Ecoinometrics - The Ethereum bet: how confident do you need to be?

What are the chances that ETH grow 10x in the next 5 years?

If you are investing with a long term horizon bad news is often just a different way of spelling opportunities.

That's kind of how I feel with Ethereum (and digital assets in general) right now.

Risk assets are getting crushed. This will continue until we reach the turning point of the upcoming recession. But if you are optimistic about the future that's just a temporary setback inside a bigger trend that is unlikely to have reversed. That means anything you can buy now, you are buying at a discount.

Still nothing is guaranteed about the future. So what are really the odds that we'll see ETH growing 10x in the next 5 years?

The Ecoinometrics newsletter helps you navigate the landscape of digital assets and macroeconomics with investment strategies backed by data. Subscribe to get an edge on the future of finance.

Done? Thanks! That’s great! Now let’s dive in.

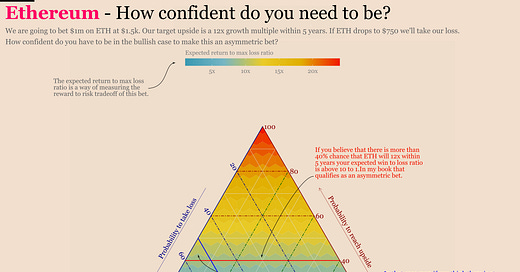

The Ethereum bet: how confident do you need to be?

Last week we talked about the problem of estimating how much Ethereum could be worth five years from now.

Our conclusion was that coming up with some model for the total addressable market of Ethereum is extremely difficult. And instead we should focus on a simpler question i.e. if you are bullish what’s a reasonable growth rate for the next five years?

Go read the whole thing if you haven't already but we determined that a reasonable bull case for Ethereum is somewhere between:

45% annualized returns over the next 5 years or a 7x multiple.

85% annualized returns over the next 5 years or a 22x multiple.

To put that in perspective that’s at least our expect growth rate for Bitcoin and probably some upside premium due to Ethereum’s smaller market cap, the merge, narratives around the flippening and so on.

Now if you remember the framework we are using to evaluate our bets we already have:

An upside target (well a range for now).

A time horizon for this upside target to be reached i.e. 5 years.

And we are missing:

The odds that we'll reach that upside target.

A place where we want to exit our trade if it goes against us.

An idea of the likelihood we'll have to exit our trade.

Keep reading with a 7-day free trial

Subscribe to Ecoinometrics to keep reading this post and get 7 days of free access to the full post archives.