The long term Bitcoin accumulation trend that led to the price bouncing off from $30k is still healthy.

But recently whales and small fish have started to behave differently. Is it time to worry about this divergence?

The Ecoinometrics newsletter decrypts Bitcoin’s place in the global financial system. If you want to get an edge in understanding the future of finance you only have to do one thing, click on the subscribe button right below:

Done? Thanks! That’s great! Now let’s dive in.

Dealing with divergences

That bounce off the low around $30k was only a few weeks ago. But now that Bitcoin is stalling right under $50k I’m starting to hear a lot of the good old “BTC is boring” chatter.

I mean guys... let’s just chill out for a moment.

Two months ago bears were calling for Bitcoin at $10k. Now that we are back at $50k people still aren’t happy.

Raise your hand if you’ve heard the following:

“Bitcoin is UNDERPERFORMING!!! All altcoins are doing much better over the past two days.”

“Wow BTC returns are trash compared to Bored Apes Yacht Club!!!”

Alright, first nobody said you aren’t allowed to collect NFTs if you are hodling Bitcoin. Some people will buy NFTs just because they like to collect things. Others will use them as part of a barbell investment strategy.

That’s all fine by me, just understand that not all investments are equal:

Bitcoin is a liquid store of value. Given its current scale it carries relatively low risks, yet it has a lot of upside potential coming with the growing adoption.

Ethereum is a liquid token whose value is entirely tied to the decentralized applications running on the network. Lots of upside if it works out. But the technical complexity of the project means there is a strong execution risk.

Other altcoins are, in most cases, random bets if we are talking long term value. What’s liquid today might dry up pretty fast in a bear market and never recover. If you have been around the ICOs boom of the previous cycle you’ll know what I’m talking about.

NFTs are highly illiquid. That makes them a great potential for massive returns if there is demand. Conversely it is also extremely easy to get stuck with tokens that won’t sell.

As long as you are mindful of those differences you can make good use of them to build a crypto-barbell strategy. The idea of a barbell strategy is that you balance the risk vs reward of the assets in your portfolio between very safe bets on one side, very risky bets with massive potential for returns on the other side, and nothing in the middle.

So if you had to build a crypto-barbell strategy you’d probably be:

Mostly hodling Bitcoin and some Ethereum as the safe bets.

Getting your hands on some NFTs or moonshot projects on the high risk, high reward side.

Skipping your random altcoins as not being worth the risk.

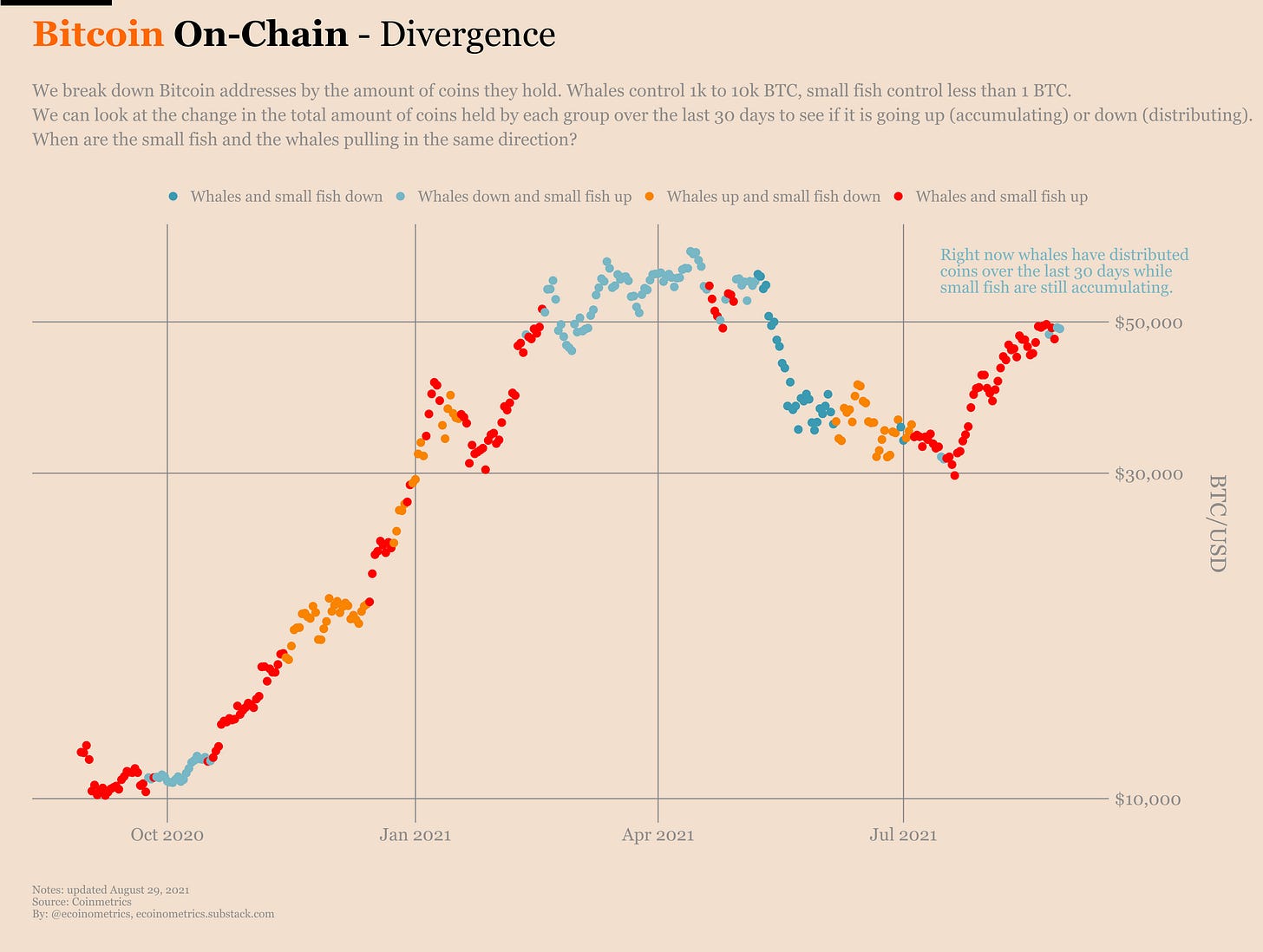

Now getting back to Bitcoin’s price action. The long term trend looks good. But since we crossed back above $45k there has been some on-chain divergence between the small fish and the whales:

The small fish are continuing to accumulate at a smooth pace.

The whales have been offloading some of their hodlings.

To see that in more detail we can split out the small fish (addresses controlling less than 1 BTC) from the whales (addresses controlling 1k to 10k BTC) and look at the evolution of their aggregate hodlings since October last year.

Each point is colour coded by the value of BTC so that the darker the colour, the higher the price.

Check it out.

The thing with whales is that recently their accumulation trend has been anything but smooth.

You can see their aggregate hodling trending up pretty much from $30k to $45k. But even in that trend there are jumps and drops. The difference is striking when you compare it to the smooth picture given by the small fish.

Now, since $45k the whales have been distributing coins. But is it a short term thing or are we getting a repeat of February?

Given that the trend isn’t smooth for whales I’d say we cannot tell for now.

To put this divergence between small fish and whales in perspective we can use a different way of visualizing what’s going on.

Here is the recipe.

Take small fish (addresses controlling less than 1 BTC) and whales (addresses controlling 1k to 10k BTC). Look at whether each group is up or down on their aggregate Bitcoin hodlings on a 30 days basis.

We have four possibilities from least supportive of price to most supportive of price:

Whales and small fish are down (dark blue).

Whales are down and small fish are up (light blue).

Whales are up and small fish are down (orange).

Whales and small fish are up (red).

If we apply this colour coding to the price action of Bitcoin since October last year, we get the following picture.

Right, so this kind of makes sense.

If there is a sustained accumulation at the two extremes we get supply-side conditions supportive of price (orange and red).

When we get sustained periods of the small fish doing all the work, the supply is less tight and it is harder for the price to take off (light blue).

If both whales and small fish decide to dump then there is no support for the price as there is plenty of available supply (dark blue).

Currently we have only a few light blue days so really that’s not enough to make any conclusion. But the sooner we resume with everyone pulling in the same direction the better it is for the strength of the next leg up.

Time for tapering

You heard it from the man. Last week Jerome Powell said that it is more or less mission-accomplished for the Fed.

If you look at the three main things the Federal Reserve was set to achieve I guess it does look like they are on track:

Unemployment is still relatively high but on the decline.

The average inflation is at the target level of 2%.

The stock market is making new all-time highs regularly. I know this isn’t part of their direct mandate but still.

So naturally the Fed is starting to think about how to get out of QE-infinity.

Now, I’m a bit skeptical that they’ll manage to do anything significant on that front.

I’m sure they said the same thing after 2008. But if you look at what happened in practice, the Fed continued to expand its balance sheet for a long time after that.

But who knows, maybe the FOMC is actually worried about inflation. If that’s the case they might at least try to tighten the monetary conditions.

There is just a small problem with that… the stock market probably isn’t ready for the end of easy money. Which means tapering could be followed by some stock market correction. And when there are sizeable corrections in the stock market usually all other assets are taking a hit, Bitcoin included. Such is the game of margin calls.

For sure the Fed Put will ultimately save the day. But still, we need to keep an eye on it.

That’s it for today. If you have learned something please subscribe and share to help the newsletter grow.

Cheers,

Nick

The whale-fish graph can be reduced to this idiom: fishes goes with the flow, but whales capitalizes on momentum; fishes enters the rally while whales buy the dip.

But this always leads back to the question: what is the difference between "dips" and "crashes" other than the factor of deceleration and acceleration?