Ecoinometrics - October 12, 2020

Bitcoin treasuries...

Well it looks like Bitcoin continues to move forward on the adoption curve.

First it was for cypherpunks and individual investors. Then we added funds and family offices which saw its potential to truly become digital gold.

Now we are at the stage where publicly traded companies are actually considering the value of Bitcoin as a reserve asset.

Next step will be bigger institutions and pension funds.

The wider the adoption, the bigger the network effect. We are entering the transition that will make Bitcoin an integral part of the global economy.

So let’s focus on the present...

The Ecoinometrics newsletter decrypts Bitcoin’s place in the global financial system. If you want to get an edge in understanding the future of finance you only have to do two things:

Click on the subscribe button right below.

Follow Ecoinometrics on Twitter at https://twitter.com/ecoinometrics.

Done? That’s great! Thank you and enjoy.

Bitcoin as a treasury asset

After MicroStrategy it is time for Square to be using Bitcoin as a treasury asset.

Pop quiz! Are they the first two public companies to hold Bitcoin on their balance sheet?

Of course if I ask the question you have guessed that the answer is no.

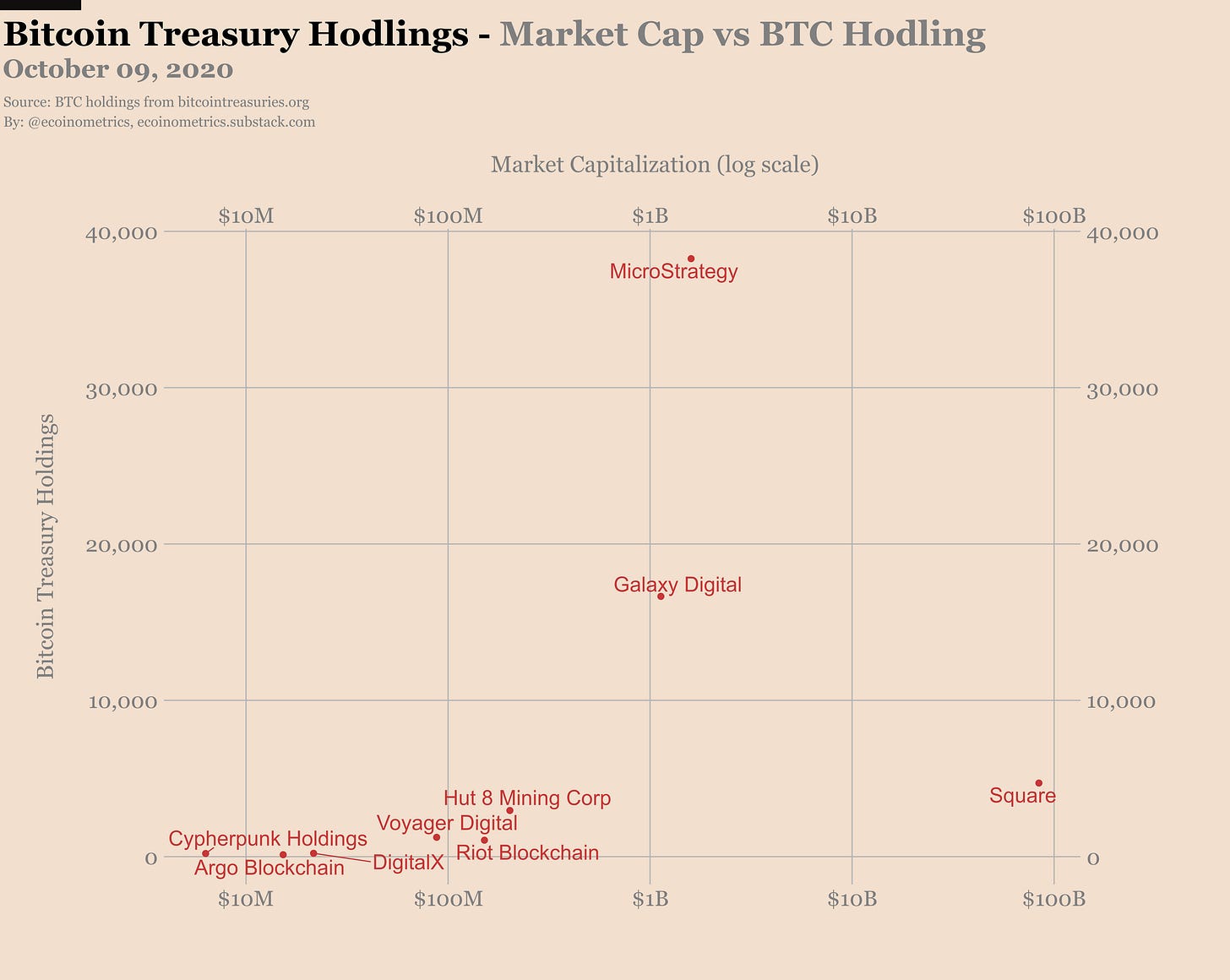

Based on the data from bitcointreasuries.org there are nine publicly traded companies that have decided to bet on Bitcoin.

MicroStrategy and Square are the most recent ones.

But we also have Galaxy Digital, Hut 8 Mining Corp, Voyager Digital, Riot Blockchain, DigitalX, Cypherpunk Holdings and Agro Blockchain.

As you can guess from the names, the big difference is that at the exception of MicroStrategy and Square the rest of them is directly in the business of digital assets.

Check it out.

MicroStrategy is by far making the biggest allocation. But when you add Grayscale (and other funds) to the picture it still looks pretty small.

Actually in terms of Bitcoin held GBTC is 10x bigger than MicroStrategy which is itself 10x bigger than Square.

The actual amount these companies are deciding to hold in Bitcoin isn’t the most interesting part though.

The most interesting part is that they got off zero. The step from nothing to something is always the hardest.

But why would you want to use Bitcoin as a treasury asset?

Well it turns out those reasons are the same for individual investors and businesses. Only the scale changes.

Bitcoin is a pristine collateral asset. To the extent that you hold your keys it has no counter party risk and can be easily audited.

Bitcoin is very liquid. It trades 24/7 everywhere in the world. It has also proven it can handle large buying volumes without creating extreme volatility.

Bitcoin is easy to store. Compared to gold or other commodities there is no physical cost of storage. To be fair companies will have to deal with proper custody of the keys and invest in solid cybersecurity practices to make sure their coins are secure. So there are costs in securely storing your coins. But that’s the only sensitive part of the system.

Bitcoin is a hedge against inflation. It is the hardest money out there. Period.

Bitcoin is an asymmetric bet. Buying now that we are still early in the adoption curve also gives you the potential for outsized returns on top of the utility it provides as a reserve asset.

The only property of Bitcoin that will go away with time is its status of asymmetric bet. Obviously the earlier you get in the more advantage you will derive from investing in it.

But all those other very desirable properties for a treasury asset will still be valid even when Bitcoin is widely adopted.

MicroStrategy and Square made the first move. Now the game theory starts for everybody else.

Liquidity

Another interesting thing regarding the latest Bitcoin purchase by MicroStrategy and Square is the impact those transactions had on the price.

That is almost none.

That’s a good signal given to other companies who might be considering the same move.

Until then the narrative had been that Bitcoin is very volatile, that it is not liquid enough to absorb large transactions...

Clearly that’s not the case.

At least as long as the trade execution is not butchered.

If you think about it this is no different than what happens in the stock market.

Say I own 2% of the total shares of Square. I wake up one morning and decide to sell it all to buy Bitcoin instead.

If I just go to the market and place one market order to sell my whole 2% of Square, it is likely that this will put a big downward pressure on the price.

As a result I might end up selling for less money than I intended.

But if instead I decide to sell my 2% in small chunks within a fixed price range and over a period of time my action will likely have very little impact on the share price.

MicroStrategy and Square have proven to other public companies that Bitcoin is mature enough for this execution strategy to work.

Square has made public a whitepaper on how they did it. Honestly it isn’t that complicated. Just check it out.

Cryptocurrencies enforcement framework

The US Department of Justice is taking another look at the crypto space with a new cryptocurrencies enforcement framework.

As usual the FBI is taking shots at the dark web, anonymity, the usual suspects...

Here is a quote:

“At the FBI, we see first-hand the dangers posed when criminals bend the important technological promise of cryptocurrency to illicit ends,” says Wray. The director explains that employees at his agency have observed that “criminals (are now) using cryptocurrency to try to prevent us from following the money across a wide range of investigations.”

Hold on.

Let’s start back with the following question: why are cryptocurrencies used on dark web marketplaces?

The FBI has their interpretation. The picture they paint is always the same:

Cryptocurrencies are a tool of the dark web.

Cryptocurrencies are used to conduct illicit activities.

Cryptocurrencies are used to evade the gaze of law enforcement agencies.

For people who know nothing about crypto this transforms into a narrative of “Bitcoin is used to buy drugs anonymously on the deep dark web”.

But there is another way of thinking about it.

What if the answer is simply: because it is so convenient to use cryptocurrencies to do business!

Think about it. When you are doing business on the dark web you have a set of constraints.

You want to be able to do international transactions easily. Bitcoin fixes this.

You want to minimize trust when doing a transaction. Bitcoin fixes this.

You want your transaction to be fast and if possible not involve any third party. Bitcoin fixes this.

You don’t want to rely on the banking system to process your transactions. Bitcoin fixes this.

So the narrative might as well be that cryptocurrencies are currencies native to the internet and are perfectly adapted to doing business there.

That’s it for today. If you have learned something please subscribe and share to help the newsletter grow.

Cheers,

Nick

The Ecoinometrics newsletter decrypts Bitcoin’s place in the global financial system. If you want to get an edge in understanding the future of finance you only have to do two things:

Click on the subscribe button right below.

Follow Ecoinometrics on Twitter at https://twitter.com/ecoinometrics.

Done? That’s great! Thank you and enjoy.