Honestly Bitcoin has so much potential upside that it is always time to buy the dip.

What I mean is that the core of your Bitcoin strategy should be hodling with a long term horizon to let the asymmetric bet play out.

But nobody said you aren’t allowed to trade some smaller positions along the way. So when to buy the dip?

The Ecoinometrics newsletter decrypts Bitcoin’s place in the global financial system. If you want to get an edge in understanding the future of finance you only have to do two things:

Click on the subscribe button right below.

Follow Ecoinometrics on Twitter at https://twitter.com/ecoinometrics.

Done? That’s great! Thank you and enjoy.

When it comes to trading rules I like to keep it simple.

If you look at price retracements, a.k.a. the dips, there are two basic things you can observe:

How large is the price retracement from top to bottom?

How long did it take for the price retracement to reach the bottom?

I’ve pulled all the dips during the past Bitcoin bull markets so you can see for yourself:

The vast majority (95%) of the dips are smaller than 35%.

Three quarters of the dips reached the bottom in less than 13 days.

Check it out.

Actually if you look more closely at the chart you’ll see that most retracements are smaller than 20%.

So when it comes to simple rules I’d say it should be something like:

When a dip is reaching 20% that’s a good time to buy.

When a dip is reaching 35% that’s an excellent occasion to buy.

Interestingly when you look at the time it takes to reach the bottom of the retracement there is no strong pattern.

You have one 55% dip that happened in 13 days while some 5% dip played out over more than 20 days.

Even if you take the retracements in the 10% to 20% range the time to reach the bottom is anywhere between one day and more than one month…

That’s just to say it is hard to guess how long it will take for a dip to play out so you might want to layer the way you get into the position.

Don’t get all in at a fixed retracement level.

Maybe start buying the dip at 10% and continue adding to your position until it reaches the 35% level for maximum effect.

While we are at it I’ve also looked at when those price retracements tend to happen.

One way of measuring how hot a bull market is running is to check out the distance between the current BTC price and its 200 days moving average.

When you express these two quantities as a ratio people tend to refer to it as the Bitcoin Mayer multiple.

The tl;dr on it is:

When the Mayer multiple is equal to 1 then the BTC price is at a crossing point with the 200 days moving average.

A Mayer multiple larger than 1 means the BTC price is running above its 200 days moving average.

The median Mayer multiple is about 1.13.

In the bull market right after the 1st halving the Mayer multiple reached up to 6.

During the second halving cycle the Mayer multiple reached up to 4.

The higher the Mayer multiple the more overextended the market is.

When you plot the Mayer multiple at the start of each Bitcoin price retracement what you actually see is that the Mayer multiple doesn’t need to be particularly high to trigger a dip.

Actually:

95% of the dips start with a Mayer multiple lower than 2.5.

Most of the dips start with a Mayer multiple lower than 1.8.

Only the very large dips i.e. more than 50% start with a Mayer multiple higher than 3.

So if you want to play it safe and avoid buying a dip that will end going much deeper than 35% consider adding the rule that you only buy the retracements whose Mayer multiple was smaller than 2.5 at the start.

So my rules for when is it a good time to buy the dip would be something like:

Check if the Mayer multiple at the start of the dip is lower than 2.5, if that’s the case then you can start layering in your position

Start buying the dip when the retracement is reaching 10%.

Continue to add to your position until the retracement is reaching 35%.

Wait for the bull market to resume.

I think that’s keeping it relatively simple.

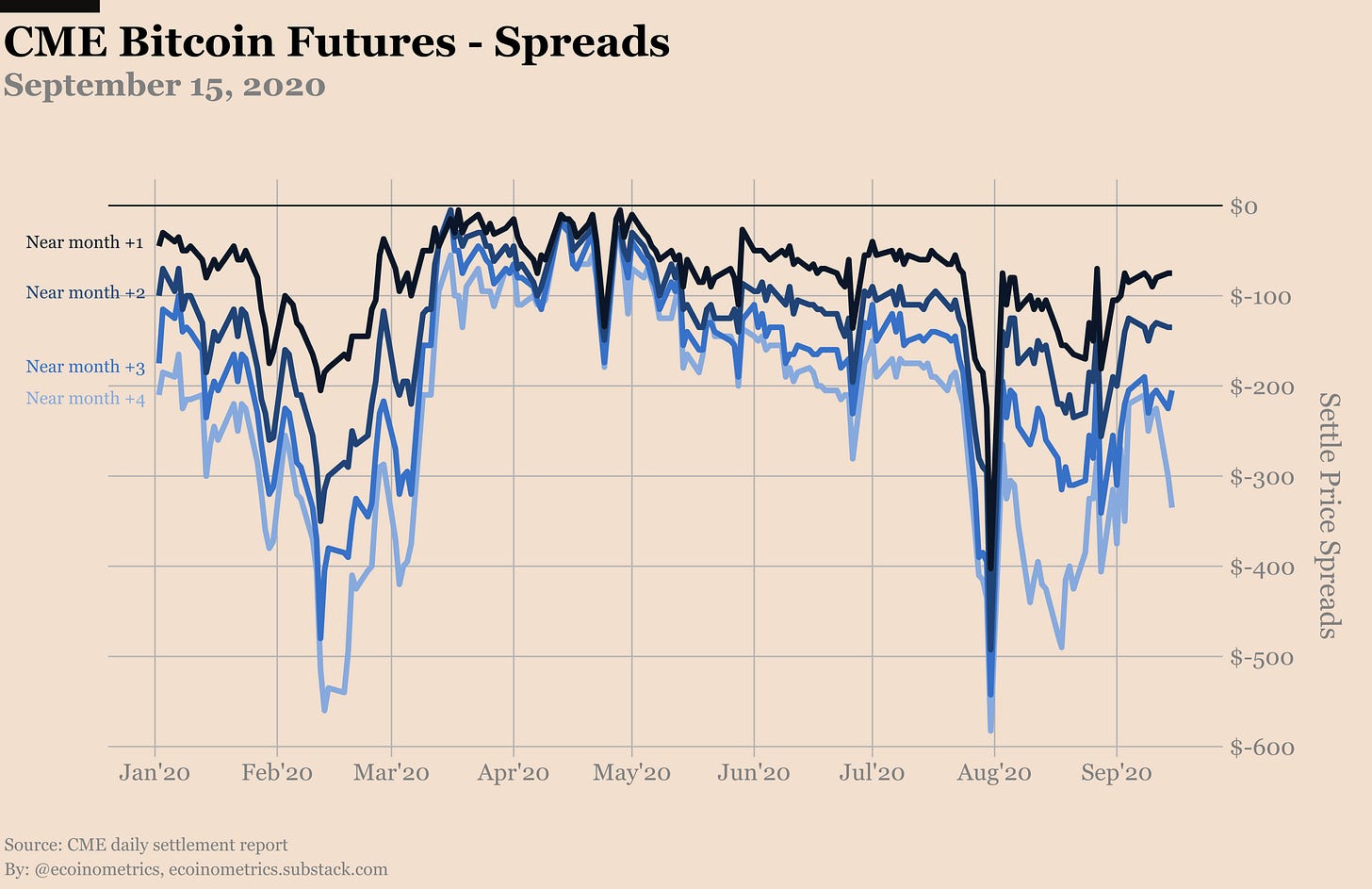

Let’s move on to check out what’s happening in the CME Bitcoin derivative markets.

This week’s Commitment of Traders report is dated September 08, that means we are able to see the aftermath of Bitcoin taking a plunge to $10,000.

If you just look at the net positions it would seem like not much happened actually:

Retail traders are net long at about the same level as last week.

The smart money is net short at about the same level as last week.

…

But while it is the case that for retail traders the positions have barely changed, that’s not the case for the smart money.

Take a look.

First we got a large number of liquidations on the short positions. That’s about 10,000 BTC worth of cash and carry trades positions getting closed after the dip.

And the same amount of long positions also got liquidated after the dip.

Actually since the failed attempt at breaking over $12,000 the smart money has closed 20,000 BTC worth of long positions.

To me that’s a confirmation that the re-test of $10,000 is a move to shake out weak hands.

And after holding the $10,000 level, Bitcoin is starting to trend up once more.

But the futures traders don’t look totally convinced we will move back to $12,000 in a straight line. The open interest is bouncing back but this is all happening on pretty low volumes.

Maybe traders are waiting for the CME gap at $9,700 to get filled before getting back in the game. Who knows?

The options traders are much more clearly bullish.

From 5 calls for every 2 puts last week we are back at 3 calls for every 1 put now.

The dynamic is pretty clear. When the price action showed that there was a big threat Bitcoin would drop back down significantly option traders bought puts on the near month.

After $10,000 showed it was a good support traders switched to buying calls on the far months.

That’s net bullish all the way to $20,000. Just checkout the distribution of positions below!

That’s it for today. If you have learned something please subscribe and share the newsletter.

And don’t forget to stack sats!

Cheers,

Nick

The Ecoinometrics newsletter decrypts Bitcoin’s place in the global financial system. If you want to get an edge in understanding the future of finance you only have to do two things:

Click on the subscribe button right below.

Follow Ecoinometrics on Twitter at https://twitter.com/ecoinometrics.

Done? That’s great! Thank you and enjoy.

🔥👌