You know about the 60/40 portfolio right? The idea is simple: you allocate 60% of your portfolio to stocks and 40% to bonds. The stocks are there to generate growth while the bonds are there to generate income and reduce volatility.

That’s been a nice and steady portfolio construction for decades.

But how about we spice it up with some Bitcoin?

The Ecoinometrics newsletter decrypts Bitcoin’s place in the global financial system. If you want to get an edge in understanding the future of finance you only have to do one thing, click on the subscribe button right below:

Done? Thanks! That’s great! Now let’s dive in.

The other 60/40 portfolio

Alright so here are the rules of the game:

You can invest in bonds through the BND ETF, stocks through the VOO ETF (representing the SP500) and you can buy spot BTC.

You decide on a fixed percentage allocation for these three assets.

You rebalance your portfolio to this allocation mix at the close on the 1st trading day of each month.

The traditional 60/40 portfolio is 60% stocks, 40% bonds and is designed to give you a pretty smooth growth over time.

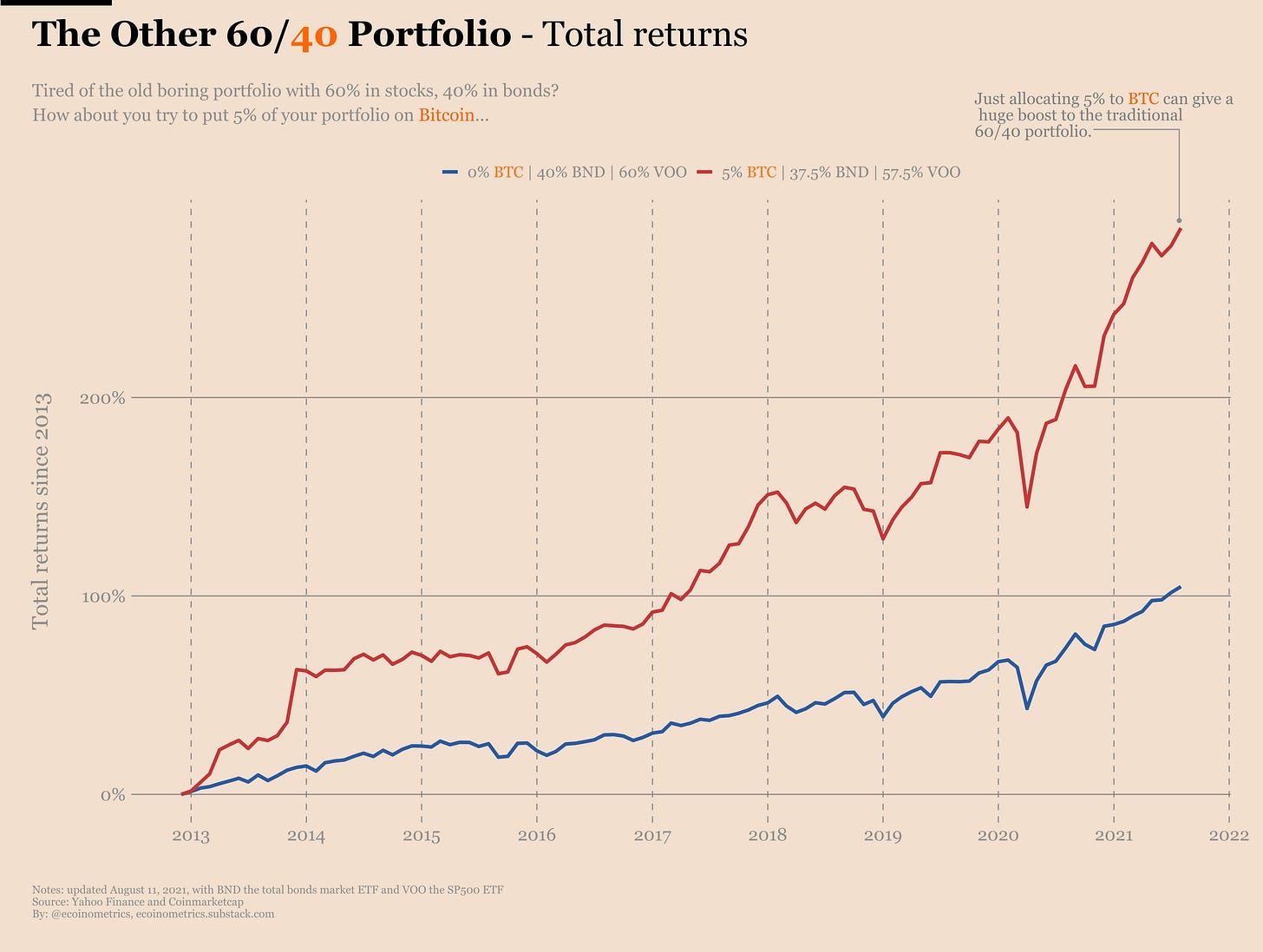

Now what if we change this a little. Maybe say put 5% of our portfolio on Bitcoin and keep 37.5% on bonds, 57.5% on stocks.

You don’t take too much risk with that. I mean what’s the worst that can happen? If suddenly Bitcoin goes to zero you’d lose 5% of your assets. That’s not the end of the world right?

But for such a small risk you are getting a sizeable boost to your total returns.

Here is what it would have looked like if you started doing that in 2013.

For a 5% risk, after two halving cycles your total returns would be 2.5x higher than the traditional 60/40! Pretty nice isn’t it.

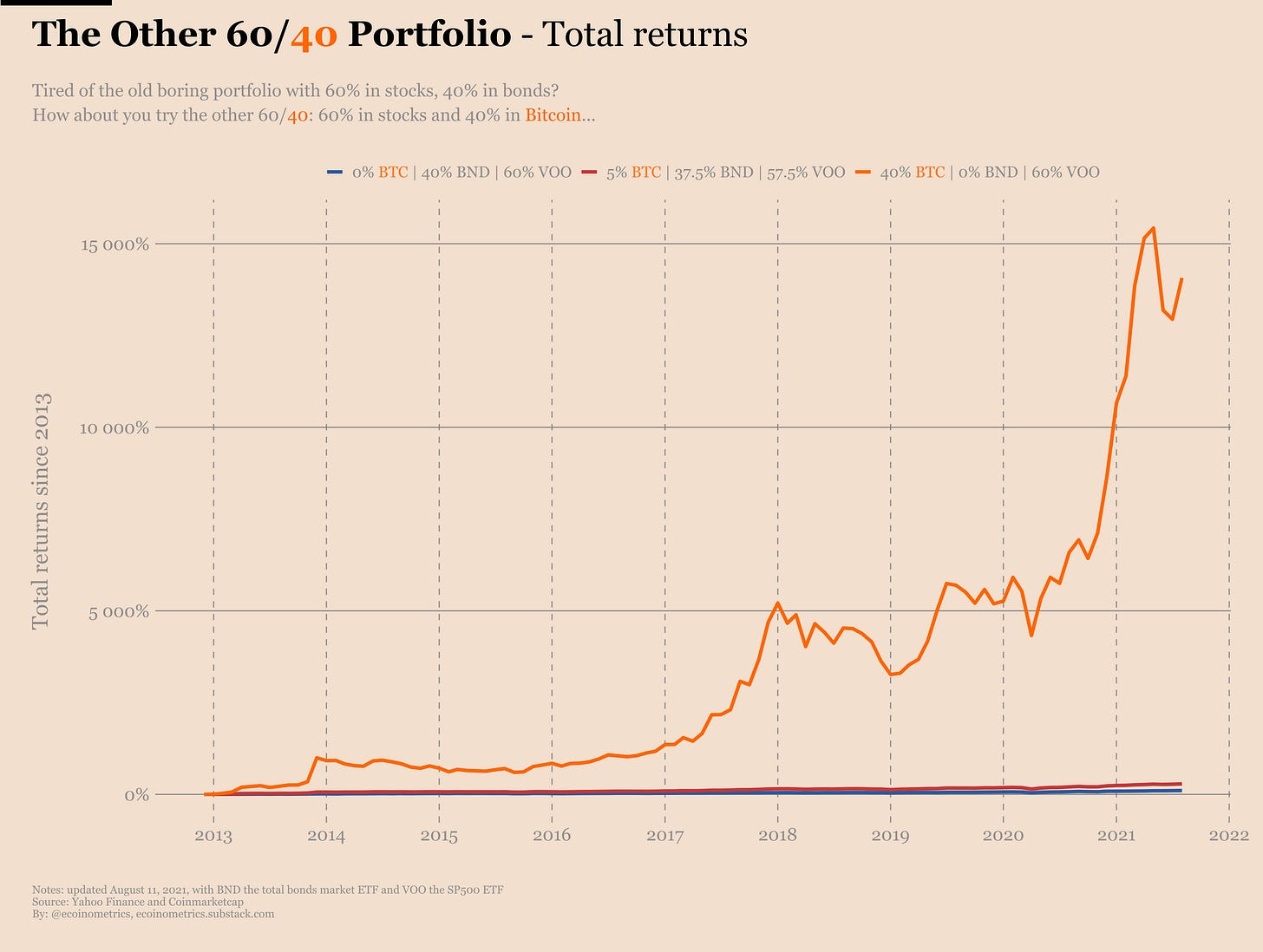

But why stop there? How about we go the aggressive route? How about we flip things to “the other 60/40 portfolio”... 60% stocks, 40% Bitcoin…

See for yourself.

Okay…. Clearly your returns are off the chart if you lean in on Bitcoin. Sure, with that composition if Bitcoin goes down 50% in a month you are down 20% on your portfolio. But given the upside this is probably worth it.

Now at this point you might have one objection: “this historical data is cool, but what if I didn’t start buying Bitcoin in 2013”?

Fair enough. Who knows if Bitcoin will ever experience again the same kind of growth it did in 2013.

So let’s look at it on a rolling performance basis instead.

Take the one-year rolling returns below. You do see this pattern of over performance play out every cycle whether you have 5% or 40% of your portfolio on Bitcoin.

That means you don’t really need to have started in 2013 to experience the benefits of a BTC allocation.

Check it out.

Now if you stare a bit at this one-year returns chart you’ll observe the following:

The 5% allocation to BTC doesn’t dip very often into negative one-year returns territory.

When it does the period is brief and the drawdown isn’t that big.

When everything is doing well this 5% allocation setup is almost always outperforming the traditional 60/40.

So maybe 5% on BTC is enough right? Maybe 40% is too much risk?

Well, it depends on how you look at things.

On one hand the size of your largest drawdown matters. Because even though the 40% allocation will give you better total returns it also means you’ll have to deal with being down maybe -25% year over year at some point.

On the other hand what really matters is the risk adjusted returns on your portfolio. If you can be up 200% year over year maybe you won’t mind being down -25% from time to time.

If all you care about is the risk adjusted returns then being 40% in BTC has been the clear winner over the past 8 years.

For measuring risk adjusted returns I like to use the Sortino ratio.

I don’t know about you, but personally I don’t care if my assets have volatility on the upside. That’s why I picked the Sortino ratio. It works the same way as the Sharpe ratio except it only penalizes downside volatility.

Here is what you get over the past 8 years.

Basically adding a 5% Bitcoin allocation doubles your risk adjusted returns when compared to the traditional 60/40 portfolio.

And switching to the 60% stocks, 40% Bitcoin portfolio doubles that again.

So the moral of the story is that even a small allocation to Bitcoin greatly improves your returns for a very limited absolute risk. Clearly including Bitcoin in your portfolio is a no-brainer.

In an upcoming issue of the newsletter we’ll take this analysis further. We’ll try to see what kind of returns you can expect on these portfolios in the future under various assumptions regarding Bitcoin’s growth trajectory.

If you don’t want to miss that, subscribe right now:

CME Bitcoin Derivatives

This summer remains pretty quiet on the CME derivatives market. Despite BTC gaining momentum the retail crowd hasn’t changed their positioning.

At the same time it looks like the smart money is resuming the basis trade. That makes sense. If BTC starts trending up again the premium of the futures over spot will probably become very attractive again.

We’ll have to see where this goes.

The CME Bitcoin options market is getting more balanced with 4 puts for every 3 calls. Another sign that the sentiment is turning.

There is still a long way until we are out of this drawdown but the signs are there:

BTC is back above the 200 days moving average.

On-chain data shows that everyone is accumulating.

The premium of the futures over spot looks to be on the way up.

The options market is getting less tilted towards the puts.

Now let’s see if Bitcoin can sustain its momentum.

That’s it for today. If you have learned something please subscribe and share to help the newsletter grow.

Cheers,

Nick

Nice work Nick! Love the yearly analysis, a lot of people think they "missed" the best chance but it's all relative.