How many Big Macs can you buy with one Bitcoin? As of today about 6,350. That’s already a lot, something like one Big Mac every day for the next 17 years.

But this number is about to get much bigger. So maybe it is time to track the Big Sats Index.

The Ecoinometrics newsletter decrypts Bitcoin’s place in the global financial system. If you want to get an edge in understanding the future of finance you only have to do two things:

Click on the subscribe button right below.

Done? That’s great!

Now let’s dive in.

The Big Sats Index

According to the Financial Times there is no reason to worry about inflation, it is basically a conspiracy theory invented by “crypto bros” and “goldbugs”.

Well, I guess since it is written in the FT then there is nothing to see here.

Unless...

Yep you are seeing that correctly. A Big Mac in the 1970s went for $0.65. A Big Mac in 2021 goes for $5.66. But according to the FT you shouldn’t be worried about losing your purchasing power...

You might argue that the 70s is too far away and that anyway there was a big inflation period happening in the US during that decade so it doesn’t count.

Let’s start a bit closer then. Arbitrarily I’ll take 1990 as a reference:

In 1990 you could get a Big Mac for $2.20.

In 2021 you need $5.66 to get a Big Mac.

Has your salary gone up 2.4 times since 1990? I guess not.

This is where you see that the CPI with its weighted average of averages is not enough to tell you the full story.

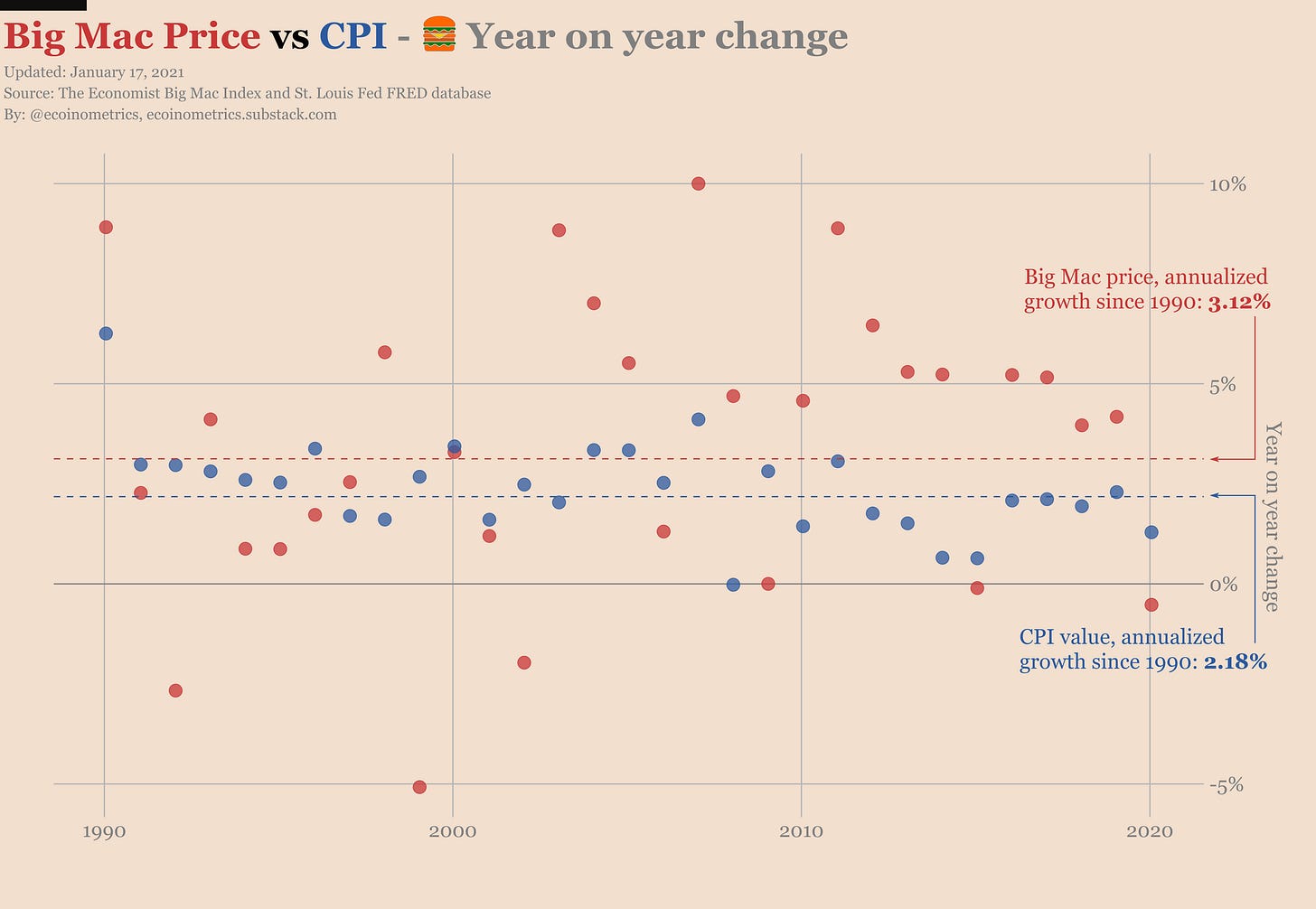

Again taking 1990 as a reference you can see that since the early 2000 the growth rate of the Big Mac price is outpacing the CPI.

It is outpacing it so much that the gap is starting to get really big really fast. As of 2020 the Big Mac price has grown 25% more than the CPI.

When you look at the year on year change it is clear that the price of a Big Mac is consistently growing faster than the CPI since 2003.

If you annualize those growth rates you get that:

The Big Mac price has increased 3.12% a year since 1990.

The CPI value has increased by 2.18% a year since 1990.

That’s a 43% difference and obviously it compounds over time.

Now, I’m not claiming that it means inflation is running at 3.12% annualized in the US.

What I’m claiming is that the cost of living and the evolution of the purchasing power can’t be summarized with one number.

People living in different regions, with different kinds of jobs and with different family compositions do not experience the economic situation the same way.

A software engineer working for Facebook, single and living in San Francisco, the owner of a barbershop living in Arizona and a nurse from Chicago with three kids can’t be reduced to a single number.

Which is why arguing over where the target inflation of the Fed should be is rather pointless for the real economy. It drives the narrative of the financial markets for sure. But its practical impact on your day to day life varies greatly depending on who you are.

So what else can we do with the Big Mac price?

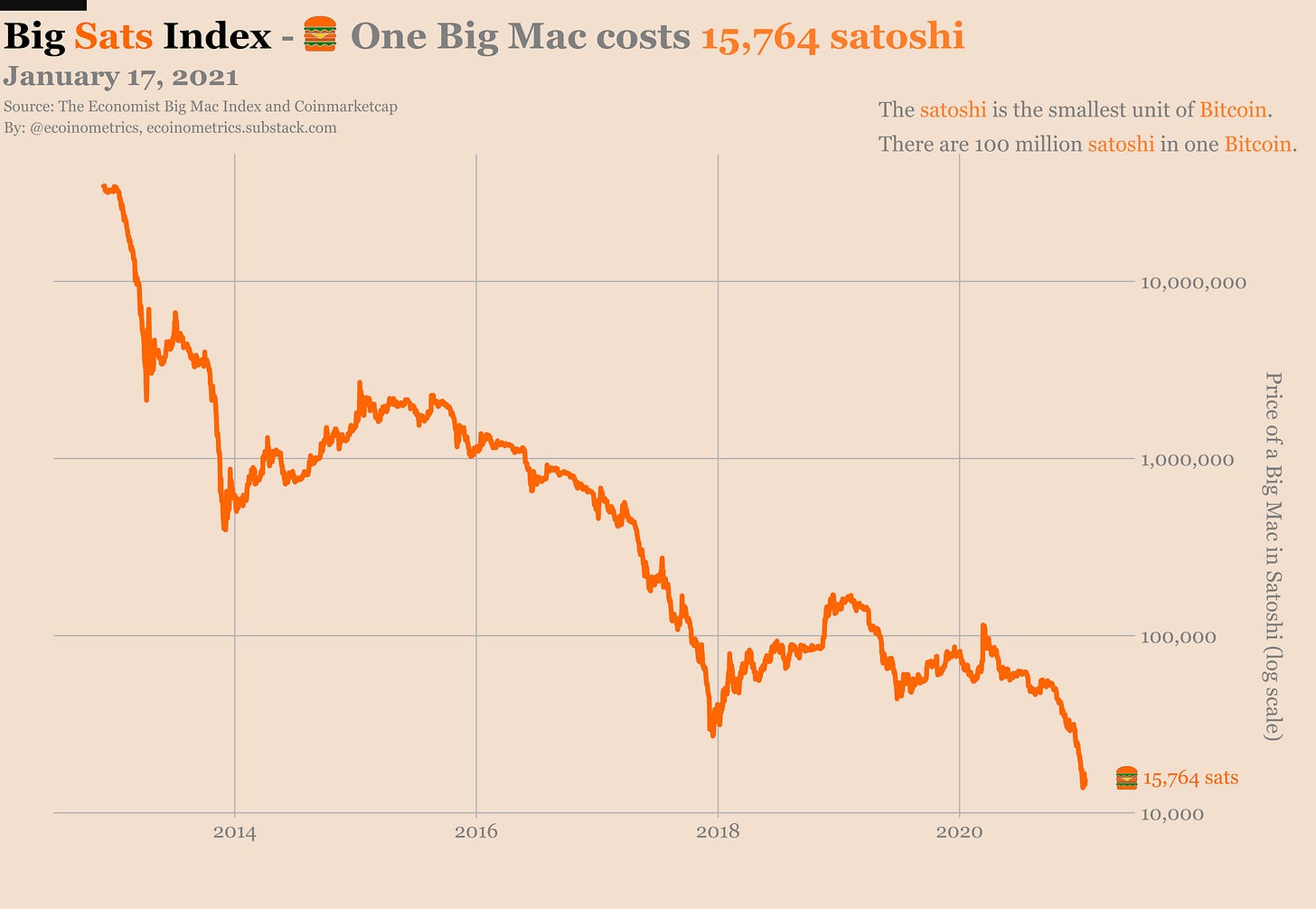

Taking inspiration from The Economist’s Big Mac Index we can make our own Big Sats Index.

How?

It is pretty easy. Hear me out.

One Bitcoin is getting more and more valuable in US$. So much that it has been impractical for a while to talk about the value of small items as expressed in Bitcoin… too many decimals points for a burger.

But one Bitcoin is actually nothing else but 100 million satoshi, the satoshi being the smallest unit of Bitcoin.

So for items of small US$ value it makes sense to talk in terms of satoshi.

We can then define the Big Sats Index simply as the amount of satoshi one needs to buy one Big Mac.

As of today it takes 15,764 satoshi to buy a Big Mac in the US. We are slowly heading towards Big Mac to sats parity...

Money Printing

There is an interesting trifecta coming with the Biden presidency:

Janet Yellen as Treasury Secretary.

Bernie Sanders as the Chairman of the Senate Budget Committee.

Jerome Powell as the Chairman of the Federal Reserve.

I reckon that this is not going to lead to a smaller US deficit…

Bernie Sanders is going to push for more stimulus and more MMT style policies.

Janet Yellen is more than likely to oblige by issuing more US Treasury bonds to finance all that.

But everything is fine since Jerome Powell stands ready to buy all that new debt with the Fed’s printing machine.

The net result is likely to be:

A larger US debt to GDP ratio as putting more money in the machine only affects the GDP with diminishing returns.

More bonds flooding the market which might call for yield curve control measures from the Fed to keep interest rates in check.

More US$ distributed in the economy MMT style. Which means a faster debasement of the currency.

This is good for Bitcoin.

Money Laundering

Here we go again. It had been a while since we heard someone say that Bitcoin is used for money laundering, buying drugs and pay for hitmen.

Christine Lagarde, the president of the European Central Bank, commented last week that Bitcoin is being used to do “funny business” and has led to “some reprehensible” activity.

Because of that she concludes that it should be regulated globally.

Good luck with having every country agree on a common set of regulations regarding Bitcoin.

What will come out of that is probably going to be the least common set of regulations everyone can get behind: KYC and control of on-ramp / off-ramp mechanisms with local currencies.

That’s about it. Nothing that we don’t already have more or less everywhere.

No FUD to see here.

That’s it for today. If you have learned something please subscribe and share to help the newsletter grow.

Cheers,

Nick

The Ecoinometrics newsletter decrypts Bitcoin’s place in the global financial system. If you want to get an edge in understanding the future of finance you only have to do two things:

Click on the subscribe button right below.

Done? That’s great!

Thanks Nick! I gotta say, I have been in the working world since 1983 and I have never come across a more optimistic, generous and sharing community than the bitcoin crowd. Thanks for your quick and positive response. I look forward to getting you a copy of my 'masterwork' when it is done. Best, Brooke

Nick, May I have your permission to use the Big Mac to $ and the Big Mac to BTC charts you posted here in my book about bitcoin? Pls let me know, thanks, Brooke https://www.linkedin.com/in/brookeinsb/