Ecoinometrics - January 06, 2021

Growth trajectories...

We are still pretty early in this 3rd halving cycle. So it is probably a good time to remind everybody that usually the Bitcoin price doesn’t go up in a straight line… except when it does...

The Ecoinometrics newsletter decrypts Bitcoin’s place in the global financial system. If you want to get an edge in understanding the future of finance you only have to do two things:

Click on the subscribe button right below.

Done? That’s great! Now let’s dive in.

Growth trajectories

I know it is common to warn investors that value doesn’t go up in a straight line.

Some people will use that knowledge to be mentally prepared when the rally takes a break and we experience pullbacks.

Some people will use that knowledge to actively trade Bitcoin moves trying to sell at local tops in the hope of buying back at lower prices.

Some people who don’t have a position yet will take this as a justification to wait for the mythical dip before starting to buy in.

Let me start by saying that honestly the latter is a bad take. More likely than not, the “big dip” will never come and you will have missed the opportunity of getting on the trend. Or even worse a pullback will come but you’ll get cold feet and end up not buying…

This is just human psychology.

But why am I saying that it is unlikely a “big dip” will come at this point?

Well just look at the price trajectory after each halving and you’ll notice that after the price starts taking off it never dips down back to where it started.

See for yourself.

After the first halving Bitcoin straight up 10x with very small pullbacks on the way. Then there was a period of plateau. That was the only significant drawdown of the bull phase in this cycle. Finally it peaked another 10x higher before slowly drifting lower until the next halving.

After the second halving things played out a bit different. Instead of those short bursts of exponential growth we had something more even with several significant drawdowns on the way to 10x. This cycle ended the same though: a top after 10x and then drifting lower until the next halving.

After the third halving we have started the bull market phase. So far it is something of a hybrid of the previous two cycles.

So of course there’s no guarantee that a massive dip won’t happen. But the odds aren’t in your favour.

That’s not to say that there are no pullbacks during a bull market though.

As you have seen on the previous charts there are various drawdowns along the way in each cycle. It is just that they aren’t massive compared to the growth.

To make it a bit easier to visualize we can do the following:

Break the Bitcoin price charts by halving cycles.

Gather the drawdowns for each cycle.

Rank those by their depth and how long it took to reach the bottom of the dip.

What you end up with is a picture like that.

Most drawdowns take less than 10 days to reach a bottom and are corrections smaller than 40%.

We also have a couple of outliers with drawdowns of more than 80% taking a year to reach a bottom. Obviously those are the ones happening at the end of each of the previous cycles.

But to summarize we get that:

50% of the drawdowns are smaller than 8%.

70% of the drawdowns are smaller than 15%.

80% of the drawdowns are smaller than 23%.

90% of the drawdowns are smaller than 37%.

If you take those historical drawdowns as a guide and apply them to the current price configuration you get the following:

50% of the drawdowns won’t take you lower than $31,800.

70% of the drawdowns won’t take you lower than $29,600.

80% of the drawdowns won’t take you lower than $26,800.

90% of the drawdowns won’t take you lower than $22,000.

And it would take a pullback such as the ones seen at the end of a cycle to bring you down to the lows of March.

Tl;dr if you are playing the odds, waiting for $10,000 or even $20,000 to buy is extremely unlikely to happen. That ship has sailed.

Don’t overthink it. Start accumulating now, build a position and enjoy the bull market. At this point you are more at risk of missing on the upside by not owning Bitcoin than anything else.

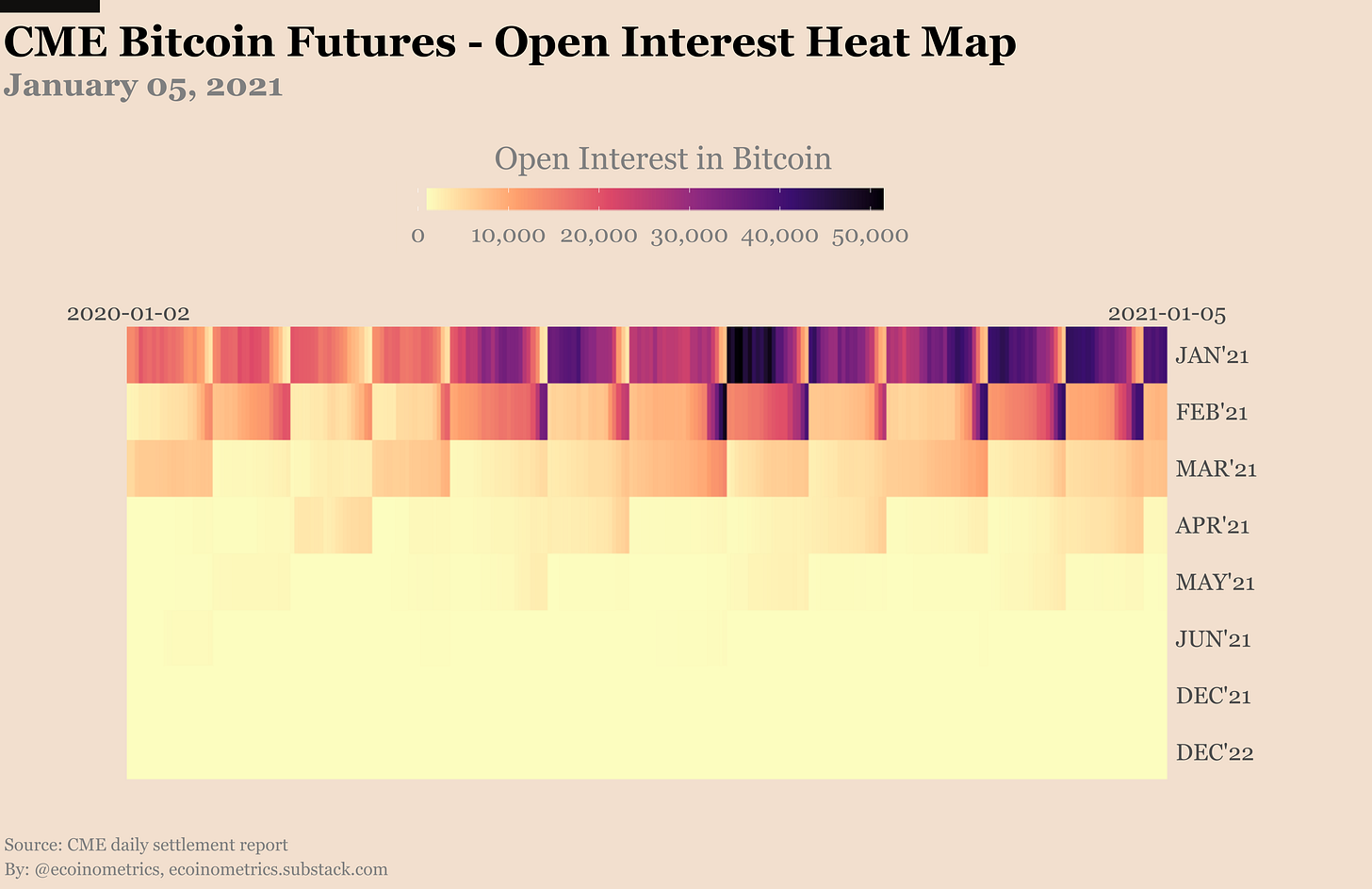

CME Bitcoin Derivatives

The open interest on the cash settled Bitcoin futures has been stuck on a plateau for weeks now, well below the record high of July.

But to be fair with the sharp rise in the BTC value we are at an all time high open interest when expressed in US$. At the current price the total of all the open positions is worth something like $2 billion.

So maybe thinking in terms of the cash value of the contracts is a more appropriate way of gauging the level of activity in the market.

After all if you chose to use the cash settled futures as your main tool to trade Bitcoin then you probably don’t care how many Bitcoin equivalents those contracts represent. If you did you’d use spot instead.

So I’ll update the relevant charts to better reflect this in the future.

For today though all we can say is that:

When measured in Bitcoin / contracts the activity is flat.

When measured in US$ then we are at record high activity.

Things are a bit different when you look at the options market. Here the setup hasn’t changed either:

The market is dominated by the calls.

More than half of the calls are currently in the money.

The raging bull market is not driving any extra activity.

The trading activity on the options remains well below its peak even when you look at it in US$.

We’ll dive deeper in how this market seems to actually be slowing down by breaking down the positions month by month in an upcoming issue of the newsletter.

The last Commitment of Traders report for 2020 is showing some changes but they are more likely to be end of year phenomena than changes in strategies.

Retail traders have closed a good amount of their long positions. If I had to guess I’d say this is just taking profits for the year. Overall still net long.

The smart money has stopped adding to their short positions. Instead it closed some of them taking us off the record net short level. But as you can see it doesn’t materially change the situation.

We have yet to see a rush from assets managers to bet on the trend. Or simply most of those who decided to go long Bitcoin did it on the spot market.

That’s it for today. If you have learned something please subscribe and share to help the newsletter grow.

Cheers,

Nick

The Ecoinometrics newsletter decrypts Bitcoin’s place in the global financial system. If you want to get an edge in understanding the future of finance you only have to do two things:

Click on the subscribe button right below.

Done? That’s great! Thank you.

Hi, if we do X10 during this halving like the 2 others , we will reach around of 95k during this one according the pictures of this cycle above in the article. So how can we reach 286k as mentioned in the daily tweets prediction if we reach 95k at the end of the bullrun ???

Thank you so much for the Great Work!