Ecoinometrics - October 07, 2020

Derivatives...

I think a lot of people misunderstand what’s the use of the Bitcoin derivatives markets. A pretty widely shared opinion is that those markets were put in place for Wall Street to take control of Bitcoin.

But the truth is the Bitcoin futures and options are used for many things by many different people.

The Ecoinometrics newsletter decrypts Bitcoin’s place in the global financial system. If you want to get an edge in understanding the future of finance you only have to do two things:

Click on the subscribe button right below.

Follow Ecoinometrics on Twitter at https://twitter.com/ecoinometrics.

Done? That’s great! Thank you and enjoy.

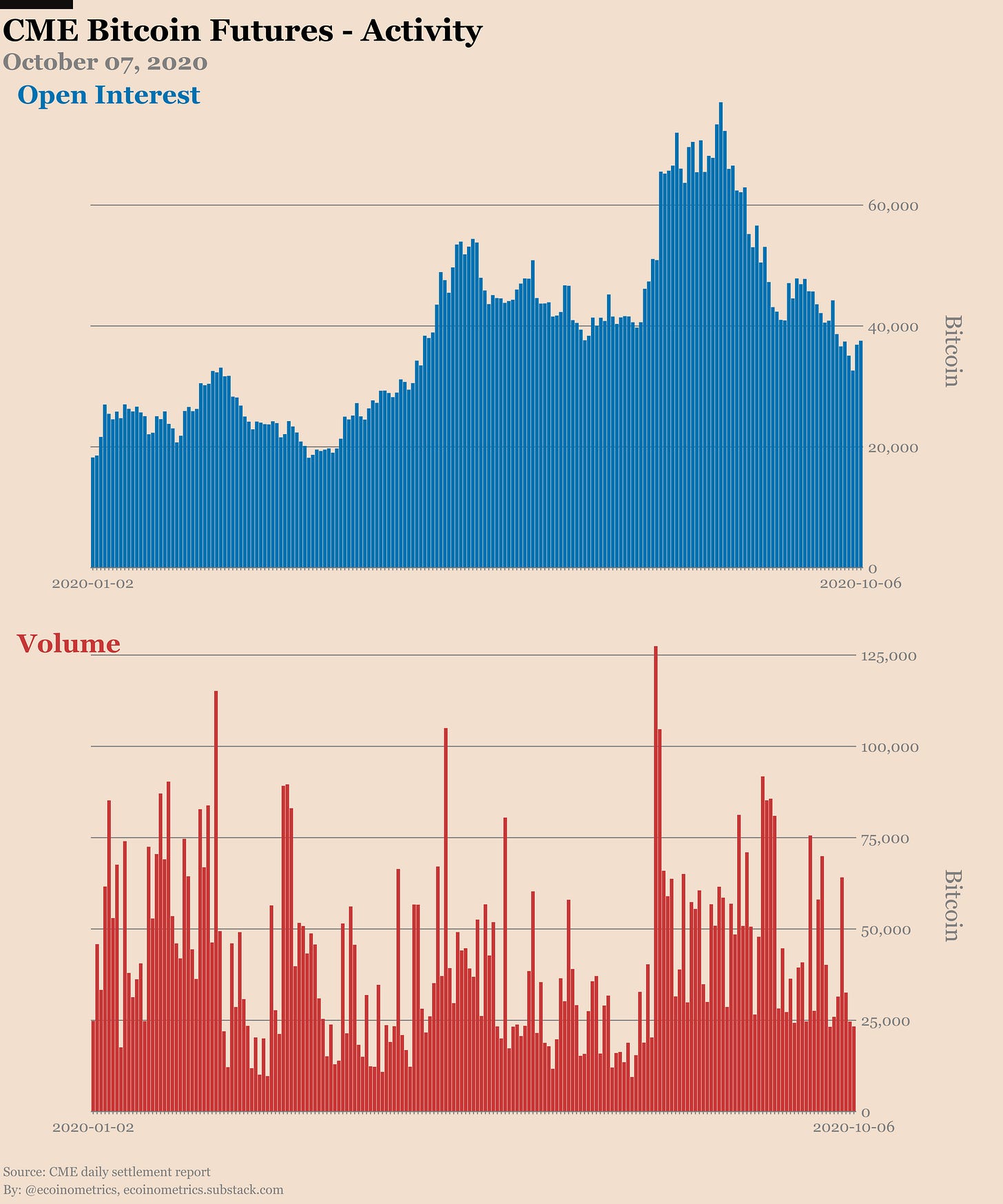

Falling open interest, anemic trading activity, sideways trading action in a $1,000 price range…

Yep, Bitcoin is doing a repeat of the June / July trading sequence.

If you are a long term hodler this is no big deal. Just noise on the long road.

But some market participants do need to watch out their timing. Of course I’m talking about the derivatives traders who need to deal with rolling contracts and options expirations.

So let’s have a look at the situation on the CME.

Right after the breakout at the end of July there had been a surge in open interest up to an all time high of more than 70,000 BTC on the CME Bitcoin futures.

Since then things have been getting downhill. I mean literally… just look at the chart of the open interest...

There are now less open positions than before the breakout above $10,000. And the volume is the same. Slowly but surely the trading activity is dying down.

You can’t really blame the derivatives traders for getting out of the game when nothing is going on.

Most people don’t trade cash settled Bitcoin derivatives for hodling purpose. Nope, if you want to hodl there are plenty of options:

Buy some actual physical Bitcoin and secure it yourself. Be your own bank.

Go over to Grayscale and get yourself some GBTC.

Maybe buy some MicroStrategy shares…

What you really want to do with the CME Bitcoin derivatives is either make leveraged trades or hedge your existing exposure to Bitcoin.

Off the top of my head here are a few use cases.

Let’s say I’m a Bitcoin miner. Then I’m naturally long Bitcoin. If I want to generate some cash for my business I can sell my Bitcoin holdings. Or I can keep my coins and instead sell out of the money calls to pocket some premium. As long as those calls stay out of the money until they expire I will keep the premium and my Bitcoin holdings.

Or I might be a hedge fund looking to profit for some arbitrage. One popular trade on the CME is to sell Bitcoin futures while at the same time being long in the spot market. When the futures trade above spot this trade is pocketing the difference. Apply some leverage to that and you can probably get good returns.

Or you are Paul Tudor Jones. In that case your bet is that we are at the beginning of a massive up trend for Bitcoin. To extract the maximum amount of juice out of it you might want to use Bitcoin futures that give you some extra leverage.

My point is there are specific use cases for choosing to trade Bitcoin derivatives instead of simply hodling. As you can see most of those cases tend to cater more to people whose job is to extract money from the market.

That’s the main incentive here. Professional investors are there to make money, not to play tricks on Bitcoin hodlers.

I'm saying that because if you are a hodler you need to put yourself into those peoples shoes to be able to interpret what's going on in the market.

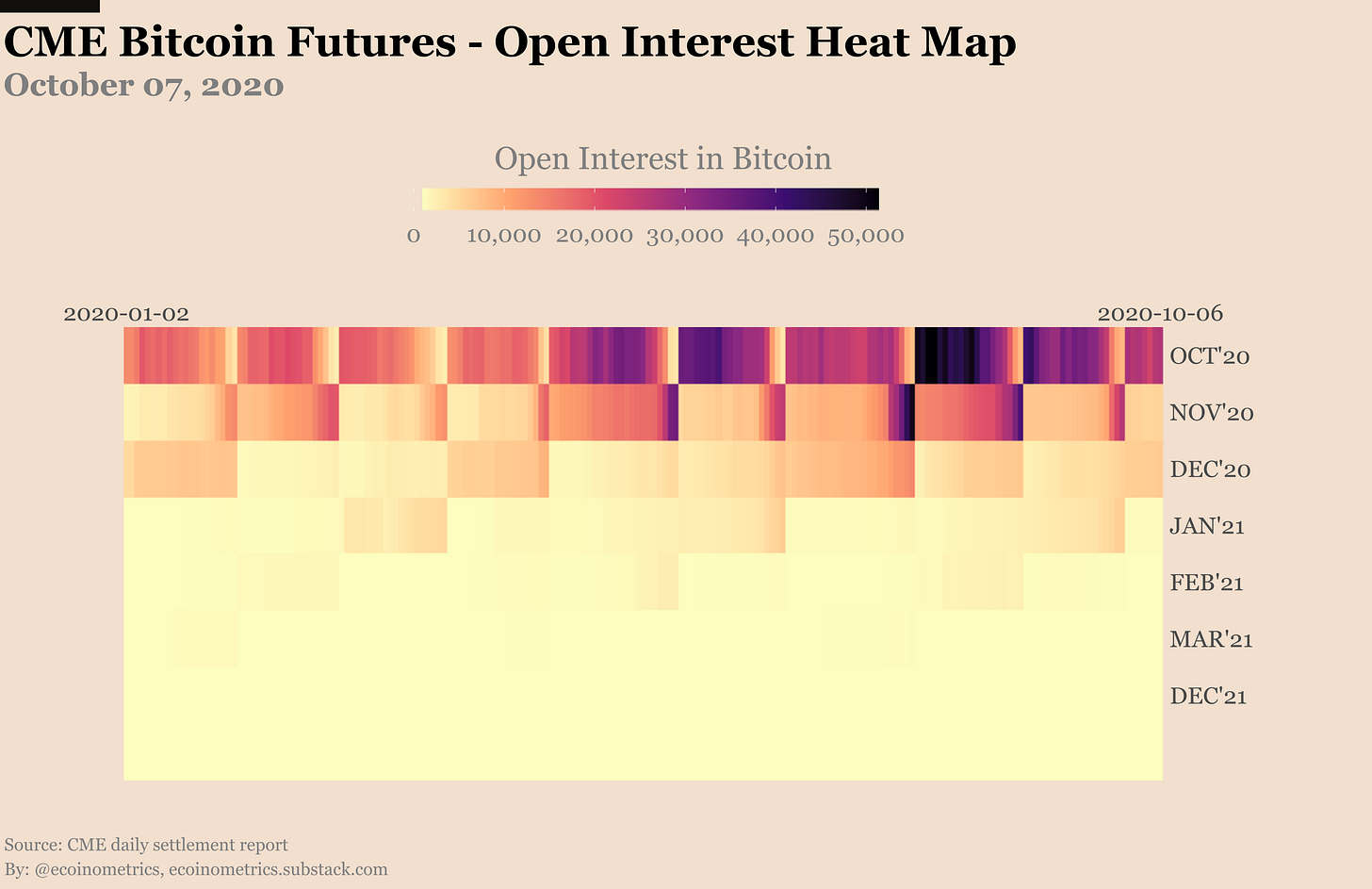

Going back to interpreting the data I hope things are a little more clear now.

When the trend gets weaker the trend followers are more likely to deleverage.

I haven't done much research on that but when the market cools down the arbitrage opportunities might also get smaller. The premium farmers would then also naturally deleverage.

Finally those who were un-ironically short the BTC futures when it got to $12,000 are wisely closing their position to take profit since clearly $10,000 is now a solid support.

This is pretty much what we are seeing in the Commitment of Traders report:

- The smart money is deleveraging both on the long and the short side.

- The retail investors are also deleveraging which isn't totally surprising since they are overwhelmingly trend followers in this market.

The CME Bitcoin options market is quite interesting these days even though nothing much happens.

I feel like making a good guess on what is happening in the options market is always more tricky.

So let me reverse that and instead tell you what is not happening.

The era of the very large bull call spreads is over. Those were big bets involving several hundreds of contracts with BTC price targets 20% to 30% above the money. As we’ve seen in previous issues of the newsletter those bets haven’t paid off.

But there are still 4 calls for every 1 put. You can’t call that bearish.

Something is clear, in aggregate the option traders don’t see a market crash as something very likely.

Remember, it doesn’t mean they are right, options traders are not oracles. It just means the overall sentiment isn’t bearish.

There is more to be learned by breaking down the positions month by month but that will be for next week.

That’s it for today. If you have learned something please subscribe and share to help the newsletter grow.

Cheers,

Nick

The Ecoinometrics newsletter decrypts Bitcoin’s place in the global financial system. If you want to get an edge in understanding the future of finance you only have to do two things:

Click on the subscribe button right below.

Follow Ecoinometrics on Twitter at https://twitter.com/ecoinometrics.

Done? That’s great! Thank you and enjoy.