Ethereum is the second largest cryptocurrency by market cap after Bitcoin. But not all cryptocurrencies are alike and there are some key differences between Ethereum and Bitcoin. Here is my take on it...

The Ecoinometrics newsletter decrypts Bitcoin’s place in the global financial system. If you want to get an edge in understanding the future of finance you only have to do two things:

Click on the subscribe button right below.

Done? That’s great! Now let’s dive in.

Bitcoin vs Ethereum

“But Ethereum is up 800% this year, it is the best performing asset. Why don’t you talk about that?”

That’s a comment I get frequently below charts that compare the growth trajectory of Bitcoin to other assets.

Look I'm not anti Ethereum. But there are only so many things I can follow at the same time and as we’ll discuss below, getting a good understanding of Ethereum is a full time job.

But before that, since a lot of people have asked for it, here is the Bitcoin vs Ethereum comparison.

Check out the graph and we’ll discuss it below.

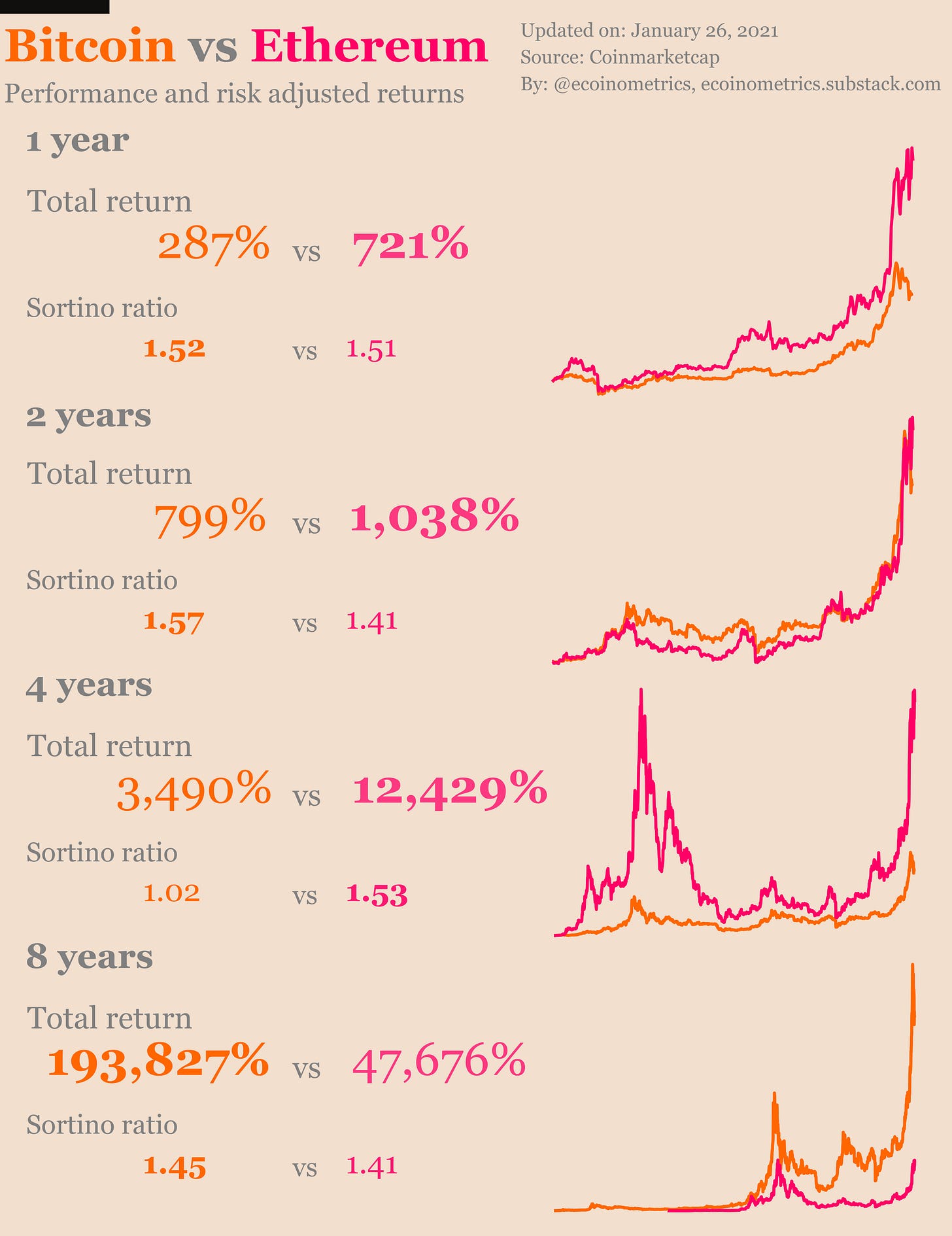

Yes, Ethereum outperforms Bitcoin over the 1 year, 2 years and 4 years timeframes.

Yes, Ethereum and Bitcoin have similar risk adjusted returns.

As of today Bitcoin is still 4 times larger than Ethereum which is still the second largest cryptocurrency. Ethereum hasn’t caught up with Bitcoin’s total growth but it also has a shorter history.

Now, what’s really driving the performance of Ethereum?

I mean when you look at the chart above you can see that the trajectories of Bitcoin and Ethereum are very similar.

Actually the way I think about it is that there are two forces driving the price of Ethereum:

The Bitcoin cycles are the main drivers of the growth trajectory for ETH. This is why the shape of the BTC and ETH growth curves are so similar.

The applications running on the Ethereum network are responsible for the smaller movements within the main cycles.

The second point is the key difference between BTC and ETH.

Bitcoin is money. Bitcoin is digital gold. Bitcoin is optimized to do this one thing in the most resilient way possible. That means Bitcoin is boring, rigid and pretty much a finished product when it comes to the base layer.

Ethereum is a smart contract platform. Enabling all sorts of smart contracts to run in a decentralized fashion requires much more complexity than what’s needed to make Bitcoin run. To be somewhat useful Ethereum needs to have lots of bells and whistles. It needs to be a Jack of all trades. And as it stands in early 2021 the base layer of Ethereum is not yet a finished product.

Bitcoin derives its value for doing a good job at being hard money.

Ethereum derives its value from being a useful platform on which to run smart contracts and decentralized applications.

So to make an intelligent analysis of Ethereum you need to:

Follow the state of the development of Ethereum (since it is a work in progress).

Follow the ecosystem of decentralized applications built on top of Ethereum.

These are all the reasons why you can’t directly compare Bitcoin and Ethereum by putting them in the same “cryptocurrency basket”. They are different beasts. They do not compete in the same space.

That being said the long term trend of ETH is definitely driven by BTC. If you had to decompose the price movements of ETH with a symbolic equation you’d probably do something like:

ETH = BTC trend + smaller market cap premium + decentralized apps trends

Obviously Ethereum is still young so we don’t have so much data to work with, but I like to think about it this way.

And this line of thinking kind of checks out when you look at the BTC vs ETH one month correlation plot.

After the initial launch we had the ICOs boom in 2017 which produced periods of times where ETH and BTC had a low correlation.

But when the bear market came in at the beginning of 2018 and the ICO craze died down the correlation jumped to extremely high levels. During that period most of the movements of ETH could be explained as following BTC.

Now that we are in a new bull market that correlation is slightly lower. But so far the DeFi movement hasn’t been strong enough to really decouple ETH from BTC.

So that’s it from a high level way of thinking about Ethereum. As I said earlier, in my opinion, a deeper understanding of the market would require much more research in the dapps ecosystem.

If you only care about your portfolio return though you might still consider buying both BTC and ETH without looking at the details. But don’t confuse them for being the same thing:

If you need a store of value with an asymmetric return potential that is going to be stable for the foreseeable future then you want Bitcoin.

If you want to do a “venture capital” type bet that Ethereum will be the base layer for major decentralized applications that could bring a lot of innovation then you are also likely to get asymmetric returns.

Different risks to consider, different strategies to manage those bets.

CME Bitcoin Derivatives

The January contracts expire this week but there is not much to talk about. As of Wednesday we are about halfway through the rollover.

With BTC stuck in the low $30k range it looks like a number of positions have been closed outright. Check out the open interest slowly sliding.

The time spreads have been on a rollercoaster too but things are settling for now. The cost of rolling over your long positions won’t get prohibitive this month.

On the options side 47% of the contracts are due to expire on Friday. This is a continuation of the downtrend in trading activity on this market.

As I’m writing those lines Bitcoin is still stuck below $35k which happens to be a hot spot for the calls strikes:

If BTC is finishing the week below $35k, 39% of the calls will expire in the money.

If BTC is finishing the week just above $35k, 62% of the calls will expire in the money.

Quite a big difference, but probably not enough to move the market.

From the latest Commitment of Traders report:

The smart money is net short.

Retail traders are net long.

Water is wet...

Yep, nothing we didn’t already knew.

That’s it for today. If you have learned something please subscribe and share to help the newsletter grow.

Cheers,

Nick

The Ecoinometrics newsletter decrypts Bitcoin’s place in the global financial system. If you want to get an edge in understanding the future of finance you only have to do two things:

Click on the subscribe button right below.

Done? That’s great!