Ecoinometrics - Sizing the bear market rallies

How does this Bitcoin rally fits as part of the bear market?

There is a disconnect between the mounting evidence of an upcoming recession and the price action of Bitcoin and the stock market.

Said differently risk assets are more likely to be experiencing a bear market rally than they are to be climbing their way out of this drawdown.

How does this bear market rally compares to historical ones and is there room for it to continue much longer?

The Ecoinometrics newsletter helps you understand Bitcoin and digital assets through the macro quantitative lens. Subscribe to get an edge on the future of finance.

Done? Thanks! That’s great! Now let’s dive in.

Sizing the bear market rallies

If you make abstraction of the macro economic environment and simply look at where risk assets stand in this drawdown you can argue that the worst is behind us.

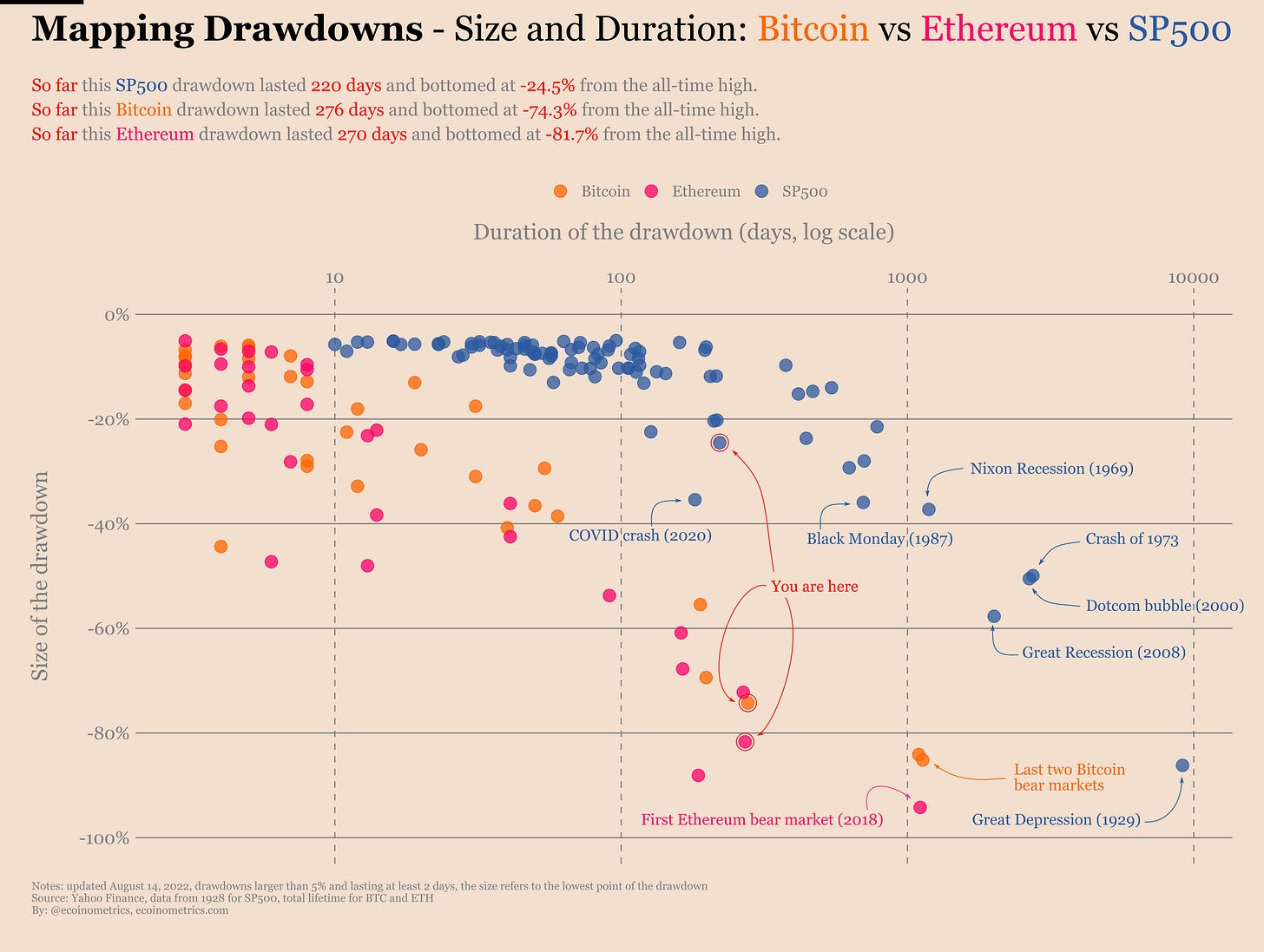

Take a look at where we are on this map of the drawdowns. Currently they sit at:

-74% for Bitcoin

-82% for Ethereum

-25% for the SP500

For Bitcoin and Ethereum that’s not very far from historical bottoms. And for the stock market, as long as you don’t believe the next recession will be as bad as say the Great Recession or the Dotcom crash, you can make a case that this has been a fair correction already.

Keep reading with a 7-day free trial

Subscribe to Ecoinometrics to keep reading this post and get 7 days of free access to the full post archives.