First it was MicroStrategy, then Square and suddenly everybody realized that there is a whole bunch of Bitcoin that are held by business entities.

And that is getting some people worried...

The Ecoinometrics newsletter decrypts Bitcoin’s place in the global financial system. If you want to get an edge in understanding the future of finance you only have to do two things:

Click on the subscribe button right below.

Follow Ecoinometrics on Twitter at https://twitter.com/ecoinometrics.

Done? That’s great! Thank you and enjoy.

This is a shift in perception. Until now I bet that people imagined the landscape differently.

Probably something like:

Miners have a lot of BTC due to the nature of their business.

Exchanges concentrate a lot of BTC but technically it isn’t theirs.

Some hedge funds have speculative BTC positions.

The rest is held by individuals hodling most of the coins. That includes whales and small investors.

But this year things have changed.

Actually when I think about it the landscape started to change when people realized how fast Grayscale is growing.

Since the beginning of the year the cumulative inflow into the Grayscale Bitcoin Trust is up 10x. Which means that obviously they end up holding a large proportion of the total supply.

How large? This large...

That’s a little over 2% of the supply (data from Bitcoin Treasuries).

Of course Grayscale is an investment vehicle made specifically to hold Bitcoin within a certain regulatory framework. So it isn’t exactly the same thing as the other business entities on this chart.

Outside of the ETF like category the next big company to hold some BTC is Block One. They are a private company.

These are the guys behind the EOS cryptocurrency. Back in the days of the ICO boom they had raised a large amount of ETH pre-launch and probably converted some of it to BTC.

But that’s old news already.

Next up is MicroStrategy which is the public company with the largest Bitcoin holdings to date.

Next is… ok, I’m not gonna list them all so lets zoom out.

The landscape of the Bitcoin business holdings is pretty clear:

On one side you have the investment vehicles (ETF like). By design they are taking some cash inflow to convert it to Bitcoin.

On the other side you have companies that decide to convert part of their cash to Bitcoin as a reserve asset.

What is getting people worried is that someday the majority of the Bitcoin supply could be captured by a few entities.

That’s a legit concern since Bitcoin will only get stronger if it continues to spread around.

Indeed the power of the network effect is that the network as a whole becomes more valuable the larger it gets. If instead Bitcoin gets concentrated into the hands of a few big players the network becomes less valuable.

Just to clarify I’m talking about the network of Bitcoin users. The technical aspect of the full nodes and miners is another story.

So is it likely that the Bitcoin holdings will get more concentrated over time?

I don’t think so.

On the Bitcoin Treasury Hodlings chart above you can see five points in orange at the moment. These are - at least as far as we know from public information -the only business entities that have managed to concentrate more than 0.1% of the total supply.

This is only possible because they were early.

I’m always coming back to the same thing. Right now the market cap of Bitcoin is small. That’s why a few players can acquire large amounts.

During this halving cycle it is likely we’ll see the market cap of Bitcoin increase 10x. When we get there, getting your hand on any large amount of coins will become increasingly difficult which will limit the risk of further concentration.

In the meantime if companies are rushing to establish Bitcoin holdings that will only accelerate the growth of the BTC market cap thanks to the limited supply.

So if you want to hold a significant piece of the land you know what you have to do.

Act now before it is too late!

Now let’s take a look at the current price action.

Honestly things are looking good. $12,000 is a really important level to clear. Above that line there are very few points that could act as resistance zones.

The reason is of course that Bitcoin hasn’t spent a whole lot of time above $12k. Maybe a couple of days last year. And before that you have to go all the way to the 2017 top.

With few established prior levels to guide traders the price action is going to turn even more psychological than it normally is.

In my opinion the most likely scenario is that once Bitcoin can clear $14,000 FOMO will start to kick in pretty hard on the way to all time high.

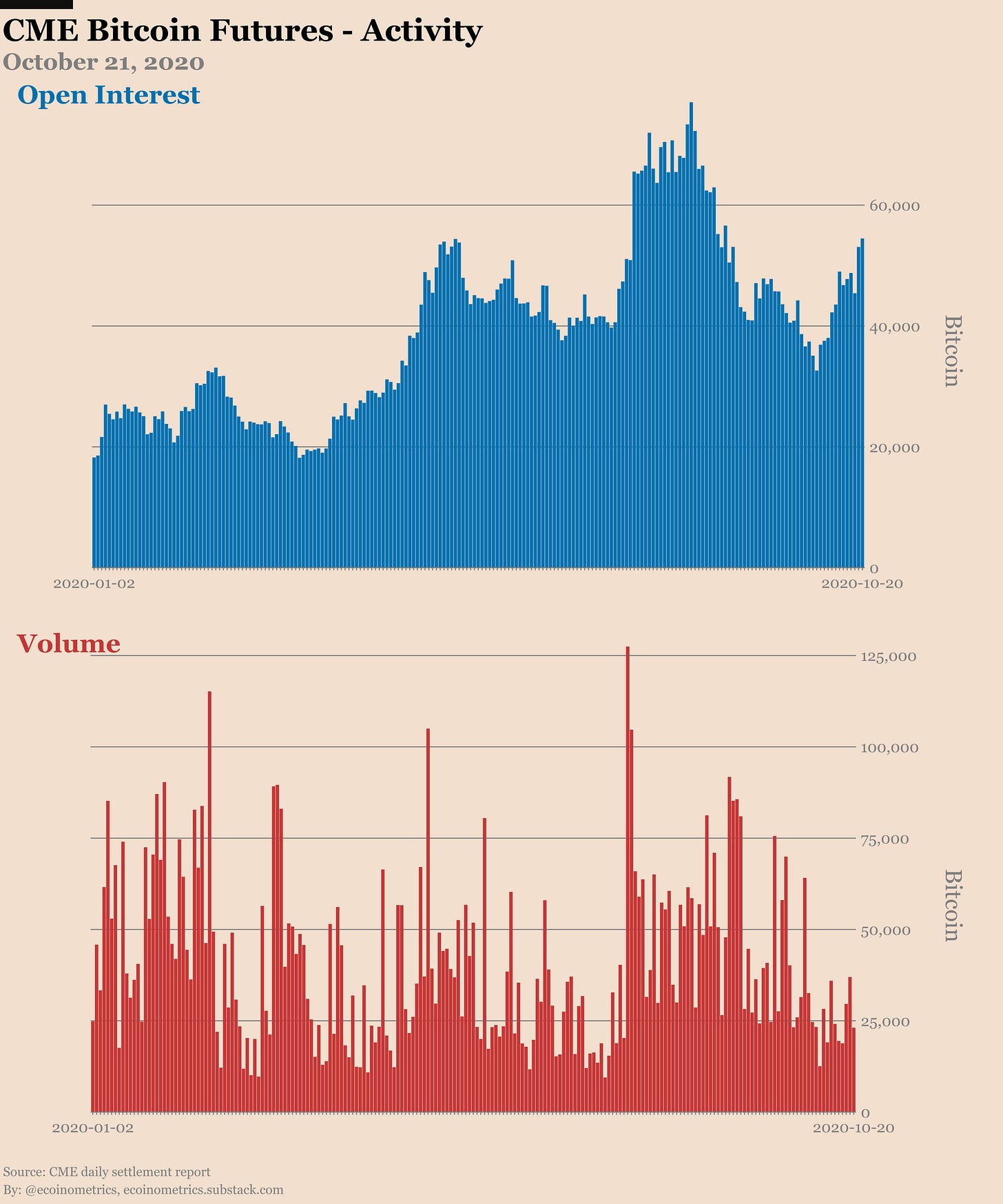

But looking at the CME Bitcoin futures FOMO isn’t there yet.

For sure the open interest is rising but despite a 15% BTC pump in 10 days the daily traded volume is low.

It doesn’t look like the future traders are particularly excited… yet.

It isn’t like there isn’t any demand at all. The buying pressure is there and as you can see the spreads are starting to rise again.

Could be that compared to the last breakout move, this time nobody is getting caught by surprise.

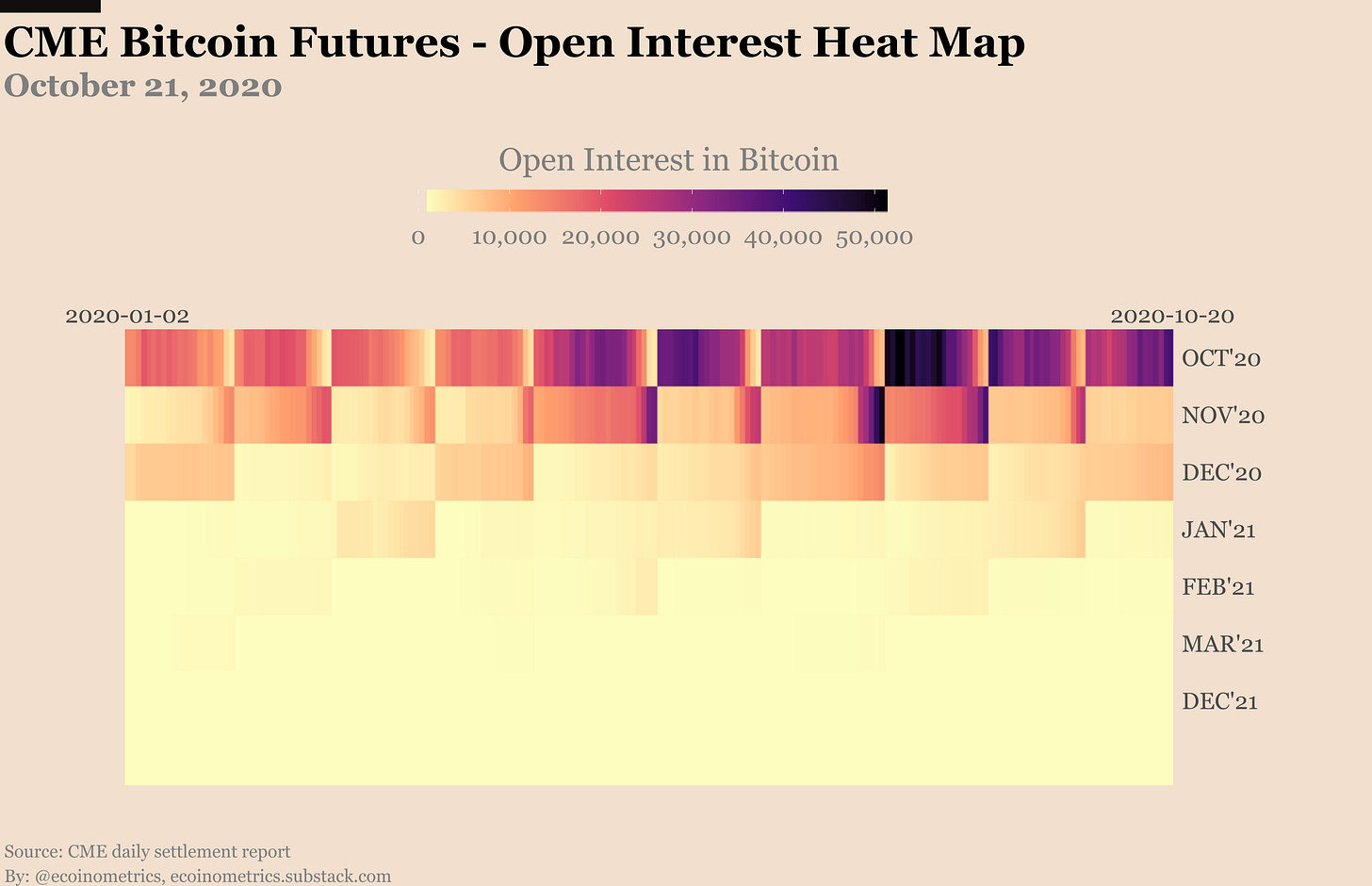

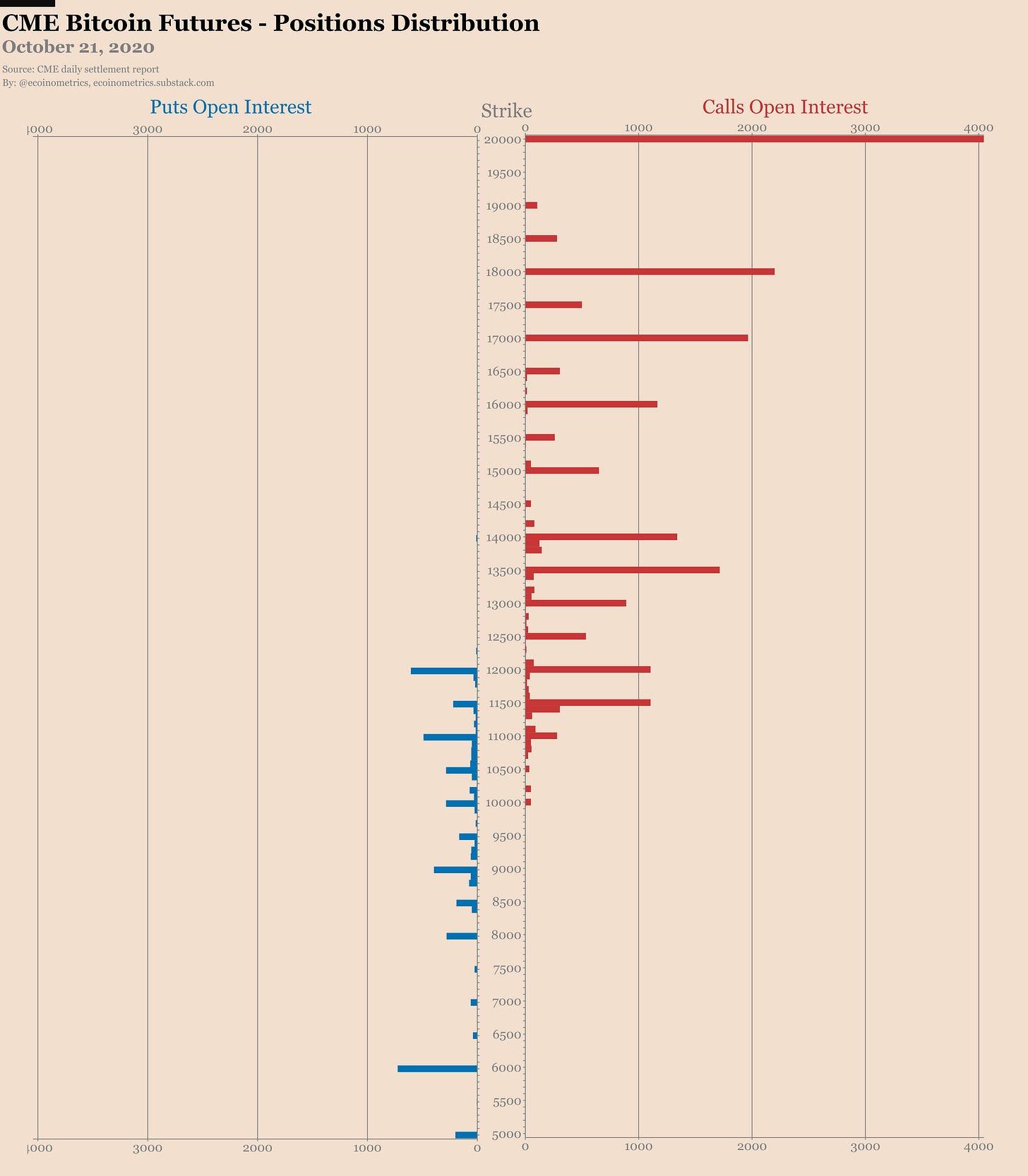

It is a similar picture on the CME Bitcoin options market. Checkout the evolution of the open positions over the past 10 days.

The calls and the puts have plateaued.

Most likely this is because traders are already positioned for the big move.

If you look at the distribution of the calls you can see that the positions are very much spread out all the way to $20k. Traders are expecting volatility to the upside and they are prepared for it.

So it isn’t surprising to see that the trading activity on the options side has died down. After all we haven’t had a clean breakout over $12k… yet.

The latest commitment of traders report covers data up to October 13. That means we have a good picture of where the rise in the open interest is coming from.

Retail traders are getting back into long positions. But they are still 1,000 contracts below the all time high.

Nothing unexpected.

The smart money is pretty much flat when you look at the aggregate net positions. However things get interesting when you dig down further.

The long and short positions are rising in parallel. That is pretty common. However there is a divergence when you split the positions between the asset managers and the leveraged funds.

The asset managers are moving towards record long net positions.

The leveraged funds are moving towards record short net positions.

See for yourself.

As we’ve discussed several times in this newsletter, you shouldn’t jump on the conclusion that hedge funds are massively shorting Bitcoin.

Remember that here you only see part of the positions held by those funds. Those funds could be short Bitcoin on the CME but hold long positions somewhere else.

And actually that’s the most likely explanation. Most of the short positions on the CME futures are matched by long spot BTC positions in order to capture the premium between those two.

This trade has been a favorite of the leveraged funds since the start of the year.

The more interesting part is what’s going on with the asset managers. I’ve been thinking for a while that they have to jump on the trend following trade at some point.

Since May Bitcoin has been staying clear above its 200 days moving average. That’s typically where you’d see the trend following money entering the market.

However as far as the CME futures are concerned this process has been slow.

But that might change if the Bitcoin price action shows a clear path towards all time high.

Let’s see how that plays out.

That’s it for today. If you have learned something please subscribe and share to help the newsletter grow.

Cheers,

Nick

The Ecoinometrics newsletter decrypts Bitcoin’s place in the global financial system. If you want to get an edge in understanding the future of finance you only have to do two things:

Click on the subscribe button right below.

Follow Ecoinometrics on Twitter at https://twitter.com/ecoinometrics.

Done? That’s great! Thank you and enjoy.