Ecoinometrics - Is the Fed doing a soft pivot?

Inflation is trending down so what is the Fed fighting for now?

Inflation, even core inflation, is on a downtrend.

Yes you need to factor in the base effect. Yes reaching the 2% goal is still a long time away.

But inflation is trending down.

And while that doesn’t warrant the hard Fed pivot many are looking for, there is a case to be made for the soft pivot already being there.

That comes with opportunities (and risks) for Bitcoin and digital assets.

Without data you are just another investor with an opinion.

The Ecoinometrics newsletter gives you insights from crypto and macro data to help you make better investment decisions.

Each issue of the newsletter tells you what you need to know in 5 minutes or less, direct to the point, with lots of charts to allow you to quickly visualize what’s important.

Join more than 20,000 investors here:

Done? Thanks! That’s great! Now let’s dive in.

P.S. Checkout our latest tracker of MicroStrategy Bitcoin holdings at https://www.ecoinometrics.com/microstrategy-bitcoin-holdings-with-charts/.

Is the Fed doing a soft pivot?

The takeaway

If you don’t have time to read everything here is what you need to know:

Inflation is on the kind of downtrend the Federal Reserve wants to see.

The base effect means that headline inflation won’t come down as fast moving forward even though core inflation is going to decrease faster in the next few months.

The point is that the trend is compatible with the Fed doing a soft pivot: no more rate hike after July and the adoption of a wait and see approach with respect to the state of the US economy.

What that means is that until the US move into a recession the financial conditions are going to drift looser.

As a result Bitcoin, digital assets and risk assets in general will have more room to push for a rally.

It is still time to follow the trend if that’s your strategy but make sure you can exit your positions fast in case the economic conditions worsen.

That’s our conclusion. But let’s rewind and discuss what makes us say that from the data.

Dealing with the base effect

Something we need to discuss first is the base effect.

The inflation rate we are talking about is the rate of change of the Consumer Price Index (or the equivalent for core prices, or PCE).

As a rate of change calculated between the current month and the same month a year prior it is subject to the base effect.

Now the base effect isn’t rocket science. This is simply the idea that a given metrics is influenced by the reference point which is used to calculate it. Let’s make that concrete with a simple example.

Take an imaginary consumer price index which is always equal to 100. The inflation rate for a CPI like that is 0%.

Now say that at some point we introduce some volatility in this fake CPI: instead of being 100 always it goes 100, 125, 75, 100, 100, …

Then one year later the inflation rate will look like: 0%, -25%, +25%, 0%, 0%, …

On average this fake inflation rate is 0%. But the spike of the CPI at 125 is introducing an inflation drop to -25% a year later. And the drop of the CPI to 75 is introducing an inflation rise to +25% a year later.

Those two numbers might very well be significant of a real world event. But the point is that they are deviations around a trend which is that inflation is at 0%.

Now in the real world we have the same phenomenon except the trend is not as clear as in my made up example.

If 12 months ago there was a spike in the consumer price index then we would expect this base effect to introduce some deviation to the downside compare to the long term trend for inflation in the current print.

The same goes the opposite way. If 12 months ago there was a drop in the CPI compared to the long term trend then we would expect to see now a deviation of the inflation rate to the upside compared to the trend.

If you define precisely what you mean by the trend, you can actually quantify those deviations. But since there is no unique way of doing that it is best to keep the general idea behind the base effect on inflation in mind.

The lesson is that to avoid being distracted by the volatility in the CPI better to not focus on a single inflation print.

Case in point what happened with the June number. There was a serious drop in the inflation rate for June making it look like we are going to be able to reach the 2% target anytime now.

But unfortunately a big part of this drop is simply the consequence of inflation having spiked 12 months ago.

Based on the trends of the CPI and the core CPI from about 12 months ago the base effect is going to:

Make it harder for headline inflation to slowdown significantly in the next 3 months.

But core inflation should ease faster over the next couple of months.

Now these are the deviations from the trend expected from the base effect. They could still be completely cancelled out by current price changes. But those we cannot know in advance.

The thing to remember is that the base effect is going to help with core inflation easing and make it harder for headline inflation to ease in the next few months.

That being said, the economists at the Fed and us macro investors aren’t particularly concerned about a single data point. What we really care about is the big trend. And at this level we are starting to see a compelling story.

Why you should focus on the trend

In order to avoid this discussion of the base effect let’s smooth things out a little bit.

Instead of looking at inflation as the year-over-year change in the consumer price index we are going to:

Average the CPI over a rolling window to smooth out the volatility that creates the base effect.

Calculate the inflation rate based on this smoothed out consumer price index.

Let’s call this the smoothed inflation rate and see what the trend is saying at this level.

We focus on smoothing out the consumer price index and the core consumer price index. Chart below for the inflation rate with a 6-month smoothing of the headline CPI and the Core CPI.

Without being distracted by the base effect, the trend that’s emerging is that both inflation and core inflation are easing. And both of them have been easing for at least 3 months. That’s what you need for economists to start saying that it matters.

So while the Federal Reserve isn’t going to directly announce that inflation is getting under control (that would be too risky at this point) they can certainly start to think that they have done the job.

All the FOMC has to do moving forward is maintain the pressure with some jawboning and keep rates close enough to where they are. The momentum of the US economy should take care of the rest.

That’s what I’d call a soft pivot.

Now a soft pivot isn’t the same as restarting the money printer.

But keeping rates where they are will naturally let the real financial conditions loosen for the US economy. We have seen that already. Since the FOMC slowed down the pace of rate hikes the financial conditions (measured by the NFCI) have stopped tightening and are slowly getting looser.

Looking at the dot plot together with the trajectory of the Fed Funds rate you can argue that the soft pivot has already happened.

So peak rate seems pretty clear. At least that’s what the market is believing.

Dwindling chances of more rate hikes after July

When you are close to the FOMC meeting, the Fed Funds rate futures are very rarely wrong. Basically it takes an unforeseen market event to change what’s already baked in the projections.

And just two days from the July meeting there is a 99% chance of a 25bps rate hike. But if you look further down the line the odds are very much in favour of this rate hike being the last one of the year.

Actually with the latest inflation print the odds of another rate hike shrank again. The futures are even starting to consider that we could see rate cuts before the end of the year.

Personally I don’t see that fitting the plan of the Federal Reserve. And those probabilities are still lower than the chance of another 25bps rate hike. But if the US enters a recession, the Fed won’t have much choice. At least now they have some room to loosen progressively.

And talking about a recession, here is another data point. The Leading Economic Indicator from the Conference Board aggregates a bunch of metrics that lead the health of the US economy. The LEI contracted again in June. When you have had an inverted yield curve for more than a year that’s not something you want to ignore.

What to do in uncertain macro conditions

So we are still in this ambiguous situation:

A soft pivot from the Fed is going to benefit Bitcoin, digital assets and risk assets in general.

A degradation of the US economy into a recession could lead to a liquidity crisis.

The macro weather is like upside with risk of some serious downside in ~6 months.

What to do in this kind of situation?

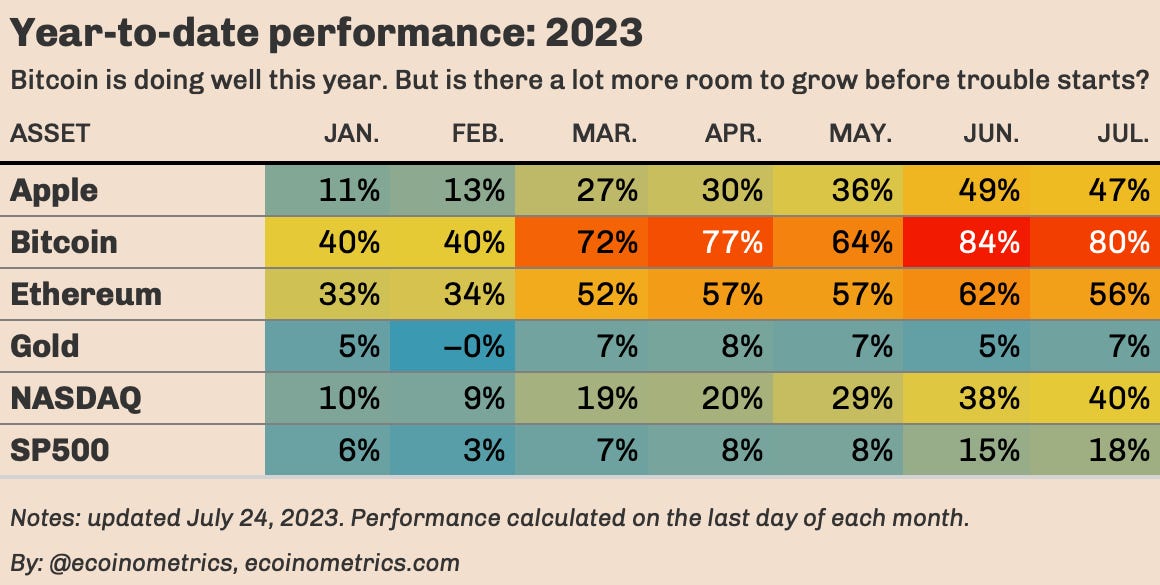

Well, the first thing to observe is that risk assets aren’t waiting for the Fed to be done with this rate hike sequence to rally. Check out the table below, it shows the evolution of the year-to-date returns of a few assets month by month.

Bitcoin is leading in this table but mega cap stocks or stock indices have done very well so far.

There is clearly some FOMO going on. The SP500 is almost getting out of the bear market drawdown so many investors are jumping on the trend in order to not miss the next 100-year bull market…

But despite the dominant narrative shifting to a soft landing (no recession just a slowdown) as the most likely scenario, there is still a big risk of a recession for the end of this year or beginning of the next.

Look, no one can be certain of where the economy will be in 6 months. Not you, not me, not the economists at the Fed. As Ben Bernanke (then Fed Chairman) said just before the 2008 financial crisis:

“Economists are extremely bad at predicting turning points, and we don’t pretend to be any better.”

So jumping on the trend isn’t simply FOMO. It is also a perfectly rational thing to do for investors. Pessimists sound smart, optimists make money.

That means following the trend is always the way to go. But the risk is in doing so blindly.

We know that if the US economy enters a recession the risk of a liquidity crisis in the financial markets will be very high. It is always the case. Despite what the efficient market hypothesis would have you think, the stock market never priced in a recession in advance.

Now during a liquidity crisis all assets lose value fast as investors scramble to raise cash in order to meet margin calls. You don’t need to look very far to see that. Just go back to the COVID crash in 2020.

Based on the rough estimates we can make for timing the next recession (with the inversion of the yield curve), the risk of a liquidity crisis will be high in Q4 2023 ~ Q1 2024.

That means if you are following the trend you need to make sure you do so while minimizing the risk of getting stuck with illiquid positions:

Stick only to investing in the most liquid markets.

Exit your positions as soon as something smells fishy.

Said differently, don’t get lulled into complacency by the rally.

That’s not being a pessimist. That’s just being a cautious optimist.

Your call.

That’s it for today. If you have any question don’t hesitate to reply to this email and I’ll get back to you.

If you have learned something please like and share to help the newsletter grow. Using the referral button you get rewarded for bringing in new subscribers:

If you are already a free subscriber consider upgrading to a paid tier to get the full access including:

All the issues of the newsletter (2 every week) including all the reports (Bitcoin miners, Bitcoin on-chain accumulation, Bitcoin correlations, macro liquidity, …)

A fast track to get your questions answer. Shoot me an email, if I don’t have an answer I’ll do the research and publish the result in an issue of the newsletter.

Cheers,

Nick

P.S. For hot takes and daily charts follow Ecoinometrics on Twitter, Instagram and on Threads @ecoinometrics.