Digital gold is the main narrative driving the growth of Bitcoin in this cycle.

Whether you look at it as a hedge against inflation, the ultimate store of value, or simply the hardest money out there it is clear that Bitcoin and gold are trying to occupy the same space.

Of course gold has a head start of a few thousand years. But Bitcoin is catching up pretty fast...

The Ecoinometrics newsletter decrypts Bitcoin’s place in the global financial system. If you want to get an edge in understanding the future of finance you only have to do two things:

Click on the subscribe button right below.

Follow Ecoinometrics on Twitter at https://twitter.com/ecoinometrics.

Done? That’s great! Thank you and enjoy.

Chasing gold

It wasn’t so long ago that you needed more than 100 Bitcoin to buy one ounce of gold. That was back in 2012 around the time of the 1st halving.

Fast forward to the second halving and you could buy one ounce of gold for 2.1 BTC.

Add 4 more years to that and you can now buy almost 7 ounce of gold for one Bitcoin.

And 4 months after the 3rd halving we are poised for another leg down on this chart.

Each halving is making Bitcoin more scarce and solidifies its status as a fantastic store of value.

Even more interesting Bitcoin has achieved this growth while retaining a very low correlation to gold over the past two halving cycles:

2% correlation during the 1st halving cycle.

11% correlation during the 2nd halving cycle.

With these kinds of numbers you might as well say that Bitcoin and gold are not correlated.

Of course people have been worried that this is changing.

Since the beginning of the 3rd halving cycle earlier this year the correlation has jumped to 43%.

This is not crazy high. But still that’s a pretty big deviation from what we have been used to.

Now I’ve commented on that before but the situation is not surprising. The liquidity event triggered in the stock market by the coronavirus crisis has affected all asset classes.

In these kind of events it is expected that everything gets correlated in two phases:

First everything goes down at the same time.

Then everything rebounds at the same time.

So of course Bitcoin, gold and the stock market have seen their correlation increase this year. But that’s unlikely to last over the scale of the full halving cycle.

When the halving effect kicks in we expect Bitcoin to grow by 10x in a matter of months. During the growth phase Bitcoin should have a dynamic of its own largely disconnected from that of gold.

That will take care of the correlation.

That’s not to say that gold and Bitcoin won’t rise at the same time. From what we have seen in the past cycles the halving supply shock is driving a jump in the Bitcoin value. But another force driving the value of Bitcoin is the debasement of fiat currencies.

Money printing is a background trend that is lifting both gold and Bitcoin. It just happens that Bitcoin will benefit more from all that.

One of the reasons is that Bitcoin is currently only a small fraction of the gold market cap.

On the chart below each point represents the market cap of Bitcoin as a percentage of the market cap of gold starting at the 1st halving:

The 1st halving brought Bitcoin to a fraction of a percent of the size of gold.

The 2nd halving peaked at about 5% of the size of the gold market at the time. It ended up stabilizing around 2%.

And 2.4% is where we are now four months after the 3rd halving.

As you can see from the jump in the distribution of points between the 1st and the 2nd halving things can move really fast.

And of course the market cap of gold is itself a moving target:

On one side money printing by the central banks is driving the market cap of gold higher.

On the other side the stock of above ground physical gold is also increasing as a response. This will at least slow down the growth of gold and at most reduce its market cap.

Bitcoin has the advantages of a fixed supply and an algorithmic monetary policy. Using as a reference the current market cap of gold:

BTC at $27k will bring it to 5% of the market cap of gold.

BTC at $55k will bring it to 10% of the market cap of gold.

BTC at $110k will bring it to 20% of the market cap of gold.

This is where we can expect Bitcoin to stabilize at the end of the 3rd halving cycle if it follows the same growth pattern as the previous cycles.

But Bitcoin at $110k is a market cap of only about $2 trillion. That’s barely more than the market capitalization of Apple…

When it comes to asymmetric bets there has rarely been so much potential upside accessible to so many peoples.

Don’t miss the wave.

CME Bitcoin derivatives

Just as Bitcoin is experiencing another leg up the October contract is due to expire at the end of the week.

This is good for the options traders whose bullish bets might finally payoff.

This is bad for the futures traders who have to roll over their long positions from the front month to the back months.

So let’s take a closer look at this.

The strategic $14,000 level is now in sight. Given that there is very little Bitcoin price history above that line it is likely to be the last real resistance level before we move back to the all time high at $20,000.

In the meantime we are getting a rise in the open interest together with some decent trading activity for the last week of the October contract.

As you can see from the heat map the rollover has only seriously started yesterday. I suppose that’s a bit slow when compared to the average month.

But given that the BTC breakout started last week you can understand that some traders wanted to see where this is going.

As usual though the longer you wait in those situations the more costly it is to roll over your positions. Take a look at the time spreads.

Predictably the combo end of month plus pump means fast rising spreads.

But hey, who is going to complain that we are in a bull market?

Certainly not the CME options traders!

They have been betting big on the rise of Bitcoin after the halving. For some months now this hasn’t netted them much profit.

They are not discouraged though. There are 9 calls for every 2 puts across all positions and the further you look in terms of expiry the more things are tilted to the bullish side.

But unless we get a surprise BTC dump just before Friday it looks like more than 62% of the calls on the October contract will expire in the money. That would be a record 5,840 BTC worth of money making contracts on the CME.

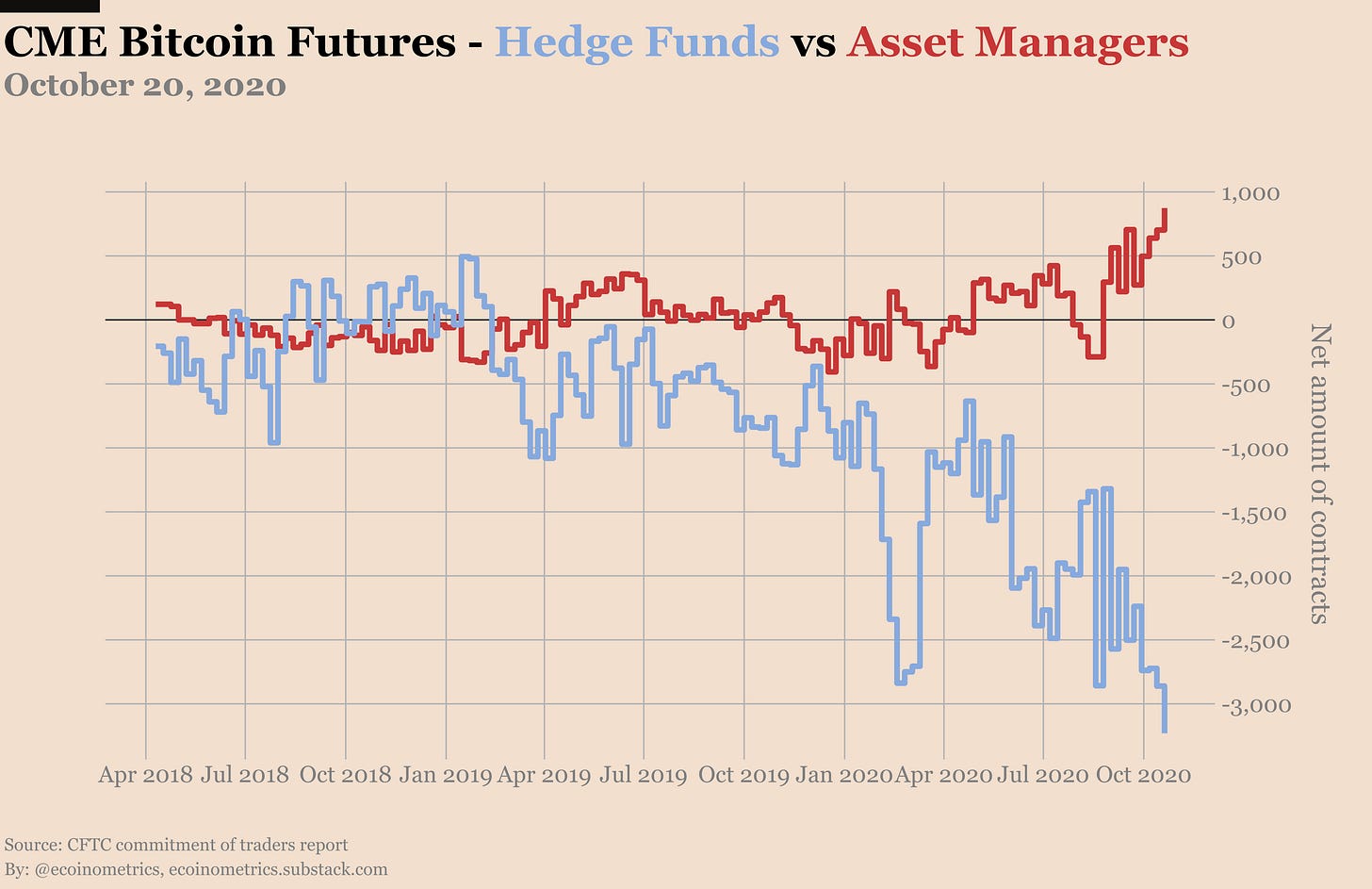

There are no big surprises in the Commitment of Traders report covering up to October 20:

Retail traders are adding to their long positions.

The smart money is piling in on the two main trades. More short positions to capture the basis trade. More long positions for the trend following crew.

In the smart money group we continue to see a divergence between the leveraged funds and the asset managers.

The leverage funds have never been this net short before. Again this is the spot-futures premium arbitrage play. It doesn’t mean that hedge funds are actually shorting Bitcoin.

The asset managers have never been so net long. This is the trend following play.

It will be interesting to observe how strong the $14,000 resistance zone will be given that Bitcoin has a good momentum right now.

Let’s see how that plays out.

That’s it for today. If you have learned something please subscribe and share to help the newsletter grow.

Cheers,

Nick

The Ecoinometrics newsletter decrypts Bitcoin’s place in the global financial system. If you want to get an edge in understanding the future of finance you only have to do two things:

Click on the subscribe button right below.

Follow Ecoinometrics on Twitter at https://twitter.com/ecoinometrics.

Done? That’s great! Thank you and enjoy.