Not everybody is convinced that the world is heading towards inflation.

Some say it won’t happen at all. Some say it might happen but will be very brief. Many think that central banks have what it takes to keep it under control.

Today I’m not going to discuss whether or not we’ll get it.

Instead I want to show you why you better be hedged, just in case...

The Ecoinometrics newsletter decrypts Bitcoin’s place in the global financial system. If you want to get an edge in understanding the future of finance you only have to do two things:

Click on the subscribe button right below.

Done? That’s great! Now let’s dive in.

Inflation, you better be hedged

To clarify I’m talking about CPI inflation. Asset price inflation is a whole different story.

Take a basket of goods and track the evolution of the price of this basket on a year-over-year basis. The result is the CPI inflation rate that is supposed to capture the change in cost of living for the average citizen.

It isn’t a perfect measure, or even a good measure at all, but it is the number of reference for monetary authorities around the world.

Typically the inflation rate is positive. Every year the cost of life is getting more expensive.

Another way of looking at this is to say that the purchasing power of your cash savings is getting smaller and smaller every year.

That’s probably the way you want to think about it since it informs what kind of returns you need to make on your savings to preserve your lifestyle over a given time horizon.

You might know this saying attributed to Einstein:

“Compound interest is the most powerful force in the universe.”

This comes from the idea that compounding is an exponential process. So done long enough it produces large returns even if the compounding rate is modest.

Well this applies to inflation too… but in a negative way for you.

Say you start with $100k in cash and the inflation rate is a constant 5% per year. After 1 year your $100,000 in cash has lost 5% of its purchasing power. So it is equivalent to $95,000. Lets continue to play this game:

After 1 year $100,000 becomes $95,000.

After 1 more year $95,000 becomes $90,250.

After 1 more year $90,250 becomes $85,738.

After 1 more year $85,738 becomes $81,451.

After 1 more year $81,451 becomes $77,378.

After 1 more year $77,378 becomes $73,510.

And so on...

Few… after just 6 years with a 5% inflation rate the purchasing power of your savings has already been trimmed by a quarter.

So 5% doesn’t seem much, but compounded over a few years it can melt your savings in less than a generation.

This is why you can’t ignore the risk of sustained, even mild, inflation for the long term strength of your purchasing power.

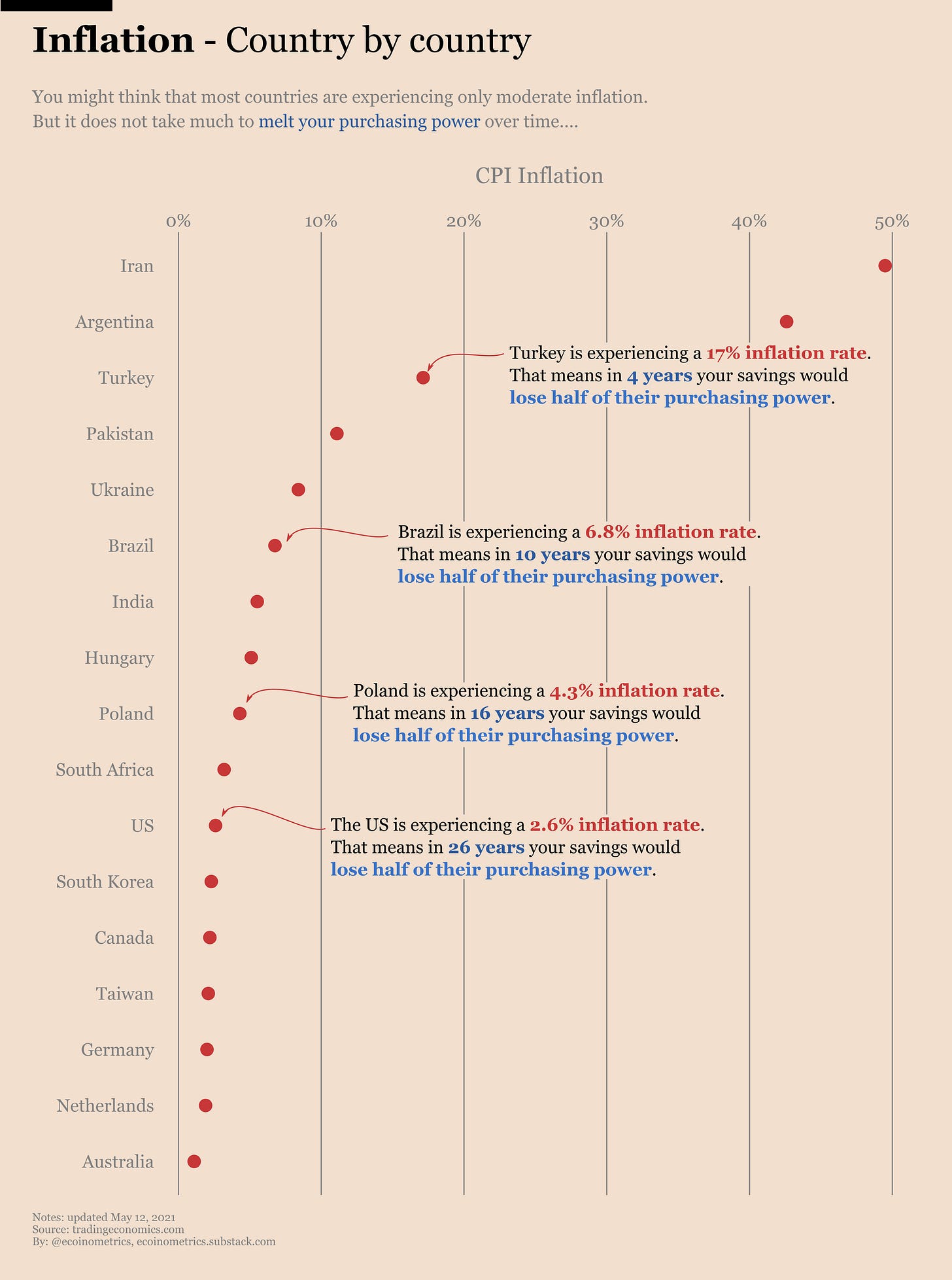

If you want to know how that feels ask the people in Brazil or Turkey what they think about inflation:

With the current inflation rate of 6.8% in Brazil you would lose half of your purchasing power in 10 years.

With the 17% inflation rate in Turkey right now you would lose half of your purchasing power in just 4 years.

Check it out.

At this point you are probably thinking something like:

“Sure that could happen in Turkey but the US$ is a global reserve currency, so saving in US$ is fine right?”

Sure, in the past decade the inflation rate in the US has averaged below 2%. But it hasn’t always been the case.

The last time the world went through a change of monetary regime was the end of the gold standard. And you can see what kind of effect this had on inflation in the US during the 70s.

Over that decade the inflation rate averaged at 8%. With an inflation rate of 8% it only takes 8 years for your cash to lose half of its purchasing power.

Actually we can go back in time and do a little thought experiment. Imagine you are on January 1st 1970 and you get $100k in cash.

From 1971 to 1981 you will check the year-on-year inflation rate to estimate what your $100k from 1970 are now worth.

Here is the result.

On January 1st 1981, after a decade of inflation, your $100k of 1970 are only worth about $40,000...

If you were planning to buy a house or pay university for your kids with those $100k then bad luck for you.

Now back to 2021.

Central banks are printing money like it is going out of style. The COVID pandemic might have durably disrupted the global supply chain which means that commodities and everything else is at risk of getting permanently more expensive.

In the longer term countries such as China and Russia (among others) would be happy to see the US$ displaced as a global reserve currency. So while nothing is certain there are reasons to be worried about another change of monetary regime that could look like a repeat of the 70s.

If anything like that happens you will want to be hedged against inflation or risk losing a big chunk of your savings in a short time.

To protect from that, betting on Bitcoin isn’t a bad idea. From a technological point of view Bitcoin already has the characteristics of a good store of value. And even if we don’t see any sustained inflation Bitcoin should perform well given that it is still in its adoption phase.

Heads I win, tails you lose.

Time to hedge your bets.

That’s it for today. If you have learned something please subscribe and share to help the newsletter grow.

Cheers,

Nick

The Ecoinometrics newsletter decrypts Bitcoin’s place in the global financial system. If you want to get an edge in understanding the future of finance you only have to do two things:

Click on the subscribe button right below.

Done? That’s great!

Well, I'm from Brazil and I can tell you this inflation rates sucks real bad, it's even worse because regular and poor people don't understand it and so can't protect them from it. I think that is what governments really want, to keep society poor.

Really good piece, thank you!