Ecoinometrics - October 05, 2020

Bitcoin vs tech stocks...

Bitcoin is a bubble...

Bitcoin is down 85% from its all time high which means it is dead...

Bitcoin is too volatile to be a good investment…

You have heard all these things and more. Yet Bitcoin is still there.

And do you know what else is still around? Tech stocks...

The Ecoinometrics newsletter decrypts Bitcoin’s place in the global financial system. If you want to get an edge in understanding the future of finance you only have to do two things:

Click on the subscribe button right below.

Follow Ecoinometrics on Twitter at https://twitter.com/ecoinometrics.

Done? That’s great! Thank you and enjoy.

Bitcoin and tech stocks

When you read the mainstream news talking about Bitcoin you’d think it is the only asset that exhibits certain characteristics:

Parabolic rise.

Massive drawdowns.

Huge returns.

High volatility.

But that’s far from being the case!

There is one asset class that also shares many of these traits: tech stocks.

Since the end of 2012:

Bitcoin has grown by a factor of 1,000x.

Bitcoin has had a drawdown of 85% from its all time high.

How does that compare to the likes of Amazon, Netflix or Tesla?

Just checkout the chart. On the vertical axis you have the growth multiplier in log scale.

Do you see a pattern here?

Amazon has grown exponentially more than 1,000x since its IPO. It has a maximum drawdown of 94%!

Netflix is on its way to grow 1,000x in an exponential fashion . It has a maximum drawdown of 82%.

Tesla is more recent but it has also had a parabolic rise to 100x with a maximum drawdown of 60%.

For this chart I’ve only used price data for Bitcoin starting at the first halving. If you consider prior values the total growth has been even larger.

But my point is not to compare exact values here.

My point is to show that exponential growth and big drawdowns are not specific to Bitcoin.

And hindsight being 20/20, you’d have done pretty well if you had bought Amazon or Netflix when they were down more than 80%...

So next time you read that Bitcoin is dead or that Bitcoin is a bubble headline, put it back in context.

Now I’m not saying that owning some Bitcoin is like owning a tech stock.

The dynamics at play are very different here.

For one, the way the value of Bitcoin is constructed at any given time is quite different than that of a stock.

There is one main exchange on which most of any given stock is traded and that’s the source of truth.

Bitcoin instead is bought and sold in many different places all over the world. It is affected by on-ramp and off-ramp methods that differ depending on your country, your use of cash or crypto and so on.

Bitcoin also trades 7 days a week, 24 hours a day without the benefits of circuit breakers in case of wild price swings.

Bitcoin is not covered by the Fed put…

Unsurprisingly all that leads to Bitcoin being more volatile than those exponentially growing tech stocks.

See the chart of the 30 days realized volatility below.

Another big difference between Bitcoin and those tech stocks is their “line of business”.

Bitcoin business is sound money.

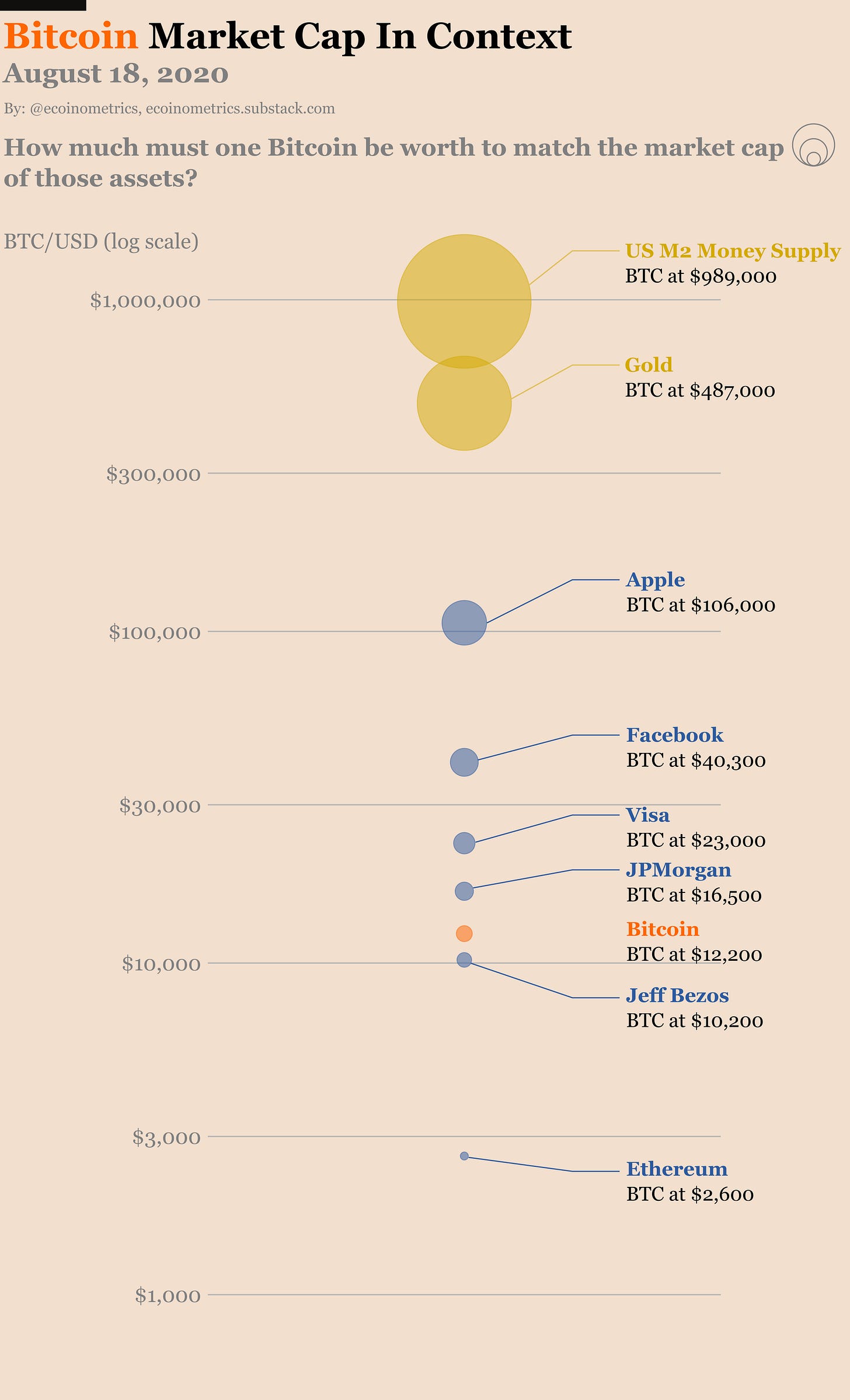

That’s a pretty big total addressable market…

And right now BTC only captures a very small fraction of that market.

We are still early in the adoption curve.

Just consider that the current market cap of Bitcoin is not much higher than the total net worth of Jeff Bezos…

Next stop on the way to adoption involves taking market shares from gold… Bitcoin is not dead, this is only the beginning.

BitMEX get charged, Bitcoin yawns

In case you don't know, BitMEX is a crypto exchange that allows you, among other things, to place high leveraged bets on Bitcoin.

Those leveraged bets tend to amplify large price movements as the triggered automatic liquidation of large positions leads itself to more volatility.

Now it turns out BitMEX got indicted in the US by the CFTC last week.

The reason? Yes you have guessed correctly, the problem is compliance. BitMEX does not follow the US standards of Know Your Customer and Anti Money Laundering regulations.

There are a few $100 million worth of open BTC contracts on BitMEX. So you might think that the news would trigger some big price movement.

But actually nothing happened.

Traders who think that there is a real chance things will escalate have withdrawn their BTC from the exchange. Last estimations I've seen show this is more than 40,000 BTC.

Price barely moved. No panic. Just an orderly retreat.

I guess the Bitcoin market is indeed maturing.

DEX

Now you might think that a solution to the BitMEX issue is just to move towards a decentralized exchange model.

Decentralized exchanges run on smart contracts. So in theory it is possible to make them unstoppable.

But what happens in practice as we have seen in various DeFi projects is that some group of developers may retain special privileges that allow them to freeze transactions or stop the system.

As someone who has played with coding smart contracts on Ethereum a few years ago I can understand the appeal. You want to keep some degree of control on the system just in case something goes wrong.

The issue is that by doing so you end up, as the developer, making the system less resilient. You become a point of failure.

Think of it this way: if we found out who Satoshi Nakamoto is, that person would still be unable to shut down the Bitcoin network. Even if they were forced to.

Now if Bitcoin was built so that Satoshi had the possibility to freeze the whole system the story would be completely different...

At the end of the day if anyone ends up with special privileges on a decentralized exchange it is no better than its centralized counterpart.

But designing complex systems so they work autonomously is a complicated task.

I guess there is still work to do on the road to a more resilient decentralized world.

That’s it for today. If you have learned something please subscribe and share to help the newsletter grow.

Cheers,

Nick

The Ecoinometrics newsletter decrypts Bitcoin’s place in the global financial system. If you want to get an edge in understanding the future of finance you only have to do two things:

Click on the subscribe button right below.

Follow Ecoinometrics on Twitter at https://twitter.com/ecoinometrics.

Done? That’s great! Thank you and enjoy.