If you pay attention to the narrative around Bitcoin in the traditional media you’ll notice that something has changed. It is as if the more expensive Bitcoin gets the less risky it is to own some...

The Ecoinometrics newsletter decrypts Bitcoin’s place in the global financial system. If you want to get an edge in understanding the future of finance you only have to do two things:

Click on the subscribe button right below.

Done? That’s great!

Now let’s dive in.

Bitcoin front and centre

Look at that...

Bitcoin front and center on the Financial Times cover. That’s not a bad way to start the year.

If you have read articles from the traditional financial press recently you've certainly felt that the tone has changed.

It used to be that you could find three types of articles:

- Bitcoin is a tulip bubble.

- Bitcoin is used by criminals.

- Bitcoin is dead.

As its market cap is growing and institutional investors are gradually buying in we are seeing less of these.

It is funny how things work, Bitcoin at $300 back in 2016 was a scam but Bitcoin at $30,000 in 2021 is a great investment opportunity.

You can make sense of it if you put yourself in the shoes of the people working in traditional finance. There are many kind of risks if you are in the finance business:

- The risk of making a bad investment and losing money.

- The risk of having to jump through compliance hoops.

- The risk of going against what your peers are doing.

- The risk of missing out on a great investment opportunity.

The larger the institution the more they want to avoid compliance risk, the more they want to avoid looking foolish by losing money on some unusual investment idea and the more likely they are to conform to what everybody else in their peer group is doing.

If a fund manager loses money by betting on Apple no one is going to blame him because everybody else is doing the same thing.

So you shouldn't be surprised to see that it is taking so long for traditional finance to start adopting Bitcoin.

But things are changing.

With a market cap at $600 billion, Bitcoin is as big as a mega cap stock. That makes it more investable for financial institutions that are used to deploy large amounts of money.

And you know what? The more expensive Bitcoin is the more attractive it gets for them.

With Stanley Druckenmiller, Paul Tudor Jones, Michael Saylor and others being public about their investment thesis it is also becoming easier to buy Bitcoin without risking to look foolish.

Slowly but surely the narrative is shifting. We aren't there yet but you can feel that we'll reach a point during this cycle or the next where not having Bitcoin as part of your portfolio will make you look foolish.

The funny thing is even though institutional investors start entering the space at $30,000 they still get the benefits of asymmetric returns:

- 4x to reach the market cap of Apple

- 20x to reach the market cap of gold.

- 40x to reach the current value of the US Federal debt...

... not bad for being late to the party.

Who’s next

Exactly one week ago I wrote that Bitcoin was taking the fast lane... at that time we were still below $30,000.

Fast forward to now, a few giant green candles later, and Bitcoin is about to flip Tesla.

The next three target are:

Tesla flipped with BTC at $36,000

Facebook flipped with BTC at $41,000

Google flipped with BTC at $63,000

I’ve been thinking for a while that the big goal of this halving cycle is for Bitcoin to flip all the mega cap stocks and become larger than Apple before taking a stab at devouring gold.

So far we are still on track.

Money to nowhere

You won’t be surprised if I tell you that the world’s economy is running on debt.

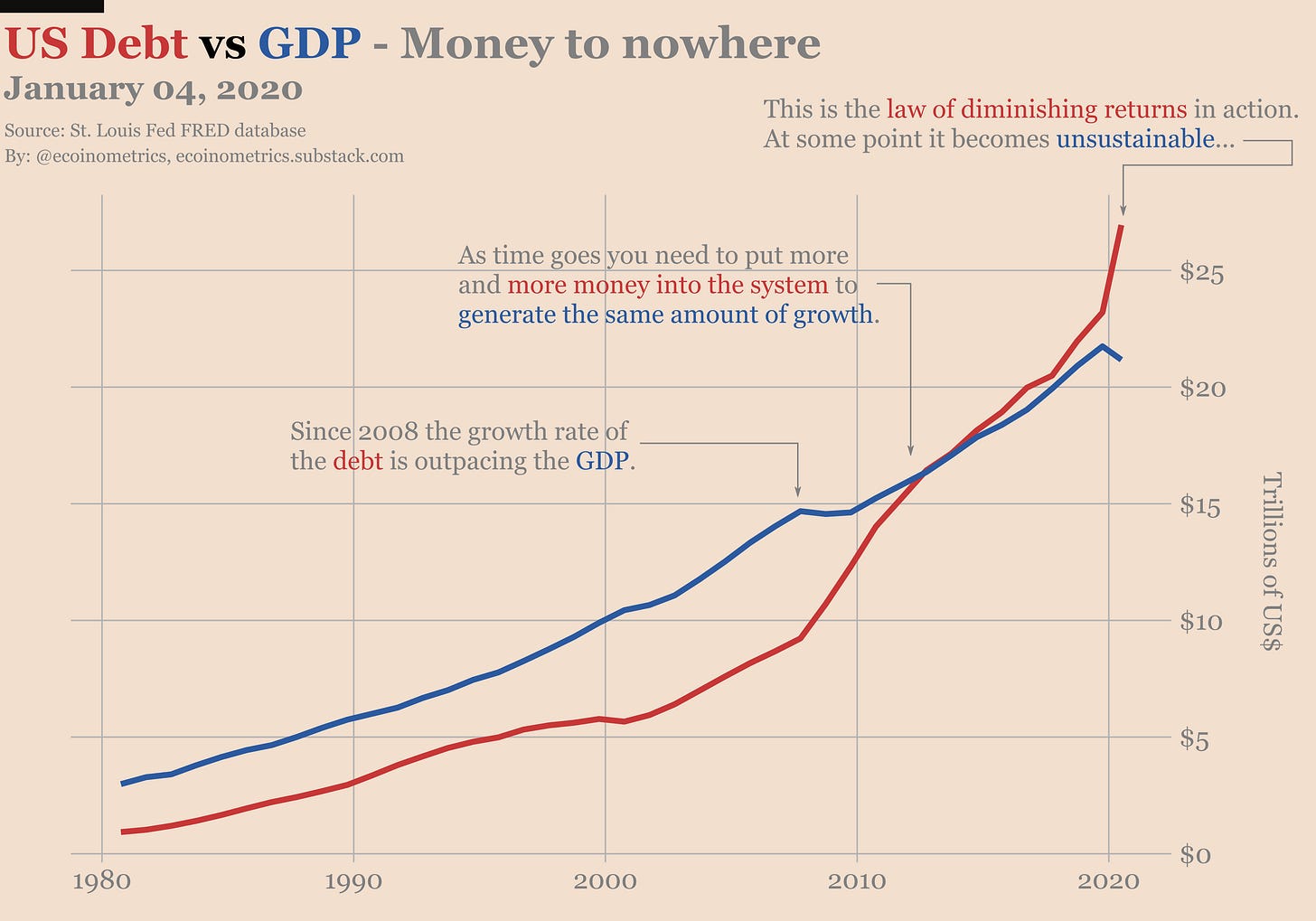

Take the US as an example. Below is the chart looking at the Federal debt together with the GDP since 1980.

From 1980 to 2008 you can see that the debt and the GDP are moving in parallel. More money is injected into the system but as a ratio the output was constant in terms of growth.

But 2008 marks an inflection point. After that it always takes more debt being created to sustain the same growth rate of the GDP.

This is the law of diminishing returns in action.

What happens next isn’t clear. The global economy is not a linear system. It is a complex system full of non-linear effects and emergent properties.

But long term history is teaching us that you can only sustain high levels of debt for so long. That’s especially true when you have reached the point of diminishing returns.

That means the debt has to be purged one way or another.

The central banks of the world can decide that enough is enough, now is the time to stop feeding the debt cycle. That would mean removing the “Fed put”, letting bad businesses fail and a default on a large amount of the sovereign debt.

That’s one way to get out of this.

Another way is to debase the currency. Inflate the debt away. Repay your creditors with money that is worth less and less.

So far major central banks seem to follow the second path.

But neither of these solutions is painless. Someone has to pay the price of too much debt.

In a world where even sovereign bonds will carry increasing risks of default you better be careful of the debt tied to the assets you own.

Most people aren’t thinking about that yet, but in that context Bitcoin could play a major role as a pristine collateral asset.

That’s one of the reasons Bitcoin’s potential market cap is likely to be much larger than gold itself as the world moves deeper into this long debt cycle.

That’s it for today. If you have learned something please subscribe and share to help the newsletter grow.

Cheers,

Nick

The Ecoinometrics newsletter decrypts Bitcoin’s place in the global financial system. If you want to get an edge in understanding the future of finance you only have to do two things:

Click on the subscribe button right below.

Done? That’s great!