Up until this year very few traditional investors had Bitcoin on their radar. But that’s changing.

JPMorgan, Citigroup and Fidelity are recommend allocating a fraction of your portfolio to Bitcoin.

At the same time billionaire investors like Paul Tudor Jones or Stanley Druckenmiller see it as the next big thing.

And there is one common argument that you hear from all traditional investors: buying Bitcoin now is like buying gold in the 1970s.

But how good is the comparison?

The Ecoinometrics newsletter decrypts Bitcoin’s place in the global financial system. If you want to get an edge in understanding the future of finance you only have to do two things:

Click on the subscribe button right below.

Follow Ecoinometrics on Twitter at https://twitter.com/ecoinometrics.

Done? That’s great! Thank you and enjoy.

Bitcoin vs gold in the 70s

Here are some quotes.

“Bitcoin reminds me of gold when I first got into the business in 1976”

Paul Tudor Jones

So what happened in the 1970s?

It turns out the world’s situation was rather unstable during that decade:

The CPI inflation was high, averaging 7% per year over the period with a few double digits years.

The US$ was weak.

The oil price went from $20 to $120 per barrel.

The geopolitical situation was dominated by the East vs West struggle.

To summarize, the future was unclear and investors couldn’t rely on cash to preserve their wealth.

As a result people turned to gold as a store of value and its price went up 24x from 1970 to 1981.

If you had bought gold in 1970 and kept it for the next 50 years until now, you’d have enjoyed a 55x growth.

Not too bad.

Buying gold in the early 70s as a long term investment was a good call.

Now fast forward to 2020 and think about the current situation:

There is fear of inflation (or at least of major currency debasement) thanks to the actions of the central banks.

The response to the coronavirus is creating a global economic crisis.

Whether it is China vs the US or the internal struggles in the European Union the geopolitical situation is not stable.

If history doesn’t repeat it certainly rhymes.

And while many of the old school investors expect that gold will do well in this environment they cannot ignore the new kid on the block: Bitcoin.

Just take a look at its growth since the 1st halving and you’ll understand why a lot of people want a piece of the action.

More than 1,400x in less than 10 years vs a 55x growth in 50 years… it should be pretty clear who is the fastest horse.

When you put in parallel the growth of Bitcoin since the first halving and the growth of gold in the 70s there is no comparison.

So why is that? How come Bitcoin is growing so much faster than gold even when compared to the 70s?

Several reasons.

Bitcoin is early in its adoption curve. Most people don’t have a clue. Even among investors the institutional interest is barely starting 11 years after its creation.

When you compare that to gold which has been used as a store of value for thousands of years this isn’t a fair fight.

Bitcoin also has a time forcing mechanism. With the halving coming up every 4 years there is a built-in programmatic supply shock guaranteed to make Bitcoin more scarce and thus more valuable as time goes.

That means while the gold price depends mostly on external factors, Bitcoin has an internal driving force pushing its price higher at regular time intervals.

For sure this won’t last forever. At some point the Bitcoin market cap will be so large and the supply shock from the halving so small that we’ll end up having to deal with diminishing returns.

But we are not getting there in the next 10 years.

Right now the market cap of Bitcoin is 3% of the market size of gold. If this halving cycle plays out like a previous ones we should settle at 30% of the market size of gold by 2024.

After that there will still be plenty of room to grow.

So yes buying Bitcoin now is like buying gold in the 70s, except that you can expect a much faster growth of your asset.

The supply shock of the 3rd halving is already starting to produce its effects. Don’t waste time and go stack sats now.

CME Bitcoin Derivatives

I'm a bit puzzled by what is going in the CME Bitcoin derivatives these days.

BTC is really starting to take off following the usual post-halving growth pattern.

Everybody can see that, including the systematic trend following traders.

What you would expect is that those systematic trend following strategies will start building long Bitcoin positions.

And to take advantage of leverage they should be building those positions by using the CME Bitcoin cash settled futures.

Trend following positions are kept open for relatively long periods of time, basically until the trend dies down.

So putting it all together we should see an increase in the open interest as the trend develops.

But we don’t.

Despite a breakout that moved BTC from $14k to $17k in three weeks, the open interest is staying stable and there is no marked increase in daily traded volume.

So why is that?

It could be that investors want to buy actual Bitcoin and not cash settled contracts. That’s reasonable if you are going to be a long term investor.

Hodlers don’t want to have to deal with rolling their future contracts every month while it is very easy to take self-custody of your coins. After all, Bitcoin is made for that.

But that simply isn’t what a systematic trend following fund is doing. They need the futures, they need the leverage.

Why aren’t those systematic trend following funds in the market then?

You have to remember that systematic trend following strategies manage their risk by sizing their positions based on the historical volatility of the asset.

The more volatile the asset, the smaller the position size.

Bitcoin being relatively volatile means that the systematic trend following positions will start small.

So most likely leveraged trend following is starting to get there but for now it is still outnumbered by other kinds of strategies.

How does that theory hold up when we look at the latest Commitment of Traders report?

First, retail traders have closed a lot of their long positions. About 750 contracts. That’s not unexpected: the market pump, traders want to take profit, positions get closed.

But at the same time the smart money added about 750 contracts to their long positions while keeping their short positions steady.

The result is that when you look at the total open interest it seems like nothing has changed. In reality the smart money has added to their long positions.

Okay that’s nice. How do I know if these long positions are systematic trend following?

Well you can’t know for sure at this stage. However the breakdown between asset managers and hedge funds shows that those long positions come from leveraged funds.

So that’s encouraging but we’ll need to continue observing the situation in the weeks to come to get to the bottom of that.

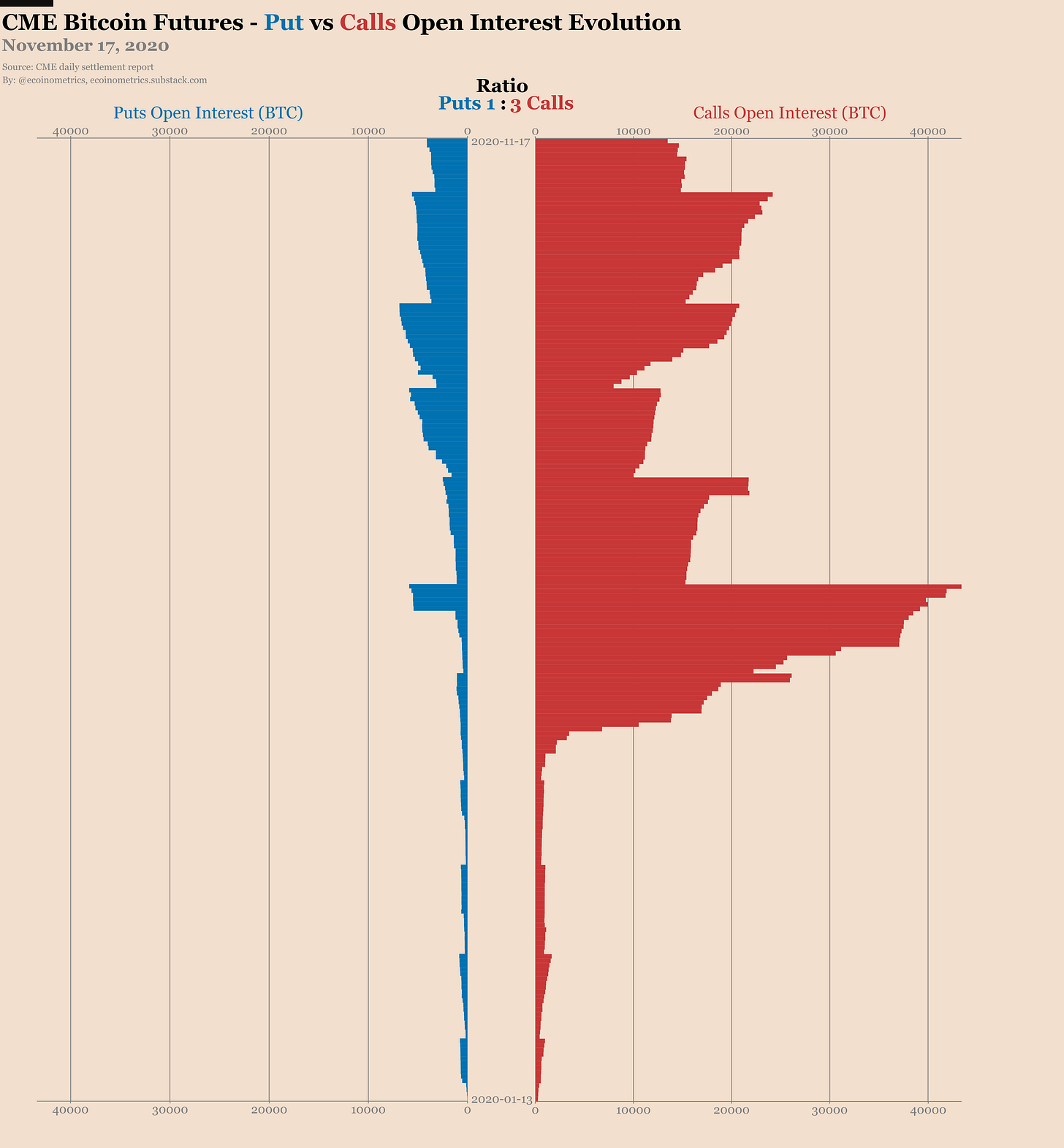

In other news, it is payday on the CME Bitcoin options market.

For months options traders have been placing bull call spreads with the hope of catching the surge.

And for months those positions mostly expired worthless.

But the surge is there now and the remaining bull call spreads are moving in the money.

Traders are starting to close the positions that are in the green. As a consequence the put to call ratio is trending up towards 3 calls for every 1 put.

The November contract expires in 10 days with more than 1,000 BTC worth of calls on the $20,000 strike.

Given the rate at which Bitcoin is pumping it isn’t impossible those calls will end up in the money too.

Let’s see how that plays out.

That’s it for today. If you have learned something please subscribe and share to help the newsletter grow.

Cheers,

Nick

The Ecoinometrics newsletter decrypts Bitcoin’s place in the global financial system. If you want to get an edge in understanding the future of finance you only have to do two things:

Click on the subscribe button right below.

Follow Ecoinometrics on Twitter at https://twitter.com/ecoinometrics.

Done? That’s great! Thank you and enjoy.