The average critics of Bitcoin is pretty weak. It often comes from people who either haven't done their homework or people who have a direct interest in spreading FUD.

But that doesn't mean we should dismiss all criticisms.

So let's take a look at some legit question. If Bitcoin gets too big aren't governments going to simply ban it?

The Ecoinometrics newsletter decrypts Bitcoin’s place in the global financial system. If you want to get an edge in understanding the future of finance you only have to do two things:

Click on the subscribe button right below.

Follow Ecoinometrics on Twitter at https://twitter.com/ecoinometrics.

Done? That’s great! Thank you and enjoy.

Bitcoin vs national currencies

One recurring argument for why Bitcoin could fail is that if it becomes a threat to national currencies it will simply get banned.

But how realistic is that?

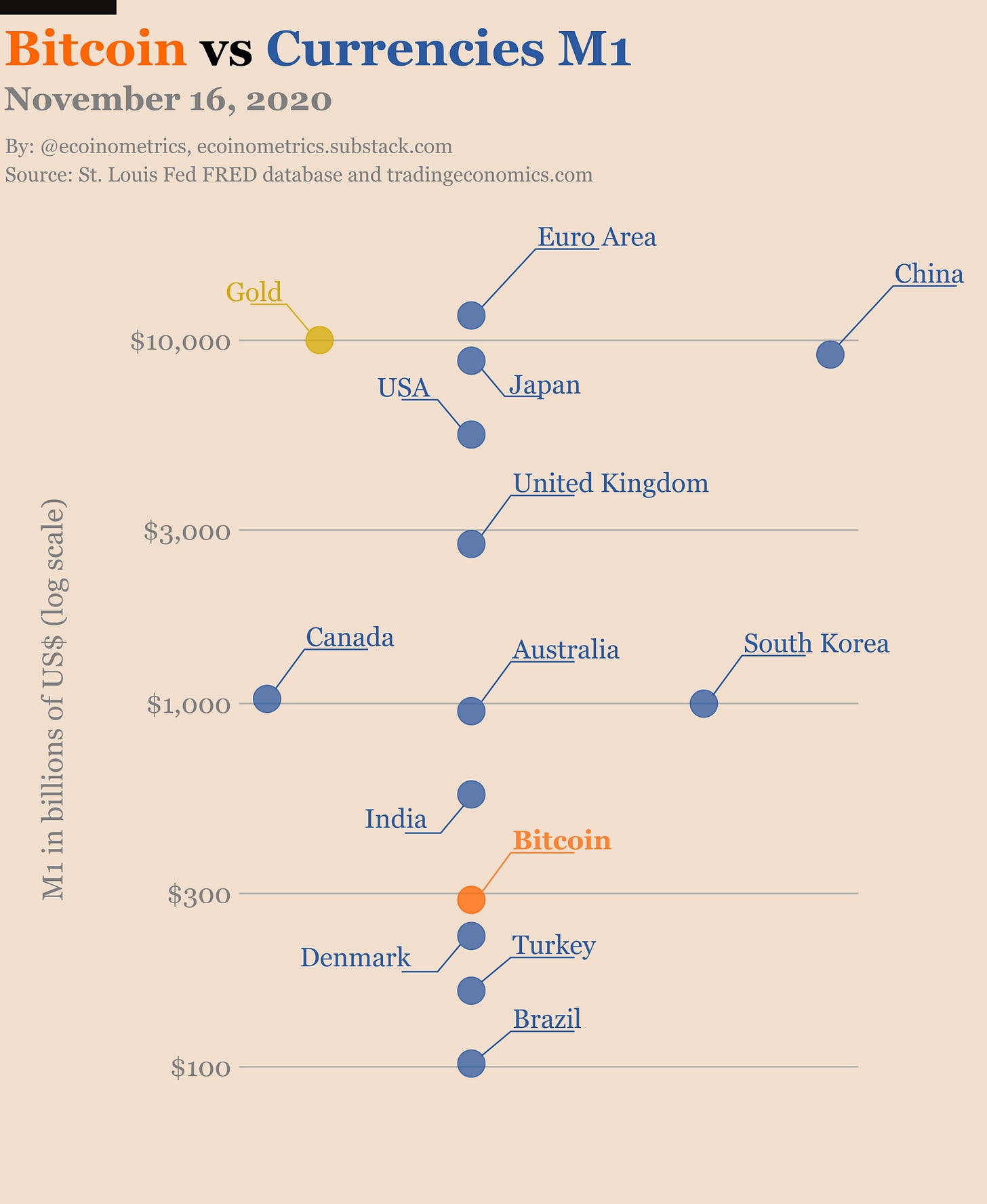

To understand where we stand right now let’s start by looking at how Bitcoin fares against the money supply of various national currencies.

The world of fiat currencies isn’t straightforward. Ask a simple question like ‘how much US$ are in circulation?’ and the answer is probably going to be ‘it depends’.

Central bankers have a few ways of counting. There is money (M1), near money (M2), near near money (M3)… and then there are actually offshore systems like the Eurodollar that make it even harder to keep track of how much money is in circulation.

But let’s keep it simple and focus on M1 for now.

M1 is the narrow definition of money. Basically anything that is physical money or can be immediately redeemed for physical money qualifies.

This M1 money supply can roughly be compared to the Bitcoin supply or the amount of physical gold in the market.

As of today the market cap of Bitcoin is about $300 billion. That’s bigger than the M1 money supply of Brazil, Turkey or Denmark.

But that’s not very large either. It is:

3 times smaller than the M1 money supply of South Korea.

10 times smaller than the M1 money supply of the UK.

30 times smaller than the M1 money supply of China or the Euro Area.

Check it out.

One thing is pretty clear, with its current size Bitcoin doesn't look like a threat for the major global currencies.

But give it one or two halving cycles and its market cap can be expected to reach the market size of physical gold, 30x its current value.

So should we be worried about, say the US banning private ownership of Bitcoin in the next 10 years?

I don't think so. In my mind things are more likely to play out as follows.

The current trend is going towards more integration of Bitcoin inside the global financial system. This will continue for a while.

Think about the evolution since 2017.

There are now regulated derivative markets, custodial services for institutions, banks are allowed to hold digital assets, companies are using Bitcoin as a reserve asset and you can even buy BTC with PayPal...

The longer this goes on the harder it will be to remove Bitcoin from the system.

When Bitcoin reaches the point where it is the size of the gold market central banks might start getting concerned but it will be too late. Too much integration, too much network effect, too many people invested.

Don't get me wrong. I'm not saying central banks and governments will embrace Bitcoin. Something likely to happen is that Central Bank Digital Currencies will be designed to prevent the average citizen to easily exchange them for Bitcoin.

The average man on the street will be affected by that. But high net worth individuals, those already invested or large institutions will always find workarounds. So that's a fight governments cannot win.

Bitcoin is designed to be antifragile at its core and the bigger the network the more resilient it will get.

As Raoul Pal puts it, Bitcoin is the unkillable cockroach of finance, it is there and you won't get rid of it.

Ray Dalio doesn’t get Bitcoin

It feels like Ray Dalio hasn't done his homework on Bitcoin.

When asked recently about his opinion on BTC, he offered a bearish prediction based on the following criticisms:

Bitcoin is too volatile to be considered a store of value.

He can't buy groceries using my Bitcoin.

If Bitcoin gets too big it will get banned by governments.

Raise your hand if you have heard that before.

Yep, I see a lot of hands. There is a lot of rehashing of old tired arguments here.

Coming from the founder of one of the largest hedge funds in the world we could have expected more. But apparently Ray Dalio is not up to date with the current narrative.

So let's go through those criticisms quickly.

Of course Bitcoin is volatile. That's something expected for a small market that is still early in its adoption curve.

And most of it is upside volatility anyway... so not really the one investors tend to complain about.

At the end of the day that means Bitcoin is not only a store of value, it is also an asymmetric bet. In my book that counts as something good.

Which brings us to the next issue.

Why would I want to buy pizza with my asymmetric bet? Since May 22, 2010 people have learned their lesson…

The last argument is more legit and we've discussed it in the previous section. There will be attempts by various governments to fight Bitcoin but over the long run this is a fight they cannot win.

Let's see how long Ray Dalio will take to change his mind. After all he wouldn't be the first to call Bitcoin trash before embracing it.

CBDCs to keep fintech in check

Here is an interesting theory: the People’s Bank of China desperately needs to roll out the digital yuan in order to keep fintech giants and shadow banking in check.

This is becoming apparent after the hastily canceled Ant’s IPO related to the risks it poses to the stability of the Chinese economy. Read the article to get the full picture, but in short the problem is too much leverage.

If you are a regular reader this should not surprise you. We’ve discussed a few times what Central Banks Digital Currencies will mean in terms of control given to the central banks over the economy of a country.

Every citizen having a digital wallet at their central bank gives the latter a very high degree of control over the economy.

But if every business also holds an account directly with their central bank we are simply entering the realm of a soviet style planned economy. We know how well that worked...

When was the last time central planning worked to manage the complex system that is the economy of a country? It probably never did.

Regardless this is where we are going. The People’s Bank of China is certainly the most advanced when it comes to implementing this system.

But make no mistake, this is coming everywhere.

Stanley Druckenmiller is long Bitcoin

Another legendary investor is long Bitcoin.

If you are not familiar with him Stanley Druckenmiller is a macro hedge fund manager with an impressive track record. Among other things he was involved in the trade that broke the Bank of England in the 90s and has run his own multi-billion dollar fund outperforming the market for decades.

In a recent interview Stanley Druckenmiller talked about his bet on Bitcoin. The reasoning behind it is familiar:

The actions of central banks are debasing currencies.

In that environment gold will do well.

Bitcoin will do better.

This is the narrative for Bitcoin in the investment circles. Watch how the idea is spreading around and see the Bitcoin value rise as a result.

That’s it for today. If you have learned something please subscribe and share to help the newsletter grow.

Cheers,

Nick

The Ecoinometrics newsletter decrypts Bitcoin’s place in the global financial system. If you want to get an edge in understanding the future of finance you only have to do two things:

Click on the subscribe button right below.

Follow Ecoinometrics on Twitter at https://twitter.com/ecoinometrics.

Done? That’s great! Thank you and enjoy.