Do you ever look at Bitcoin’s price action and feel a sense of despair? That happens right? Well maybe that won’t make you feel better, but know that you are definitely not alone according to what we are seeing out of the Commitment of Traders report this week...

The Ecoinometrics newsletter decrypts Bitcoin’s place in the global financial system. If you want to get an edge in understanding the future of finance you only have to do two things:

Click on the subscribe button right below.

Follow Ecoinometrics on Twitter at https://twitter.com/ecoinometrics.

Done? That’s great! Thank you and enjoy.

You have all seen this chart where the price action of Bitcoin for the 2017 bull run is broken down in different phases. You know those right? It goes like:

Take off

Enthusiasm

Greed

Fear

Capitulation

Despair

And after despair you are ready for another cycle.

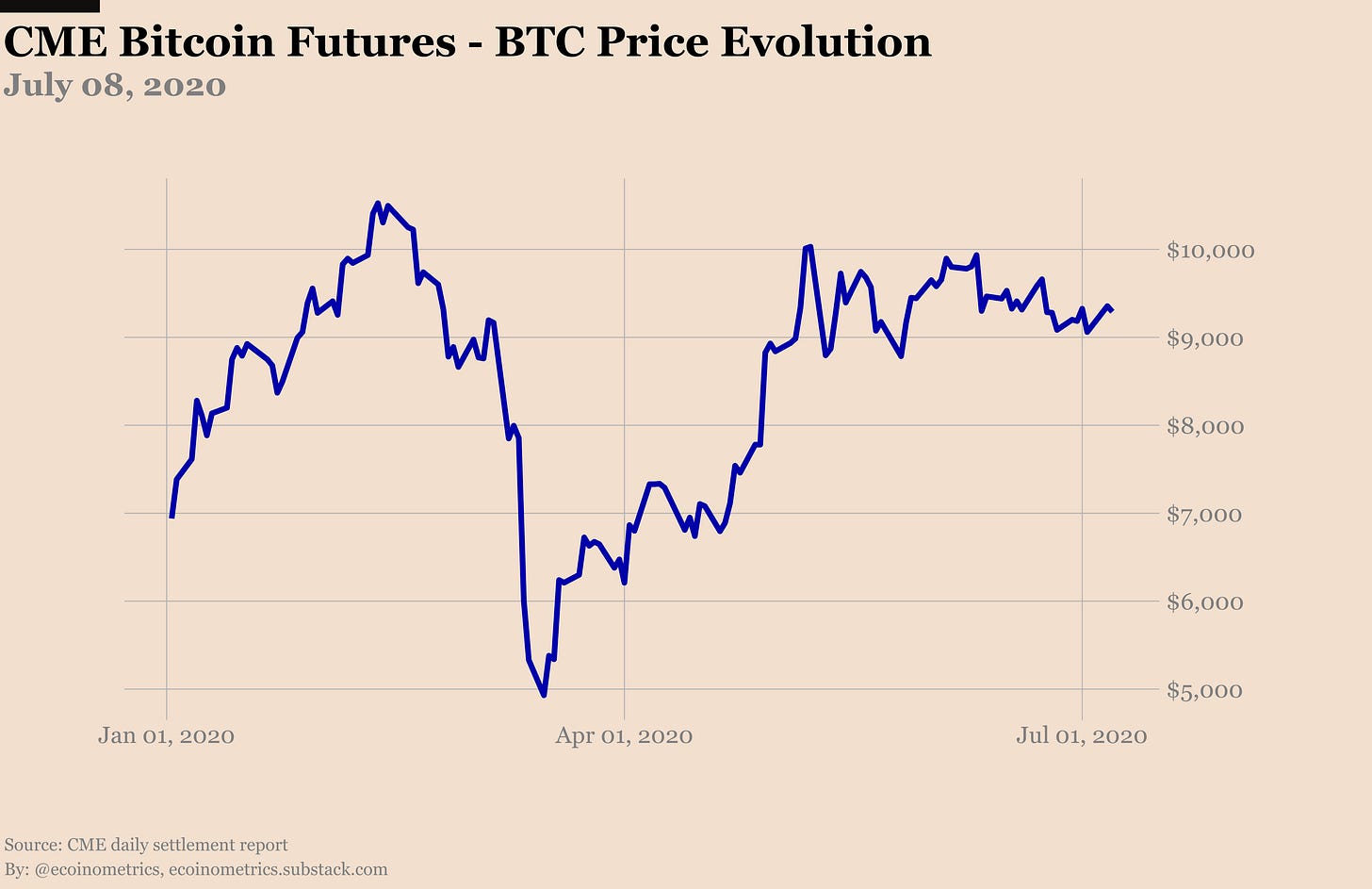

Of course you can’t compare the 2017 cycle to what we are seeing right now. But still. We just had a major crash followed by a 100% recovery and now some sideways trading. So maybe we can do some traders sentiment analysis to see where we are at.

We could do that by looking at the price action. But it is always hard to get a full story only from that.

Instead let’s look at how traders are positioned on the CME Bitcoin derivatives market.

If you try to breakdown the evolution of open interests on the CME Bitcoin futures you end up with something like this:

After the crash traders were enthusiastic about the price recovery. That translated in the open interests regaining and ultimately beating its all time high.

After that there was a brief period of FOMO, or greed, which pushed the open interests past 50k BTC.

But since then Bitcoin is stuck in the same trading range. Unable to clearly push above $10,000 and well supported around $8,700.

That has led to a slow decline of the open interests which you could label as a capitulation.

Now the question is what’s coming next. Because as I see it there are two ways things could turn out if we don’t get a breakout above $10,000:

Traders are using the sideways price action to accumulate in the $8,700 to $9,000 range.

BTC breaks out to the downside.

The first option would show open interests rising again. Then you’d have to call it an accumulation phase more than a real capitulation.

The second option moves the sentiment straight to despair. In that case who knows what level Bitcoin will re-test. Maybe $7,000. Maybe $6,000…

Regardless I’d see that as an opportunity to buy the dip. Trust me, you never have enough cheap sats in your wallets.

So what scenario are we closer to? Is it accumulation or despair?

The data is lagging by a week, but the Commitment of Traders report is on a path to despair. On top of a downtrend for the open interests we have:

The smart money staying very much net short. Only 500 contracts away from a record net short position.

Retail traders long positions coming back down to earth. From 2500 max net long position, retail is now at 1250 net long contracts.

Less open positions together with the long positions fading away at a high rate is the path to despair.

Now since June 30 (date of the last Commitment of Traders data) it is true that open interests have stabilized. So accumulation is still in the cards.

And actually if we focus on the CME Bitcoin options market, the story it tells isn’t bearish.

Sure the trading activity on the options side has been very low since we rolled into the July contract.

Essentially the appetite for bullish positions is dead. No more large bull call spreads. No buying of far out of the money calls.

But at the same time you don’t see anyone rushing to buy puts either…

That means options traders don’t see much money to be made on the downside. And they are already covered for the upside with 13 calls for every put.

So they are just sitting there waiting for something to happen. And isn’t it what we are all doing at the moment?

My idea is that, regardless of what other traders are up to, you should be doing two things if you are in it for the long run:

You should stack sats regularly (weekly or more).

You should keep some dry powder to buy even more when there is an anomalous dip.

Remember that despite the massive growth of the past few years Bitcoin remains a tiny market with a massive upside.

That means hodling is definitely an asymmetric bet. Don’t miss the opportunity!

The Ecoinometrics newsletter decrypts Bitcoin’s place in the global financial system. If you want to get an edge in understanding the future of finance you only have to do two things:

Click on the subscribe button right below.

Follow Ecoinometrics on Twitter at https://twitter.com/ecoinometrics.

Done? That’s great! Thank you and enjoy.