When I write this report I’m usually sitting at my desk with some iced coffee and a view of the Hong Kong skyline.

Today from my window the sea looks completely flat… like the price action of Bitcoin these past few weeks...

And the reason for that is the market participants don’t have a clue. Let me explain.

The Ecoinometrics newsletter decrypts Bitcoin’s place in the global financial system. If you want to get an edge in understanding the future of finance you only have to do two things:

Click on the subscribe button right below.

Follow Ecoinometrics on Twitter at https://twitter.com/ecoinometrics.

Done? That’s great! Thank you and enjoy.

It is starting to get frustrating isn’t it? You get a massive crash followed by a total recovery and then… then, well nothing.

Roughly since May 01 the range for Bitcoin is $8,500 to $10,500.

But recently this range is getting even more tight as the realized volatility is moving always lower.

If you have any knowledge of the art of technical analysis you will have recognized a (I guess descending) triangle pattern. So we’d expect this is going to get resolved hopefully soonish.

Even if you aren’t a specialist of technical analysis you can think of it purely in terms of volatility.

The argument boils down to something simple. Historically speaking the current volatility is very low. So unless there was a structural change in the market volatility should come back up. And with higher volatility comes a breakout.

What do you think? I don’t see any structural change. So that sounds reasonable to me.

With the distribution of past returns you can run some simulations of where Bitcoin will be in the next seven days. This isn’t rocket science but it gives an idea of what is expect vs what isn’t.

The low volatility environment means that the most likely scenario is for Bitcoin to stay in the current range. But at seven days the probability that BTC is testing the boundaries of the range is high enough that we could have a breakout.

Who knows in what direction though...

Which brings us to the idea that the market participants don’t have a clue of what will be the next move for Bitcoin.

Let me qualify that.

First when I say market participants I mean the remaining active market participants. Because as you can see on the CME futures activity the daily traded volume is declining significantly.

Second, what do I mean by they don’t have a clue. What I mean is that traders have moved to a much shorter time frame when taking positions.

How short? Well closer and closer to one day…

In normal market conditions you’d expect to see a mix of traders with different time horizons.

Some might trade a very brief price action. Some might jump into a trend expecting to stay in the trade for days, weeks or months. Others have a much longer time horizon and are just happy to establish positions and hold on to them.

What that means is that in normal conditions the daily change in open interests should have a relatively low correlation to the daily change in price.

So let’s take a look!

Reminder:

A correlation close to 0 means that two sets of values are not related.

A correlation close to 1 means that two sets of values tend to move in the same direction.

A correlation close to -1 means that two sets of values tend to move in opposite directions.

I have taken the daily changes in open interest and Bitcoin price on the CME futures and divided those days as before and after May 01.

Result:

Before May 01, BTC and open interests daily change have a low correlation +0.18.

After May 01, this correlation jumps to +0.69 which is starting to get pretty high.

Check out the graph.

As you can see the red dots (after May 01) tend to be much more concentrated around the first diagonal line than the golden dots (before May 01).

That means the daily change in open interests is now pretty strongly correlated to the change in Bitcoin price.

Bitcoin goes up one day, traders are buying.

Bitcoin goes down the next day, traders are liquidating their positions.

This is pretty much weak hand trading 101.

So for now the trading activity on the futures market is very short term oriented. Traders apparently do not have any long term bias.

We’ll see if there is any change when volatility returns.

At the same time, the CME Bitcoin options market looks more like a longer time horizon play. The trading activity remains very low compared to the previous months but the bias is bullish.

There are 12 calls for every 1 put and that is a little surprising to me.

The implied volatility on these options contract has moved lower in the past weeks. So I would have guessed more people bet on a rise in implied volatility or a breakout in any direction with options strategies that involve buying both puts and calls.

But we haven’t seen that.

That might mean two things:

Most traders think the breakout will be on the upside.

Or most traders think it is too early to bet on the return of volatility.

I am not sure which way it is.

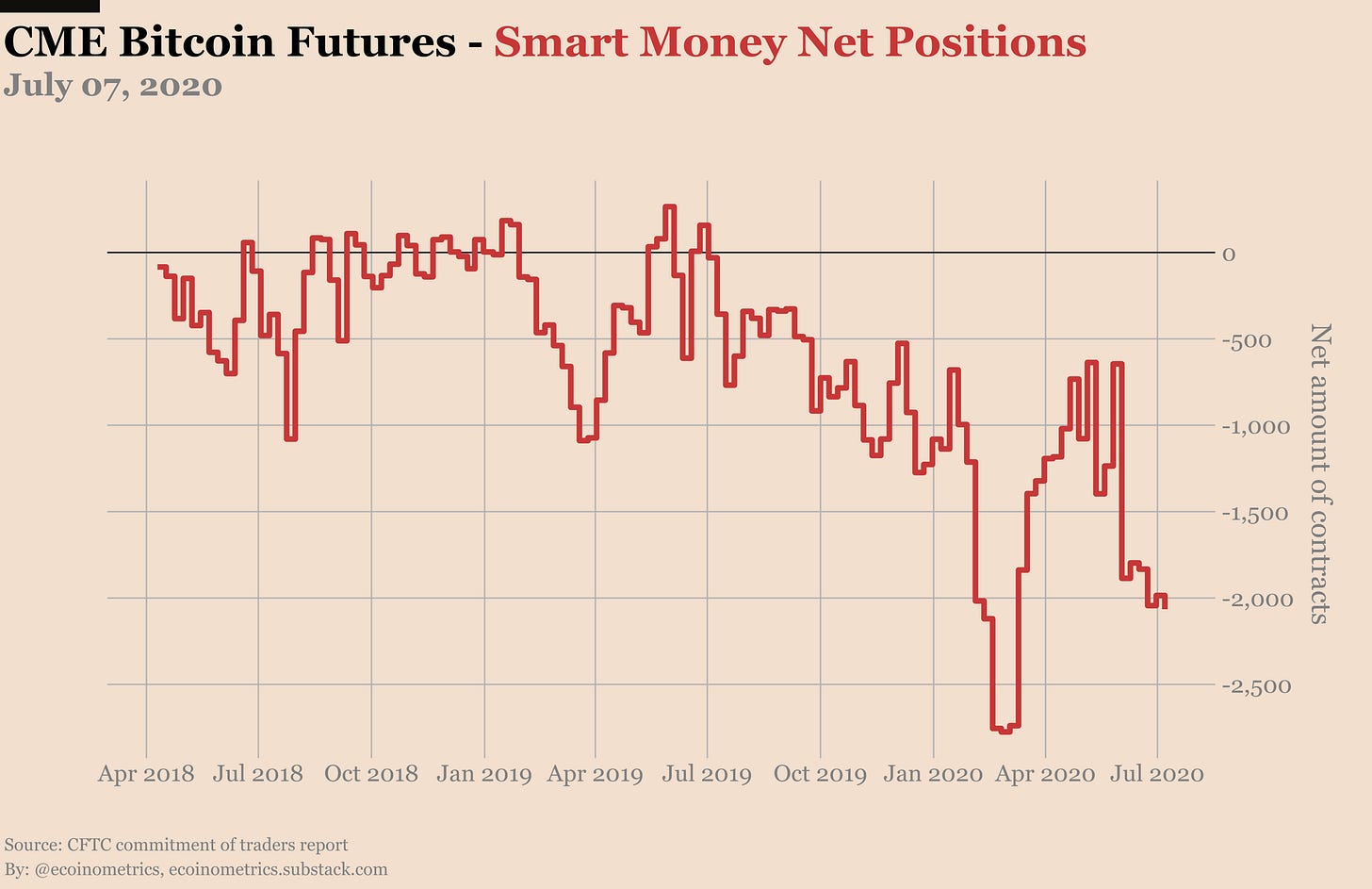

Finally the Commitment of Traders data from July 07 is showing that:

The smart money is net short pretty much the same amount of contracts as last week.

While retail traders are more net long than last week.

But given the short term trading bias of this market we can’t infer much out of that.

So let’s see if we are going to be stuck at $9,200 for one more week or if we are finally going to get some action!

The Ecoinometrics newsletter decrypts Bitcoin’s place in the global financial system. If you want to get an edge in understanding the future of finance you only have to do two things:

Click on the subscribe button right below.

Follow Ecoinometrics on Twitter at https://twitter.com/ecoinometrics.

Done? That’s great! Thank you and enjoy.