Thanks to Michael Saylor more and more public companies are putting Bitcoin on their balance sheet. This is good for Bitcoin.

But what if you wanted to bet on those companies? I guess it’s time to introduce a Bitcoin Treasuries Index.

The Ecoinometrics newsletter decrypts Bitcoin’s place in the global financial system. If you want to get an edge in understanding the future of finance you only have to do two things:

Click on the subscribe button right below.

Done? That’s great! Now let’s dive in.

Bitcoin Treasuries Index

Let me start by saying that this index we are going to build here is a work in progress. Some data is still missing and the rules of the index are subject to change until they are finalized.

But with the recent announcements that Tesla acquired some Bitcoin for their own treasury and that MicroStrategy is planning to raise another $600 million to buy more BTC, now is not a bad time to think about that.

According to Bitcoin Treasuries there are 20 public companies holding Bitcoin on their balance sheet plus Tesla.

But for practical purpose we are not going to include all of these in the index.

We want stocks that are liquid enough so that they can be traded easily. And we want companies that have a sizeable amount of Bitcoins in their treasury.

Those two conditions give us some rules for being included in the Bitcoin Treasuries Index:

The company must be public.

The company must be traded on US exchanges (no OTC only).

The company must hold more than 0.005% of the 21,000,000 Bitcoins.

That leaves us with:

MicroStrategy (71,079 BTC).

Marathon Patent Group (4,813 BTC).

Square (4,709 BTC).

Riot Blockchain (1,175 BTC).

Tesla (??? BTC).

Tesla is a special case. While we know they’ve spent $1.5 billion to buy some BTC, we don’t know yet exactly how many they hold.

Lets assume that they bought during January 2021. With the price ranging from $29k to $42k during that period we can estimate that they managed to scoop between 35,714 BTC and 53,571 BTC.

Until we get more information on the exact amount of Bitcoin they hold I’ll use the low estimate of 35,714 BTC for all my calculations.

Alright. What’s next?

Now that we know which companies are in our index we need to decide on some rules to calculate the actual index value.

For now I’ve settled on the following:

The Bitcoin Treasuries Index is a Bitcoin holdings weighted index. That means the price of each component of the index is weighted by how much Bitcoin they hold on their balance sheet on any given day.

The index starts at the reference value of 10 on the day of the 3rd halving i.e. May 11, 2020.

Inclusions, removals and updates of the weights are based on the date a company is publicly announcing that they’ve changed their Bitcoin holdings on their balance sheet.

That’s it for the rules.

We’ll probably have to tweak those to deal with companies like Tesla that do not immediately divulge the size of their BTC holdings. But whatever. Let’s see how things look first.

As of today the composition of the index is the following:

MicroStrategy is the largest component of the index. Even with the low estimate for Tesla’s holdings it is a clear second.

The other few companies are currently much smaller by comparison.

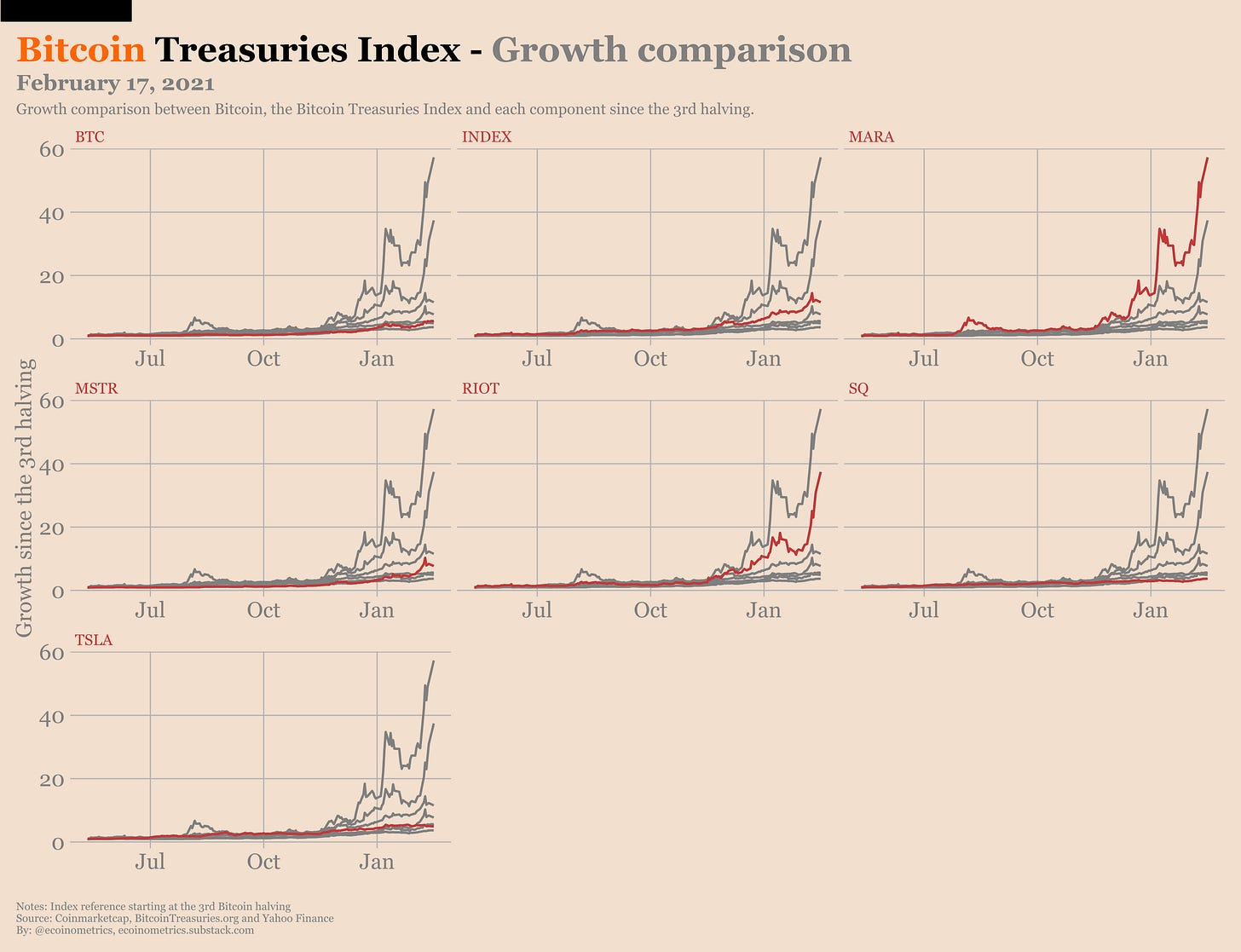

The Bitcoin Treasury Index started at a reference level of 10 on the day of the 3rd halving. It is now at 115.56 which is a nice 12x in less than a year.

Over the same period the Bitcoin Treasuries Index has been growing twice as much as Bitcoin itself.

Contrary to what you might have guessed the loudest stock is not the one which performed best since the halving.

Sure MicroStrategy is up something like 600% since they first bought Bitcoin. But the miners are doing substantially better:

Marathon is up 5,500% since the halving.

Riot Blockchain is up 3,500% since the halving.

So overall you aren’t doing bad if you track the Bitcoin Treasuries Index.

There are many more things we’ll need to explore regarding this index such as:

How does it correlate to Bitcoin?

How the weights have changed over time?

What if we use an equal weight calculation instead of a BTC holdings weighted calculation?

How about a market cap weighted index?

How about a Bitcoin holdings to market cap weighted index?

… as you can see there are lots of interesting questions we can dig into.

But that will be for next week after we’ve finalized the inclusion rules. Don’t forget to subscribe to get the next update.

CME Bitcoin Derivatives

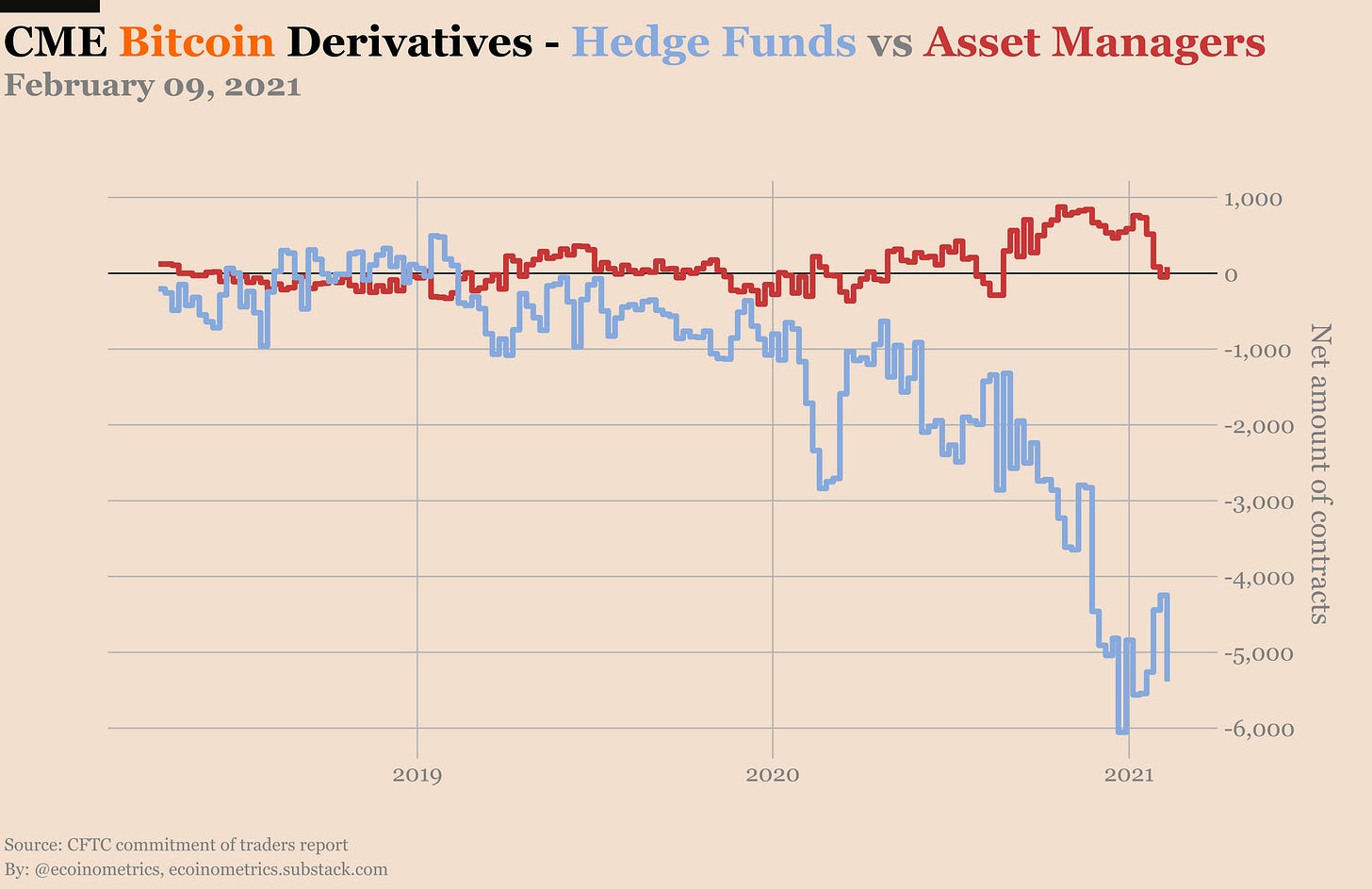

If you’ve been following this report for months you know what’s going on… the basis trade prevails.

The smart money is net short BTC on the CME futures but that’s mostly because they are long spot BTC at the same time to capture the futures premium over the spot market.

As you can see on the chart by tracking the rise of the net short positions, this strategy has been very popular since around the halving last year. And amazingly there is no sign that this is anywhere near to being arbitraged away...

Meanwhile this is just an invitation to print yield for the smart money.

Note that this trade is not confined to the CME. Just checkout the comments by PlanB and others on this tweet by Preston Pysh for more details:

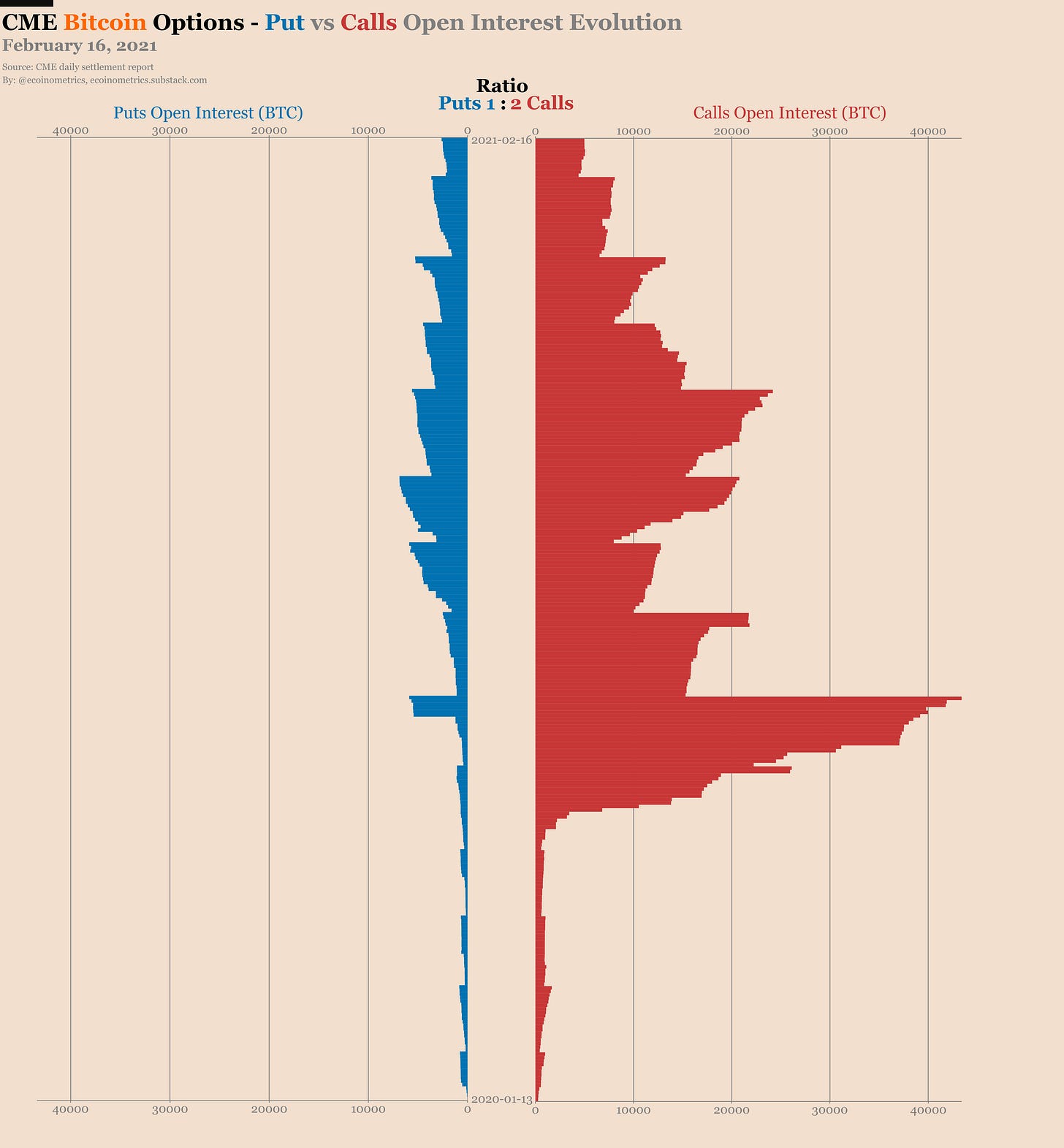

We have 10 days to go on the February contract and there is nothing worth mentioning when it comes to the trading activity on the futures.

The CME Bitcoin options market is equally quiet. As BTC is pushing over $50,000 we have 70% of the calls on the February contract already in the money. Not a record but pretty close.

Ten days to go, let’s see how that plays out.

That’s it for today. If you have learned something please subscribe and share to help the newsletter grow.

Cheers,

Nick

The Ecoinometrics newsletter decrypts Bitcoin’s place in the global financial system. If you want to get an edge in understanding the future of finance you only have to do two things:

Click on the subscribe button right below.

Done? That’s great!