Ecoinometrics - Inverted yield curve and market corrections

Does the size (of the inversion) matter?

The inversion of the yield curve is one of the most consistent harbinger of a recession. And with troubles in the economy come troubles in the financial markets.

But is there any relationship between the size of the inversion and the size of the stock market correction.

The Ecoinometrics newsletter gives you insights from crypto and macro data to help you make better investment decisions.

Each issue of the newsletter tells you what you need to know in 5 minutes or less, direct to the point, with lots of charts to allow you to quickly visualize what’s important.

Join more than 19,000 subscribers here:

Done? Thanks! That’s great! Now let’s dive in.

Inverted yield curve and market corrections

A deep inversion

You have probably seen some chart like the one below making the rounds over the last couple of days.

This is a chart showing the spread between the US Treasury 10-year and 1-year yield going back 60 years. In red are the periods of inversion (short duration yield higher than long duration yield). Recession periods highlighted.

Now the reason this chart has been making the rounds is that as you can see the depth of the inversion is massive. You have to go back to the end of the 1970s to find something similar.

So a legit question as an investor is, should I really care about the depth of the inversion of the yield curve?

Is there something to learn from the depth of the inversion?

Obviously if you are trading debt this kind of stuff matters. Like if you are trading those duration spreads it isn't stupid to start thinking about a mean reversion bet.

That's about the only directly applicable insight you get from looking at this depth and it only really matters for bond traders.

But chances are you aren't (only) trading debt if you read this newsletter. If you are in crypto you are trading risk assets. And for risk assets the question is a bit different.

Let me phrase it this way.

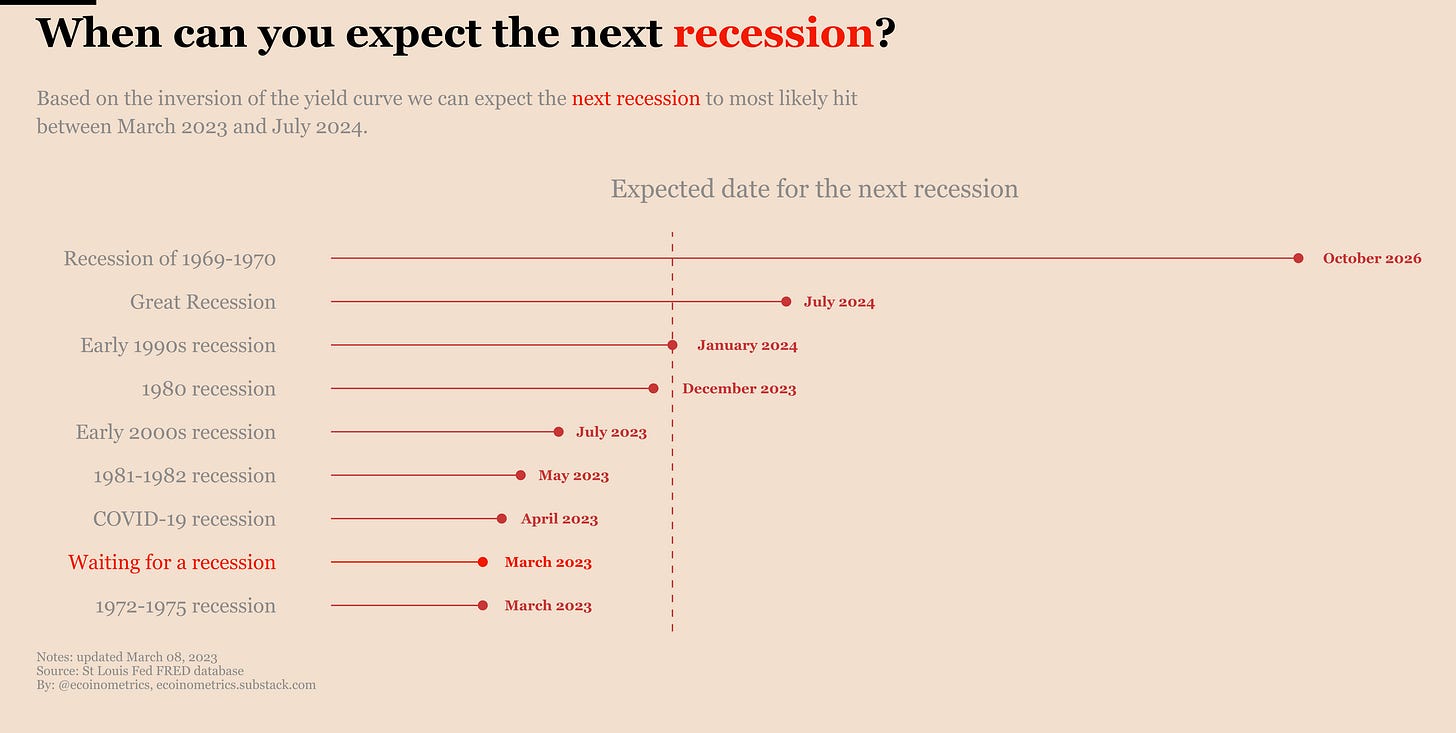

An inverted yield curve precedes a recession typically between a few months to a year an a half. Around periods of recession the stock market typically dives down.

Is there any correlation between how deep the inversion is and how large the stock market correction will be for this recession period?

60 years of drawdowns

Let’s make that question more precise from a quantitative perspective.

Take largest point of the inversion of the yield curve that preceded each recession.

Take the stock market drawdown which aligns with each of those recession periods and record the lowest point of the drawdown.

Now plot these two values against each other.

The further you go to the right the deeper the inversion. The lower you go on the vertical axis the more severe the stock market correction. Each point is labelled based on the associated recession period.

Is there any pattern in this?

Well, over the past 60 years we only have 8 recessions to work with, so 8 points. That’s not a lot so don’t expect anything statistically significant.

What is clear at least is that deep inversion does not equal deep market correction. Actually if you squint it is almost the opposite thing going on…

What does that mean?

For risk assets that means you shouldn’t worry too much about the magnitude of the inversion of the yield curve. Based on the historical data a deep inversion does not correlate to a particularly severe bear market.

If anything what the depth really conveys is the speed and magnitude of the change in the Fed Funds rate by the Federal Reserve. That’s it.

The stock market, and Bitcoin by correlation, is more affected by the actual damage done to the economy during a recession than by yield spreads.

That being said the clock is ticking.

Bitcoin derivatives

As we’ve discussed in the previous weeks the CFTC was indirectly hit by a ransomware attack which has created massive delays in the Commitment of Traders report. That’s affecting our reporting on the CME Bitcoin derivatives since we are missing a bunch of data.

But we are starting to see data for February trickle down and it seems we haven’t missed much, as of February 07:

Asset managers are at an all time high net long position.

The hedge funds haven’t reverted back to the carry trade.

The Bitcoin rally is not completely dead yet so the futures are managing to keep a premium over the spot market.

But the market activity has slowed down significantly now that Bitcoin’s price is on a plateau as you can see is in the open interest on the Bitcoin futures. We are down the highs and going back to a more familiar range to this bear market.

On the CME Bitcoin options side the status quo remains since last week. For the first time in almost two years the puts to calls ratio is even. That suggests a shift in the market sentiment regarding where Bitcoin is headed in the short term.

The least we can say looking at the evolution of the open interest on the puts and the calls is that not only are people placing bullish bets but the also the number of defensive puts has clearly receded.

That’s a positive shift in the market sentiment.

Let’s see if that changes when Bitcoin breaks out of this tight range.

That’s it for today. If you have learned something please like and share to help the newsletter grow.

Don’t forget to checkout other resources on the Ecoinometrics website such as:

A dollar cost averaging performance calculator for the stock market.

Which assets really hold up against inflation over the long run.

If you are already a free subscriber please consider upgrading to a paid tier to get the full access including:

Investment insights on crypto and macro backed by data.

All that delivered to you twice a week, read in less than 5 minutes and completed with data visualizations.

Cheers,

Nick

P.S. For weekly threads and hot takes follow Ecoinometrics on Twitter.