As I’m writing these lines Bitcoin is pumping and that’s great. But today let’s take a step back and look at the big picture.

The Ecoinometrics newsletter decrypts Bitcoin’s place in the global financial system. If you want to get an edge in understanding the future of finance you only have to do two things:

Click on the subscribe button right below.

Follow Ecoinometrics on Twitter at https://twitter.com/ecoinometrics.

Done? That’s great! Thank you and enjoy.

After the halving

There is a lot going on with Bitcoin these days. There was a dump. There was a pump. Volatility went crashing down. BTC became correlated to the SP500... and now we have another attempt at breaking out above $10,000.

So let’s take a deep breath and zoom out. Think about a bigger timeframe. Think about halving cycles.

When I think about what Bitcoin has in store for this third halving cycle I have two main questions related to the price:

Are we going to repeat the exponential growth pattern of the previous two cycles?

As the market cap of Bitcoin is growing, are we going to see volatility decline?

Check out what happened after the first and the second halving (graph below). Every time, within two years Bitcoin moved to an exponential growth phase.

For the first halving it happened really fast. Then we got a plateau followed by another leg of exponential growth. And that was it until the second halving.

For the second halving the pace was a bit different. Things started with a dip and it took a little longer for the exponential growth to get going.

This time seems to be in the middle of the road. The third halving occurred while Bitcoin was in a recovery phase from the lows of March. So there was no dip to start the cycle. But the takeoff hasn’t started either.

There is no rush though. BTC is still “on schedule”.

When it comes to volatility, we do not have enough data points to say anything about this new cycle.

But the trend between the first and the second halving periods seems to be a marginal reduction of the volatility.

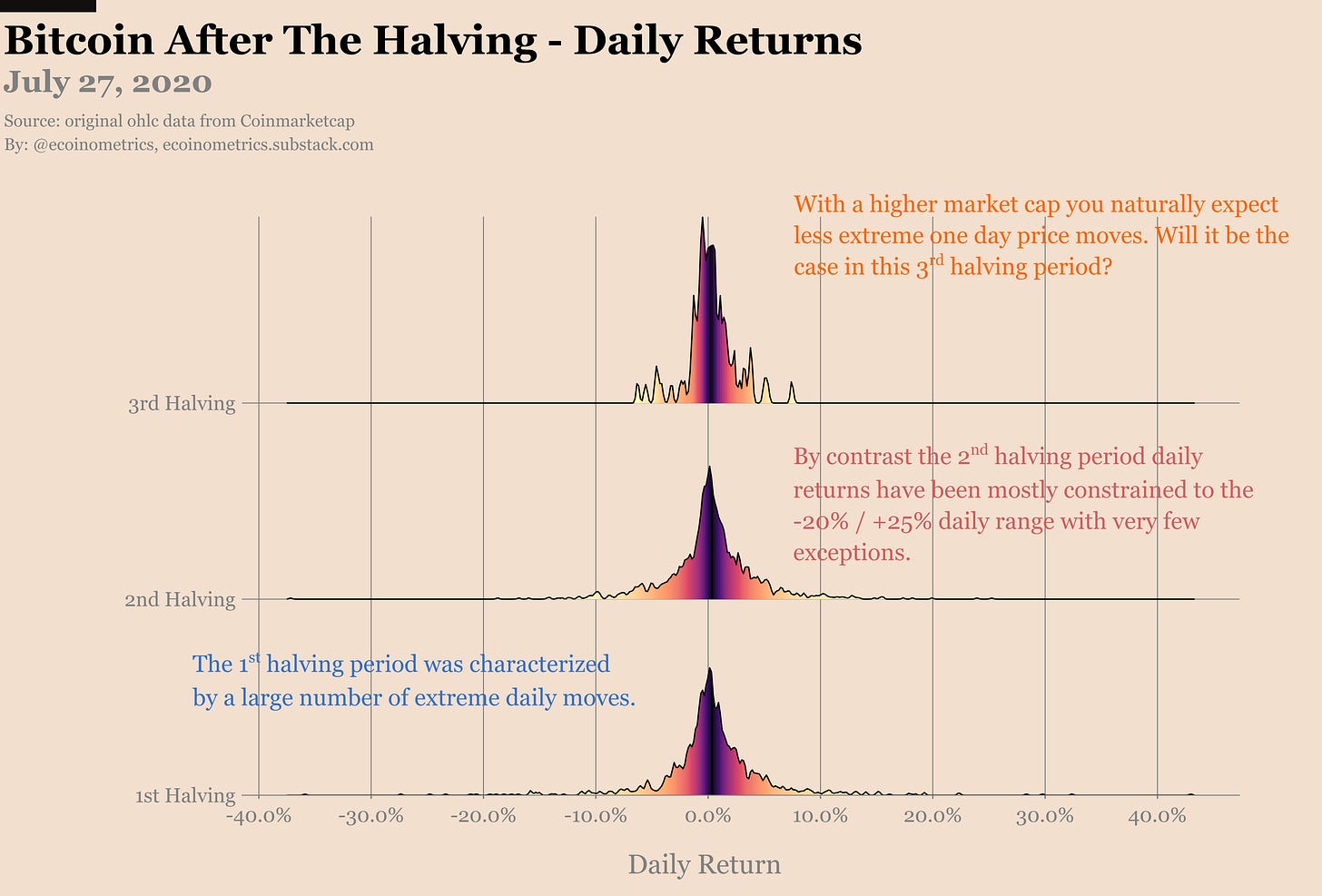

The distribution of daily returns is showing less extreme moves (all those little bumps to the left and right of the main distribution on the graph).

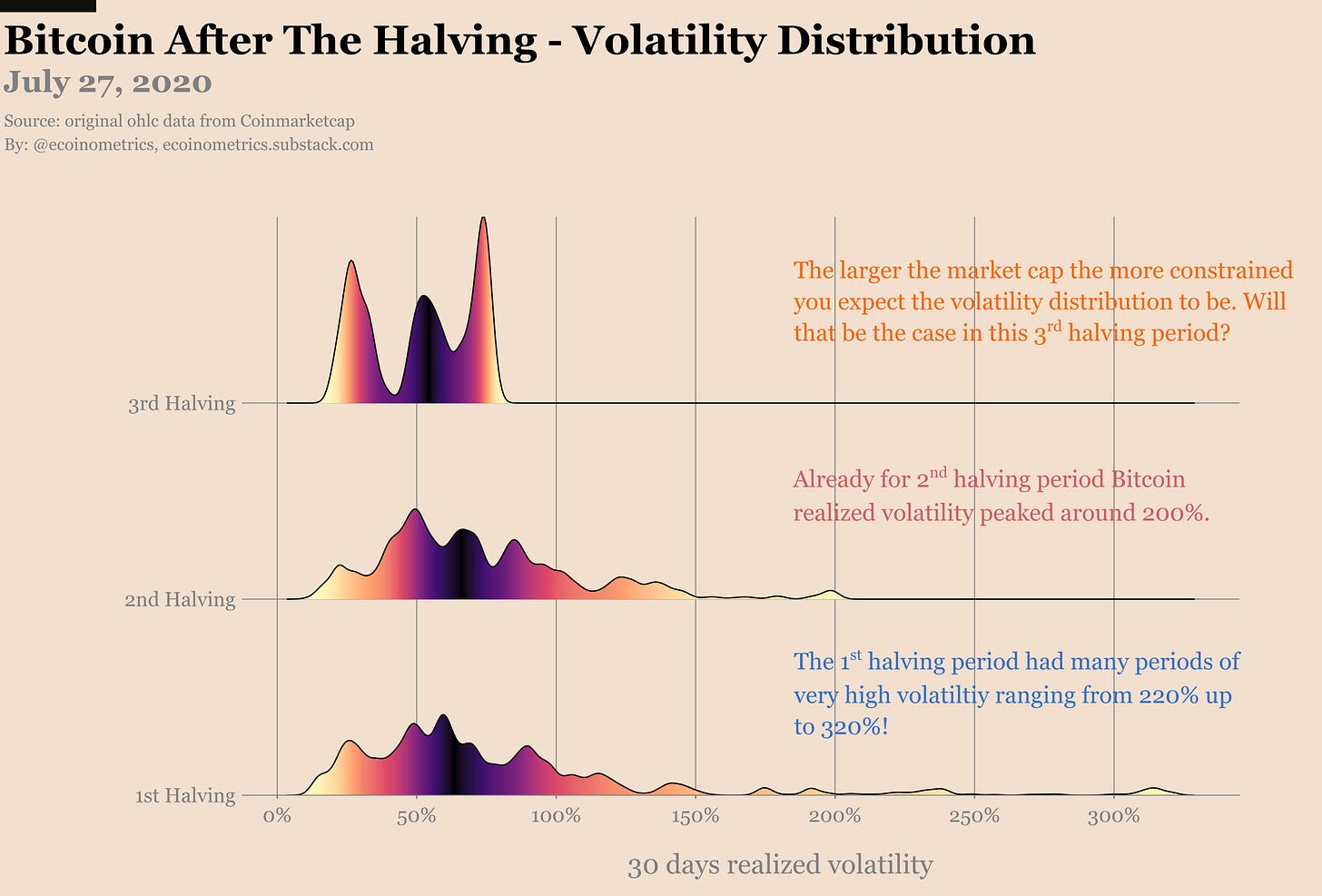

Same idea when you look at the 30 days realized volatility distribution. The average realized volatility is in the 65% to 70% range after both the first and the second halving. But the extreme periods are much less frequent for the second halving cycle.

At the moment Bitcoin’s realized volatility remains on the low side but a breakout might change that.

There will be some point at which the Bitcoin market cap is big enough to contain volatility in a tighter range. But that’s probably way down the road.

I used to have a vision of how the next bull run would play out. It was something like that:

From $10,000 to just below $20,000 the move would be driven by institutional money. Mostly hedge funds who missed on the pre-2017 opportunity and don’t want to miss the next wave.

Starting below $20,000 we’d see more media coverage such as “BTC breaking all time high...” and so on. That would drive FOMO from a wider base of investors and things would start to really take off.

I still think this is a likely scenario. But now that you see silver, gold and the likes being pumped by Robinhood traders I’m wondering if FOMO could come earlier than I expected.

When the US is giving out the next round of stimulus cheques maybe a good portion of it will go to Bitcoin. Honestly that’s the best use for it. Take the money and opt out of the system.

Headaches

Maybe you are wondering why there aren’t more institutional investors betting on Bitcoin. You might be thinking that they are just idiots for missing out on the action. But things are often more complicated than they look.

I have some experience on the professional investment side of things. I was never a banker, lawyer or fund manager. My stuff was always quantitative trading, technology and research. But still I got exposed to the complexities of dealing with compliance.

Believe it or not but in big institutions there are people ready to bet on Bitcoin. But the big hurdle often lies with compliance.

This is why hedge funds are often the first to act. Smaller chain of command, less regulatory burdens, etc…

If you don’t trust me just I suggest you read the Finopsinfo article linked below about prime brokerage and the crypto markets. After that I guarantee you will understand what kind of headaches institutions have to deal with...

Banking on Bitcoin

In the US, banks can now act as custodians for crypto assets. Big deal. I mean not really, but kinda.

Let me clarify.

The whole point of Bitcoin is that you can be your own bank. So as an individual I’m not going to rush and give custody of my coins to any bank. That would defeat the purpose.

But some institutions might do so. That means Bitcoin is getting more integrated with the legacy financial system. The more that happens, the less likely it is we’ll see any sort of ban on crypto assets being rolled out by governments.

This is good for Bitcoin.

MMT

Let’s face it, we might not get it this year but Modern Monetary Theory is going to fall upon us.

Might be UBI. Might be even more reckless fiscal policy. Might be debasement of money into oblivion.

So I’ve decided to sacrifice myself in order for you to get a glimpse of the future. I am going to read Stephanie Kelton’s book The Deficit Myth.

In case you don’t know, Stephanie Kelton is the High Priestess of MMT.

I’ll share with you my book review when I’m done with it.

The Ecoinometrics newsletter decrypts Bitcoin’s place in the global financial system. If you want to get an edge in understanding the future of finance you only have to do two things:

Click on the subscribe button right below.

Follow Ecoinometrics on Twitter at https://twitter.com/ecoinometrics.

Done? That’s great! Thank you and enjoy.