No doubt institutional investors are taking Bitcoin seriously. But that means the market dynamics is likely to change moving forward.

So we better start to think about that now...

The Ecoinometrics newsletter decrypts Bitcoin’s place in the global financial system. If you want to get an edge in understanding the future of finance you only have to do two things:

Click on the subscribe button right below.

Done? That’s great! Now let’s dive in.

Changing market dynamics

There is something different about this Bitcoin bull market.

Actually come to think of it there are many new things when you compare to the environment of 2013 and 2017.

First of all this post-halving growth phase happens to coincide with a new round of quantitative easing following the pandemic. Talk about a tailwind…

Second, institutional investors are there. How many times since 2017 have you heard that institutional investors are coming for Bitcoin?

Well this time there is no ambiguity. If you want only one data point to confirm they are here, you just have to look at the growing list of companies holding Bitcoin on their balance sheet.

And of course you can feel that the zeitgeist has changed. The amount of smart money dismissing the “Bitcoin as digital gold” narrative is getting thinner by the day.

Most people are celebrating this transition. Bitcoin is spreading all over the global financial system. The more spread out it is the harder it will be to outright ban BTC and the longer it will stick around.

So I think we can all agree institutional investors are going to hold Bitcoins at an increasing rate.

But what that means is that we are slowly going to witness a change in market dynamics.

Indeed who owns Bitcoin and why do they own it is what’s driving the market once you look past the scarcity constraint.

Thinking about this market dynamics is important to interpret short term price movements and longer term trends. So let’s give it a try.

There are a bunch of moving parts so bear with me.

The first thing to understand is that at this point in the history of Bitcoin there is one main driving force: adoption.

When you combine a growing market with algorithmically driven scarcity cycles you get the post-halving exponential growth phases. There is nothing magical about that. Growing adoption means more demand. Halving means less supply. You put the two together and the numbers go up.

The forcing mechanism of adoption is likely to continue at the same pace until Bitcoin reaches its “natural” size. In my opinion this natural size is more or less the size of the physical gold market as it is today.

Why? Because right now Bitcoin is two things:

An asymmetric bet on adoption.

A store of value from a technical perspective.

My guess is that when digital gold completely displaces physical gold the perception as an asymmetric bet will change and Bitcoin will transition to a pure store of value play.

But we aren't there yet.

Alright, so adoption is the main driving force. But within that movement the kind of trajectory we’ll get depends on who the players are:

Some players are sucking liquidity out of the market. They are the long term hodlers who don’t plan on selling their coins.

Some players are all in on the asymmetric bet. They will cash out when they think Bitcoin no longer has more upside than any other investment opportunity available.

Some players are investing in Bitcoin as a new asset. They run a portfolio which may have stocks, bonds, commodities and whatever. Now that Bitcoin is a big enough market they are allocating some portion of this portfolio to it.

I’d bet that most of the institutional money falls into the third category. For them Bitcoin is nothing special. It is just another asset that fits in their classical store of value framework with the added bonus that if you get in early you‘ll also get a boost from the adoption curve.

The more institutional money we get in the market, the more short term and middle term dynamics will be shaped by their behaviour.

I think one of the big changes we might witness has to do with the bond market.

The closer Bitcoin gets to replacing gold the more it will develop a relationship to the bonds market and more specifically to the real yield. That’s a consequence of the digital gold framework.

But it seems that we are not there yet.

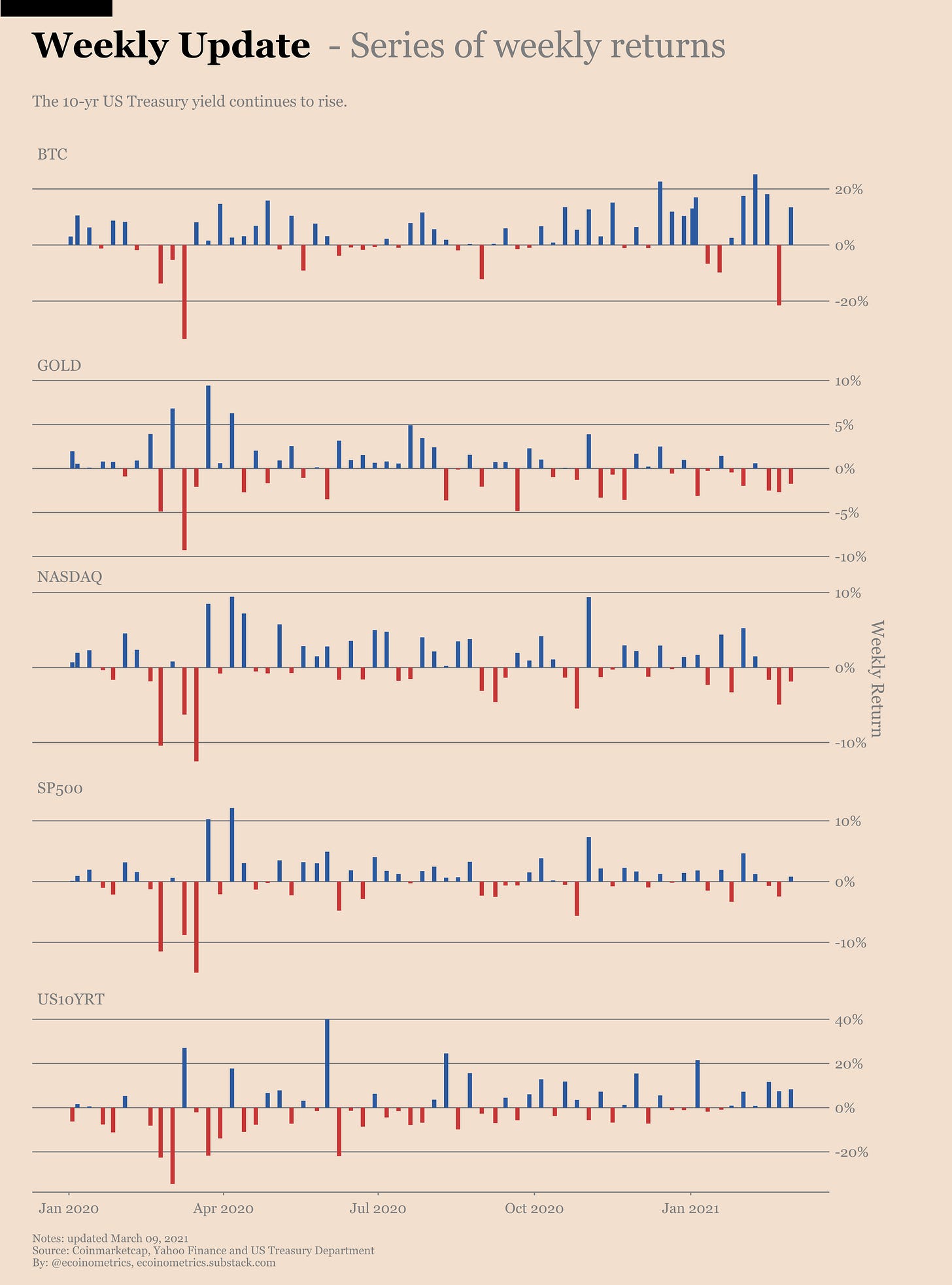

If you look at the weekly returns, gold and Bitcoin still have very different patterns. Obviously BTC has been on the upside while gold is struggling.

That’s not the interesting observation though.

No, the interesting observation is to see how gold and Bitcoin differ in their relationship to the US Treasury yield.

Check it out:

Gold is pretty much defined by its negative correlation to the US 10-year yield.

Meanwhile Bitcoin is firmly in the uncorrelated range during both bull and bear markets.

The day we’ll start to see Bitcoin being correlated to the US 10-year the same way gold is, you'll know that it is traded mostly by institutional investors.

But we are not there yet.

It is still time to play the asymmetric bet.

CME Bitcoin Derivatives

There is definitely something going on at the CME. Just take a look at the numbers coming out of the latest Commitment of Traders report.

The retail traders are puking their long positions. They are now down 1,000 contracts in two weeks. That’s not what I would call diamond hands...

Meanwhile the smart money is deleveraging both on the long side and on the basis trade side.

It’s hard to say if this is because the basis trade is not as juicy anymore. After all hedge funds are still net short 20,000 BTC so it cannot be that bad.

We’ll have to see where this goes if we start a new leg up in the bull market.

So yes, no big surprise, the open interest is stuck around 40,000 BTC worth of contracts and the traded volume is nothing to brag about.

The CME Bitcoin options market is also very quiet but that isn’t very surprising:

When BTC is moving +10% to +20% a week it isn’t really worth selling calls in order to generate yield. So the market is limited on that side.

While we have seen a slow rise in the number of puts it looks like there aren’t many people to buy protective puts in this bull market either.

The result is that we have some puts at $40k but everything else is small action far out of the money.

Let’s see how that plays out.

That’s it for today. If you have learned something please subscribe and share to help the newsletter grow.

Cheers,

Nick

The Ecoinometrics newsletter decrypts Bitcoin’s place in the global financial system. If you want to get an edge in understanding the future of finance you only have to do two things:

Click on the subscribe button right below.

Done? That’s great!