Full disclosure, I'm not an economist.

So when I see professors and chief economists debate philosophical questions such as “what's the intrinsic value of Bitcoin” I'm often left a bit cold inside.

But regardless of my feelings this is a common topic. So let's give it a try.

The Ecoinometrics newsletter decrypts Bitcoin’s place in the global financial system. If you want to get an edge in understanding the future of finance you only have to do two things:

Click on the subscribe button right below.

Done? That’s great!

Now let’s dive in.

Intrinsic value

It all starts with a tweet and a follow up article on Bloomberg:

Note that both FUNDAMENTAL and ZERO are in all caps so that's a pretty convincing argument I guess...

Joking aside, there seem to be two values:

- The market value which is the amount of US$ people are paying for Bitcoin right now.

- The fundamental value or intrinsic value which is another amount of US$ representing what Bitcoin is really worth.

Honestly I find the concept of intrinsic value hard to wrap my head around. According to Investopedia:

"Intrinsic value is a measure of what an asset is worth. This measure is arrived at by means of an objective calculation or complex financial model, rather than using the currently trading market price of that asset."

Ok, so to get the intrinsic value you need to run some "objective" calculation or apply some model. But who decides if a calculation is objective or not? It kinda seems like the idea of "objective" calculation is a bit subjective isn't it.

Steve Hanke's objective calculation is giving you a fundamental value of ZERO for Bitcoin (now and forever apparently). Meanwhile PlanB's stock-to-flow model is giving you a fundamental value of Bitcoin equal to $288k during this halving cycle.

Who is correct? Does asking the question even make sense?

You get my point right?

Some economists would have you think that their fundamental value calculations are like the laws of general relativity for gravity. But economics is not physics. The economy is a complex system with built in reflexive loops and chaotic tendencies.

There is no absolute truth in the discipline. There is no such thing as intrinsic value.

There is one value that you can observe at any point in time. That’s the market value.

You can make assumptions, models or study what constraints are weighing on this market value. That will give you a range of possible futures to which you can assign rough probabilities.

Steve Hanke’s view is that the Bitcoin network is useless and as a consequence nobody will use it for anything. Running this analysis he concludes that Bitcoin should be worthless.

PlanB’s view is that scarcity as measured by the stock-to-flow ratio is a major driver of the value of Bitcoin. Applying this view in a model he concludes that during the third halving cycle Bitcoin should be worth something like $288k.

You are free to examine those approaches for yourself to understand the reasoning and flaws of each “calculation”.

But giving the impression that there is one correct objective value is misleading and honestly not very useful.

I personally think that you’d get more out of your experience of the world by thinking in terms of likelihoods instead of certainties, but hey, that’s my subjective opinion.

Getting closer

Let’s transition from philosophy to actual data.

The bull market continues. This weekend Bitcoin managed to climb above $60k. I guess that’s some kind of milestone if you think of it in comparison to gold.

At $60k, the market cap of Bitcoin is now 10% of the market size of physical gold. Another 10x to flip the shiny rock is still a long way to go but this is heading in the right direction.

The main target for this cycle remains Apple. When Bitcoin manages to flip the largest stock in town it will become complicated for any serious investor to just dismiss it as a niche asset.

And once Bitcoin transitions to a fully fledged store of value it will be time to look for the next stop which is Bitcoin displacing gold.

But one thing at a time.

Macro update

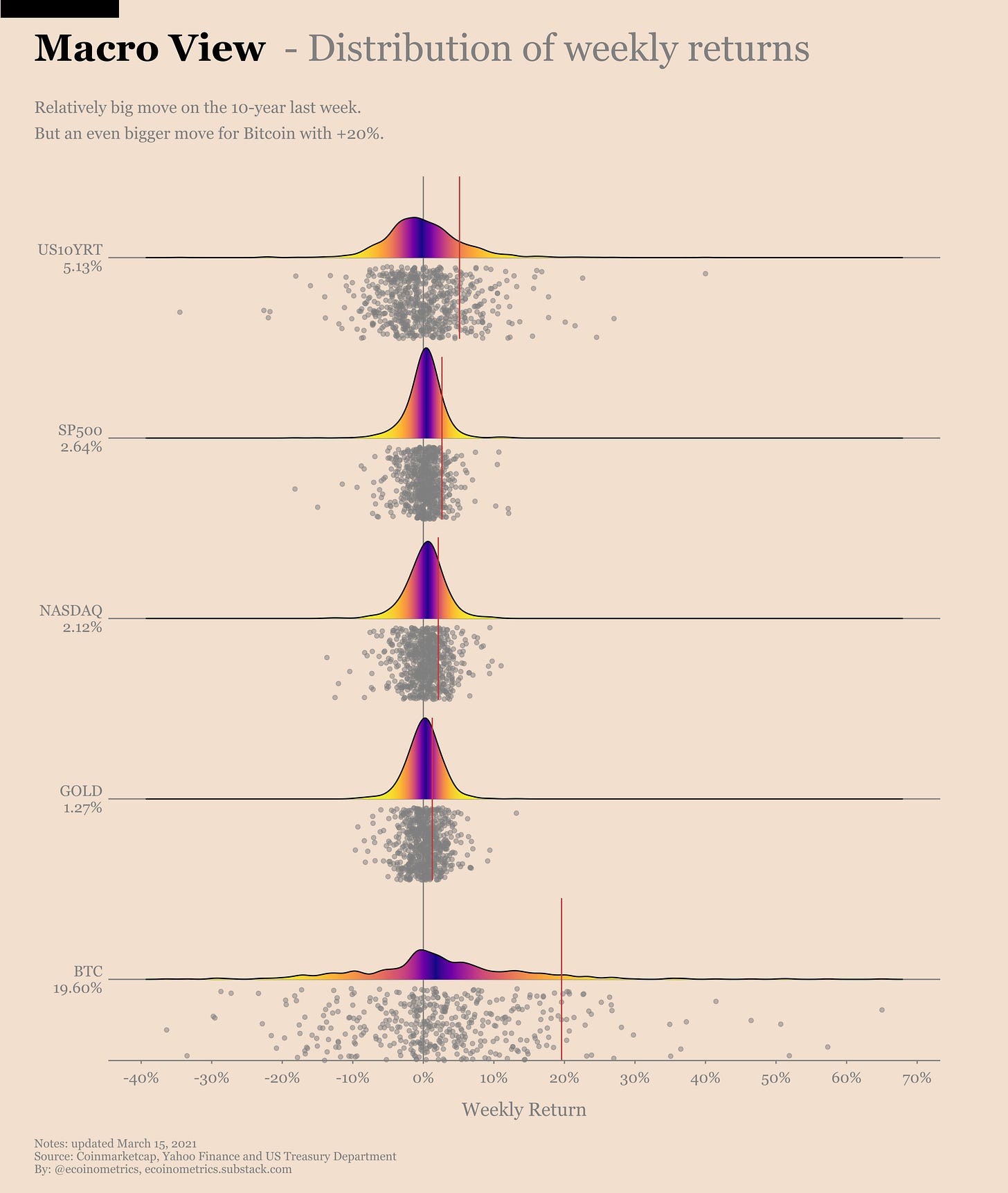

Everything was up last week. Even gold... and that despite the 10-year yield climbing always higher:

Bitcoin is up +19.6%

The US 10-year yield is up +5.13%

Gold is up +1.27%

The SP500 is up +2.64%

+20% in one week is pretty large for Bitcoin but that’s what you expect during a bull market.

So the main story remains that the yield curve is getting steeper but Bitcoin doesn’t care.

The back end of the yield curve is now at pre-pandemic levels but so far the Fed isn’t doing anything about it.

That’s not very surprising. The Federal Reserve is reactive not proactive. If it becomes clear that higher rates are tanking the stock market or the broader economy they’ll implement some policies to cap interest rates along the curve.

But we aren’t there yet.

Overall it feels like a “heads I win, tails you lose” situation for Bitcoin:

Bitcoin is not directly correlated to the 10-year yield. Continued adoption by institutional players is the main driver for now. So rising interest rates are not an issue at the moment.

At the same time if the Federal Reserve had to implement some form of yield curve control you can imagine that it would help the Bitcoin as a store of value / hedge against inflation narrative.

So, bar a market crash triggering a liquidity crisis similar to what happened a year ago, there is no major obstacle in the macro environment to a continuation of the bull market.

Let’s see how that plays out.

That’s it for today. If you have learned something please subscribe and share to help the newsletter grow.

Cheers,

Nick

The Ecoinometrics newsletter decrypts Bitcoin’s place in the global financial system. If you want to get an edge in understanding the future of finance you only have to do two things:

Click on the subscribe button right below.

Done? That’s great!