We have the results of our first price predictions poll. Two words to summarize the answers: bullish and reasonable.

Let’s have a look.

The Ecoinometrics newsletter decrypts Bitcoin’s place in the global financial system. If you want to get an edge in understanding the future of finance you only have to do one thing, click on the subscribe button right below:

Done? Thanks! That’s great! Now let’s dive in.

Price predictions

Last week was the first edition of our poll on price predictions for Bitcoin and Ethereum.

Pretty slow start with only 300 responses. But hey, that’s better than nothing. So let’s look at what we got.

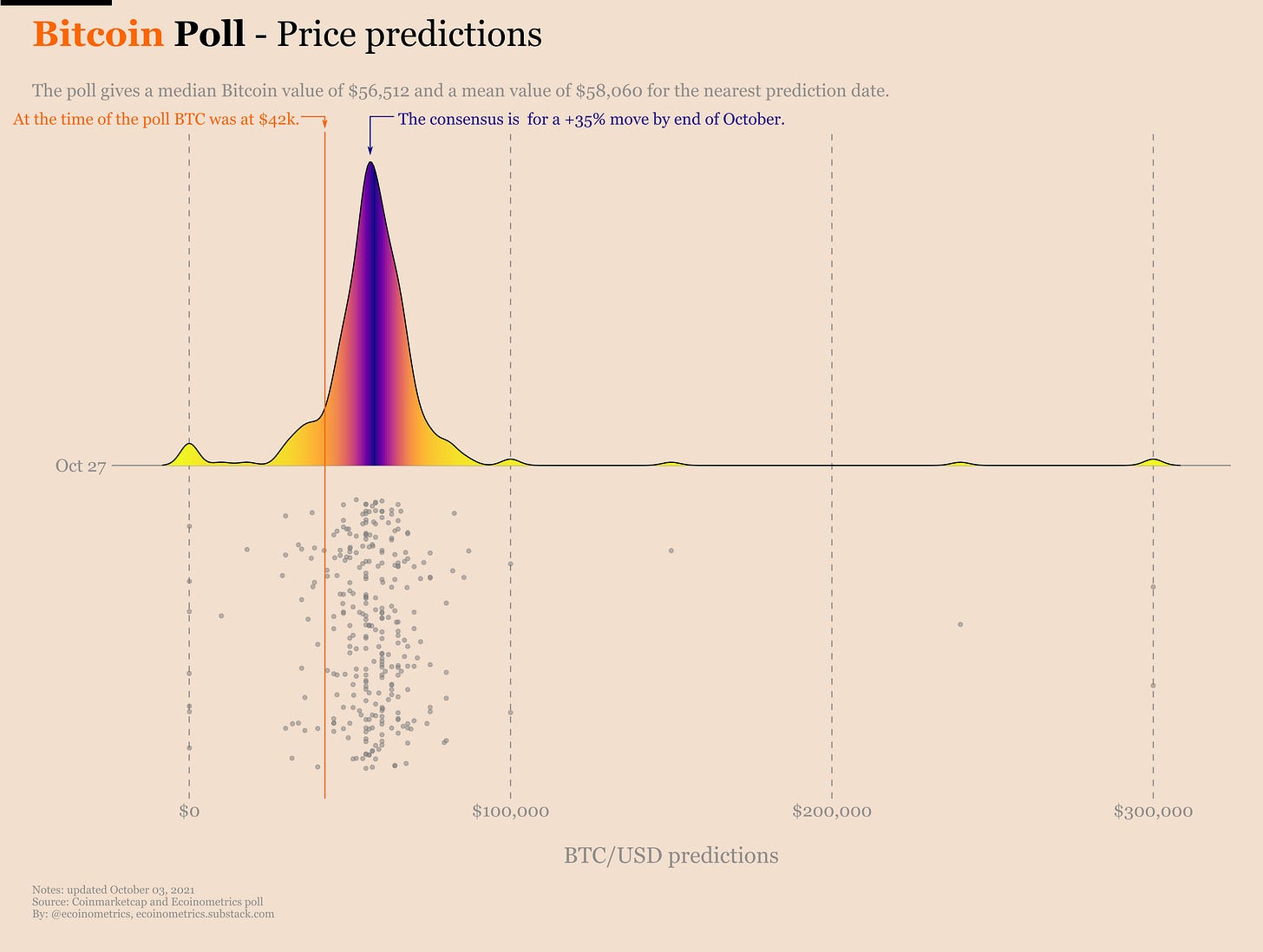

The question was: at what price do you see Bitcoin one month from now?

Respondents predicted that:

On average BTC should hit $58k on October 27.

The median prediction is $56k.

Most of the answers fall in the $30k to $75k range.

Check out the distribution of predictions on the chart below.

Each point is a price prediction for October 27. The taller the area the more prediction in a given price range. The darker the area the closer to the average prediction.

When last week’s poll was up BTC was trading around $42k per coin. So what this data indicates is that people are reasonably bullish on Bitcoin for the coming month.

A +35% move with a breakout above $50k is realistic but we’ll have to see how close we get to the $56k target.

We’ll be keeping track of the accuracy of those predictions as October comes to pass. But for now let’s collect more data.

Something I’m curious about is to what extent the price action preceding the poll can influence people’s predictions.

Right now it is too early to make any conclusion since we barely started getting relevant data. But the idea is to look for a relationship between Bitcoin’s returns at 1 day, 7 days and 30 days before the poll and people’s predictions.

As an example before this poll, BTC was:

Down -2% over 1 day.

Down -1% over 7 days.

Down -14% over 30 days.

And the consensus from the respondents is that Bitcoin will be up +35% over the next 30 days.

Are we likely to see people more bullish when BTC pumps before they give their predictions? Are those predictions more sensitive to the previous day’s move or is the long term trend having more influence?

Those are the kind of questions we’ll try to answer over the weeks.

Moving on to Ethereum, the question was: at what price do you see Ethereum one month from now?

Respondents predicted that:

On average ETH would hit a mean value of $4,200 on October 27.

The median prediction was $4,000.

Most of the answers fall in the $3,500 to $4,500 range.

See the distribution of predictions below.

That’s actually in line with what you expect from the answers related to Bitcoin. BTC and ETH are highly correlated. Usually any significant move of BTC is followed by a similar move in ETH.

So if you think that Bitcoin is going to rise +35% then guessing that Ethereum will also rise by a similar amount is reasonable.

Note that ETH all-time high is around $4,200. That means a breakout above $4,000 could also drive some momentum on the ETH/BTC pair.

At least the majority of the respondents seem to think that we are heading for a re-test of this all-time high.

You can see that on the chart below.

October 27th is broken down in small price buckets. The darker the colour, the more respondents have predicted that ETH will be in a given bucket. The $3,500 to $4,500 zone is where most of the predictions are concentrated.

There is more to explore, especially when we break down the responses by people’s BTC and ETH holdings, but we’ll look into that when we have more data.

So please visit the form below, give your predictions and pass the link around. The more responses we get, the more significant the results will be.

The link to today’s poll is https://forms.gle/92zPtkuKhuWkeXnY8

I’ll collect the answers 24 hours after you’ve received this newsletter.

Thanks for your help.

ETFs

The SEC has delayed once more the approval of a Bitcoin ETF. Or to be more precise, it has delayed the approval of some Bitcoin ETFs.

Indeed there are two classes of ETFs that are up for review by the SEC this fall:

The ETFs based on BTC futures.

The ETFs based on spot BTC.

As the SEC chair Garry Gensler has said repeatedly, it seems that the SEC is ready to approve the first kind, but not the second.

What difference does it make you might ask?

Well there are two pretty big differences.

The first one concerns the supply-demand dynamics of Bitcoin.

An ETF that holds only futures does not act as a sink for the liquid supply of spot BTC. That means once the news of the approval has passed, the effect on the value of Bitcoin should be minimal.

Sure there will be second order effects where the ETF trading the futures will create some activity in the spot market. But don’t forget that the CME Bitcoin futures are cash settled. So at the end of the day it is US$ all the way down.

That’s very different from an ETF that has to actually hold coins, drying up the supply and pushing the price higher.

The second difference has to do with performance. A Bitcoin ETF that buys futures won’t track BTC performance as well as an ETF that holds the actual coins.

The big reason has to do with the rollover of the futures contracts.

Futures contracts aren’t valid forever. They have an expiration date. Which means that every month you need to settle the contracts that are about to expire and buy longer dated ones.

But typically the longer dated ones are more expensive than the ones about to expire. So you have to put up the difference as the cost of doing business. Obviously that is some percentage point of performance you are losing when compared to holding coins outright every time you have to roll over your contracts.

Over the long run those things add up and long term investors are at risk of getting a worst deal that if the ETF was backed by spot.

So be mindful of that when the announcement comes up, not all ETFs are created equal…

That’s it for today. If you have learned something please subscribe and share to help the newsletter grow.

Cheers,

Nick