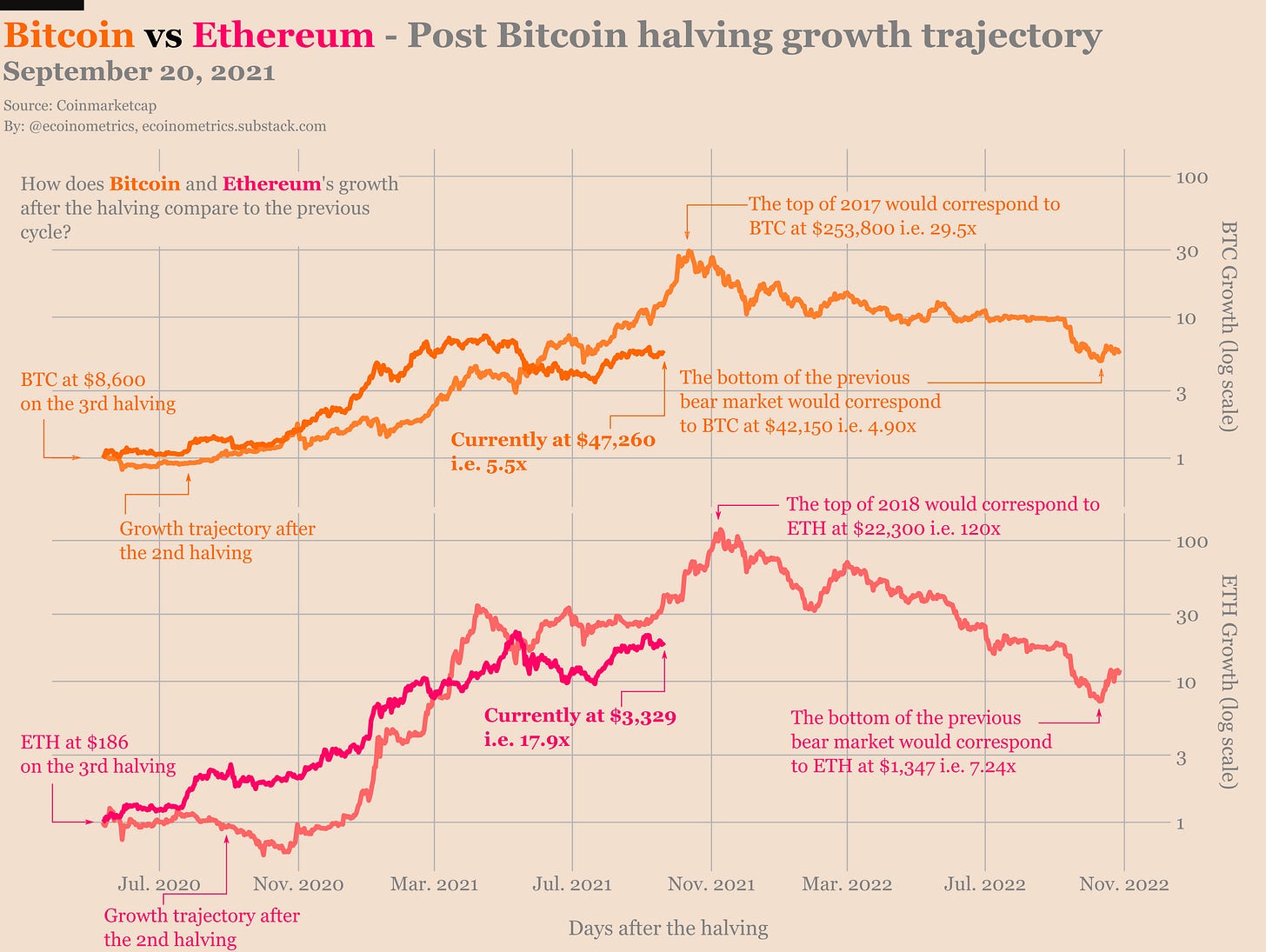

This halving cycle started pretty well for Bitcoin. During one whole year BTC outperformed the growth trajectory of the previous cycle.

But now it is lagging behind.

Is it the fate of the lengthening cycles? The curse of the diminishing returns? Or is the market simply missing something?

The Ecoinometrics newsletter decrypts Bitcoin’s place in the global financial system. If you want to get an edge in understanding the future of finance you only have to do one thing, click on the subscribe button right below:

Done? Thanks! That’s great! Now let’s dive in.

Retail FOMO

Bitcoin is up 5.5x in 1.5 years but people aren’t satisfied. They want more. Or they missed the first wave and are wondering if it is a good time to be long.

Either way, let’s take a step back to remember what we are doing here.

Look, if your investment thesis is that Bitcoin is evolving to be a global reserve asset then it is always a good time to enter the market. It has nothing to do with cycles or what whales are doing. It is all about scales.

With its hard capped supply Bitcoin has a current market capitalization sitting around $900B. This is small for a global reserve asset.

Apple, which is only one stock, is worth 2.5 times that. Physical gold which is the historical store of value asset is worth 10 times that.

That's the investment thesis.

How long until BTC reaches the scale of a global reserve asset? No idea. Bitcoin could 10x this cycle or it could take years to reach that level.

But as long as there are no signs that either Bitcoin cannot be a store of value or that adoption stops then it is game on.

This “big bet and long time frame” is characteristic of macro investments. You do your research, establish a thesis, place a bet and then you just wait. You wait until your thesis get disproved or your bet plays out.

What you do in the meantime is making sure you are on top of what’s going on in the market. You take your time, you do not panic sell, your default mode should be to do nothing.

Simple yet hard.

So let’s get back to what’s going on in the market.

Is there a reason why this cycle looks “slower” than the previous ones?

Maybe. It could be that we have been missing an ingredient that has produced parabolic moves in the past.

This ingredient is retail FOMO.

To simplify a little let’s define as retail the hodlers who are in control of less than 10 BTC.

Depending on when you started your journey of stacking sats 10 Bitcoin might look like a lot. But you have to remember that this is a long game and if you started buying say 5 years ago then you could get your hands on 1 BTC for about $1,000.

So for looking at a reasonable timeframe a cutoff at 10 BTC for retail seems appropriate.

Now what we can do is look at the change in the amount of coins held in aggregate by those “retail” addresses over a 30 days period.

On the chart below you can see the evolution of the Bitcoin price for the 2nd and 3rd halving cycles. Each day is colour coded to show the change in coins held by the retail addresses. Green is neutral, blue is down and red means hodlers have been buying.

Can you spot the difference between the two cycles?

Yes, that’s right, there was a lot more yellow/orange in 2017. Which means that during the big parabolic move 4 years ago the retail crowd was in high FOMO mode for something like a year and a half until the top.

By comparison this cycle is looking much more quiet on the retail side.

Sure, those small addresses have been accumulating pretty steadily. But nothing resembling true FOMO.

So the big question is: are we going to see a retail FOMO phase this time around? Or is Bitcoin becoming a big boys game only dominated by institutions?

Hard to tell at this point.

Certainly there is a psychological effect associated with the sticker price on one BTC. It is likely that a lot of the retail crowd that has had low exposure to the cryptocurrencies market is not thinking in terms of fractions of a Bitcoin and simply think they cannot afford it.

If that’s the case then there might be an easy fix for that. The introduction of a Bitcoin ETF in the US. This would certainly attract a whole new class of retail investors who want exposure to the returns but don’t want to get involved with the network. As well as driving a lot of institutional flow to the space.

Apparently we’ll get some update on that from the SEC pretty soon. So let’s see what’s coming this fall.

Making predictions

You know what they say: it is hard to make predictions, especially about the future.

The good news is that when you are investing you don’t need to be exactly right to be profitable. Neither do you need to have perfect timing or be correct 100% of the time.

Unless you are day trading it is good enough to simply be on the right trend as it develops.

This is why I try to keep this newsletter at a relatively high level when it comes to commenting on the price action.

That being said, making price predictions is a fun game and doing it in the open on social media can probably help with getting a good grip on the mood in the market.

So starting in the next few weeks I’ll start collecting price predictions at regular time intervals and use that to do some research on market sentiment.

The format will be the following:

Once per week I will open a Twitter poll (so don’t forget to follow) with a link to a google form.

People will be able to fill the form with their price prediction for the price of Bitcoin one month from the date of the poll.

When the poll is closed after one day, I’ll pull the data together to make some charts and analyze the results.

We’ll be able to track over time the accuracy of the predictions from the crowd.

We’ll also be able to see how recent price action influence the predictions and hopefully get some insights on the market sentiment and bias.

I might also do the same for ETH price predictions to see if we can use that to gauge how people think about the decoupling between BTC and ETH.

If we can get enough submissions and repeat the process long enough this should lead to some interesting data.

So keep an eye for this experiment on Twitter. Results and analysis will follow in the newsletter.

That’s it for today. If you have learned something please subscribe and share to help the newsletter grow.

Cheers,

Nick

thank you!

I don’t think this analysis makes sense. 10 BTC at any point in this cycle is worth a lot more than 10 BTC at the same point last cycle. Obviously, more people would be able to cross that threshold last cycle than this one. Perhaps looking at length of time BTC is held, length of time the wallet was in existence, or looking at it in terms of quintiles/percentages of the distribution of ownership would be more accurate.

There’s no real barrier to entry, anyone can create a Coinbase account just like in 2017 and buy fractional coins. And on other apps too like Cash App. ETF will spur more inflows esp from retirement money but to imply the lack of it is stopping retail doesn’t make sense. Not to mention we already have GBTC.