Ecoinometrics - Meta Narrative

November 08, 2021

When you are investing in macroeconomic trends things can take a long time to play out. That’s why you need a good narrative, to shape the way you think about a bet without being distracted by all the noise.

When it comes to Bitcoin we’ve had a solid narrative for years.

But for Ethereum it feels like things are just starting to shape up. Let’s have a look.

The Ecoinometrics newsletter decrypts the place of Bitcoin and digital assets in the global financial system. If you want to get an edge in understanding the future of finance you only have to do one thing, click on the subscribe button right below:

Done? Thanks! That’s great! Now let’s dive in.

Meta narrative

If you have been reading this newsletter for a while, you know that once a month we look at our Ethereum vs Bitcoin comparison.

Overall my view hasn’t changed on the fact that the two networks are not in competition with each other. The tl;dr is that:

Bitcoin is a store of value. Bitcoin is hard money. Bitcoin is a pristine collateral.

Ethereum is the platform that powers decentralized applications.

But the thing is “Bitcoin is digital gold” is a much clearer narrative than “Ether is oil for dapps”.

The Bitcoin narrative is focused, specific and carries all you need to know about the value of BTC in very few words.

By comparison most investors can’t tell you what a decentralized application is, even less what the L1 coin powering them is supposed to be worth.

“So buying ETH allows me to buy this token than I can put in a LP that will generate that much APY in ETH but also give me access to that governance token that will allow me to do…”

A confused investor looking at alt coins for the first time.

Maybe this is a little exaggerated, but you get the point. Valuing ETH is much harder than valuing BTC.

That’s probably one of the big reasons why BTC and ETH have such a high correlation. Since it is hard for the average investor to assign clear different narratives to each of them, they end up in the same bag labelled “cryptocurrencies”.

The result is a trading pattern that sees BTC pump followed by ETH followed by alt coins and so on down the line of market caps until the cycle starts all over again.

No wonder then the correlation score of BTC vs ETH is still above 50%.

So maybe what Ethereum needs in order to really decouple from Bitcoin is a simple enough narrative that would make it clear for everybody how different those two are.

The problem to construct such a narrative is that Ethereum is attached to a lot of things. Is it a platform for tokens? Is it what Decentralized Finance should be running on? Is it the home of NFTs and player owned games?

You see what I mean right? This isn’t as simple as digital gold. It is missing a unifying thread.

But things are changing and the idea that Ethereum could serve as the L1 of the Metaverse is slowly being pushed around. That could be summarized with a narrative like:

“Ethereum: powering the Metaverse.”

Now I’m not entirely sure that “Ethereum: powering the Metaverse” is as strong of a narrative as “Bitcoin is digital gold”, or if it is even totally accurate.

For once most people have no idea what the Metaverse is supposed to be. Actually even the people trying to bring the Metaverse to life have different ideas on how it is supposed to be shaped.

Second, in its current state the Ethereum network isn’t ready to power any kind of Metaverse at scale. Very few people are going to use NFTs for say gaming purposes if interacting with them costs $100 to $200 in gas on average. Which means Ethereum will need mature L2 ecosystems to operate at scale. And it doesn’t have those yet.

When you compare that to the efficacy of Bitcoin as well as the maturity of the Lightning Network you can see that Ethereum as a pretty big gap to close.

But I don’t want to bash Ethereum for what it is trying to do, and “powering the metaverse” has a nice ring to it.

Here I’m just stating that Bitcoin in its current state already fulfils its promise of acting as digital gold. Meanwhile Ethereum’s objective remains aspirational.

Narratives are used for that though: giving a long term focus so that everyone can pull in the same direction.

So let me reiterate what I’ve said before. Ethereum as a separate bet from Bitcoin makes sense. But until a strong narrative gets associated with ETH, those two are likely to continue moving in lockstep. That is, don’t expect to get diversification by holding both in the short term.

Now coming back to the price action:

Bitcoin is up 7.2x this cycle. That’s much below the peak at 29.5x in the previous cycle but still above the bottom multiplier of the previous bear market at 4.9x.

Ethereum is up 24.3x. Also much below the peak at 120x in the previous cycle but above the bottom multiplier at 7.2x in the previous bear market.

See for yourself.

When it comes to their relative price, ETH/BTC is also 50% below the all-time high it managed to set in 2017.

As we said above, a real decoupling isn’t likely in the near future, at least not as long as the average investor doesn’t understand that cryptocurrencies aren’t all the same.

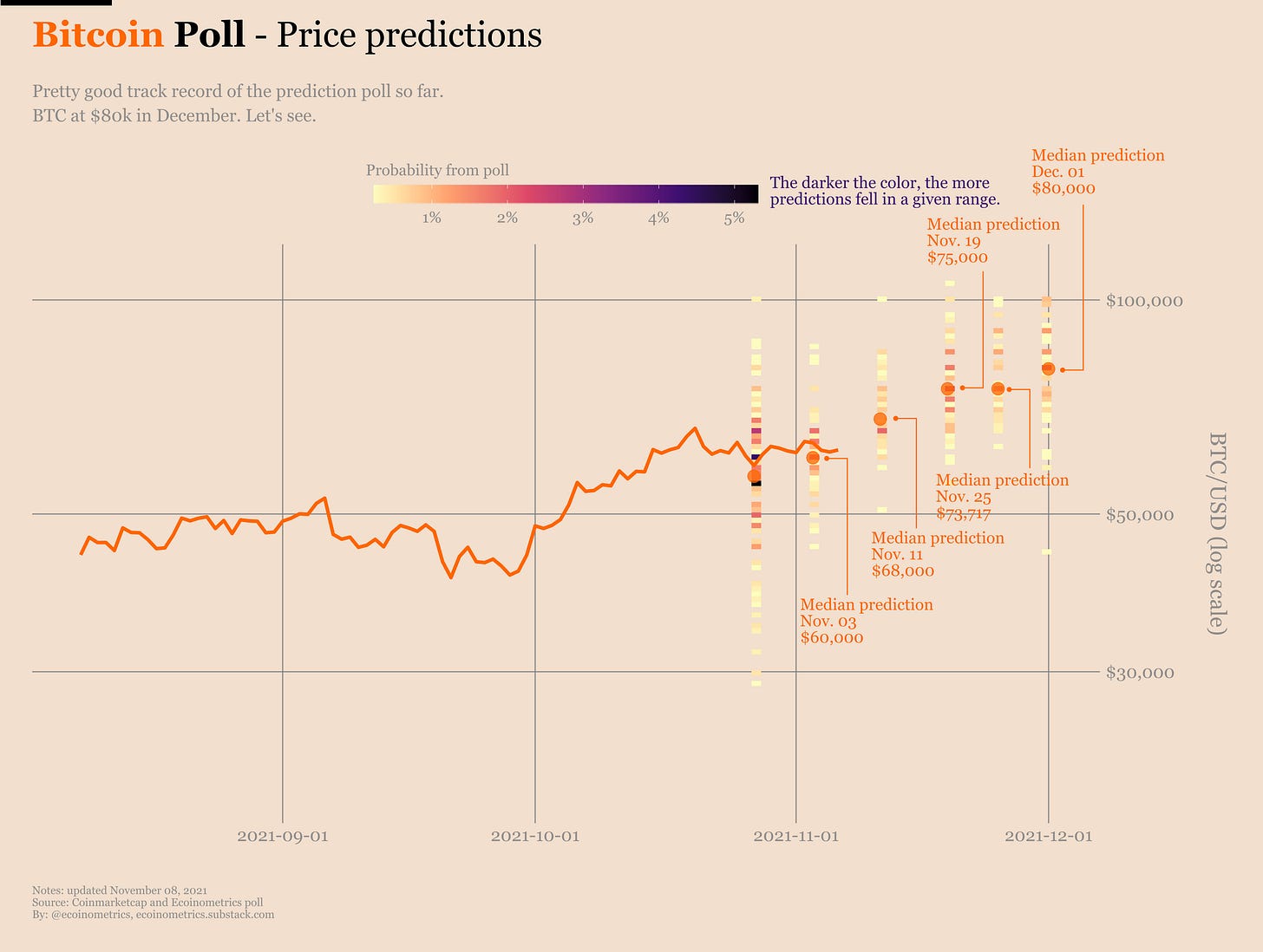

The price prediction poll that we run every week seems to agree with this sentiment:

Bitcoin is seen to rise to a median price of $80,000 on December 1st.

Ethereum is seen to be worth $5,700 on the same date.

So these two continue to be projected as moving in parallel.

But here is the link to the price prediction poll for this week, so let me know what you think:

https://forms.gle/SUdgm2hVvWd2YQdR9

Let’s see how that plays out.

That’s it for today. If you have learned something please subscribe and share to help the newsletter grow.

Cheers,

Nick