A bunch of large regional bank collapsed and everyone is already screaming for a Fed pivot.

So I guess the recession is cancelled right? Jay Powell is going to pause the rate hikes during this months meeting, cut rates next month, declare inflation is under control and the soft landing has been achieved...

Or not.

The Ecoinometrics newsletter gives you insights from crypto and macro data to help you make better investment decisions.

Each issue of the newsletter tells you what you need to know in 5 minutes or less, direct to the point, with lots of charts to allow you to quickly visualize what’s important.

Join more than 19,000 subscribers here:

Done? Thanks! That’s great! Now let’s dive in.

To pause or not to pause

Has everything changed with the collapse of Silicon Valley Bank and the risk of contagion to other regional banks?

That's the real question isn't it?

We always say that the Federal Reserve will continue running a QT playbook until something breaks. What's not always clear is what qualifies as something broken.

So let's put back what happens in the last few days in perspective.

Bank run

A lot of ink has be spilled writing about the demise of Silicon Valley Bank over the last few years that I don't think it is necessary for me to write a full recap.

So let's stick with the tl;dr.

Silicon Valley Bank is/was a large regional bank serving the tech sector in Silicon Valley.

How large? Very large. Over the past 20 years Silicon Valley Bank’s collapse is the second largest with the 3rd largest being a bank about 10 times smaller.

Last week some people started being worried about its solvability. They decided it made more sense to take their money out of the bank than risk losing it and that snowballed into a bank run.

The combination of a bear market and the rate hike cycle means that all assets owned by the banks have lost a significant amount of value. Even the pristine US Treasury bonds.

As a result Silicon Valley Bank cannot honour those redemptions meaning the bank ended up going under.

Pretty classic stuff.

Now the issue with that is if a massive regional bank can fall maybe the US banking system as a whole could collapse. That’s the risk. Or to be more realistic the risk is that people think that’s a serious risk.

For the purpose of this analysis we don’t care about what people in general think though. What we care about is what the FOMC thinks. And the way the Federal Reserve reacted suggests that while they don’t want more regional banks to go under they also don’t think the end of the world is near.

They’ve let the bank fail, they established a facility to guarantee deposits and limit the risk of contagion. That’s a reasonable move.

But you know what isn’t a reasonable move? Declaring the end of QT. Why? Because the job is not done.

Inflation, inflation, inflation

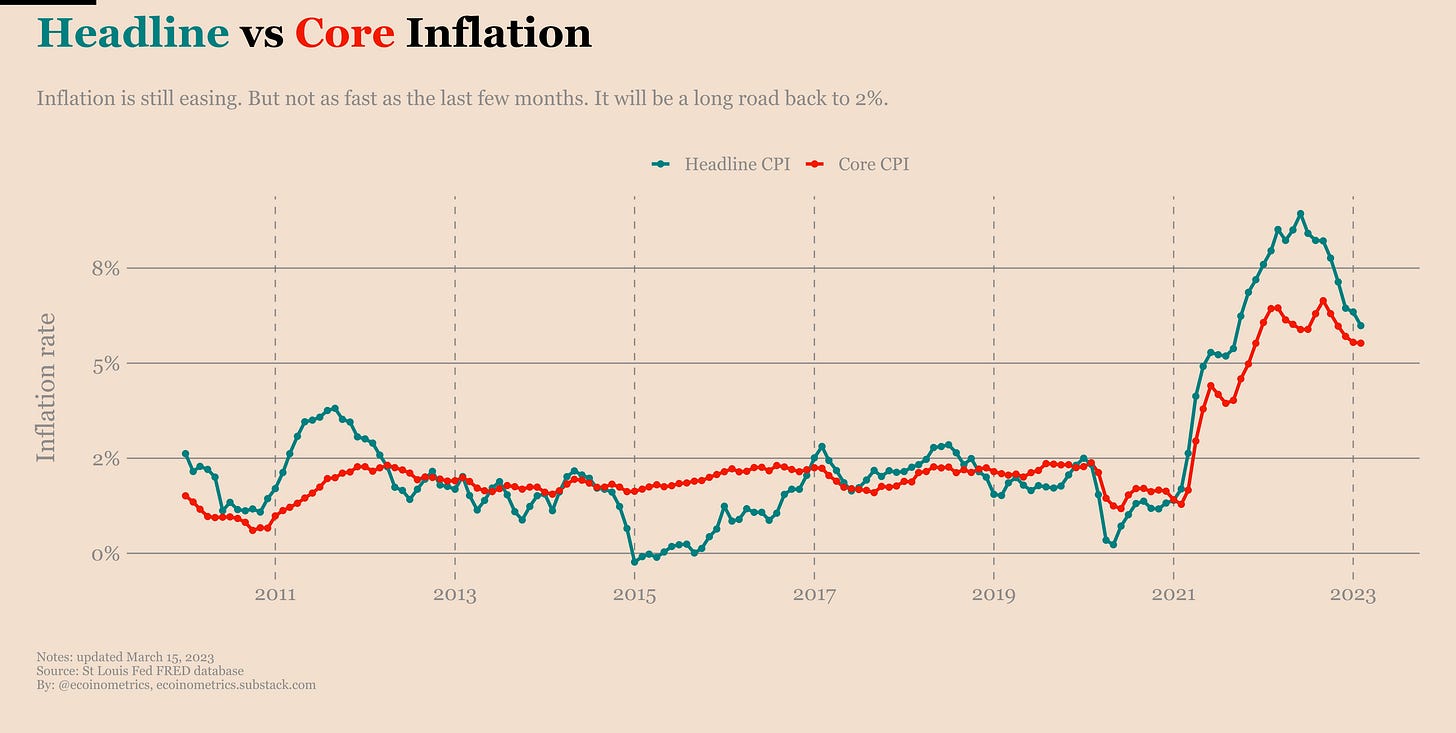

What the people calling for a Fed pivot seem to miss is that inflation is still too damn high. And that’s why QT started in the first place.

The February numbers came out yesterday and honestly they don’t look particularly good to me.

Keep reading with a 7-day free trial

Subscribe to Ecoinometrics to keep reading this post and get 7 days of free access to the full post archives.