described above, that is based on daily returns. That means it can be used to assess a few things:

Are there some persistent pattern linking the Bitcoin to other assets in terms of how they are traded daily?

From a portfolio construction perspective are there still assets that are uncorrelated to Bitcoin?

From a historical perspective are there patterns in the correlation that can be related to market regimes?

Looking at the data

So what are we looking going to look at. If we want to reduce the noise in the data it is better to calculate the correlation scores over a rolling window that is sufficiently large. Here we’ll focus on 90 days. That is on every single day we calculate the correlation scores based on the past 90 days.

In terms of the assets we taken a pretty large spectrum for this review:

The SP500 and the NASDAQ for stock indices.

A number of “Bitcoin stocks” such as MicroStrategy, Marathon (a miner), Coinbase the exchange and Block (previously Square, piloted by Jack Dorsey) which holds a nominal amount of Bitcoins on its balance sheet.

On the digital assets side we have Ethereum and Dogecoin.

For “currencies” we have the US Dollar Index (DXY) which measures the strength of the US Dollar against a basket of currencies (mostly the Euro). We also have gold.

Finally for fixed income markets we are looking at the 10-year yield as well as Eurodollar futures (which you can think essentially as a hedging instrument capturing a differential of short term rates between the US and other parts of the world).

We have plotted Bitcoin’s correlation to all these “assets” and colour coded it as follows:

Deep red means high correlation.

Deep blue means high anti correlation.

Yellow means no correlation.

The COVID crash is highlighted on the timeline.

Take a couple of minutes to checkout the chart, we’ll discuss some interesting points below.

Alright, done? Here are a few things I think are worth highlighting.

Something really happened after the COVID crash in March 2020. This is clear when you compare the correlation patterns with the stock indices and the Bitcoin stocks. Before March 2020 stock indices were basically uncorrelated to Bitcoin. After that we have a persistent orange pattern.

Many believe that the influx of cash that went to risk assets during post COVID crash recovery are the root cause. Basically there was enough cash around for Bitcoin to become “just another risk asset” in your average portfolio. And that state of things never went away.

Actually when you look at the most recent history stock indices have become even more correlated to Bitcoin. They are basically sharing the same shade of orange as the Bitcoin stocks. We’ll come back to that in the conclusion.

In the realm of digital assets, if you were waiting for a decoupling between Bitcoin and Ethereum better not to hold your breath. Even Dogecoin is less tied to BTC than ETH… Now I’ve made the case before that Bitcoin and Ethereum should be regarded as two separate investment thesis (a bet on a store of value and a bet on a dapps platform) but obviously when you see charts like that you can understand why most people don’t care.

Moving on to gold, I’m not sure there is a very clear pattern. Unless you look at DXY at the same time that is. Of course post COVID crash there was so much cash that both Bitcoin and gold gained in value. But you can see that after 2020 gold and Bitcoin basically fall back in uncorrelated territory. That is until recently… However as Bitcoin and gold are starting to be more correlated again, Bitcoin is also showing signs of anti correlation with the DXY. Clearly that means the current bear market rally is a currency story more than anything else.

For the sake of completeness let’s mention fixed income. Here there is no change of pattern before and after 2020. It seems that bonds and eurodollar futures are the last type of assets that remains consistently uncorrelated to Bitcoin. I’m waiting for the day when JPMorgan will start selling you the new 60/40 portfolio, 60% Bitcoin and 40% bonds…

What can we expect

For that exact reason I think you will not see any change in the current pattern of correlations between Bitcoin and other assets. Everything is just one big trade at the moment: bear market then global recession then recovery. Until the recession is behind us no one is going to take risks, everyone will run the same predictable playbook.

But let’s see how that plays out.

You might have missed

Here are some relevant posts you might have missed recently:

That’s it for today. If you have learned something please like and share to help the newsletter grow.

Don’t forget to checkout other resources on the Ecoinometrics website such as:

A dollar cost averaging performance calculator for the stock market.

Which assets really hold up against inflation over the long run.

If you are already a free subscriber please consider upgrading to a paid tier to get the full access including:

Two newsletters every week.

Suggest research topics and request charts.

Cheers,

Nick

P.S. For weekly threads and hot takes follow Ecoinometrics on Twitter.